According to the Baymard Institute, the average online shopping cart abandonment rate in 2022 is almost 70%. Among the obvious reasons, the researchers noted that 18% of users did not buy the product because they needed to trust the website with their credit card information, and 17% found the payment process to be long and too complicated.

At the same time, users were ready to make a purchase but encountered difficulties in the payment process, which directly affected payment conversion. This article explains how to increase payment conversion and drive customers to purchase.

What is Payment Conversion

Payment conversion is the proportion of completed payments out of the total number of transactions. Simply put, if a user visited the site, added a product to the cart, and proceeded to payment but never bought it, they did not make a conversion. If he paid for the purchase, the target action is considered to have been achieved.

Conversion should be analyzed, as it is one of the most important indicators of the project's performance. It can also be increased by growing the percentage of completed purchases.

What Affects Payment Page Conversion

Many factors have an impact on payment conversion. Let's look at the main ones.

Website reliability

The website should work consistently. Psychologically, it should be credible to the client. This requires working on design and content.

Payment Page Convenience

It is important to think over the convenience of the payment page on the website. The client should figure everything out at first try and as quickly as possible, and then make a payment. If this does not happen, they may go to another website where the transaction is easier to complete. Increase the convenience of the payment page thanks to tooltips, reduced number of fields to fill in, and intuitive structure.

Mobile-friendly payment page

According to the Digital 2022 Global Overview Report, over 92% of all Internet users go online from mobile devices. And their number only grows every year. For a long time, smartphones have been used not only to browse pages but also to order goods and services.

In 2021, online purchases via mobile devices accounted for 74% of the overall number of online purchases. Therefore, the payment page for the website must be adapted for mobile gadgets. If it is not, there is a high risk that the user will not be able to pay from their phone and leave for a competitor.

Number of payment methods

According to a study by Baymard Institute, 9% of customers refused to order goods and services because they needed more payment options. Therefore, the more payment acceptance options you have, the better. If a user doesn't find the right method with you, they won't pay. It is much more likely that they will go to a competitor who offers the payment system they are interested in and purchase goods and services from them.

Download Speed

According to Baymard Institute analysts, 17% of users have abandoned a purchase because the checkout process is too long and complicated. You've probably encountered a situation when the payment page took a long time to load after payment confirmation. Remember what you did in this case? You may have ended up leaving the website.

Antifraud Filters

The stronger the antifraud system of the payment service used, the more difficult it will be for a client to make a payment. If your client needs to use their card, to be in close proximity to the billing address (the address to which the card is registered), to confirm the transaction via SMS, there is a high probability that the payment will fail.

When setting filters, it is necessary to take into account the balance between the necessary security and convenience for the client. Typically, this applies to large international payment services such as Stripe.

Cryptocurrency as a Payment Method on the Website

One option to increase conversion to purchase is to accept cryptocurrency payments on a website. This is now one of the fastest and most seamless methods of payment, largely due to the lack of intermediaries in the form of banks.

With the help of cryptocurrency, it is also possible to accept payments under the conditions outlined in the sanctions. You can learn about other advantages of cryptocurrency in our article.

Learn how crypto acquiring can boost profit in our article: «Black Friday Guide: How to Maximize Sales».

The number of people who own cryptocurrencies has increased by more than a one-third year-on-year in 2022. GSMA Intelligence reports that more than 1 in 10 working-age internet users own cryptocurrency.

Paying with cryptocurrency on a website becomes more convenient when crypto processing is connected. It allows you to automate the payment process and makes it possible to track the status of all transactions.

It is important that when it is integrated, the other options for accepting payments still work. By adding cryptocurrency payment to your website or online store, you can increase payment conversion rates by providing a payment method that is popular and convenient among many users.

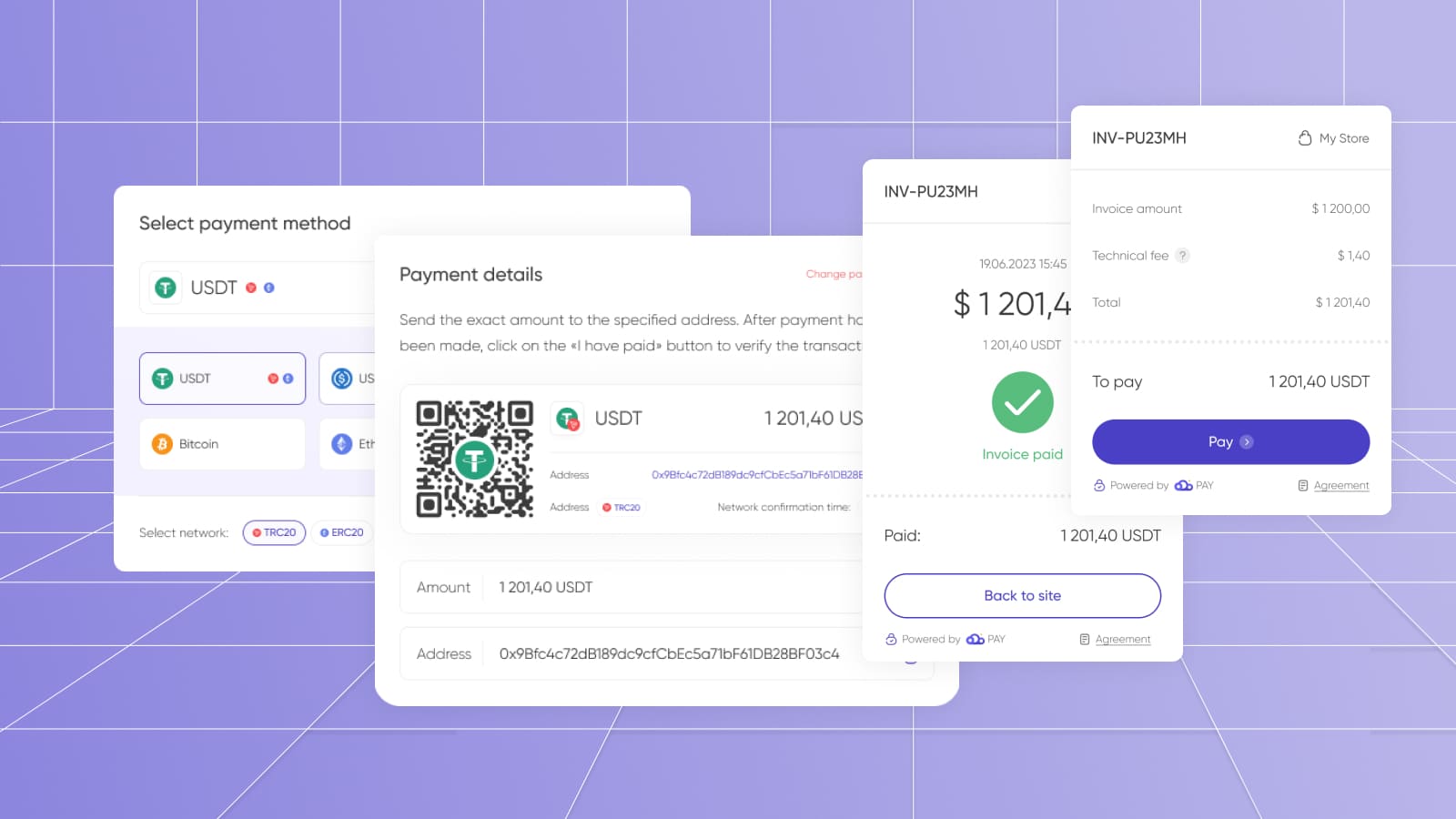

Benefits of CryptoCloud Checkout

Connecting the acceptance of cryptocurrency payments is possible with the help of crypto processing services. One of them is CryptoCloud.

To its main advantages, users include:

- a wide list of cryptocurrencies;

- ability to pass on payment of service and blockchain network fees to the buyer;

- full adaptation for mobile gadgets;

- display of payment statuses;

- possibility of additional payment;

- support of wide range of languages (English, Russian, German, Spanish, Italian, French, Chinese);

- convenient interface of the payment page;

- prompts at each stage of the payment process;

- possibility to change the payment method in the process;

- ensuring the safety of clients with protection against DDoS attacks and full data encryption;

- easy connection.

Commission for payment with CryptoCloud cryptocurrency — from 0.4%. You also need to take into account the commission of the blockchain network.

Is it Worth Working on Conversion?

Many factors affect payment conversion, including the reliability of the website, the user-friendliness of the payment page, and the number of payment acceptance options. One way to increase conversion is to accept cryptocurrency payments. It simplifies the transfer of funds and also allows you to accept international payments in the face of sanctions.

With CryptoCloud, you can connect crypto processing to start accepting crypto payments and do business beyond the territory of one state. If you have any questions regarding the operation of CryptoCloud service, check out our knowledge base.