Cryptocurrencies are no longer perceived as a bold technological innovation and have become integral to the global financial system. Geographically, the demand for this means of payment is uneven. It depends on the specific features of a particular state: legislative regulation, general level of economic development, credibility of the national currency, purchasing power of the population.

This article will explain why some countries that use cryptocurrency do it more actively than others. This information will help you in developing a sales strategy and promoting your business abroad.

Cryptocurrency Distribution in Different Countries: Evaluation Criteria

The American analytics company Chainalysis specializes in blockchain analytics. It publishes annual reports on the global cryptocurrency adoption index.

Chainalysis experts rely on the following indicators:

- The total value of cryptocurrency on centralized crypto exchanges (CEX).

- Retail trading on CEX. This metric shows the activity of non-professional traders. Only transactions with a volume of less than $10,000 are taken into account.

- Volume of peer-to-peer cryptocurrency transactions. In emerging markets, P2P transactions account for a significant portion of the total volume of cryptocurrency transactions.

- The value of cryptocurrency used in DeFi protocols.

- Retail activity in DeFi.

The adoption of cryptocurrency in different countries for all of these indicators is calculated by purchasing power parity (PPP) per capita. The volume of peer-to-peer cryptocurrency transactions is measured by PPP per capita and the number of internet users in a country.

PPP reflects a nation's wealth per resident. If two countries have the same indicator for a certain parameter, the country with the lower PPP will be higher in Chainalysis' ranking.

Global Adoption of Cryptocurrencies: Experts' Conclusions for 2022

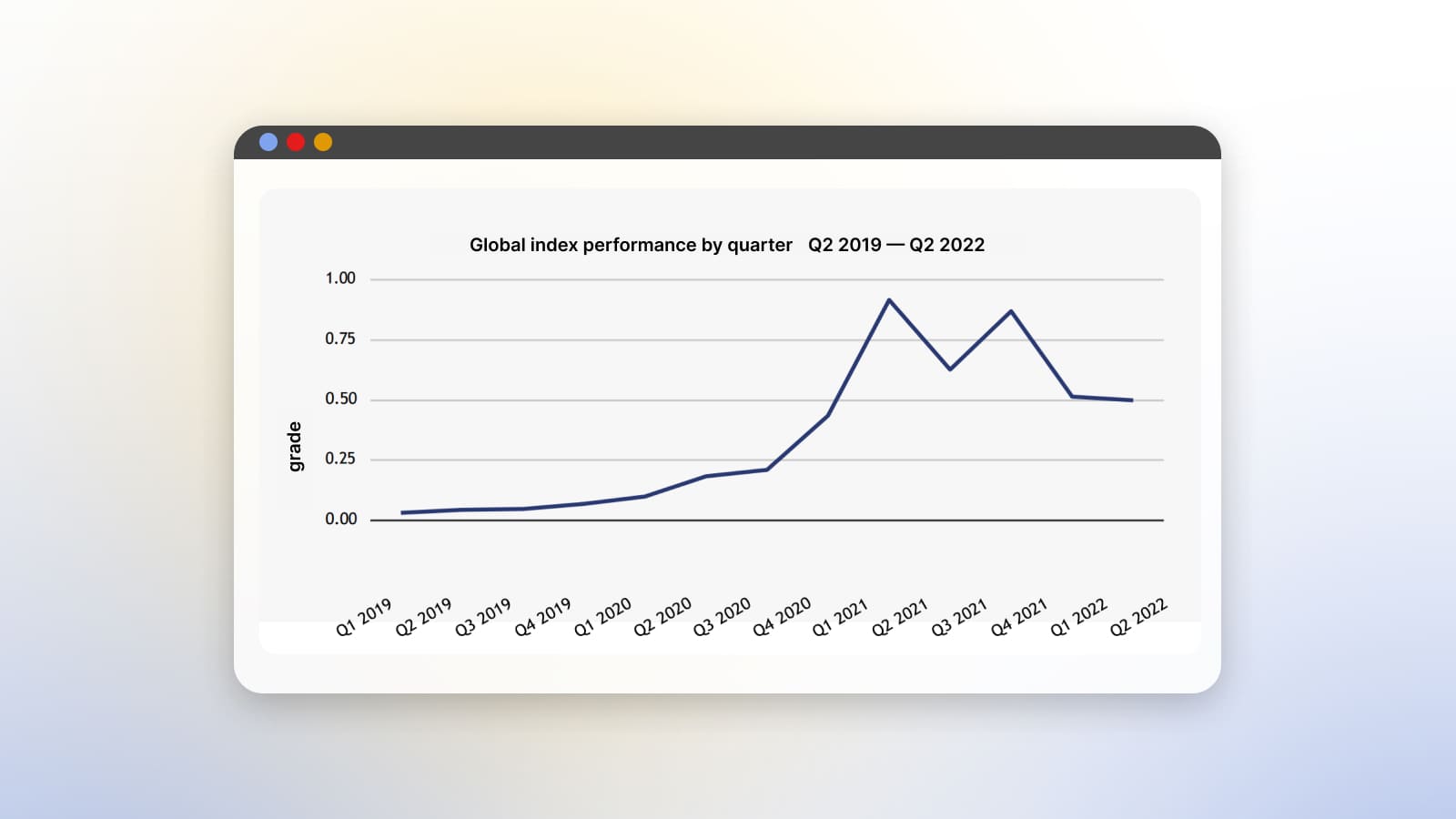

According to «The 2022 Global Crypto Adoption Index» report, the number of users willing to send and accept cryptocurrency payments has been growing globally since mid-2019. The growth stopped in 2022, but there has been no significant pullback.

The world is now in a bear market. If you plot the graph «Payment with cryptocurrency globally», it turns out to be wavy: the demand for this payment method rises slightly, then falls slightly. The average level of the graph remains higher than in 2019.

We also recommend reading our article with updated data for 2024.

The depreciation of digital assets has not led to their mass sell-off. Investors are optimistic and are maintaining portfolios. The cryptocurrency ecosystem has been growing steadily throughout market cycles, continuing to attract new users.

The World Bank distinguishes between high-income, upper-middle-income, lower-middle-income, and low-income countries based on income levels and overall economic development. Based on this, the ranking of countries for cryptocurrency adoption in 2022 is dominated by those with lower and upper-middle income. In these countries, sending and receiving payments in cryptocurrency are in the highest demand. Citizens of these countries show interest in Bitcoin and stablecoins as reliable alternatives to fiat money.

Top 10 Countries for Cryptocurrency Adoption in 2022

In 2022, the ranking of countries whose residents were the most active users of cryptocurrencies looked like this:

- Vietnam;

- Philippines;

- Ukraine;

- India;

- United States;

- Pakistan;

- Brazil;

- Thailand;

- Russia;

- China.

From this list we can understand in which countries cryptocurrencies are most often paid with cryptocurrency. However, it is not quite clear why the list includes countries with such different development: the United States, Pakistan, the Philippines and Russia.

For US residents, accepting payments from abroad is not as relevant as it is for people in developing countries. However, venture capital and strong intellectual potential are concentrated in the United States. A large number of new cryptocurrency projects are launched there.

In a falling market, investors' attention is attracted primarily not by speculative projects, but by those that close real pain points of users, such as tokenization of physical assets or identity verification.The active development of the DeFi sector has even led to a decrease in Bitcoin's dominance.

People in Brazil are primarily interested in speculative investments against the backdrop of extremely low interest rates in the country. The cryptocurrency market is attracting new users much faster than the market of traditional stocks in its time.

China banned cryptocurrency trading completely in 2021. However, the ban has not had the desired effect, judging by user activity.

Vietnam and the Philippines have the same drivers of growing interest in cryptocurrency: the influx of remittances and play-to-earn games. It is in Vietnam that Sky Mavis, the blockchain developer behind the most popular game Axie Infinity, is based.

For Indians and Pakistanis, transferring payments abroad is extremely relevant. India imposed a 30% tax on cryptocurrency gains and a 1% fee on each transaction in 2022. The government is concerned that trading is being practiced by non-professionals who cannot afford the losses that are inevitable for this kind of activity.

Nevertheless, the country is actively developing innovative cryptocurrency projects, particularly those that help rural artisans monetize their activities.

The Central Bank of Pakistan has partnered with Alipay, one of the cryptocurrency transfer channels. At the same time, the central bank and the government plan to ban digital assets in the state, as the potential harm from them is allegedly more than good. However, there is a possibility that the cryptocurrency sector will simply be subjected to stricter regulation, for which government subcommittees have already been formed.

The use of cryptocurrency in Russia and Ukraine has grown. Contrary to experts' fears, big business and wealthy individuals did not start using bitcoin and altcoins en masse in order to circumvent sanctions. Cryptocurrency markets turned out to be insufficiently liquid for this purpose.

However, the public began sending and receiving international cryptocurrency payments more frequently due to rising inflation and restrictions on fiat currency transactions conducted through banks. Ukraine has received over $65 million in cryptocurrency donations.

Cryptocurrency and Developing Countries

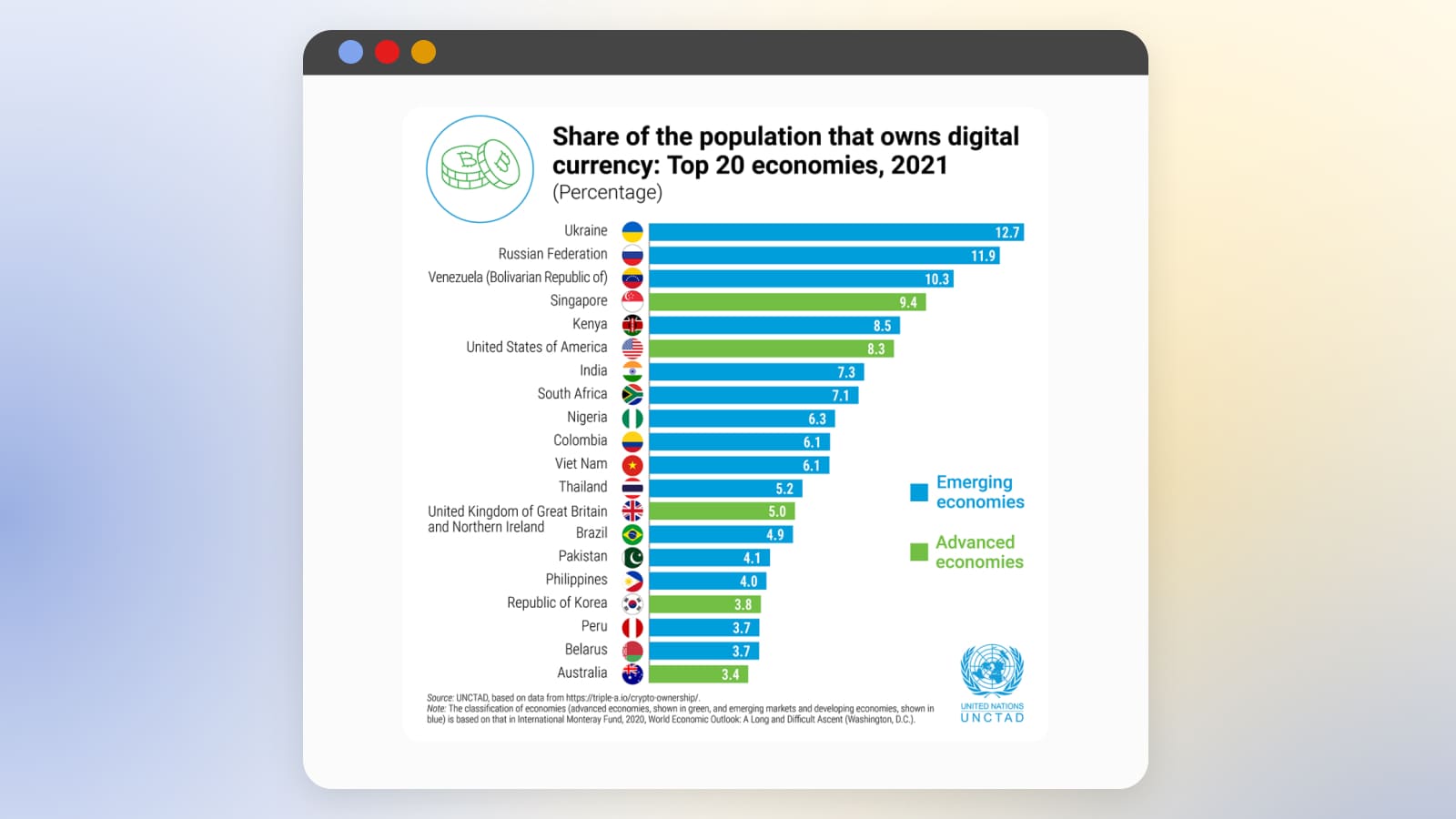

According to UN statistics, in 2021, the ranking of countries where cryptocurrencies were most widespread looked like this (the percentage indicates the share of the population owning this type of asset):

- Ukraine — 12.7%;

- Russia — 11.9%;

- Venezuela — 10.3%;

- Singapore — 9.4%;

- Kenya — 8.5%;

- USA — 8.3%;

- India — 7.3%;

- South Africa — 7.1%;

- Nigeria — 6.3%;

- Colombia — 6.1%;

- Vietnam — 6.1%;

- Thailand — 5.2%;

- United Kingdom — 5%;

- Brazil — 4.9%;

- Pakistan — 4.1%;

- Philippines — 4%;

- South Korea — 3.8%;

- Peru — 3.7%;

- Belarus — 3.7%;

- Australia — 3.4%.

Developing countries dominate the list. Their populations are interested in cryptocurrencies in order to:

- diversify their investment portfolio;

- earn profits on short-term trading in volatile assets and DeFi transactions;

- protect savings from inflation (Bitcoin and stablecoins are optimal for this purpose);

- make cross-border money transfers;

- have fun.

In the entertainment niche, the public is particularly interested in NFT collecting, meta-universe events and play-to-earn games.

Accepting Cryptocurrency Payments

Cryptocurrency is in demand in different countries depending on how much the public needs this method of transferring funds and making payments. The greatest demand for cryptocurrency is in developing countries. People use digital assets to save their savings from inflation and to establish acceptance of payments from abroad.

We discussed the advantages of cryptocurrency as a financial instrument in detail in the article.

If you want to cooperate with foreign partners and receive international payments, we advise you to activate payment acceptance with cryptocurrency. CryptoCloud will help you with this. If you have any questions about connecting crypto acquiring, please go to the FAQ or contact our technical support.