A crypto exchange is a platform for trading cryptocurrency. There are many websites available in the crypto market that allow trading, exchanging, investing, earning, storing digital assets. The top cryptocurrency exchanges according to CoinMarketCap's assessment include such services as Binance, Coinbase Exchange, Kraken, KuCoin, Bybit. The largest platform by daily transaction volume is Binance (over $4.6 billion).

In the article we will consider what crypto exchanges are, what are their functions and the principle of their work and what varieties of exchanges exist.

What is a Crypto Exchange?

A cryptocurrency exchange is a platform for buying and selling cryptocurrency. Such services provide cryptocurrency trading for both fiat and other cryptocurrencies and tokens.

Most crypto exchange websites act as broker platforms and serve as intermediaries between buyers and sellers of cryptocurrency, simplifying the search for the second party to the transaction and guaranteeing its security.

A commission is charged for processing transactions, the amount of which depends on the volume or type of transaction. In addition to exchanging and trading, many crypto exchanges also offer cryptocurrency storage services (built-in cryptocurrency wallet).

The principle of operation of cryptocurrency exchanges is similar to traditional exchanges, but there are a few differences. Firstly, most crypto exchanges are online platforms that are available at any time of the day. Secondly, in terms of legislation, cryptocurrency platforms are almost unregulated: although many countries are gradually making steps in this direction, at the moment cryptocurrency trading is in a «gray zone».

How Do Crypto Exchanges Work?

Trading on a crypto exchange works as follows:

- Registration. Centralized platforms also require verification: during the registration or before withdrawing funds.

- Deposit to the account. You can deposit both fiat money from a bank card or e-wallet and cryptocurrency.

- Opening an order (request) to buy/sell cryptocurrency. As on a regular exchange, the user can request a transaction at the current market price or set a desired price. In the first case, the order will be processed immediately, in the second case — when/if the cryptocurrency price reaches the specified value (triggering is not guaranteed).

- Transaction execution. The exchange automatically finds a suitable offer in the system and processes the order.

- Withdrawal from the crypto exchange. Available methods of withdrawal depend on the chosen platform. As a rule, withdrawal to a bank account or e-wallet (for fiat money) or to a cryptocurrency wallet (for cryptocurrency) is used.

Although the main function of such platforms is trading, the capabilities of cryptocurrency exchanges also include the exchange and storage of cryptocurrency. Many services have their own crypto wallets and crypto cards.

Types of Crypto Exchanges

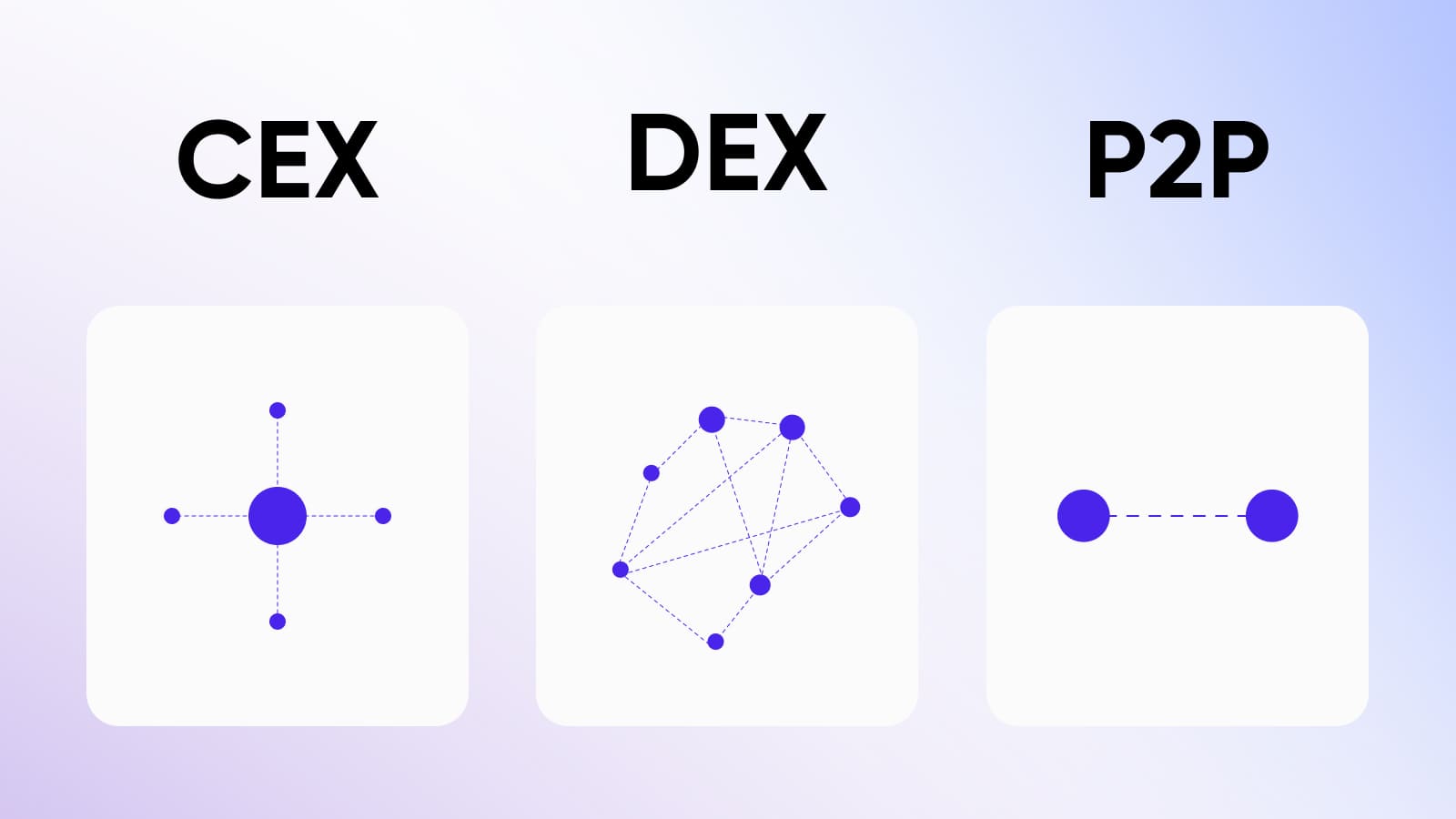

In the list of cryptocurrency exchanges, you can find platforms of several types: centralized, decentralized, peer-to-peer. When comparing crypto exchanges, it is important to take into account the difference between these varieties, so let's consider them in detail.

Centralized (CEX)

Such crypto exchanges are managed by a company or organization and stick to the laws of the country where they are registered. Verification and undergoing KYC is required to work on such platforms. The administration has access to users' accounts, can block them due to suspicious activity or restore access to the account if necessary.

While the very fact of centralization contradicts one of the basic principles of blockchain, CEX exchanges have their own advantages. For example, it is easier to work on them for those who have not dealt with cryptocurrency before. In addition, the best crypto exchanges of this type take a number of measures to protect assets: cold storage, monitoring of transactions and IP addresses, etc.

Decentralized (DEX)

DEX exchanges are not supervised by regulatory authorities, do not require verification, do not store user data and do not have access to accounts. All transactions are carried out through smart contracts.

Crypto-owners on such an exchange act as traders (those who carry out transactions) or investors (liquidity providers who receive a commission on transactions). Transactions are performed directly from traders' personal wallets — the exchange does not have access to accounts.

The decentralized system of work allows users to maintain anonymity and full control over their funds. Nevertheless, before choosing a decentralized crypto exchange, it should be taken into account that it will be more difficult for beginners to work on such a platform.

Peer-to-peer (P2P)

In essence, P2P crypto exchanges are message boards, where users can independently choose which application to respond to. Here, verification is not always required, the transaction can be canceled, and trading is done directly without intermediaries, which reduces the size of commissions.

Nevertheless, it should be taken into account that the response to a posted ad may not be received immediately, and when working directly with other users, you may encounter fraud.

Peer-to-peer platforms from the top crypto exchanges take measures to protect users from fraudsters. Thus, a number of services use their own escrow system, when the required amount of assets is automatically transferred to a temporary balance.

Popular Cryptocurrency Exchanges

There are many available crypto exchanges. We have collected the top 10 actual platforms that you can pay attention to.

Binance

Binance takes the first place in the ranking of cryptocurrency exchanges from CoinMarketCap. It is one of the largest crypto exchanges in the world. There is a wide selection of available cryptocurrencies, passive earnings on unused assets, mobile application. The commission is no more than 0.1%. You can buy cryptocurrency through a P2P platform.

Bybit

It is in the top 5 of the rating of cryptocurrency exchanges from CoinMarketCap. The platform can be operated through a mobile application. There is a cryptocurrency card. Trading bots are available, which allow you to automate cryptocurrency trading. Assets are stored on cold wallets. Bybit also uses real-time tracking of user actions and encryption of personal data for protection.

It also offers users a build-in crypto wallet. You can learn more about it in our article.

OKX (former OKEx)

On OKX, several modes of operation are available: Lite (for beginners), Web3 (wallet) and Pro (for advanced users). There are P2P, earning opportunities, a number of trading tools (including bots). Trading is conducted on the service's own platform.

Huobi

Huobi is a centralized Chinese platform available in 100+ countries. Features include fast cryptocurrency purchase with bank card payment, P2P trading with minimal commissions, trading bots, passive income and investment opportunities, staking and crypto-loans, as well as various bonuses and rewards.

KuCoin

KuCoin handles more than 700 cryptocurrencies. It offers users tools for cryptocurrency and cryptofutures trading, staking, and investing. There is a built-in wallet and a mobile app. The exchange is characterized by a high level of security and supports Proof of Reserves technology. P2P trading and work through trading bots is available to users.

MEXC

MEXC works with trading deposits from $1 and charges a 0% commission on transactions. You can pay for the purchase of cryptocurrency by bank card or transfer. P2P deals are available. There is copy-trading and demo-trading for novice users. Earnings on staking and airdrops are available.

Bitget

Bitget is a reliable platform with proof of reservation of clients' funds, protection fund (300 million USDT) and storage on cold wallets with multi-signature. Commissions from 0.02%. There is a bonus program. Cryptocurrency purchase is possible with payment in fiat money, via P2P system or through third-party services (Simplex, Banxa, Mercuryo). A set of trading bots, earning on steaking and lunchpad is available. There is a mobile application.

Gate.io

Gate.io processes more than 1700 cryptocurrencies, which is one of the main advantages: rare altcoins are available here, which are impossible to work with through other platforms. There is an instant deposit/withdrawal feature and advanced security systems. Indefinite futures, spot/margin/ETF, investments and crypto-loans are available, as well as trading bots with the ability to subscribe to the strategy of the selected trader.

Exmo.me

On Exco.me, users can use bank cards and electronic payment systems (e.g. QIWI) to deposit funds to your account. The functionality includes both fast trading with a simplified interface and «professional mode» with advanced features. There is an option of passive earning.

The Best Crypto Exchanges in 2023

The crypto exchanges market in 2023 is huge due to the continuous growth of the cryptocurrency market. There are many platforms for trading digital assets: from simple P2P platforms to large services with extensive functionality.

When choosing an exchange, we recommend paying attention to the reputation of the platform, available features, and the level of security.