There are multiple ways for crypto owners to increase their profits, and lending is one of them. Many users see crypto lending as an effective way to generate passive income, and currently, many services offer tools for such earnings.

We will explain cryptocurrency lending, the advantages and risks of such income, how to choose a suitable platform, and which services are worth considering.

Lending: What It Is

Lending is earning profits from loaning cryptocurrency at interest. The principle of work is similar to bank deposits in fiat. The owner of the cryptocurrency lends funds to a private user or platform.

When lending through exchanges, the platform pays role of the central counterparty: the crypto owner opens a deposit, and the service gives cryptocurrency at interest to those who want to take a loan.

Despite the similar principle of work, earning on crypto investments has several significant differences from traditional deposits. One of the main ones is a significant risk. Cryptocurrency is an asset with high volatility. Long-term deposits in digital currencies with interest can lead to losses in case of a fall in the rate.

Lendings are suitable for users with idle capital who want to use it for passive income. It is an excellent way to diversify your investment portfolio and earn additional profits.

Crypto Lending Types

Depending on the term of the deposit, the following kinds of landings are distinguished:

- Flexible. This is a low-yielding but also the least risky option. The user deposits their funds on deposit for an indefinite period of time, reserving the ability to get them back at any time.

- Fixed. Assets are frozen for a specific period. This increases the risk of losing funds due to volatility, but the interest rate for fixed deposits is higher than for flexible ones.

In addition, there are three types of lending based on the principle of operation and level of centralization:

- Decentralized (DeFi). Uses decentralized protocols based on smart contracts. Due to the absence of intermediaries, there is a high level of transparency.

- Centralized. Lending in which an exchange or service acts as an intermediary. This is a simpler option from a technical point of view due to custodian services. Nevertheless, when using this type of lending, you should be wary of fraud and hacker attacks on the exchange.

- P2P. The borrower and the lender work directly. This provides more flexibility in the terms of the transaction. However, there is a risk of the second party defaulting.

Benefits and Risks of Lending

Investing in cryptocurrency and making money from crypto lending attracts users for several reasons:

- High return on investment. A crypto owner offering loans in cryptocurrency can count on higher interest rates than when placing fiat currency on a bank deposit.

- The possibility of additional earnings with the growth of value. Cryptocurrency's high volatility is not only a source of risk but also a potential way to make a profit.

- Flexible terms. There are several types of lending with different terms and interest rates. With P2P lending, the conditions are completely dependent on the participants, allowing you to negotiate a favorable deal.

- Relative simplicity of the process. Lending is a passive income that does not require the active participation of the crypto owner after the deposit is placed or the funds are transferred to the borrower.

At the same time, it is important to remember the risks associated with such income:

- Volatility of cryptocurrencies. Crypto owners receive interest in digital currency. If the exchange rate falls, they can face high losses, especially with a fixed deposit, from which they can only withdraw funds at the end of the term.

- Cryptocurrency freeze. Creating a deposit means losing access to your funds for a certain period and being unable to use the capital for other purposes.

- Fraud. It can be encountered both with P2P lending and with a centralized scheme of work. It is important to check the platform carefully before placing your funds on it.

How to Earn From Cryptocurrency Lending

To generate income, you need to:

- Choose a platform. It is important to ensure that the service is reliable in advance and carefully read the terms and conditions.

- Register. Most platforms require verification of the account.

- Deposit the necessary amount of money.

- Choose the appropriate conditions of the lending and start it in accordance with the rules of the platform.

- Track the status of the deposit. It is important to follow the situation in the market to be able to react in case of strong fluctuations in the exchange rate.

- Withdraw the income after receiving interest or invest the capital again.

- Pay income tax.

Before launching a lending platform, it is important to assess all the risks — from borrower dishonesty in P2P lending to cryptocurrency market volatility. Crypto owners not ready to accept these risks are not recommended to use this income method.

How to Choose a Lending Platform

To choose a reliable service, it is recommended to focus on several criteria:

- Reputation. To avoid fraud, you should get acquainted with the feedback and reviews of other users in advance.

- Rates. Interest can depend on the deposit term, currency, type of lending, and other factors. It can be accrued hourly, daily, or one-time after the deposit period is over.

- Terms of service. The rules depend on the chosen platform. So, most reliable exchanges with a good reputation require documents to confirm identity.

- Security. You should make sure that the platform is protected from hacker attacks. In addition, it is recommended to check the platform for problems with the regulatory authorities of the country where it is registered.

Top Crypto Lending Platforms

Binance

Binance is a large centralized exchange, one of whose services is Simple Earn. Users have access to flexible and fixed deposits for 14 to 120 days. The rate depends on the currency and changes in accordance with the market — so, at the time of writing, the reward for Bitcoin is 0.02% + 0.25%, USDT — 2.7%, and for rarer tokens can reach 15% and higher.

There is an auto subscription function to automatically update the deposit after its expiration (for fixed deposits) or to use all assets on the account in case of a flexible scheme of work.

Gate.io

The Gate.io exchange with Simple Earn allows you to invest for a flexible term and earn income after a loan offer is matched with another user's need to borrow. Interest accrues every hour and is automatically added to the deposit amount to boost earnings.

The interest rate is updated every hour depending on market conditions — some assets have interest rates as high as 500%. You can exit the program at any time, but if at the moment of exit the deposit is on loan, the user must wait for free funds to appear in the general pool.

OKX

OKX Earn is a service for passive earnings, which includes several sections: simple Earn, structured products, and on-chain.

Simple Earn is a basic service for beginners. It has minimal risks and a low entry threshold. Structured products (Snowball, Shark Fin, double investments, gull strategy) are innovative tools of OKX, allowing to increase income from deposits.

Their use involves more risk, but allows for a higher interest rate. The on-chain uses staking and DeFi protocols.

Bybit

Bybit Savings is an earnings tool that offers flexible and fixed deposits with popular coins. The interest rate changes every hour depending on market conditions.

Users can view the changes over the last 24 hours to make a deposit decision. There is no automatic reinvestment of income feature at the moment.

When creating flexible deposits, the APR booster, which increases the rate by a certain percentage, can be activated. The booster is valid for the entire deposit term or until the income amount specified in the terms and conditions is reached.

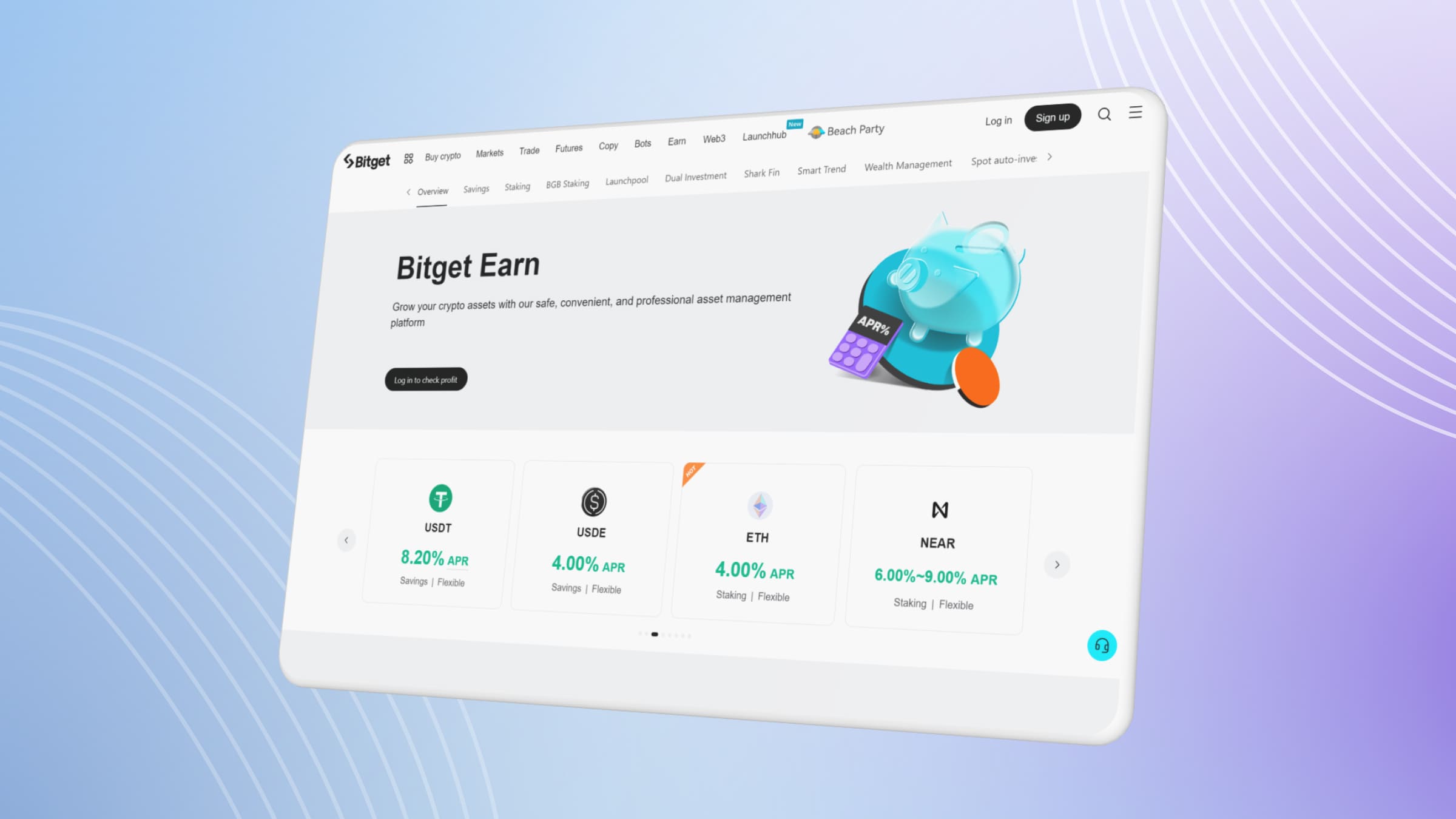

Bitget

Bitget Earn is a platform that provides products for generating income from cryptocurrency. Users can work on a «Just» scheme or use structured products to increase rates (up to 900% or more). The system supports flexible and fixed deposits.

Users have access to a convenient calculator that allows them to calculate the projected profit. The calculation requires entering the investment amount, selecting the currency and specifying the term. The system automatically suggests the most profitable scheme of work and will display the income in the selected currency based on the current rate.

Aave

Unlike the centralized exchanges presented in our selection, Aave is an Ethereum-based DeFi protocol. The platform is open source and supports several wallets.

Aave is dedicated to creating deposits, receiving cryptocurrency loans and borrowing against their assets. A user planning to earn on the lending platform only needs to choose a currency and enter the desired amount of funds. To assess the prospectivity of the asset, the crypto owner can study the statistics provided by the platform.

Yobit

Yobit is an exchange focused primarily on the lending of rare coins. The service is developer-oriented and is designed primarily for the promotion of newly created or low-popular сoins and currencies.

Compared to other systems, this platform offers lower rates (mostly 1-3%) and rather limited functionality. The user can cancel the investment and get access to their funds at any time. According to the service's statement, all payments to participants are sent from a separate fund.

Earnings on Crypto Landing

Cryptocurrency lending is a popular way to generate passive income from unused assets. It is in demand due to its simplicity, flexibility, and high interest rates compared to fiat bank deposits.

There are many services on the market that offer users platforms for crypto lending. A crypto-owner can choose from a wide range of terms, rates, and schemes — from simple services for beginners to structured products with high risks and corresponding rates.