Bitcoin is the first cryptocurrency created in 2009 by Satoshi Nakamoto — a person or group of people supposedly hiding behind this pseudonym.

Unlike traditional fiat currencies, bitcoin is not issued by a central bank or regulated by the government. Therefore, buying cryptocurrency is also different from buying stocks or bonds.

The following article will explain what factors affect the price of bitcoin to help you make more informed decisions about buying or selling this cryptocurrency.

What Determines the Price of Bitcoin

Bitcoin is not issued by the central bank of any country, and its price is not backed by the resources of states. Therefore, monetary policy instruments, inflation rates, and economic growth indicators, which usually affect the value of a currency, do not affect bitcoin. Instead, this cryptocurrency acts as a means of preserving value.

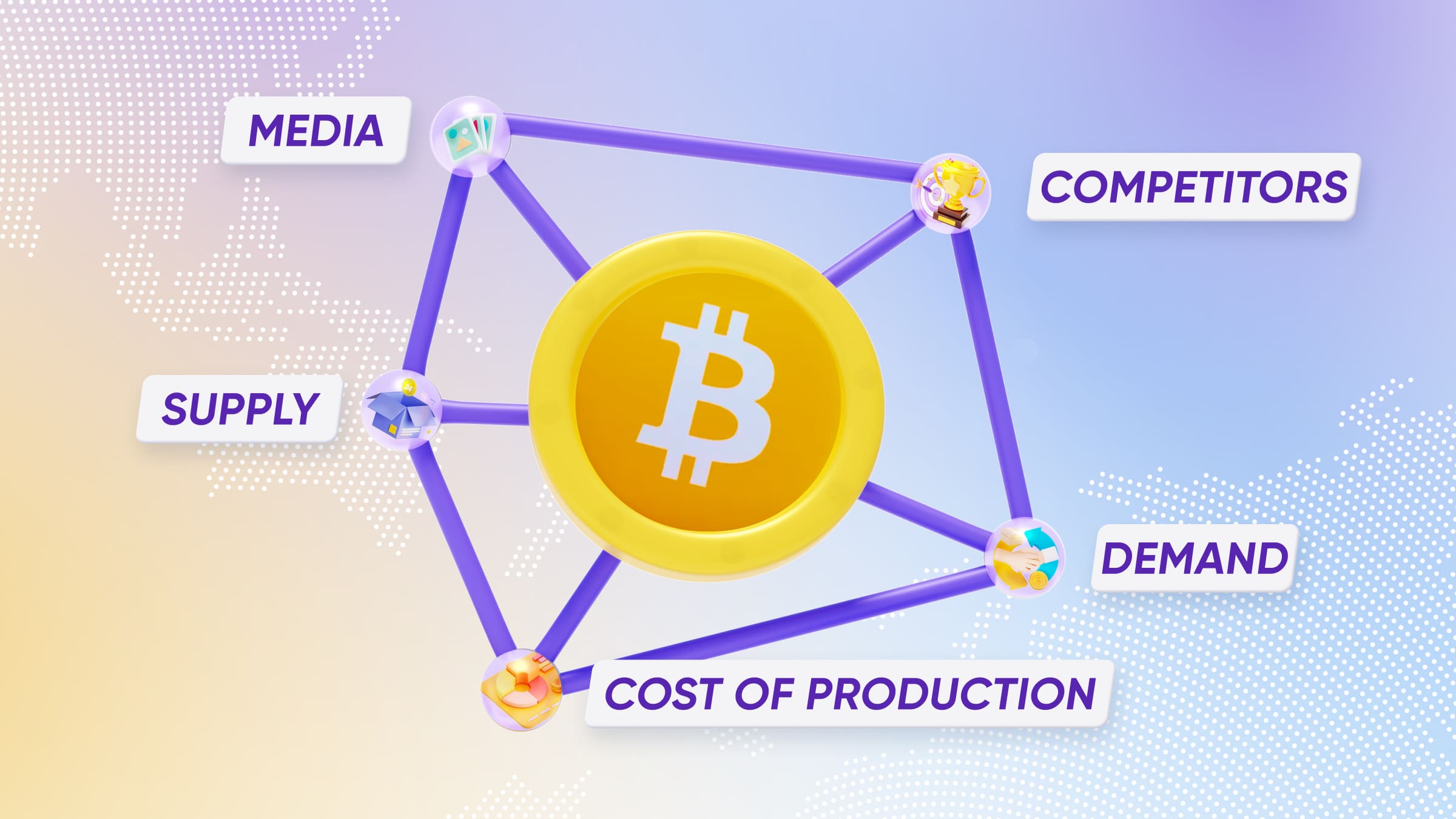

Several factors that affect the exchange rate of the digital currency can be distinguished:

- supply and demand in the market;

- the cost of production;

- news;

- regulation of its sale and use;

- the number of competing cryptocurrencies.

Let's take a closer look at each of them.

Supply and demand

When determining the price of an asset, its market supply plays an important role: the smaller it is, the higher the value of the cryptocurrency. The issuance of Bitcoin is limited — the program code of the currency determines that no more than 21 million digital currency units can be issued.

The cryptocurrency's operating protocol allows new Bitcoins to be mined in a fixed amount, which decreases with each halving. Thus, the supply of cryptocurrency in the market is limited, which stimulates an increase in demand.

Bitcoin also attracts public attention through extensive media coverage, investment experts and entrepreneurs. Cryptocurrency is actively used in countries with high inflation and as a way to transfer large sums of money internationally.

The limited issuance of cryptocurrency and high demand for it significantly increase the value of the asset. Nevertheless, its price periodically fluctuates: in 2017 it reached its peak, after which it remained quite low for a long time. In 2021, the cryptocurrency experienced 2 sharp price spikes and a decline during 2022.

Production costs

Bitcoin mining requires investment just like the production of goods — studies have shown that its costs are closely related to the amount of rewards.

Bitcoin production costs include fixed (electricity, equipment) and variable (algorithm complexity) costs. A network of miners is engaged in hashing — converting data into a string of a certain length and format. This process requires significant computing power and electricity consumption. As a result of the miners' work, new blocks appear, for which they are rewarded with new bitcoins.

News

The popularity of cryptocurrency both positively and negatively affects its price. Any changes in the above factors are immediately covered in the media. Sometimes even forecasts and expectations of price changes can affect the cryptocurrency rate.

Both official press releases and data from social networks can affect the price of cryptocurrency.

Regulation of circulation

Bitcoin was created after the global financial crisis caused by the weakening of the derivatives market. Due to the lack of centralized regulation, the cryptocurrency gained a reputation as a financial vehicle to escape the influence of regulators and sanctions.

The lack of government control has both pros and cons. Bitcoin is freely used around the world and cannot be restricted. Nevertheless, many countries introduce laws that determine the order of cryptocurrency circulation and influence asset rates.

For example, in 2021, after the U.S. Securities and Exchange Commission approved the creation of the Bitcoin Futures ETF — a fund that invests in bitcoin — the price of the digital currency jumped to $69,000.

Another example is the ban on bitcoin trading and transactions imposed in China in the same year 2021. As a result, the value of the asset dropped from $51,000 to $41,000.

Competing cryptocurrencies

Bitcoin is the most popular cryptocurrency. However, it is not the only one — there are hundreds of others that are in demand among investors and regular users. The market share that bitcoin holds has been shrinking over time. In 2017, its capitalization was more than 80% of the market. In 2023, this figure dropped to 50%.

The main reason for this decline is the growing popularity of other cryptocurrencies. The most famous of them are: Ethereum, Tether, Binance Coin, Solana. Despite the fact that they have reduced the market share occupied by Bitcoin, the growing competition has attracted even more investors to this digital currency. Being the world's first cryptocurrency, bitcoin has benefited from the increased attention to the market and as a result, its value has remained high.

Factors Affecting Bitcoin Price: A Breakdown of the Main Aspects

The price of bitcoin is influenced by many different factors. The following play a key role in the fluctuations of the cryptocurrency's value: limited supply, high demand, production costs and news shaping public opinion.

All these factors create complex dynamics in the bitcoin price, making it an investment that requires careful analysis and understanding of market trends.