Cryptocurrency is a volatile asset whose value can change in a matter of hours. This feature is both a way to generate income and a dangerous factor that can lead to loss of funds in case of an unexpected market collapse.

We will explain what the fall of cryptocurrency is associated with and how to anticipate it, what a bear and bull market mean, what factors influenced previous collapses, and how to protect yourself from losing money in such conditions.

What Is a Collapse in the Crypto Market

A cryptocurrency market crash is a sharp decline in the value of digital assets. As a rule, we start talking about a collapse when the price decreases by 10% or more in one day. Such a decline can be caused by various factors — from changes in legislation related to cryptocurrency to rumors of hacker attacks on exchanges.

For crypto owners, the danger is both the initial drop in the rate and its consequences. After a sharp decline in value, panic can set in: theories are built as to why Bitcoin or other currencies are falling, asset owners start selling off their assets, causing additional price fluctuations, and many market participants face losses.

Bear and Bull Market: What Are the Differences

Before we move on to the causes of the collapse, let's consider what a bull market in cryptocurrencies means and how the bears are related to the fall of the rate.

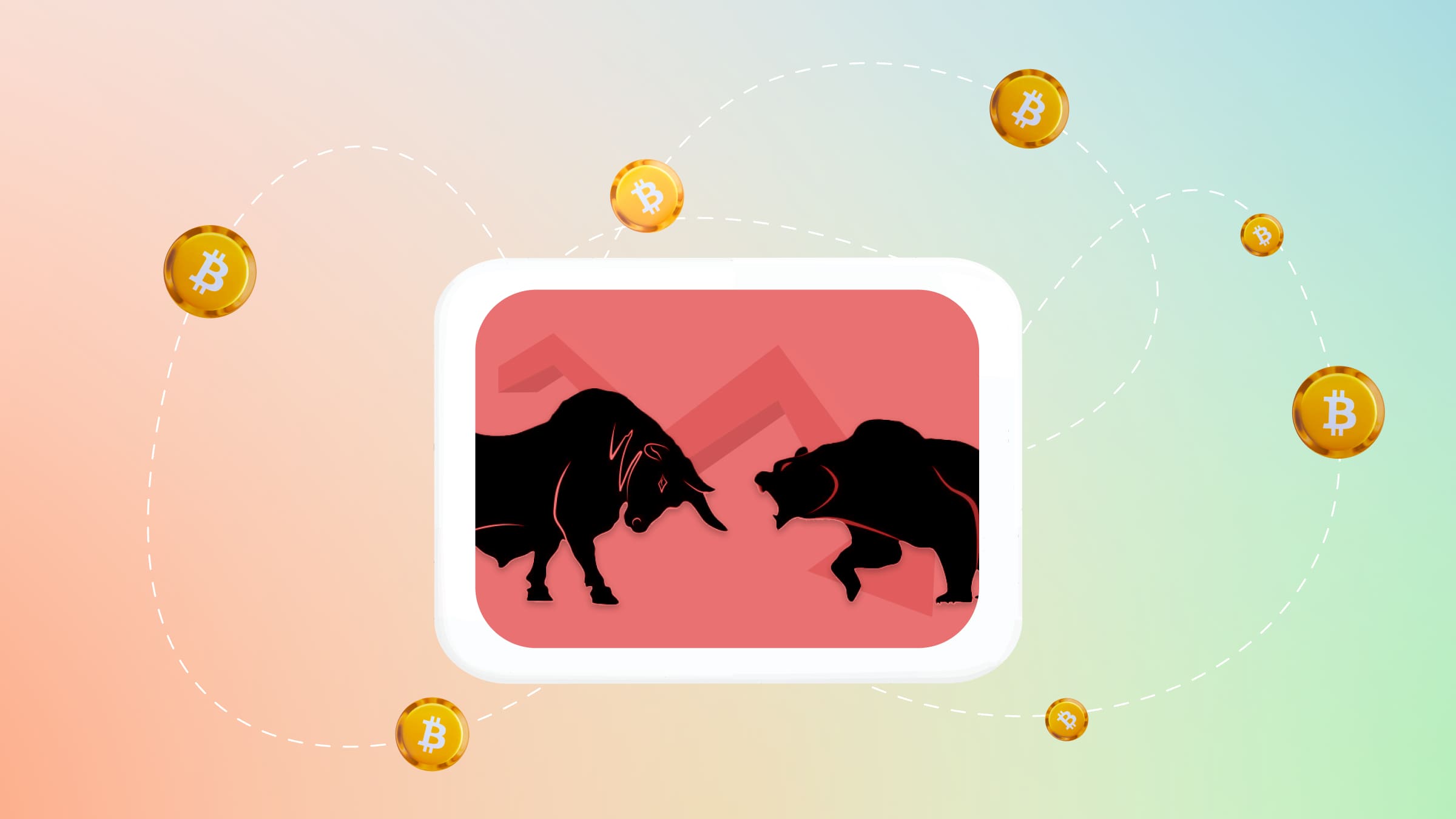

Bulls and bears are names for buyers and sellers. Depending on who dominates, two main trends stand out: bull and bear markets.

A bull market is formed during a period of growth. At this time, market participants buy assets, expecting to earn on them later.

A bear market in cryptocurrency is a sellers' market. This trend is formed during a decline in the price of assets: bears sell cryptocurrency to make money before its value drops. This strategy causes the price to drop even lower, which can result in a sharp drop in cryptocurrency and a market crash.

How to Identify an Impending Collapse

You can predict a cryptocurrency market crash based on several factors:

- Fear and Greed Index. It reflects market sentiment using a scale from 0 (maximum fear) to 100 (maximum greed). Its low level indicates a panic sell-off of assets, which usually occurs after a collapse.

On the contrary, a high index (greed) reflects a situation when crypto-owners actively invest in buying currency. The price during this period is often overvalued. Because of this, when the index level approaches 100, we can talk about the imminent decline in the value of cryptocurrencies. - Transfers of whales. Whales are called market participants who own significant amounts of money. Thanks to large capital, they can influence the state of the market and asset rates. If a whale transfers money to another currency, it can be a signal of a soon collapse, the partial cause of which will be the actions of a large crypto owner.

Capital withdrawals from a particular site can cause a cryptocurrency exchange to collapse. Many crypto owners track the actions of whales and follow their example, which also affects the state of the market. - RSI (Relative Strength Index). Reflects the change in the price of an asset on a scale from 0 to 100 and is calculated as the ratio of the average rise in value to the average fall. High values of the index (more than 70) signal oversold — too high growth in value, after which there may be a pullback and fall of the cryptocurrency.

At the same time, it should be taken into account that RSI can remain close to the upper boundary for a long time — it is not recommended to make decisions based solely on it.

- Trading volume. It can signal a too-high value, at which market participants stop buying cryptocurrency. At the same time, its owners, on the contrary, are trying to make money on the sale, which leads to a collapse of the rate.

Also, a decrease in trading can speak of a loss of confidence in a particular platform and a decrease in the number of users, which makes the exchange more vulnerable to external factors. - Regulatory measures. One of the important reasons for the fall of cryptocurrencies is the introduction of new legislative measures regulating the use of digital assets.

Both a complete ban on the use of cryptocurrency as a means of payment and more soft bills — for example, the need to obtain a special license for crypto exchanges registered in a particular country — can lead to a collapse.

It is important to monitor not only the already adopted measures but also plans and even rumors: they can affect market sentiment.

History of Cryptocurrency Market Crashes

Mt. Gox hack (2011)

The first Bitcoin collapse occurred in 2011, at the very beginning of the crypto industry. At that time, the Mt. Gox exchange was the only major platform for conducting transactions in BTC. The currency was characterized by quite high volatility: natural rate fluctuations in early 2011 ranged from $2 to $32 and then up to $17.5.

Nevertheless, one of the largest market collapses, which occurred in June 2011, was not caused by «natural» causes. Hackers attacked the exchange, reducing the price to a few cents and causing the value of the cryptocurrency to drop 99.9% in one day.

New edict from the Chinese government (2013)

The second major collapse in Bitcoin's history was preceded by a dramatic surge: the currency went from $200 to $1151 in less than a month. On the scale of the emerging crypto market of this period, it was a record and formed a bull market in which all participants were eager to buy assets.

The optimistic sentiment changed after the introduction of a new Chinese government decree. According to it, the country's banks are banned from working with crypto assets. This was the first major restriction related to the crypto sphere. It led to a pullback, during which Bitcoin fell below the original $200.

Crypto winter (2017-2018)

Crypto winter was the name given to the prolonged period of market decline that began in December 2017 and lasted until 2019. Like the previous cryptocurrency collapse, crypto winter started with a high rise: a new all-time high of BTC was reached, which amounted to $19,497.

However, it did not last long. The high price attracted a wave of new investors, which destabilized the market, and six days after reaching the maximum, Bitcoin fell to $13,800. After another month, the rate dropped to $7,000; by December 2018, it was down to $3300. Prices didn't start to partially recover until 2019.

COVID-19 (2020)

New in the world of cryptocurrency, the rate drop was caused by the COVID-19 virus. The collapse occurred when COVID-19 was officially declared a worldwide pandemic — March 12, 2020. The panic affected the entire economic sphere and led to a 37% drop in the exchange rate within a day: from $7911 to $4970.

Unlike crypto winter, the market recovered quickly from the COVID crisis. The new growth of the Bitcoin rate was associated with measures to support the financial sphere, which were adopted by the U.S. government, and followed soon after the recovery of the traditional stock market. By the end of the year, the rate had already reached $17,800.

Tesla's rejection of BTC and China's new bill (2021)

Spring 2021 was a period of growth, with Bitcoin hitting a new all-time high (~$64,000). A rapid economic recovery from pandemic restrictions drove this rise.

However, May 2021 saw a new collapse in the exchange rate — the value of BTC fell by more than 50%, stopping at around $30,000. Experts named two important events among the reasons why Bitcoin fell.

First, Tesla, which had previously supported the crypto industry, refused to use Bitcoins as payment. Secondly, mining was banned in China, although the country was previously considered a major mining center.

FTX Scandal (2022)

The most recent collapse of the crypto market occurred at the end of 2022, when a major exchange, FTX, went bankrupt. The platform was considered the second largest crypto exchange in the world, where many people stored their assets.

Rumors that the exchange might be unsustainable surfaced back in the summer. On November 2, an article questioned FTX's liquidity. A few days later, the head of Binance announced that he planned to sell his stake in FTT tokens issued by the exchange. This news led to a massive withdrawal of assets from the site, and on November 11, FTX declared bankruptcy.

What to Do in Case of a Market Crash?

You can reduce your losses when the crypto market collapses by sticking to several strategies:

- Purchase of stablecoins. Their volatility is minimal compared to regular cryptocurrencies due to the provision of other assets: fiat currency, securities, etc.

- Investment in large crypto projects. Currencies such as Bitcoin or Ethereum return to a period of growth after each market drop, so investing in them is good for the long term.

- HODL (Hold On for Dear Life, buy and hold). A strategy that involves holding assets even during market downturns and not selling when the market is down.

- Long-term investing. Regularly buying selected assets regardless of their current price and market conditions. The goal of the strategy is not short-term profit, but the formation of a large portfolio for the future.

In addition, experts offer several tips on how to reduce risks in a volatile market:

- Diversification. The advice relevant to any investment is not to invest all capital in one asset. Distributing funds between different currencies and blockchains will help avoid major losses.

- Understanding market trends. You should observe the market's state and track the factors that can lead to its destabilization. This will allow you to react to a downturn in time.

- Using Stop-Loss. It is an algorithm that will automatically put assets for sale when the rate falls below a predetermined value, which will allow you to avoid large losses.

- Short Positions. Assume the sale of cryptocurrency, which the user does not own (as a rule, it is borrowed), with the purpose of its subsequent purchase at a lower rate.

- Emotional discipline. It is important not to succumb to stress and general panic. Decisions should be made based not on fear or greed, but on objective analysis.

- Risk allocation. To avoid stress in unstable market conditions, it is worth investing only the amount of capital that can be lost without serious consequences in case of collapse.

- Technical analysis. There are a number of objective criteria that can be used to monitor the state of the market. It is important to monitor their indicators in order to make informed decisions.

Protection Against Crypto Market Collapse

Volatility is one of cryptocurrency's inherent features. Fluctuations in the exchange rate depend on several factors: legislation, the state of major exchanges, the world situation, and the general mood in the market. In some cases, volatility can be an opportunity to earn money; in others — it is a cause of losses.

To reduce losses when cryptocurrencies fall, it is essential to monitor the market, diversify your investments and choose a strategy in advance in case of a collapse. Staying calm, following a plan and considering current trends will help you avoid serious losses.