Tether (USDT) is the most popular stablecoin, pegged to the U.S. dollar at a 1:1 ratio. The USDT payment allows customers to buy goods and services using the stablecoin.

Currently, Tether stablecoin is one of the top 10 cryptocurrencies for its market capitalization. That's why paying with Tether has become a hot topic in the financial world. Our article will cover some practical aspects of these payments, including those made through crypto payment gateways.

So How Does Tether (USDT) work?

Compared to other relatively volatile crypto-assets topping the charts, Tether (USDT) is a stable coin – one of several blockchain-based tokens with its value tied to another currency or asset (in this case, the US dollar). That means its price fluctuates very little compared to other cryptocurrencies.

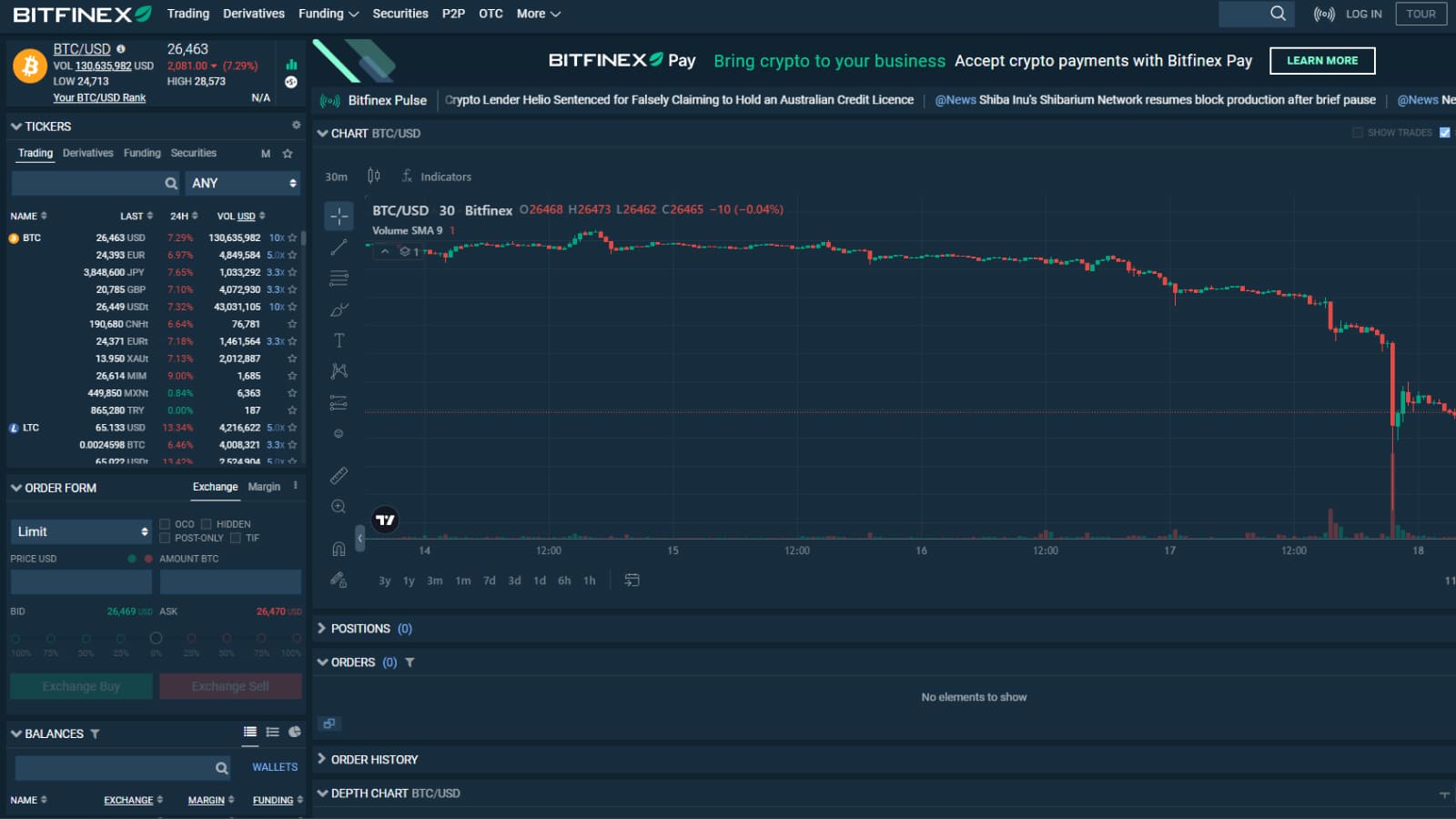

Tether was launched the industry's largest cryptocurrency exchange, Bitfinex, in 2014. Now one of the most traded currencies on the crypto markets, it plays an important role as a trading pair against Bitcoin and other top crypto-assets.

Tether is not as attractive of an investment as Bitcoin or Ethereum since it has a fixed value. Yet for the same reason, USDT is a popular instrument to use when you need to make cryptocurrency payments.

Tether (USDT): a Brief History

Tether can trace its history back to a predecessor currency called Mastercoin. Two Tether founders, Brock Pierce and Craig Sellars, were involved in the Mastercoin fund. Later they teamed up with Reeve Collins to launch Tether's direct progenitor, known as Realcoin, in 2014.

Based in Santa Monica, California, the Realcoin project issued its first tokens on the Bitcoin blockchain using the Omni Layer protocol in October 2014 and changed its name to Tether shortly after that. Three versions of the stablecoin were released within this first phase: USTether, EuroTether, and YenTether, with USTether becoming the most popular.

Tether trade started on Bitfinex in 2015, and the currency has remained closely tied to that exchange ever since.

The overwhelming success of Tether as a Bitcoin trading pair (it reportedly accounted for up to 80% of Bitcoin trading in the summer of 2018) led to allegations that USDT was being used to manipulate cryptocurrency prices. Yet further studies have questioned these accusations.

Learn more in article «Tether (USDT) Backing: Is It as Reliable as Claimed?»

There has also been controversy over the support of Tether with U.S. dollars. It was initially claimed to be 1-to-1 cash backed. However, later applicants pointed out that only a part of the coins were backed by cash or "cash equivalents". Full U.S. dollar support only emerged over time.

Starting out as a Bitcoin-based token, Tether expanded to release a USDT version on Ethereum with an ERC-20 token, as well as alternatives on EOS and Algorand. As of mid-2019, a larger amount of Tether has been released on Ethereum, leading to some congestion issues on the second-largest blockchain.

Advantages and Features of Tether

Stablecoins, like Tether, have been a hot topic of discussion over the past few months, since negative interest rates have burdened traditional safe-haven currencies and threats of inflation have increased interest in crypto-assets in general.

Among the best cryptocurrencies in the world, Tether stands out in several aspects.

- Usually, stablecoins do not present a strong investment argument as their value is inherently tied to another asset (in the case of USDT, the U.S. dollar). Still, while Tether is not entirely free of default risk, it doesn't face the same volatility as other crypto-assets. In periods of negative interest rates in most countries of the world, some investors see pegged to the stable dollar Tether as a reliable way to protect large amounts of cash holdings from bank fees. The reason for this is that the Tether fee is very low – about 0.3%.

- Tether is also used as a platform for those investing in major cryptocurrencies like Bitcoin and Ethereum. For this reason, significant increases in the issuance of USDT are sometimes seen as an indicator of upcoming buyer interest in the open market. A substantial increase in the number of created USDT can also occur during market sell-offs when investors sell cryptocurrencies like Bitcoin for USDT, leading to demand from exchanges needing to replenish their supplies of the popular stablecoin.

- In addition to increasing trading volume, Tether continues to innovate with an offshore coin denominated in Chinese yuan, called CNHT, launched on Ethereum in 2019. At that time, the TRC-20 token, USDT, was also released, functioning on Tron. The new payment method with USDT TRC-20 significantly speeds up and reduces transaction costs. This token is fully compatible with the ERC-20 version of USDT on Ethereum.

Accepting Payments in Tether

By incorporating Tether as a payment method, you can significantly increase your customer base, stand out among competitors, reduce transaction costs, and avoid volatility.

Furthermore, accepting payments in USDT enables almost instantaneous transfers that are independent of banking systems. International research has revealed that an increasing number of online stores are adapting to modern payment methods, including cryptocurrencies.

To learn how to withdraw Tether read our article.

There are several ways in which you can pay with cryptocurrency on a website and receive it as payment for any goods or services:

- Payment of cryptocurrency directly to the address of a cryptocurrency wallet or via QR-code is a simple way to accept payment in cryptocurrency. It is similar to the process of transferring fiat money from one wallet to another. There is no way to automate the billing process and check the payment amount in this case.

We have devoted an article to popular wallets for Tether. - Payment processing in USDT can be performed using an API, which makes it possible to accept a payment in Tether on your website. The payment API connects the cash system of your company and the cryptocurrency payment acceptance network. In this case, customers buy your goods or services for USDT without having to leave the site to process the payment. To implement this method, you need to develop your own payment module.

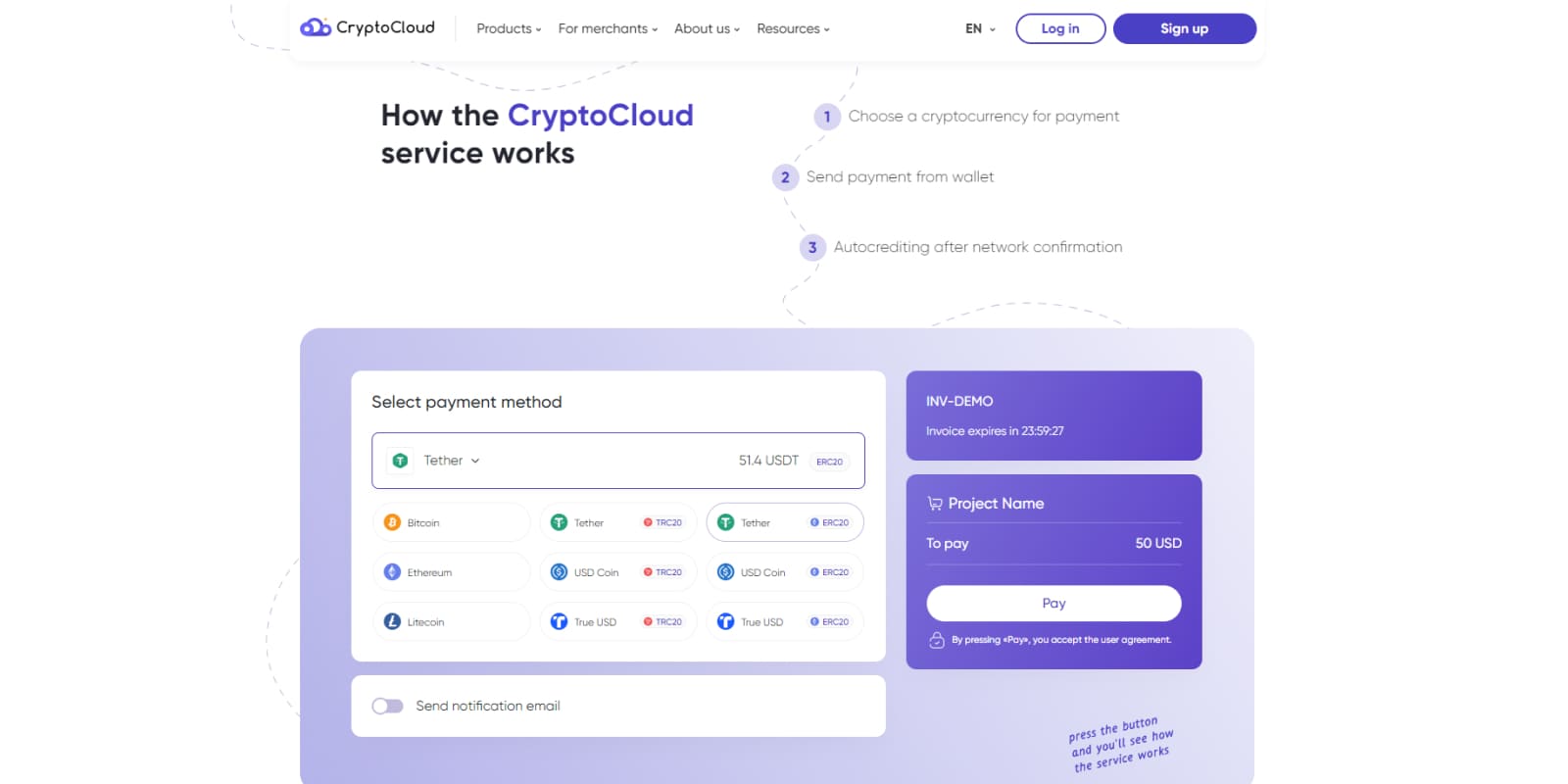

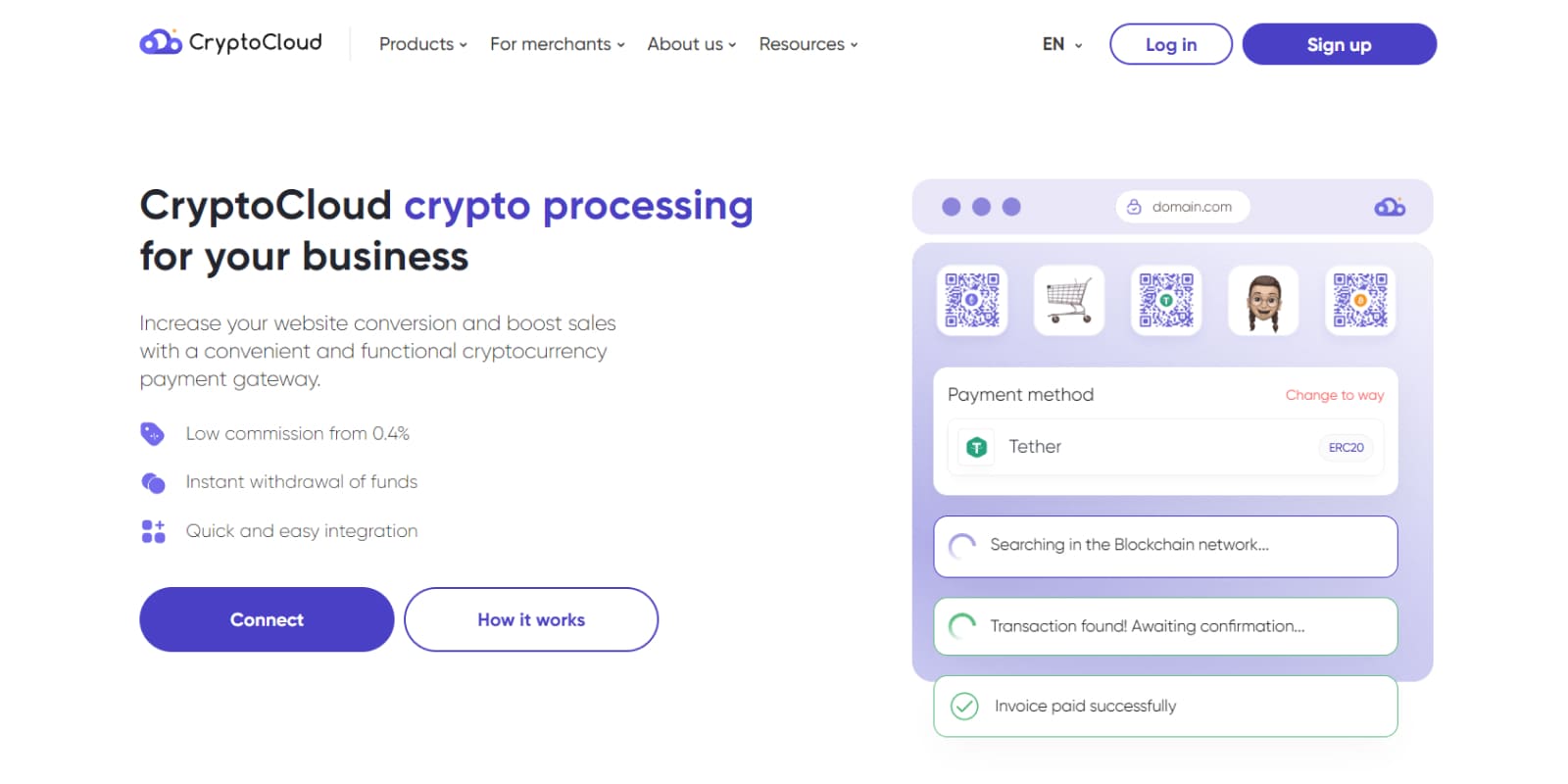

- Crypto processing is a modern feature that allows for fast acquiring of cryptocurrencies directly on an online platform, be it an online store or service.

Crypto processing outperforms all the mentioned methods of financial transactions in terms of speed, convenience and security. A significant advantage of it is the ability to track all cryptocurrency transactions in a personal account, as it happens on CryptoCloud.

By implementing crypto payment gateway on your website, you can reduce transaction costs, provide a convenient process of making payments, and attract potential customers.

Secure encryption guarantees the safety of your funds. And since the success of any transaction on the Internet is determined by the speed of the payment made, instant transactions in crypto processing are another significant advantage for your business.

We've listed payment gateways that allow users to accept Tether in the article.

Connecting Crypto Acquiring to Website

CryptoCloud integrates into any service, regardless of factors such as platform, language, or type of business. Signing up is also really easy. All you have to do is fill out a form on the cryptocloud.plus website. The registration process is standard. You just need to provide the following data:

- your e-mail address;

- password you've just created (must be re-entered);

- your Telegram username.

The connection of CryptoCloud is absolutely free. A small fee is charged only when processing transactions.

Crypto processing, unlike a bank or a traditional e-wallet, does not freeze funds. All incoming funds belong to the user only.

Connecting CryptoCloud crypto processing has a number of advantages:

- fee for transactions starting at 0,4%;

- ability to pass on payment of service and blockchain network fees to the buyer;

- easy moderation;

- fast withdrawal of funds;

- ability to invoice in any available cryptocurrency, including USDT;

- clear user interface of payment page;

- sending receipts of transactions to customers' e-mails;

- protection from DDoS attacks and full data encryption;

- wide functionality and user-friendly adaptive interface of personal account;

- ready modules for popular CMS (Woocommerce, Getcourse, Opencart, etc.);

- assistance in integration and prompt support for users.

Most importantly, CryptoCloud allows for almost instant acceptance of international payments. Amidst sanctions, this is crucial because cryptocurrency remains unaffected by them.

The Best Way to Pay in USDT

If current global market conditions persist, interest in time-honored stablecoins such as Tether will increase. This is particularly likely to happen if there is widespread acceptance of blockchain as a settlement layer technology with demand for US dollar-denominated tokens.

With the increasing value of cryptocurrency, the security requirements for associated transactions also rise. This is why, when choosing a payment method in USDT it is recommended to consider the crypto acquiring. By connecting to CryptoCloud, you can optimize the efficiency of your transactions.