Transaction rejection often occurs when placing orders in online stores and on marketplaces or attempting to make a purchase in a store abroad. This has a negative impact on sales conversion.

Such a problem always has an explanation. In the article, we present a selection of reasons why transactions often fail. By knowing what causes this, merchants can avoid similar difficulties.

Top 8 Reasons for Payment Cancellations

Incorrect card data

This error is one of the most common. It occurs when a client manually enters the card number, expiration date, owner’s name and CVC/CVV code through a browser or mobile application.

Therefore, it is essential to pay attention to the correct entry of payment data. If the information is right, check if the payment address is outdated. Also, personal data may not match, for example, if the client has changed his name or surname.

Suspicious transaction

Sometimes, an issuer will flag a transaction as suspicious or fraudulent. This usually happens if:

- the card has previously been used without consent, and the customer has requested to cancel the payment;

- a large purchase is being paid for;

- the amount is significantly higher than what is normally debited.

The bank may also mark the payment as suspicious and cancel it if the client pays on a website related to gambling or buys products on a foreign marketplace. Usually, the cardholder receives a notification via SMS or app. It is enough to confirm the transaction for it to go through.

Transfers while traveling

If a transaction is made from a non-standard IP address from another region or country, it can also be automatically recognized as suspicious. Therefore, the bank has the right to cancel and inform the client about the online payment. To avoid such situations, you can inform the bank about your upcoming trip.

Most financial companies provide cardholders with an opportunity to notify in advance about a planned tour to another region or abroad via the official website or app.

Expired card

The transaction will fail if an expired or deactivated card is used. The most common situation is when a client receives a new card to replace a card that has expired or has been damaged or lost, but forgets to update the data and tries to use the stored previous card, causing the bank to reject the payment.

To avoid such a situation, the new card should be activated immediately upon receipt and replaced with the old one in the electronic wallet.

Transaction limit

Credit cards have a certain amount of money that cannot be spent — the credit limit. With a debit card, by default, you can’t spend more than you have on your balance, although in some cases an overdraft is available. However, many banks also offer users the option to set a daily purchase limit. This is done for security purposes to avoid fraudulent transactions.

Having found that a card payment has been declined for no apparent reason, you should check how much has been debited in the last 24 hours. The limit may have already been reached.

The card is not supported

In most cases, customers may not pay attention to which payment systems the merchant accepts. For example, the merchant may have enabled the acceptance of VISA or Mastercard cards, but the buyer may try to pay with a card of another payment systems.

This situation is especially common when trying to pay for a purchase in a foreign online store or on an international marketplace. Therefore merchants should place icons of accepted cards in the checkout and on the website.

Funds on the card are frozen

Funds on the account may be blocked for the following reasons:

- the client has used a service that requires pre-authorization of the bank card — when money is debited and immediately returned or a part of the money on the account is frozen;

- the card has been seized, and although the funds have yet to be debited, they have already been blocked and cannot be used.

In such cases, it is worth recommending that the buyer go to the acquiring bank's app or website and review the transaction history.

Insufficient funds

Clients who do not keep track of receipts and spending can end up in a situation of lack of money. Usually, it is easy to clarify the situation: just go to the application or website to see the history of operations and, in the case of a credit card, make sure that the available limit is not exceeded. It is also necessary to activate SMS or push notifications.

Occasionally there is uncertainty: the transaction is rejected by the operator, although there have been no recent purchases. The reason may be that the information still needs to be updated, and the new debit needs to be displayed in the history so far.

Things a Merchant Should Do If a Client’s Payment Is Canceled

To minimize errors, a merchant must know the rules for processing payments from their acquirer and properly configure all interfaces involved in transactions.

Follow these tips to avoid payment processing errors and additional costs:

- Make sure the currencies of the receipt and payment match. This is especially important if you accept payments in a currency other than the one in which you operate.

- Set up filters carefully to avoid customer payment issues. This will help avoid misunderstandings and potential errors.

- Pay attention to where the card was issued.

- Shoppers, on the other hand, should check the expiration date of the card and the payment amount they enter.

By following these tips, you can avoid mistakes and misunderstandings when processing payments and save money and time.

Payment Rejection: Main Reasons

In general, transactions are processed without additional confirmation from the client. You can find out that a money transfer has been canceled by receiving a message from the seller or a notification from the bank. Most often, the reason can be found out within a few minutes. Sometimes you need to wait until the information is verified.

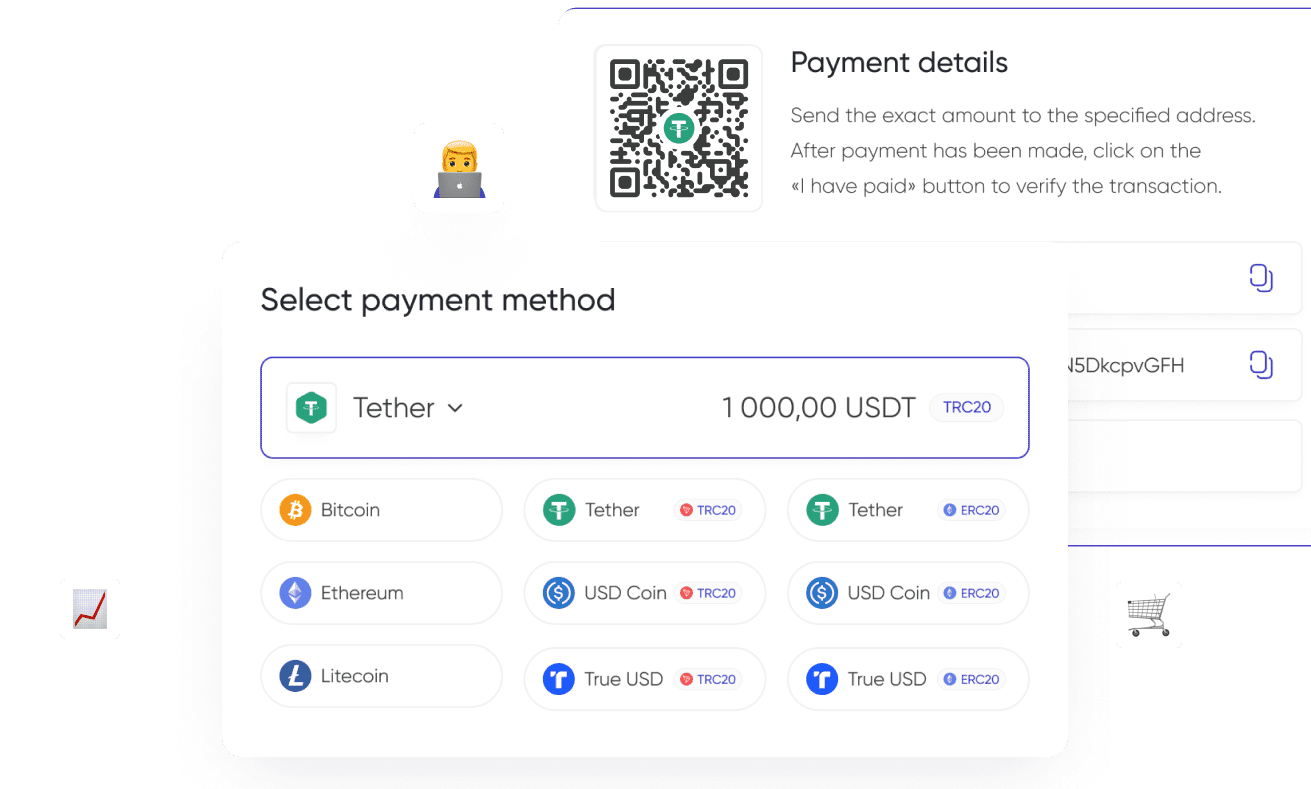

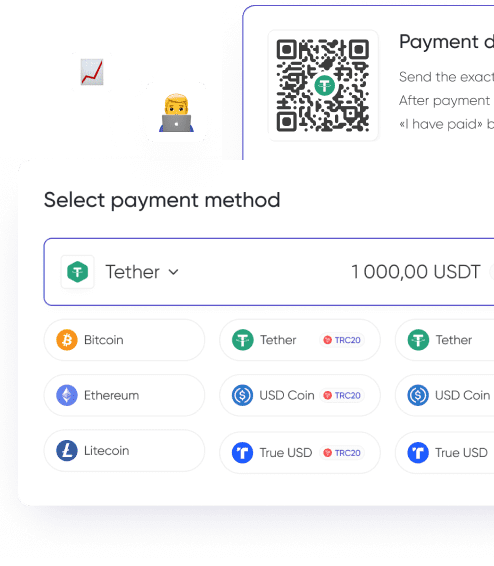

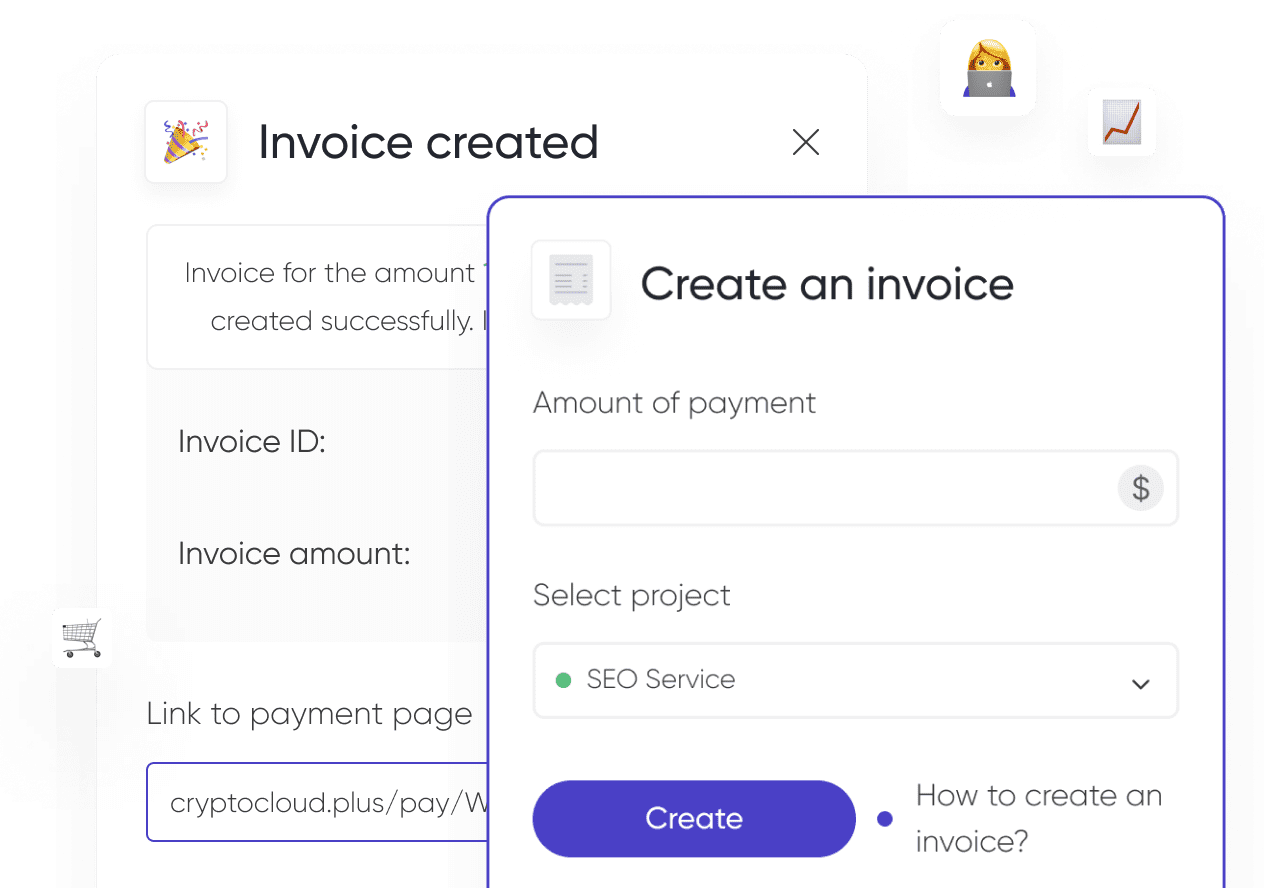

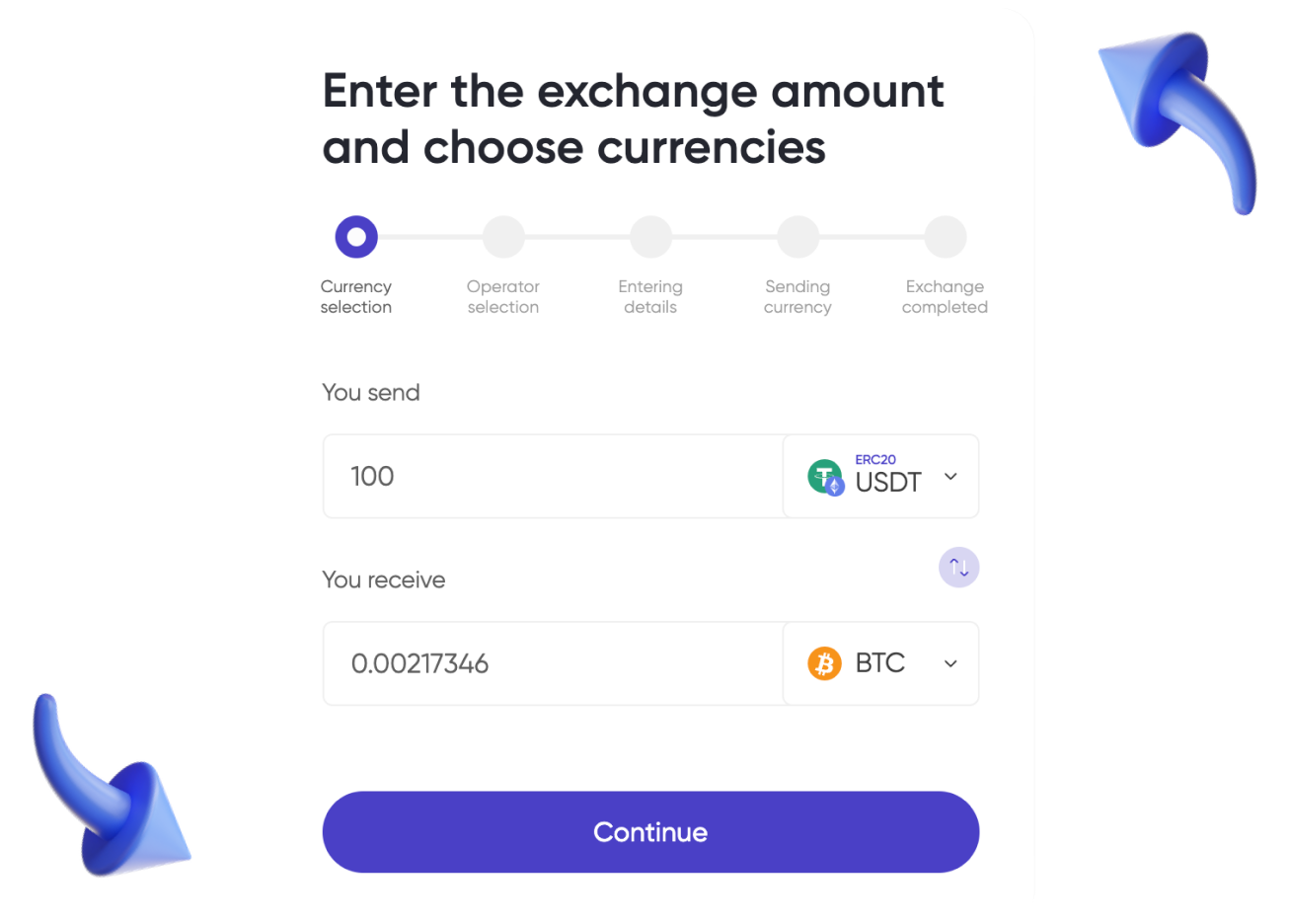

To avoid problems, you should be more careful about entering correct data and setting up payment filters. It will be also useful to provide various payment methods.