Optimization of business costs is an essential task for business owners. One of the costs to which attention should be paid is payment processing, including acquiring fees.

We explain the transaction processing fee, its factors, and how to reduce acquisition costs while maintaining the convenience and security of the payment process.

What Is the Internet Acquiring?

Before we tell you how to save money on acquiring, let's take a look at what it is and how it works.

Internet acquiring is a transaction processing service provided to businesses by banks and payment systems. Acquiring allows you to accept payments on a company's website or app. Popular platforms that provide acquiring services include Stripe, PayPal, Verifone, Braintree, etc.

Connecting acquiring includes integration to the checkout website. On this page, customers can enter bank card data or (if the system providing the service supports this possibility) e-wallet data. The checkout must comply with security standards and protect payment information.

After entering the data, the acquiring bank sends a request to the bank that issued the client's card. A check confirms that the account is valid and that there are sufficient funds for payment. Once the transaction is approved, the money is transferred to the merchant's account, and the customer receives a confirmation of the order. The process usually takes up to a minute.

What Is Included in the Acquiring Service Fee?

Acquiring companies charge a commission — a fee for processing transactions. It is formed from several elements:

- The payment system fee. This part of the acquiring fee accounts for 0.1-0.2% of the total transaction amount.

- Interchange, or interbank commission. It is charged by the issuing bank. Banks use the income from this fee to improve security systems, develop new technologies, conduct maintenance, etc. The amount depends on the bank, the type of business, and other factors.

- Acquirer's commission. It depends on the organization that provides payment processing services: each acquirer independently determines the commission's size. Its amount is set based on the method of payment, the additional services, the company's turnover and several other factors.

Why Does Acquiring Company Charge a Commission?

There are several reasons why, when using acquiring, a percentage of the commission is charged for each transaction:

- Infrastructure costs. Processing payments involves several technical resources and systems, from servers to algorithms that track suspicious activity. Part of the acquiring commission is spent on maintaining and developing this infrastructure.

- Security Assurance. Protection from fraud and data leakage is one of the most important tasks of acquiring. The system checks cards for authenticity, detects fraudulent activity, conducts additional checks of suspicious transactions and clients.

- Communication with payment systems. Third-party resources are involved in the processing of transactions — in particular, payment systems (Visa, MasterCard, etc.). In order for clients to use their cards, the acquirer pays them a part of the commission.

- Support. Prompt solution of arising problems is an important factor in working with clients. In addition, technical support helps the entrepreneur to customize the system, perform integration, eliminate technical errors in case of their occurrence, etc.

How to Reduce the Acquiring Fee?

Depending on the company's turnover and the chosen acquiring, the commission amount can become a fairly large item of expenditure. It can be reduced in several ways:

- Negotiate terms with the bank. Some organizations offer special rates and discounts for certain types of business, companies with a large turnover, or partners with whom long-term cooperation has been established.

- Revise the set of connected services options. Many acquiring organizations offer additional paid services that are not necessary for the operation of the business. Opting them out will help cut costs.

- Consider alternative payment methods with lower fees. Some options — such as ACH transfers or cryptocurrency — cost less than the usual bank cards in terms of processing.

- Make sure there are no hidden fees. Separate account maintenance fees, additional fees for transactions over the limit — some acquirers resort to hidden fees to make the commission seem lower.

- Take part in a loyalty program. Conditions depend on the bank. In some cases, the commission on acquiring operations can be reduced almost twofold.

How to Save on Payment Processing with Crypto Acquiring?

Using alternative payment options is one of the best ways to reduce your acquiring costs. We recommend considering cryptocurrency as a means of payment.

A special system is used to process cryptocurrency transactions — crypto acquiring. Many services on the market provide such a service, and crypto payments are becoming increasingly popular. Crypto processing commissions do not exceed 1-2%, depending on the chosen platform, which reduces business costs.

In addition to low fees, this payment method has several other advantages. One of them is that cryptocurrency transactions can be used worldwide: they are decentralized and not subject to sanctions, which makes it easier to work with foreign clients in restricted conditions.

In addition, such payments are safer than transactions in fiat currency: the client remains anonymous, which excludes the leakage of payment data. Finally, crypto transactions are irreversible, which eliminates additional costs for chargebacks and protects businesses from fraudsters.

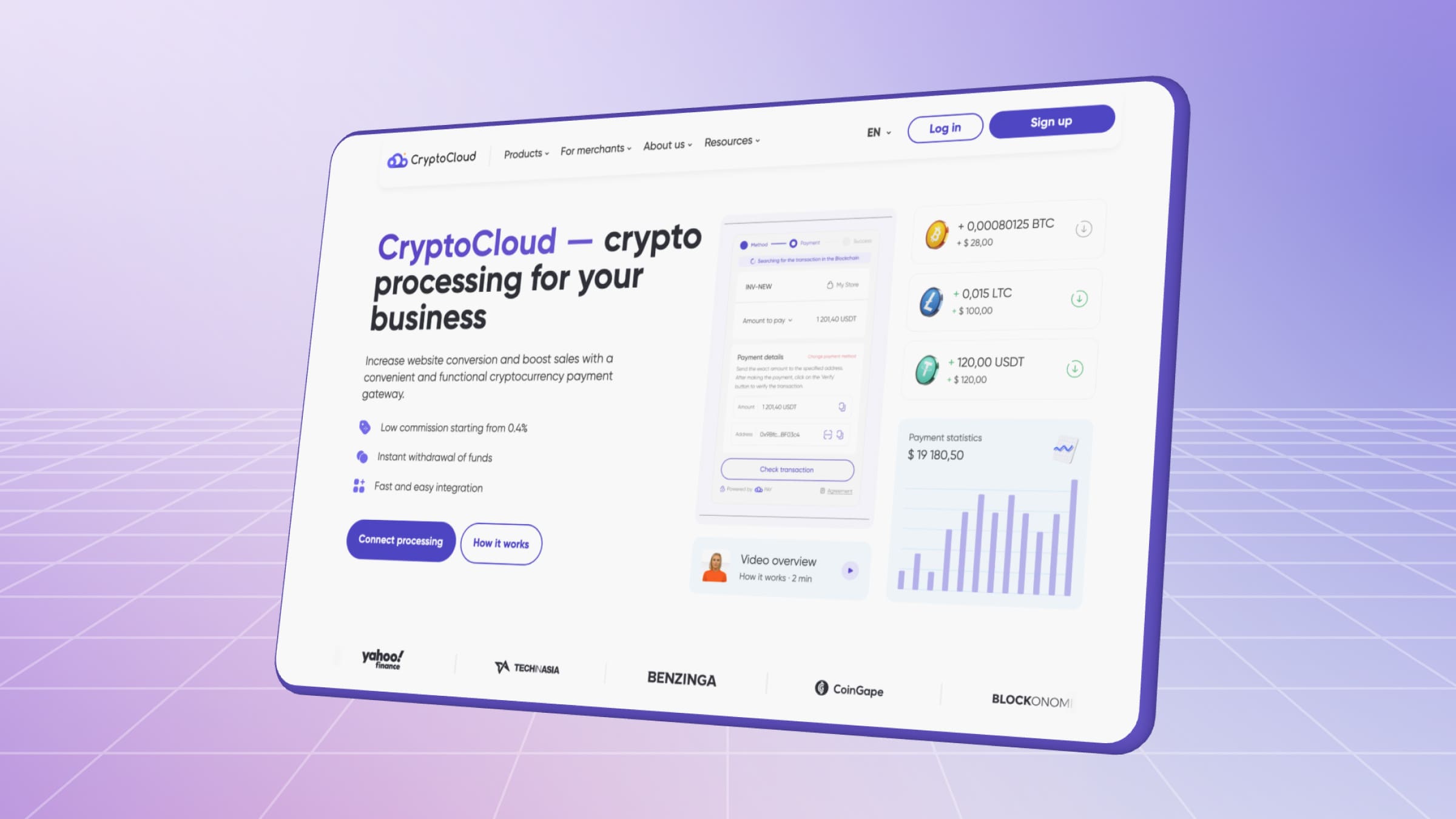

Reduce Acquiring Costs with CryptoCloud

CryptoCloud is a cryptocurrency payment gateway that will reduce payment processing costs: the service's commission is from 0.4%. Withdrawal of funds from the system is free, and there are no monthly fees — the service does not charge hidden additional fees and offers transparent rates for merchants.

CryptoCloud allows payment acceptance in Bitcoin, Ethereum, Litecoin, Tether and other cryptocurrencies. Their list is constantly expanding. Thanks to a wide range of ready-made plugins and the ability to create payment links, merchants can work with clients via website, app, Telegram bot, social networks, and other platforms.

In addition to a convenient multilingual checkout page, CryptoCloud offers merchants many additional features. These include working with statistics and analytics, automatic AML transactions checks and auto conversion of incoming payments to USDT to protect against cryptocurrency volatility.

Lower Payment Processing Costs

Any automated way of accepting online payments involves fees: they go towards maintaining the payment system infrastructure, security, tech support, and more. Nevertheless, businesses can reduce this cost by finding more favorable terms, refusing optional paid services, or switching to alternative payment methods.

One such way is crypto payments. Connection of CryptoCloud crypto acquiring is absolutely free, and the commission is from 0.4%. More details about the opportunities and tariffs — on the official website.