The Coinbase ecosystem unites a group of platforms for working with more than 170 types of cryptocurrency: an exchange where you can easily buy and sell popular and little-known tokens, a cryptocurrency wallet for storing them, an exchange, an NFT platform, and many other tools.

In the article, we will examine some of the platform's services, its advantages and disadvantages, and what system analog can be used.

Coinbase: a Brief Overview

Coinbase was founded in 2012 in the United States as a platform for buying and selling cryptocurrencies. For over a decade, it has grown from a startup to one of the largest players on the market, with millions of users and an extensive set of financial services.

Today, Coinbase is not only a crypto exchange, but an entire ecosystem of products and tools for investors, traders, developers, and businesses.

The company was the first among crypto platforms to go public, going public on NASDAQ in 2021. This allowed it to attract additional investments and strengthen its position in the international market. Coinbase's main focus is to provide maximum convenience and security for users when transacting with cryptocurrency.

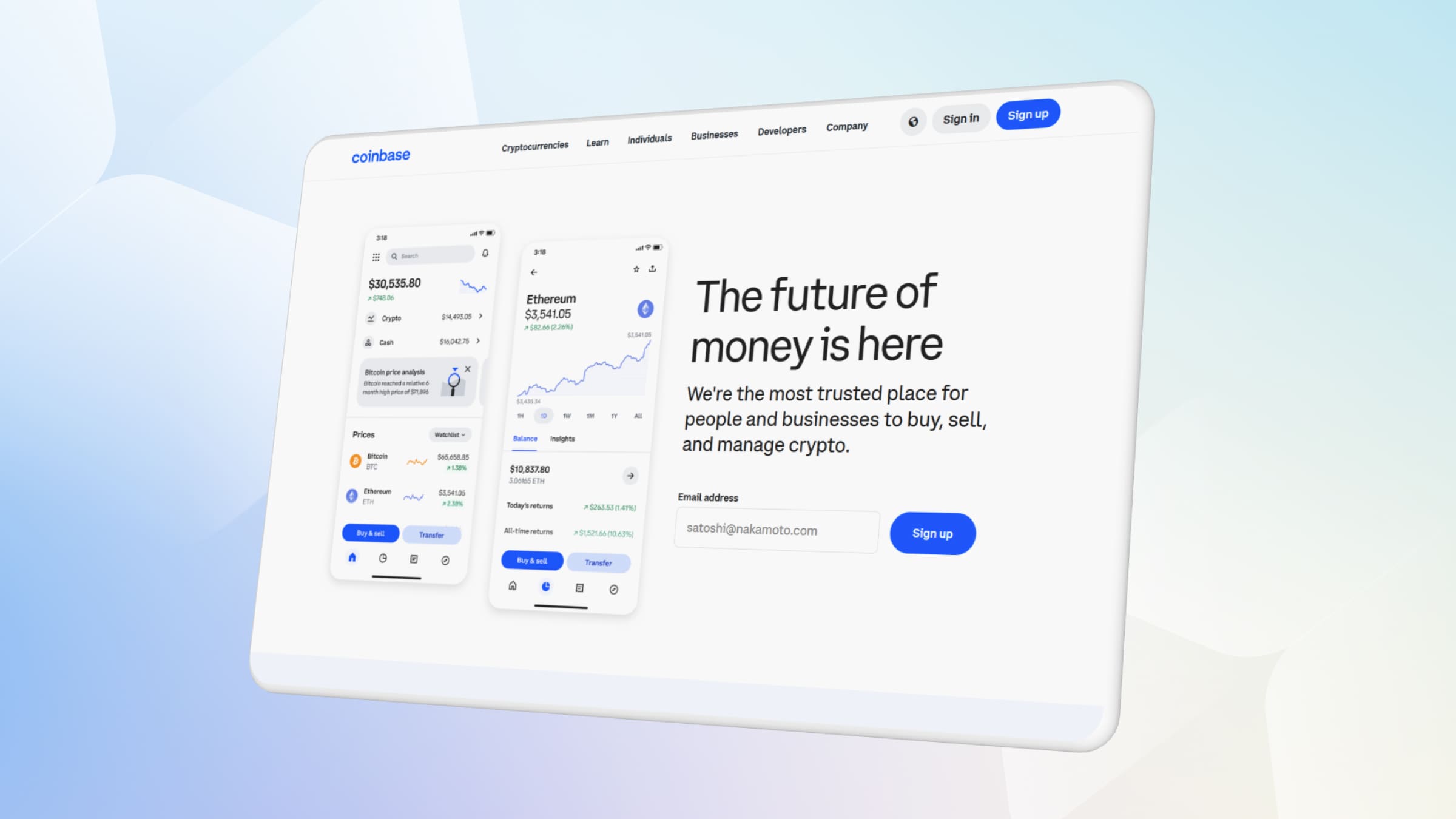

One of the most notable advantages of Coinbase exchange is its own virtual wallet, which is presented as a mobile application and browser extension. It allows users to receive and store electronic cryptocurrency and make all kinds of transactions with it at market value.

Advantages and Disadvantages

The pros of the ecosystem include:

- User-friendly interface. It is easy enough even for beginners to understand the menu and the principles of work on the site (sale, purchase, exchange of coins).

- Support for more than 150 cryptocurrencies. Exchange users can trade a variety of currencies, including both popular and little-known coins.

- Security. The web platform uses various means to protect users: standard and internal security protocols (primarily KYC), providing protection from fraudsters.

- Stacking. The service is deployed on a local API with a stable user infrastructure. Customized validators are available to run (scalable) directly from the wallet in more than 15 networks.

- A wide list of additional services. This is an electronic wallet, cryptocurrency processing, cryptocard, a basket of free services Coinbase Wallet, NFT-platform, etc.

Among the cons of the platform, users highlight:

- Spread fees (spread commissions). On average, they amount to 0.5%, but their size and principles of charging for different operations differ depending on the situation (payment method, transaction size, market volatility, etc.). These commissions are temporary and displayed just before the transaction is confirmed.

It is difficult to predict the volume of profits and costs of transactions under such conditions. If transactions are conducted frequently, it can significantly reduce the amount of profit: for example, steaking commissions reach 35% of income. - Probability of unforeseen blocking of accounts. This is partly due to Coinbase's cooperation with the American authorities. Upon request, the platform provides them with information about any user.

But sometimes the company can freeze or block an account unexpectedly and without obvious reasons.

Popular Coinbase Services

- Crypto exchange. It provides an opportunity to apply a range of analytical tools in real-time. You can work with various currencies, build your charts, study exchange patterns, forecast liquidity in various markets. Functionality is provided for both individuals and institutional investors.

- Cryptocurrency wallet. It supports all digital assets compatible with Ethereum, as well as this token itself, Bitcoin, Dogecoin, and Solana. It allows you to combine the management of all selected crypto assets and NFT in a single interface. It works both in the browser-based PC version and from a phone.

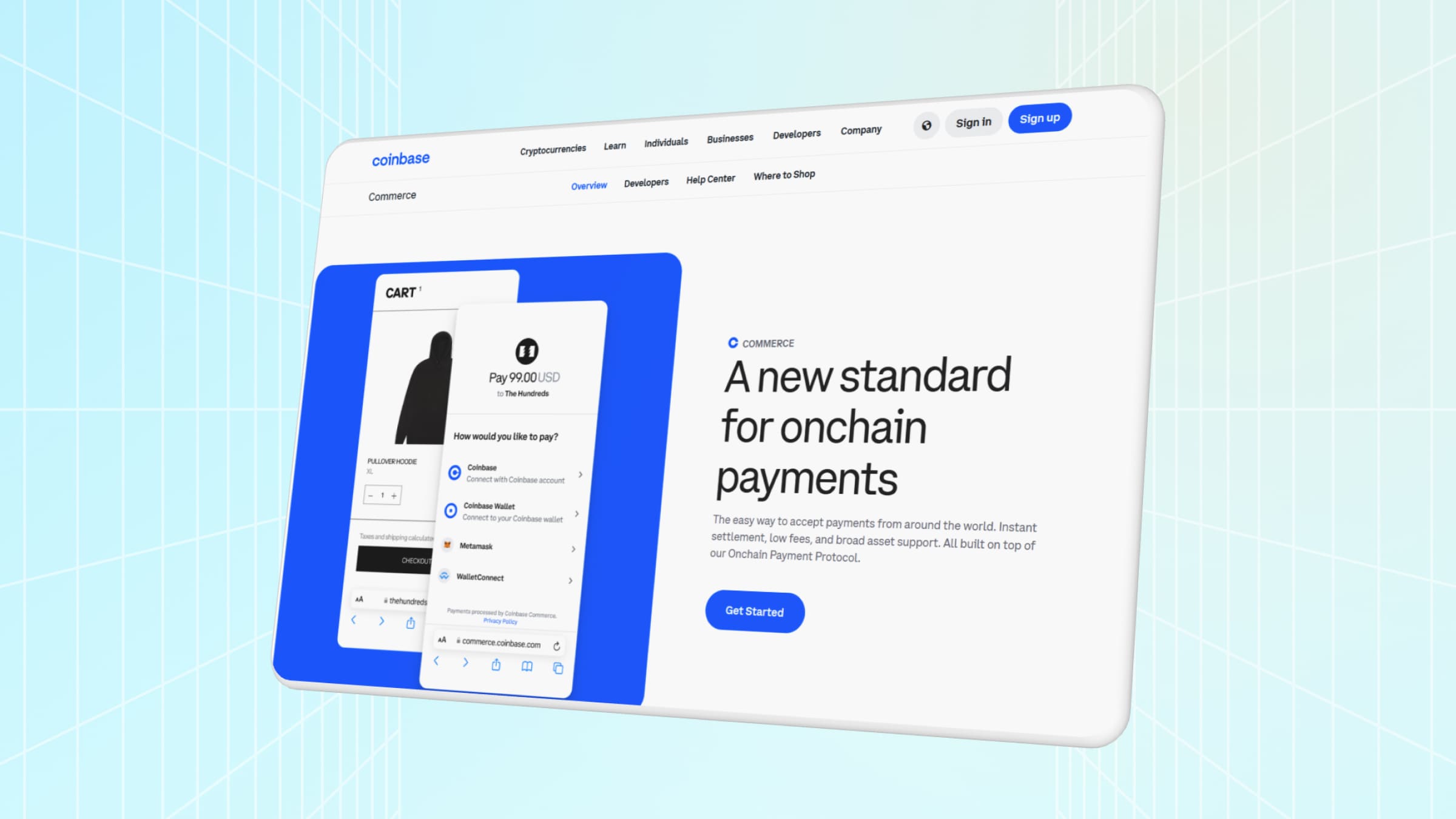

- Processing. Crypto acquiring can be connected in several ways (modules for CMS and API). The service guarantees the security of transactions and offers simple customization for the type of currency and features of the service. To get started, it is enough to register in the system, select a payment method, activate the transaction and conduct it by specifying a specific amount.

- Coinbase Earn. Yield is up to 12% per annum, the specific value of the rate is determined by the size of floating rates in the base protocol. Up-to-date information for operations is displayed in the client's personal account. The starting amount is $1. The service can be terminated at any time at the client's request.

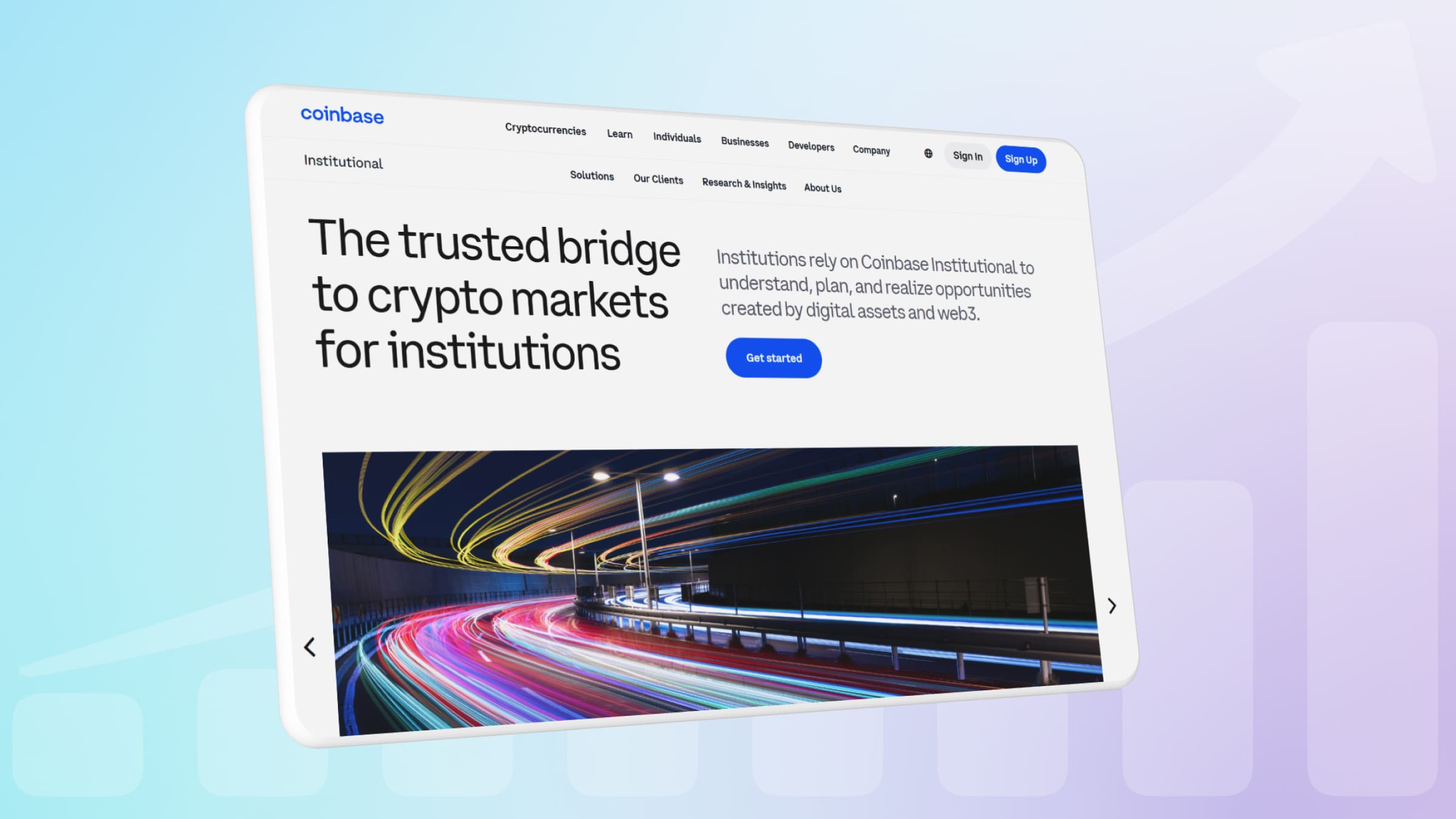

- A platform for institutional investors. The ecosystem is working on the possibility of issuing bonds convertible into financial assets or shares (they are listed on the Nasdaq exchange).

The project aims to maintain manageable flexibility in the value of the shares without negatively impacting the size of the share capital. The scheduled maturity date is 2030. In February 2024, an increase in institutional investment in bitcoin was announced for the next six months. The project's outcome has not yet been published.

- Crypto cards. The service provides an opportunity to start a debit card for storing assets and making household payments in cryptocurrency. Cryptocurrency rewards are paid for each purchase (from 8 types of tokens).

They provide all options to maintain the safety of funds, typical for bank card users such as two-factor authentication, change of PIN-code, prompt blocking at the owner's request. At the moment the cryptocurrency card payment service is available for users from the USA. - NFT trading. In this ecosystem it is conducted on several web3-platforms using a local Coinbase Wallet. Secure NFT buying and selling is provided, as well as participation in promotions. Updated lists of current on-chain trends, and tokens with the maximum number of exchanges are posted for public access.

- Tools for developers. A separate sub-platform with a list of ready-made APIs (Exchange, Commerce, Prime) provided for free work.

You can automate trading processes, connect decentralized applications to the wallet, set up a simplified login for users, find new solutions for converting fiat into cryptocurrency, etc.

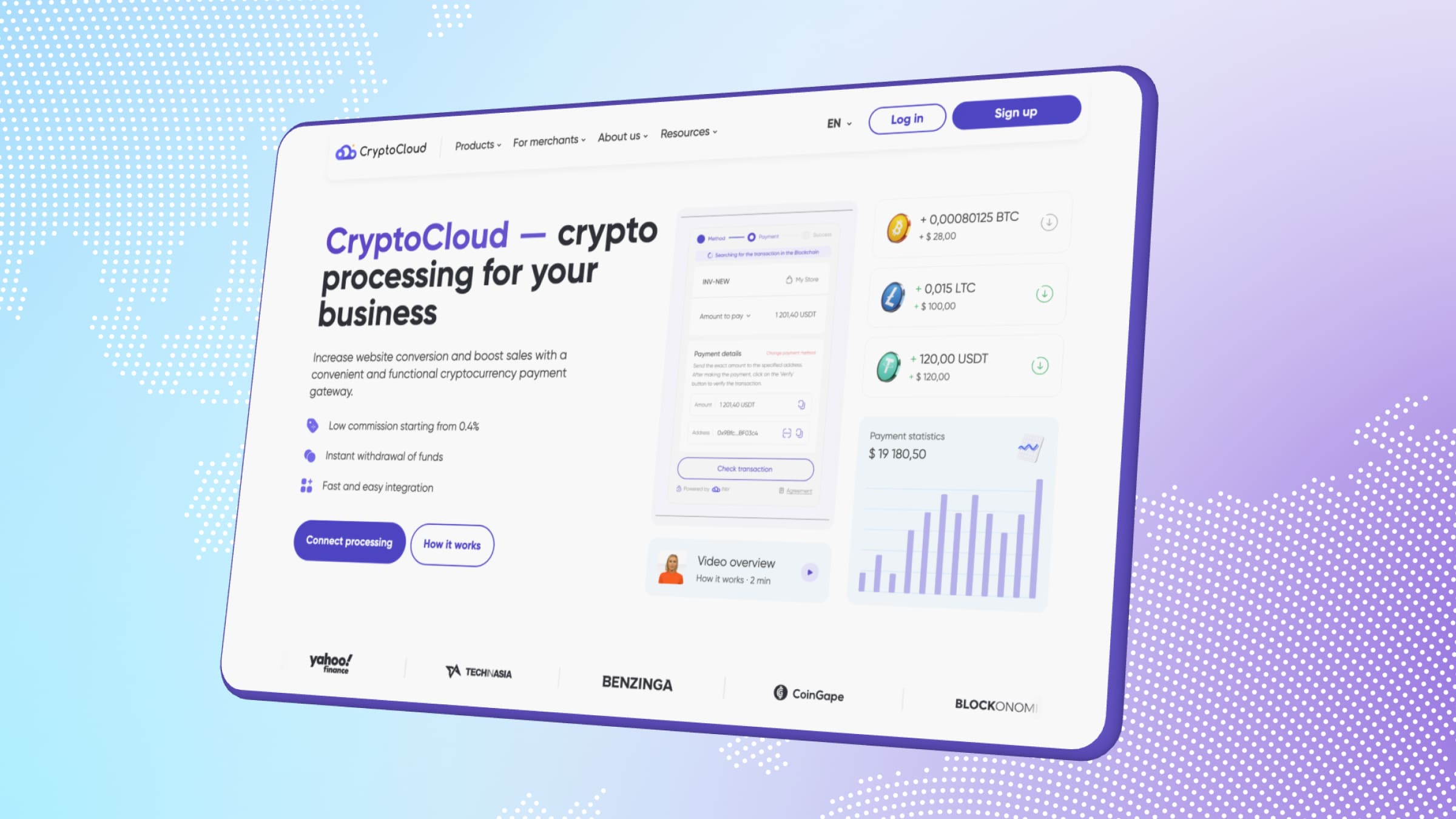

CryptoCloud: Coinbase Processing Alternative

For merchants who have encountered limitations of Coinbase processing, CryptoCloud service provides a convenient solution for accepting cryptocurrency payments.

The platform offers such advantages as high security and flexibility in choosing cryptocurrencies for accepting payments, as well as low commissions (from 0.4%).

You can connect the service in a few minutes. To do this, you need to register by specifying your e-mail and Telegram account. After that, you need to fill out a small form about your company in your personal account and choose the method of accepting payments: manual invoices or full integration. Then, following the instructions, connect the service to your platform and start accepting crypto payments.

Coinbase: a Multifunctional Crypto Platform

Coinbase is a comprehensive ecosystem for working with cryptocurrencies, including an exchange, wallet, staking and NFT trading. The platform is popular due to its wide functionality and security, although high commissions and the risk of account blocking can be a disadvantage for users.

Nevertheless, some companies cannot use the service to accept crypto payments. As an alternative, you can use CryptoCloud, which offers a convenient and flexible way to accept cryptocurrency payments with minimal commissions.