Cryptocurrency staking provides an opportunity to earn passive income by providing a certain amount of crypto assets to keep the blockchain running. According to statistics, as of December 2023, the total volume of such staking for Ethereum exceeded $63 billion, and the reward was higher than 4.3%.

What is the essence of staking and how does it differ from mining? What risks are associated with this way of passive earning? What services can be used to get rewards? Answers to the questions — in our article.

What Is Cryptocurrency Staking?

Staking is a passive income on cryptocurrency running on the Proof-of-Stake algorithm.

The essence of the method is that a certain amount of coins is frozen in the wallet. This gives the right to directly or through additional services to participate in the performance of the asset to then receive a reward.

Advantages:

- staking has higher yields than Proof-of-Work (PoW) mining;

- lower costs due to the absence of the need for expensive equipment, which is necessary, for example, for mining;

- higher level of security: steaking helps to fight against attacks 51%.

The disadvantages include a high risk of centralisation, i.e. concentration of assets in the hands of large investors, the need for increased security, as well as possible restrictions on verification results and geolocation.

There are two main types of staking:

- fixed — the duration of the deposit is designated by a certain period of time, and it is impossible to take the assets before the expiration of this period, which creates additional risks for volatile cryptocurrencies, but at the same time provides higher rates;

- unlimited — the duration of the deposit is not specified in advance, and assets can be withdrawn at any time, so this option is more suitable for young cryptocurrency projects with a relatively high degree of risk.

How Stacking Differs from Mining?

Mining is the operation of blockchains that use the Proof of Work (PoW) algorithm. Miners — participants in the process — use their computing power to support the network and conduct transactions, for which they receive remuneration.

In contrast to mining, stacking is the support of blockchain operations through the storage of specific cryptocurrency coins by their owners. The main difference is that stacking does not require significant computing power, video cards or ASIC miners. Thus, it is a greener and more energy efficient method to form new blocks in the chain.

In addition, the advantage of stacking is that a cryptocurrency owner does not have to possess the high technical skills required to set up and maintain a computing machine. Therefore, stacking is considered more accessible and attractive to a wide range of participants.

One more way to profit from cryptocurrency — lending. Learn more about it in our article «Lending of Cryptocurrency: Definition, Types, Pros and Cons».

What Risks Are Associated with Cryptocurrency Stacking?

The main threats for those who expect high passive income from staking:

- insufficiently developed legislation to protect investors from fraudulent platforms — it is important to check reviews of services;

- a sharp drop in a high-yielding asset during staking, usually due to excessive issuance, when it is impossible to withdraw the invested funds early;

- lack of insurance, which makes staking much more dangerous compared to, for example, bank deposits.

Staking Platforms

Types of platforms that are used for staking cryptocurrency:

- centralized — involve the creation of an account and the transfer of funds for storage, extremely simple in operation and can be used for several coins;

- decentralized — as a rule, they are represented as protocols for connection via Web3-wallets, they differ with relatively high complexity of work, although still remain easier in use than cryptocurrency wallets;

- cryptocurrency wallets — are characterized by increased complexity compared to exchanges, as the user needs to understand the launch of the node, but the security is significantly higher, especially when using hardware wallets.

Compilation of Services With Stacking Capabilities

Platforms

Cryptocurrency exchanges with the possibility of staking:

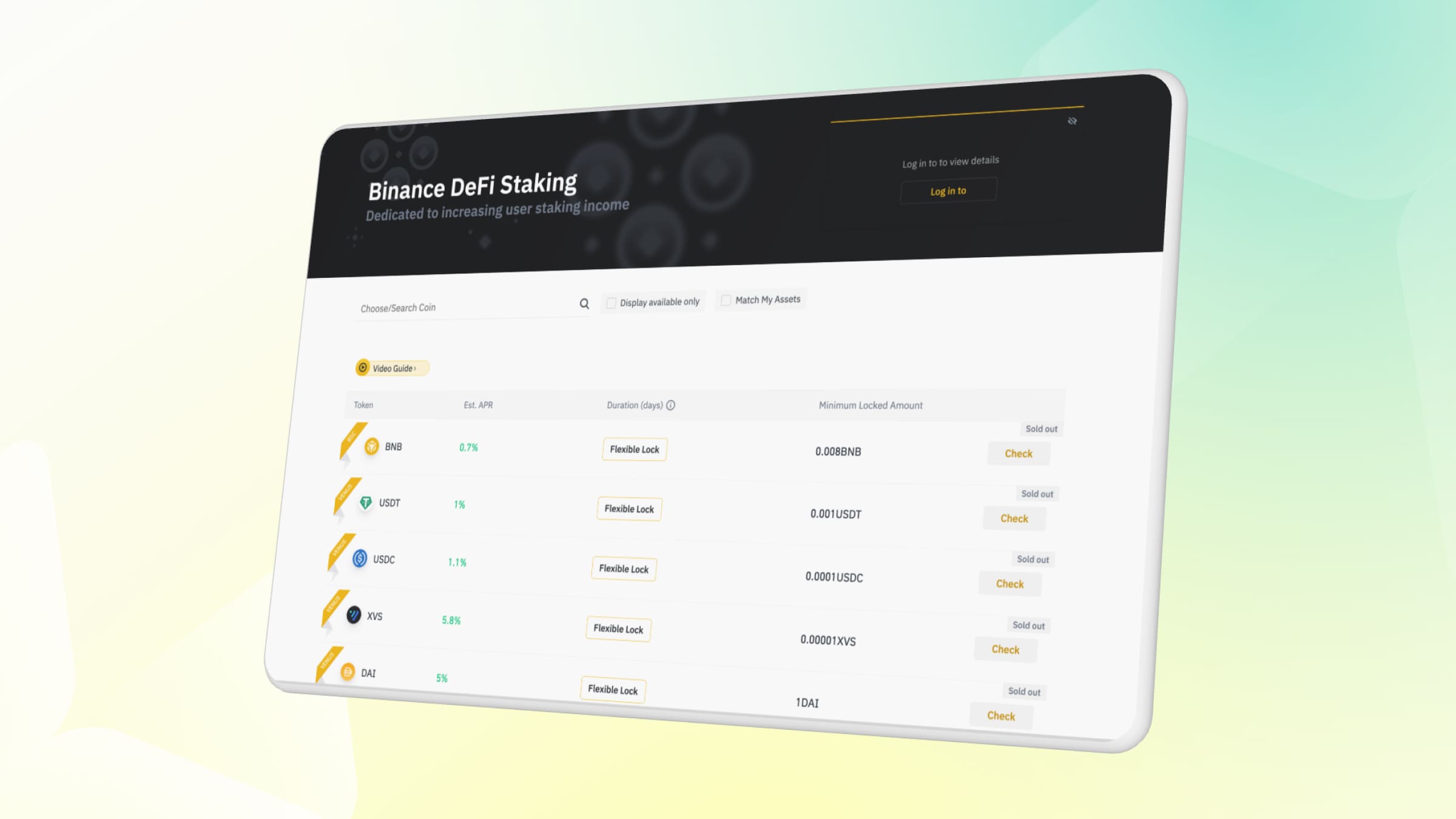

- Binance. The service is characterized by a relatively high entry threshold. Binance's staking is focused on DeFi products. The platform acts on behalf of investors to generate and distribute profits. Users get the opportunity to participate in the process literally in a couple of clicks. At the same time, the service is not responsible for risks and losses.

- Bybit. Account holders can choose both fixed and flexible terms at their discretion. Bybit Savings is a platform focused on bitcoins, ether, tether and other popular types of cryptocurrencies. The platform is popular for its guarantee of relatively high annual interest.

- OKX. The service is characterized by a rather low entry threshold, so almost everyone can earn at the expense of free savings. It is possible to choose conditions with both flexible and fixed terms. Withdrawal of earned funds is carried out on the OKX platform around the clock.

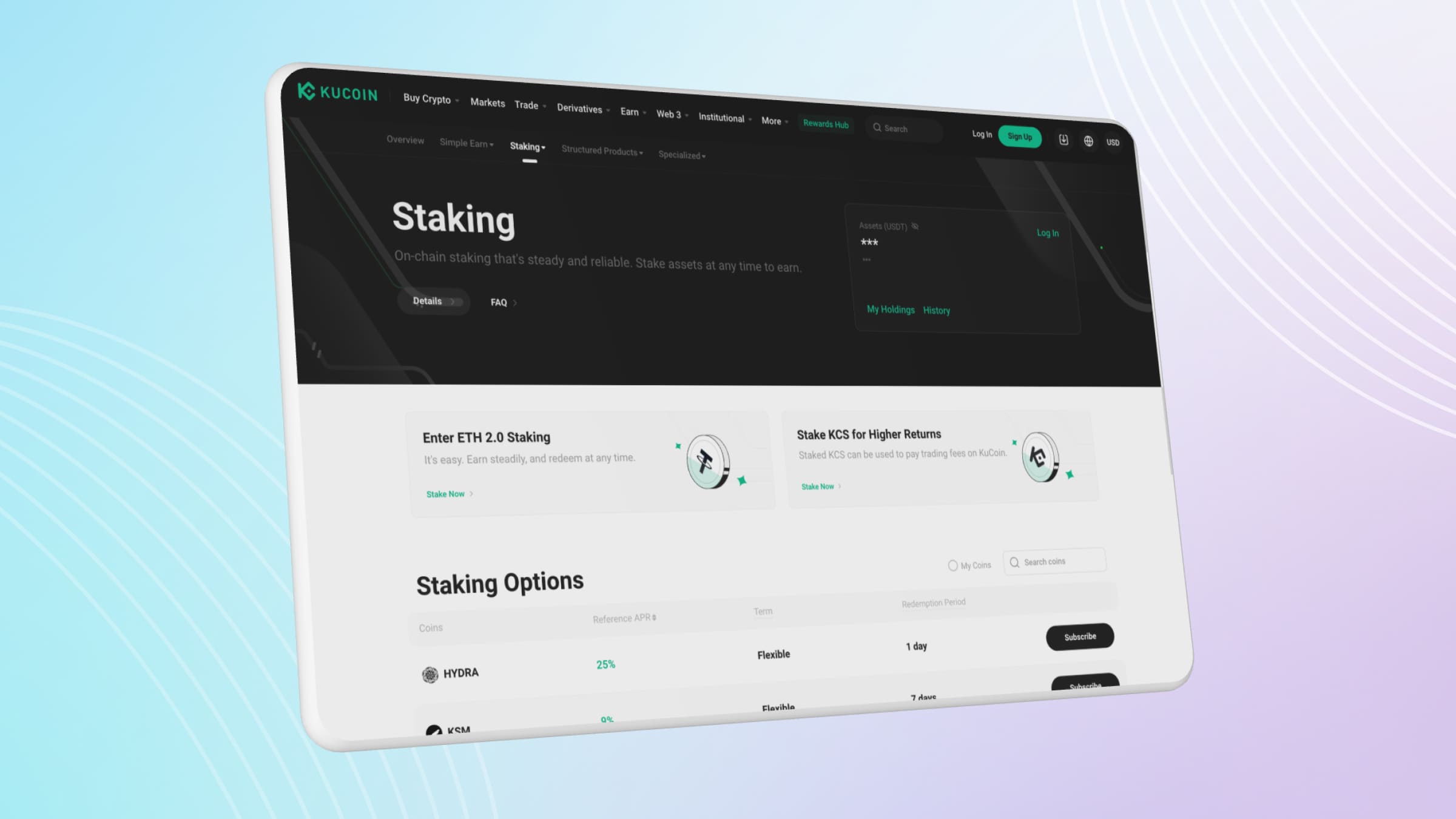

- KuCoin. The project is stable and reliable, and has a good reputation. Provides the possibility of soft staking, where users can receive rewards without blocking their funds. The main idea behind soft-staking is that cryptocurrency investors receive daily rewards without freezing assets for a long period of time.

- MEXC. Like other platforms, MEXC offers fixed-period or open-ended staking. These two options are aimed primarily at investors considering a long-term or short-term perspective, respectively. Mastering the service takes beginners a minimum of time and does not create additional difficulties.

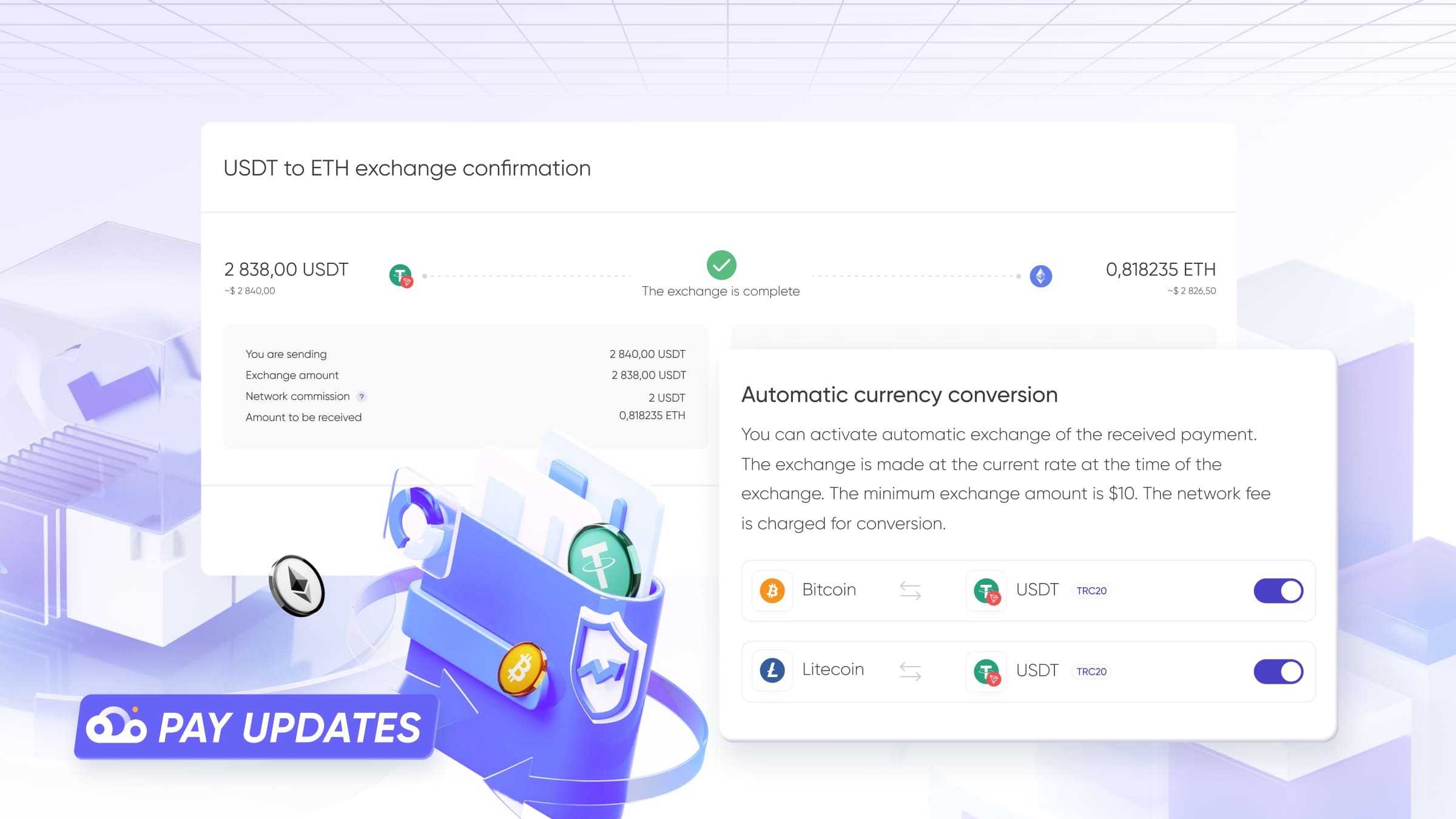

- Crypto.com. The platform is characterized by support for separate wallets and blockchain addresses for simplified asset placement. Crypto.com organizes its work in such a way that users can cancel bets and that assets do not stand still, but work and bring profit in proportion to their size.

Wallets

Some cryptocurrency wallets also provide their users with the opportunity to earn money from staking. Their list includes the following:

- Trust Wallet. A popular cryptocurrency wallet, Trust Wallet gives users the ability to place assets to increase their portfolio and for increased protection of the blockchain from attacks. By participating in the development of the network and maintaining the desired degree of its decentralization, investors receive bonus coins for this.

- Atomic Wallet. The platform provides an opportunity to receive passive income on cryptocurrency up to 20% annually. By default, rewards are transferred to the wallet automatically, and in the case of some coins, you need to collect the percentage manually.

- Ledger. The service is characterized by increased security and support for several types of cryptocurrencies. Ledger Live service can be used for purchases, and you can also perform transfers from other wallets and exchanges. The platform has opportunities for staking, saving and multiplying cryptocurrency assets.

Earnings on Staking: an Opportunity for Cryptoinvestors

Staking is a way to obtain passive income by freezing crypto assets. It is necessary to take into account possible risks, peculiarities of currencies, your experience — this will allow you to draw a conclusion about where to store cryptocurrency and what services to use for staking.

With a competent approach, this method allows you to get much more than on bank deposits. A balanced approach and the use of exclusively free funds helps to avoid unnecessary losses.