E-commerce is a huge market: in 2023 alone, global retail sales reached $5.8 trillion with an expected 39% growth in the next four years. It's not surprising that entrepreneurs working in this sphere have access to a multitude of tools — including payment services.

We explain payment systems and how they work, how to choose the right one, what requirements you may encounter, and which services you should consider for your company.

What Is a Payment System?

An online payment system is a service that provides transaction processing. Businesses use such a tool to receive payment from customers, both on their own website through a built-in checkout and through messengers, social networks, and other platforms.

In addition, such a service allows you to track operations, gather statistics, and work with customer data—the list of features depends on the specific platform.

Currencies and payment methods available to clients also differ in various services. Some payment systems work with only a few methods — for example, bank cards and online wallets — while other platforms may support dozens of currencies and payment options relevant to different countries worldwide.

Key Factors in Choosing a Payment System

The huge variety of services operating in the market makes it more difficult for an entrepreneur to make a choice. To find a suitable way of accepting payments, it is recommended to focus on several criteria:

- Reputation. Unfortunately, when working with finances, there is a risk of encountering fraud. To avoid losing money, you should make sure that the system was not the object of scandals or lawsuits, as well as study reviews and testimonials in advance.

This will help assess the service's reliability and ensure that there are no other problems, such as unwarranted blocking or instability.

- Convenience. The electronic payment system should be convenient for both the entrepreneur and the clients. To ensure this, you should study the interface of the checkout and personal account. In addition, the service should be relevant to the target audience — it should work in the right countries and support popular payment methods.

Finally, it is recommended to evaluate the speed of connection — the availability of ready-made integrations, the need for in-depth customization. - Commissions and plans. Most systems charge different fees when using different payment methods. This should be taken into account when assessing the service's cost: it is important to consider the prices relevant to popular payment methods.

In addition, it is necessary to carefully study the terms of partnership and ensure that there are no hidden fees, such as additional commissions for companies operating in certain spheres. - Requirements for connection. International payment systems generally set requirements for both the company and the site to which integration is planned. Conditions may include the country of registration, sphere of activity, or ban on the sale of certain goods.

The website must work reliably, ensure data security, and contain the necessary information — payment terms, delivery, refunds, etc. - Withdrawal speed. All electronic payment systems allow you to withdraw money to your personal or company account, but the period of money transfer may differ on different platforms. Many services offer several options — for example, standard withdrawal in 2-3 business days, fast withdrawal in 24 hours or instant withdrawal within an hour.

Requirements and Integration

One of the key requirements of many international payment systems is registration of a legal entity. Although some services support work with the individuals and sole traders, most platforms cooperate only with companies.

It should also be considered that popular foreign payment systems may not be available in some countries. Sanctions are likely to cause this situation. In order to work with such services, a foreign legal entity will be necessary.

Finally, entrepreneurs may encounter strict registration requirements, from multistage document verification to online interviews. All of this can be a barrier to joining, especially for a start-up business.

Online Payment System

Stripe

Stripe is one of the major international payment systems, which is popular among businesses all over the world. The service offers convenient tools for financial management (analytics, reporting, taxes, anti-fraud), support for a wide range of currencies and payment methods, and the possibility of detailed customization thanks to developer tools.

PayPal

E-wallet PayPal offers businesses the opportunity to create a corporate account and organize the reception of payments via checkout or button.

One of the key features of the service is the ability to pay through a PayPal account: the client automatically goes to the wallet's website, where he can log in to the account and complete the order. This ensures maximum security of payment information.

In addition to PayPal accounts, cards, payment systems and other methods can be used for payment. Credit is available for customers from the United States.

Adyen

Adyen is an international system that allows you to organize payment reception through a website or mobile application, as well as offline through branded terminals (provided by the service). The Unified Commerce system is used to manage cross-platform operations. In addition, virtual and real cards are available to users for more convenient payments.

Adyen supports more than 100 payment options, which allows the system to be used when working with customers around the world.

Authorize.Net

Authorize.Net is a VISA system that allows you to accept payments both online and offline. Bank cards, contactless payment systems, and other payment methods are supported. An eCheck service connection is available, which allows customers to write electronic checks to pay for the order.

The service is convenient for beginning entrepreneurs: in addition to a variety of payment options, Authorize.Net offers the service of opening a trading account. Customers who already have an account can choose a plan that includes only the payment gateway or gateway + eCheck.

Square

Square is an international payment processing system with functionality focused on online stores. The system is also suitable for businesses combining online and offline work. In addition to processing transactions through the payment gateway and payment links, the service offers hosting and shopping cart setup for start-ups, as well as branded POS terminals.

In addition, users have access to Afterpay's deferred payment service, which can be useful for stores with high-priced goods.

GoCardless

GoCardless is a service aiming to create an affordable alternative to conventional payment methods. Instead of traditional credit/debit cards, the service allows you to use direct bank payments. This method of payment allows to reduce transaction processing fees.

The system provides tools for automating one-time and recurring bank payments, tracking transactions, and collecting statistics. Nevertheless, such transactions are processed slower than the usual card payment.

CryptoCloud for International Payments

Cryptocurrency is a decentralized market, so crypto transactions are not subject to blocks or chargebacks that may occur when working with traditional payment systems. sanctions. In addition, such transactions require minimal fees (usually around 1–2% when using a platform) and offer customer data protection.

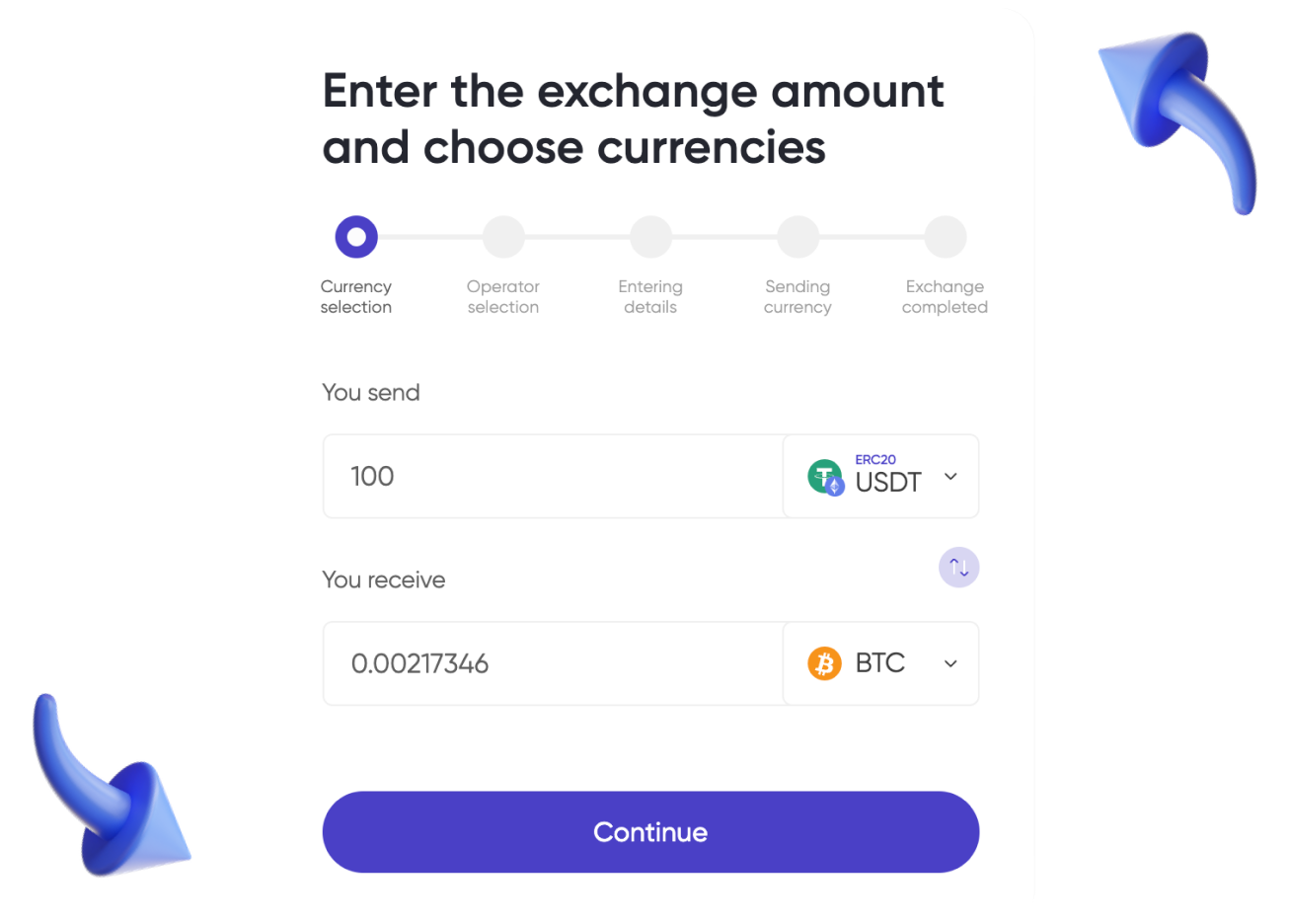

A cryptocurrency processor is a service that tracks transactions, confirms payment, converts the payment amount, collects statistics, and can help automate crypto payments. One such system is CryptoCloud.

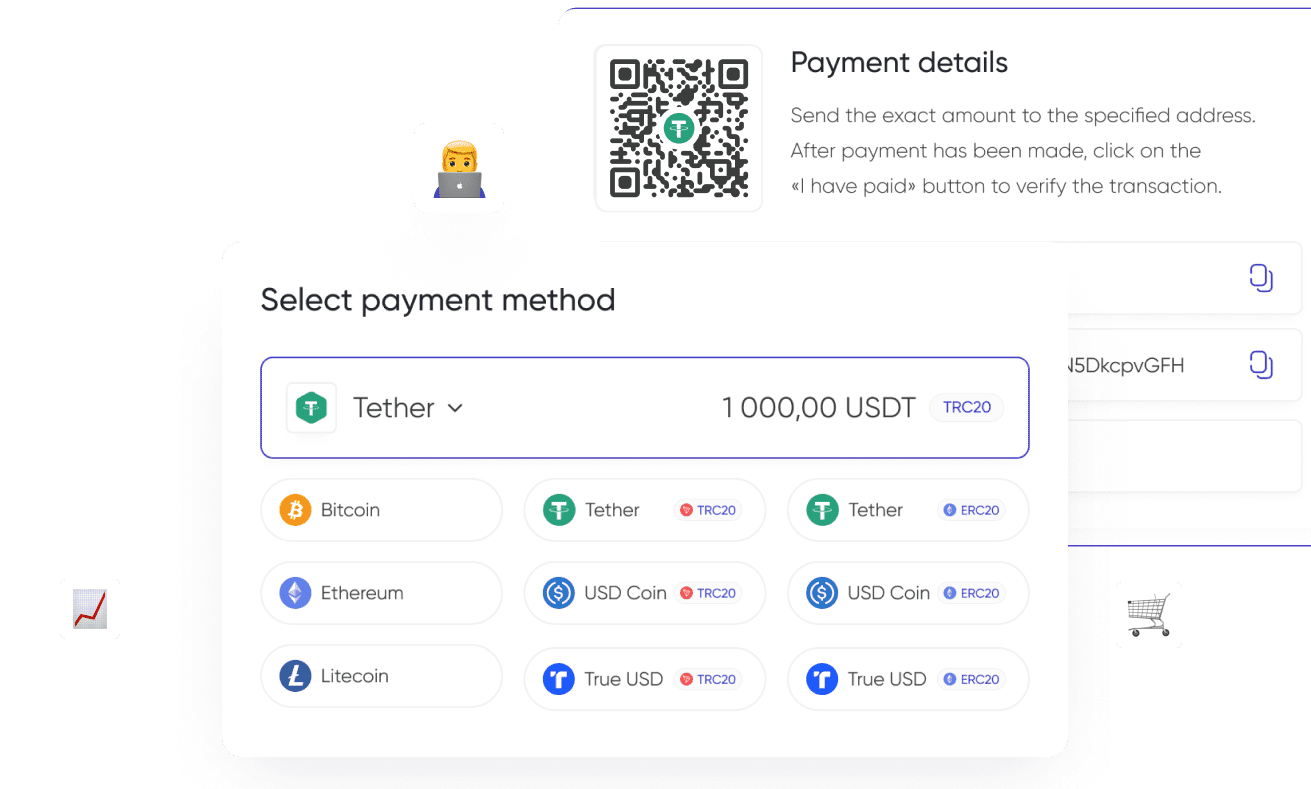

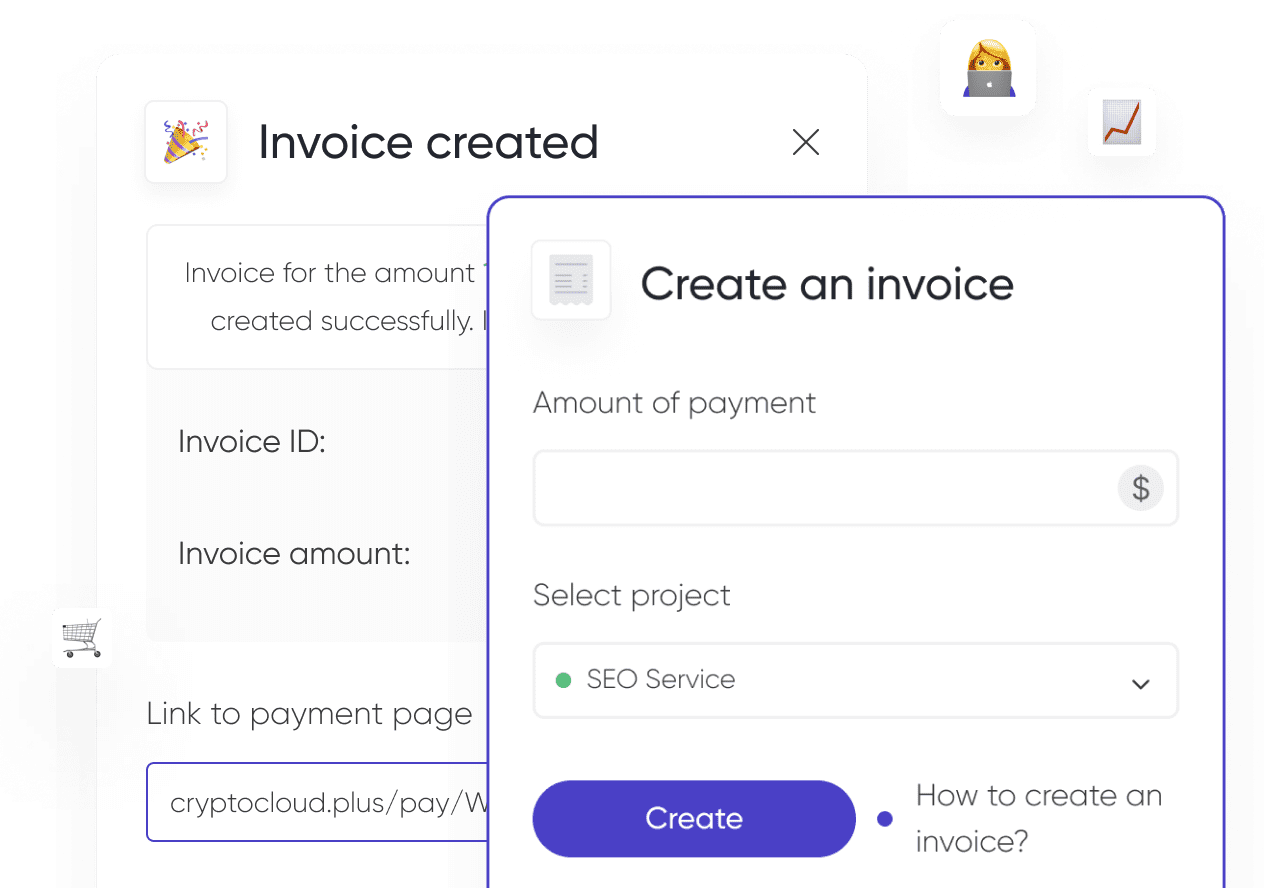

The platform allows you to work through integrated checkout and payment links, issue invoices, check transactions for dirty cryptocurrency, and configure the accuracy of transactions and the payment side of the commission. Checkout is in 7 languages and supports popular cryptocurrencies.

Registration requirements are minimal (verification is not required), and the commission is from 0.4%. There are detailed statistics and a convenient notification system.

Receiving International Payments in 2024

The rapid development of the e-commerce market has led to the emergence of a wide range of payment processing services. Entrepreneurs are faced with a large selection of payment systems. In order to find the right one, they need to take into account several factors, from convenience to prices and security systems.

A service like CryptoCloud will allow you to automate the acceptance of cryptocurrency payments and work with customers around the world. Read more about the features and rates on our website.

We also recommend reading our article «Best Cryptocurrencies for Accepting Payments».