VPN services are a sought-after tool and a promising field. Statista estimates that the size of this market reached $45 billion in 2022, with an expected growth to $350 billion by 2032. However, entrepreneurs starting a business in this sector may face several challenges — including the fact that many payment processing systems refuse to cooperate with VPN companies or offer less favorable terms than other customers.

We will describe the essence of VPNs, what causes difficulties when connecting payments and what payment methods a VPN company can use to work with clients successfully.

VPN Services: What Are They Used For?

VPN is a virtual private network designed to protect data and Internet traffic. Connecting to a VPN service allows you to change the user's location (IP address) bypassing website blocking in a particular country or connecting a remote employee to the local network.

When the virtual private network is enabled, the user's device connects to the server via VPN protocols. As a result, websites visited by the user see only the IP address of the selected server and cannot learn the user's data. The provider also loses access to the traffic and cannot read it or view the websites visited.

VPN services are in demand for several reasons: they provide privacy, data encryption (for example, when connecting to public Wi-Fi), and protection from hacking and DDoS attacks.

Despite the prospects of the sphere, VPN companies are categorized as high-risk: payment systems and other transaction processing services believe that such businesses are highly likely to encounter various problems.

Potential concerns include fraud, customer dissatisfaction, bankruptcy, and reputational losses. As a result, many systems refuse to connect companies to high-risk payments and provide other services.

Challenges of Accepting Payments for VPN Businesses

Organizing payment reception for a high-risk merchant can be daunting. Payment services consider such companies to be businesses that have a high chance of causing customer dissatisfaction (and, consequently, regular chargebacks) or facing fraud.

Such situations lead to reputational and financial losses for the company and the payment service that cooperates with it.

Various systems approach high-risk payments differently. Many acquiring companies completely refuse to cooperate with a company operating in a high-risk area—in particular, such a rule applies to many banks. Other payment systems allow payment processing services but charge higher fees and/or limit their functionality.

How Can VPN Company Accept Payments

When it is impossible or unprofitable to connect a payment system, it is possible to organize the acceptance of payments for high-risk business in three main ways:

- Electronic wallets. Many services offer payment services that allow you to receive payment both in the form of direct transfers and through integration to the website or payment links.

However, although the rules of many online wallets are less strict than those of payment systems, the service may refuse to work with a high-risk company or charge a higher commission.

- Bank cards. Another popular way to receive payments for a VPN service is card processing. This can be organized not only through a payment system, but also in the format of regular transfers, when the client receives the details and manually sends the payment.

Although this method is not always convenient, it allows you to make payments for VPN service without integrating additional systems. - Cryptocurrency. Crypto transactions are secure and anonymous, which is appreciated by users of VPN services. Crypto payments can be accepted in two ways: through transfers to the wallet address, which must be processed manually, or through crypto processing.

Cryptocurrency payment systems generally do not allocate high-risk companies and cooperate with them on general terms. In addition, such services allow accepting payments from any country, even under sanctions.

Accepting Crypto Payments with CryptoCloud

One of the additional problems faced by many entrepreneurs is the difficulty in accepting cross-border payments.

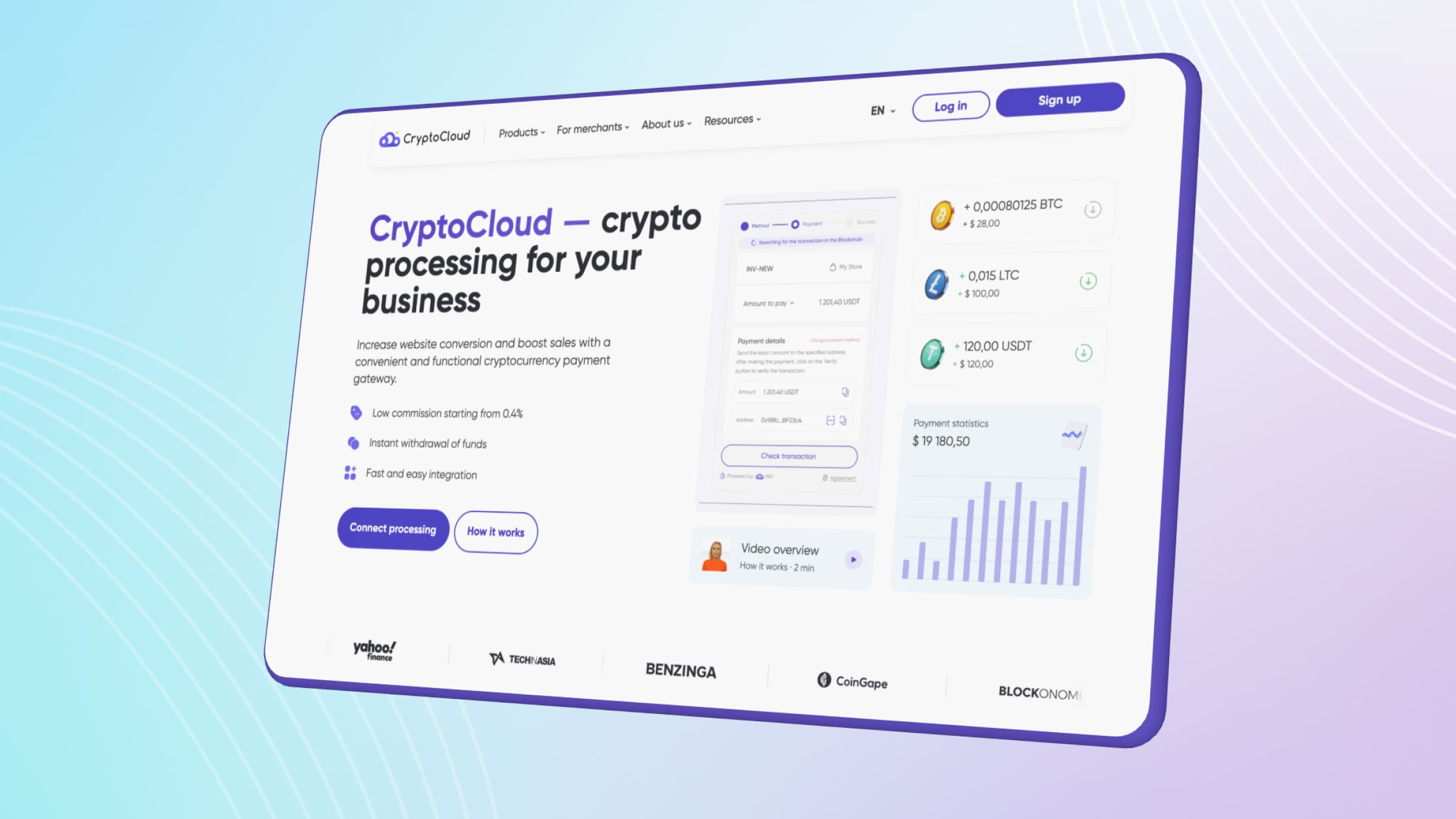

Cryptocurrency payment systems — for example, CryptoCloud processing — will help overcome this issue. The service allows payments to be received via payment links on the website, mobile app, social networks, Telegram bot, and other platforms.

When working through a website, processing can be integrated either through ready-made plugins or through a structured API. The platform provides detailed step-by-step instructions in text and video format.

In addition to accepting payments, the cryptocurrency payment gateway offers users the ability to track statistics, automatically convert received payments to USDT to protect against volatility, perform AML transaction check, customize checkout, customize payment accuracy and choose the commission payment side, etc.

Payment Options for VPN Services

Many VPN companies face a problem: in order for users to buy a VPN, payment acceptance must be connected, but many acquiring companies refuse to cooperate with such services because they belong to the high-risk category.

There are several ways to solve this problem, such as accepting payment directly to a bank account or finding a service that works with high-risk companies.

Nevertheless, one of the most reliable options for VPNs is cryptocurrency payment, which will allow you to work with clients from anywhere in the world. CryptoCloud service, which offers commissions from 0.4%, support for major currencies and a number of useful services to ensure convenience and security, can help to organize such payments.