Users may encounter mandatory security measures when working with cryptocurrency services (exchanges, payment systems, wallets). Among them is AML check of cryptocurrencies, which, if violated, can lead to the blocking of the transaction and account.

This article explains AML verification, why it is necessary, and how to check cryptocurrency for purity to protect yourself when conducting transactions.

What Is AML Check

AML check is a set of measures aimed at preventing the laundering of illegally obtained funds. AML verification of transactions is carried out by both regular payment systems working with fiat currency and many cryptocurrency services.

The main principle of AML is collecting and analyzing information about customers. Thus, one of the elements of verification is KYC (Know Your Customer). The services also use transaction information (data on account movements, registration of suspicious transactions) and temporary restrictive measures (freezing of funds) for in-depth activity analysis.

In addition, AML wallet verification systems store information about customers and their transactions. This data can be used for additional analysis and for law enforcement to investigate crimes.

The specific set of measures applied during verification is formed depending on which jurisdiction the site belongs to. AML implies internal analysis and cooperation with the country's regulators where the exchange or wallet is registered.

AML, CFT, KYC: What Is the Difference

Crypto services can use several types of checks: AML, CFT, and KYC. Let's examine how they differ.

- KYC (Know Your Customer) is a basic customer verification that is part of AML and CFT. The main elements are verifying identity and address through the customer's presentation of relevant documents (ID, bank statements, CHP bills to confirm actual address, etc.). In some cases, KYC also includes a video link interview.

- AML (Anti-Money Laundering) is a financial crime prevention measure. It involves verifying the customer's identity (KYC) and analyzing transactions made on the account. If a breach occurs, the user may face an account freeze, in-depth verification, and, in some cases, referral to law enforcement.

- CFT (Counter-Terrorist Financing) — a measure to prevent terrorist financing. The main procedures are checking the client's connection with terrorist and extremist organizations and tracking transactions. If a connection is detected, the service not only blocks the account and conducts an internal investigation, but also involves law enforcement agencies.

Cryptocurrency Verification: Why Is It Necessary

The crypto payments sphere has several characteristics that make it attractive to criminals. Transactions conducted through the blockchain are anonymous by default — this is one of the basic principles of cryptocurrency. Privacy facilitates criminal activity, from tax evasion and laundering of illegally obtained cryptocurrency to terrorist financing.

Another feature that makes the cryptosphere vulnerable is being in a gray zone in terms of legislation. Although various countries are gradually beginning to introduce measures regulating cryptocurrency transactions, most jurisdictions do not have clear rules at the moment.

Cryptocurrency exchangers, especially P2P platforms, are platforms where there is a high risk of acquiring dirty cryptocurrency, i.e. funds obtained illegally. In this case, the user who bought the currency cannot know its origin in advance.

To avoid transactions involving illegal currency, almost all major cryptocurrency exchanges conduct AML checks online when registering each new client and request identity verification.

Why Do Crypto Exchanges Need AML

There are a few main reasons why crypto exchanges introduce procedures that allow for AML verification of cryptocurrency.

- Regulatory compliance. In many countries, KYC and AML checks are mandatory for the operation of any organization related to financial transactions. Platforms that do not comply can be fined and blocked in the country.

- Crime investigation. Crypto services are required to verify wallet transactions and provide data on the flow of funds and account holders upon request from law enforcement agencies. This information is used to solve crimes involving digital assets and identify offenders.

- Users protection. The task of major crypto exchanges is to create a safe environment by protecting users from scammers and dirty cryptocurrency.

- Building trust. Measures that allow verification of cryptocurrency transactions are an important factor in building a site's reputation. This allows the site to attract an audience and avoid problems with the country's regulators where the service is registered.

How Is Dirty Cryptocurrency Laundered

Fraudsters use several ways to launder funds, including:

- Mixers are special programs that provide maximum anonymity in operations. Their main principle is mixing incoming funds in a shared pool, making the source of the outgoing transaction impossible to trace. Such services are illegal in many countries.

- Transit (intermediate) addresses. Funds pass through multiple transactions, making them difficult to track. As a rule, such chains also involve accounts on crypto exchanges registered to dropships.

- Withdrawal via crypto exchanges without KYC and KYT. While most exchanges verify the purity of cryptocurrency, some services still refrain from using such measures.

- Collateral transactions via smart contracts. A smart contract (a code with transaction terms and conditions) allows fraudsters to pledge dirty funds and receive clean currency against that pledge.

- The issuance of NFTs that the attacker buys themselves from themselves with dirty crypto. This creates an artificial source of income that can be presented to law enforcement if necessary.

How to Protect Yourself from Dirty Money

There are several ways to reduce the risk of coming into contact with illegally obtained funds:

- Using exchangers and exchanges with a good reputation, which conduct the necessary user checks and request identity verification.

- Clarifying the crypto address of the second party when sending or accepting cryptocurrency payments. The address can be verified independently on AML services by risk score.

- Regularly changing your cryptocurrency address. This will allow you to protect yourself in case the counterparties contacted by the wallet get on the list of suspicious addresses or are considered high-risk.

- When working with new counterparties whose address cannot be known in advance for any reason, it is not recommended to use the main wallet. A new address should be registered for the transaction, which will allow you to safely verify the legal origin of the funds.

- If there are doubts about the legitimacy of the currency received, you should keep all data confirming that the funds were received as a result of the transaction. This will ensure that there is evidence in case the transaction is deemed suspicious and attracts the attention of law enforcement.

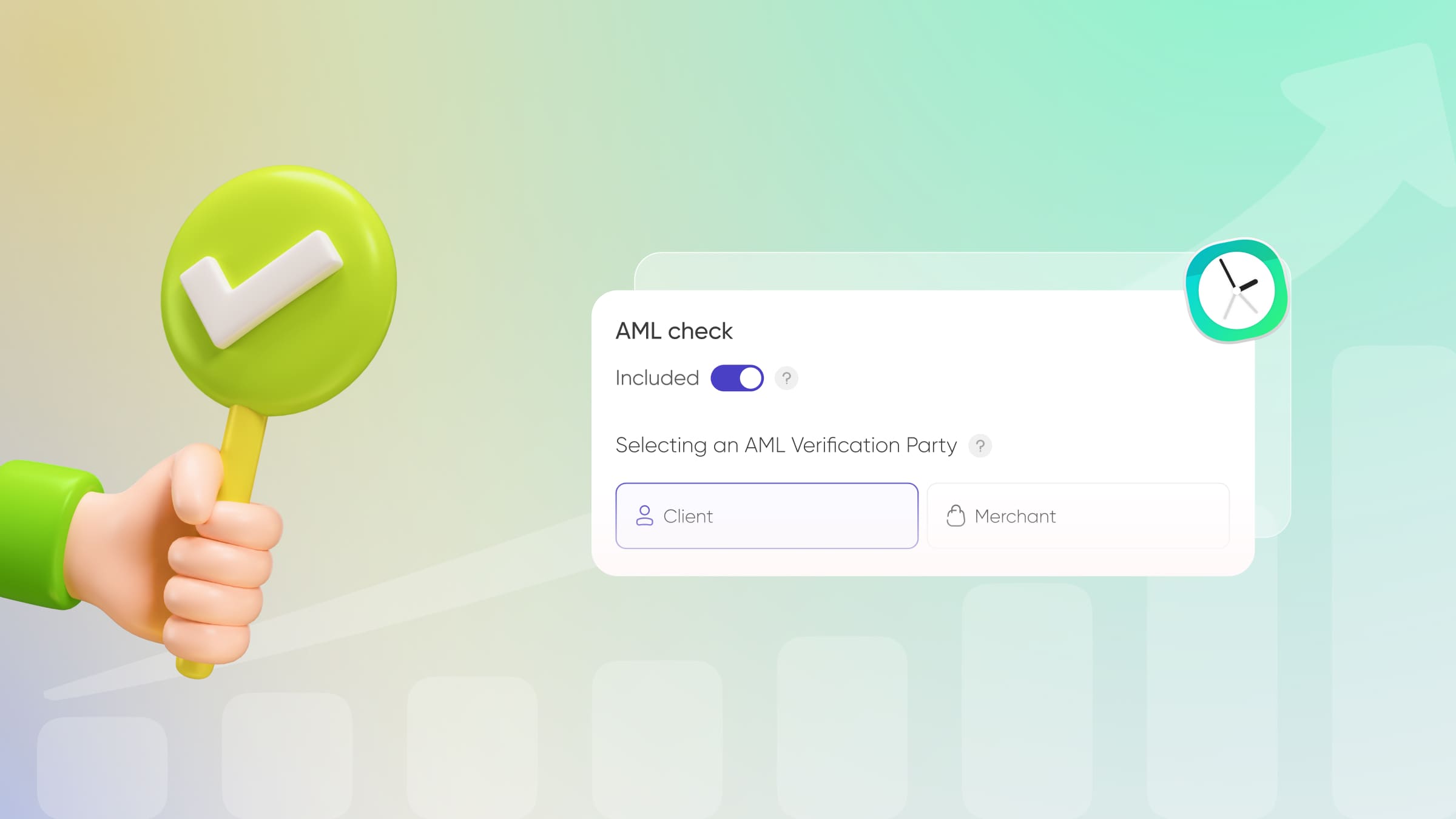

Most crypto payment processing services offer their own tools to verify transactions. Among such services is CryptoCloud crypto acquiring, which gives users the ability to verify all incoming transactions. To activate this tool, you only need to enable verification in your personal account settings.

CryptoCloud is a cryptocurrency payment gateway that allows businesses to accept payments on a website, ecommerce platform, social network or messenger.

The system supports major currencies and has a convenient multilingual interface. Installation and integration are completely free. Commission for transaction processing starts at 0.4%.

AML Checks With CryptoCloud Service

AML checks are an important part of safe cryptocurrency handling. This precaution, like KYC, is used on most major crypto services to prevent money laundering. Lack of AML can lead to the purchase of dirty currency, loss of funds, and problems with law enforcement.

CryptoCloud payment gateway offers users built-in AML checks for all incoming transactions. The system is also characterized by high reliability, security, and a user-friendly interface. Learn more on our website.