Entering a foreign market for a business is difficult without opening an account in a foreign bank or connecting a payment service. For this purpose, a company needs to undergo KYC (Know Your Customer) procedure and convince financial organizations that its business activities are transparent.

Payment providers may refuse to open a merchant account if your business is of high risk. In the article, we will explain how to avoid this and what alternatives there are for a high-risk business.

What Is a High-Risk Business?

A high-risk business is one that banks and payment systems believe has the highest probability of experiencing fraud, financial and reputational losses. The reason for high risk may be the specifics of the business (for example, VPN companies), the location of the company, low quality of goods and services, short time on the market, etc.

Many payment systems refuse to work with high-risk projects, as they want to avoid damaging their reputation and being involved in fraudulent transactions. As a rule, high-risk businesses include companies involved in pharmaceuticals, travel and booking, selling cosmetics, gambling, etc.

What a Merchant Account Is and Why It Is Required

Accepting online payments is one of the primary conditions for a company to operate thoroughly. To do this, it needs processing, the technology that verifies and processes incoming funds.

The following parties are involved in processing:

- the merchant or seller;

- the buyer;

- issuer — the bank that issued the buyer's card;

- the acquirer — the bank where the payment is received;

- processing center, which provides communication between the participants of the transaction and fast data processing;

- payment system acting as an intermediary between the merchant and the acquirer.

The processing center deals with information about the transaction: it analyzes the security of the transfer, transmits payment data to the acquirer, and receives information from the issuer about sufficient or insufficient funds on the buyer's account. After the payment is confirmed, the funds are frozen in the customer's account or immediately transferred to the seller's merchant account, and the buyer and seller receive a notification of successful payment.

Merchant account is a commercial account of a seller, which allows them to accept online payments regardless of the time of day and bank opening hours. Creating such an account allows you to accept international payments from bank cards and e-wallets.

To create a merchant account, an entrepreneur must undergo several verifications. Financial organizations study the business, the corporate website, the goods and services offered. If there is a possibility of risk to the company's customers, the bank may refuse to open an account for security reasons.

How Risk Is Determined

There are a number of common signs of a high-risk business that may cause an entrepreneur to be rejected for opening a merchant account. These signs include:

- high percentage of refunds initiated by customers;

- sale of prohibited or low-quality goods and services;

- lack of transaction history and reputation of the company;

- the company is located offshore, in a jurisdiction with a high risk of fraud or financial loss, or in a country regularly subject to sanctions;

- lack of credit history or poor credit history (both of the company and its owner);

- seasonality of activity, indicating instability of income;

- operation of suspiciously large amounts: sales of $20,000 or more per month, each transaction of at least $500;

- use of several currencies at once;

- working in a subscription format, receiving periodic payments.

Beyond the general factors that most payment processors focus on, a business may be deemed high risk based on criteria used by a particular system.

Getting a Merchant Account for a High-Risk Business

To choose the right high-risk acquiring service for your business and open a merchant account, we recommend following these steps:

- Compare the available payment systems and select the best option.

- Make sure your company's website looks reliable, is stable and meets all security requirements. Post your privacy policy, terms of use, payment and returns terms.

- Check popular sites for negative reviews about your company. If there are any, take measures to "clean" negative feedback.

- Contact a specialist of the payment provider to find out the detailed terms of cooperation.

- Prepare the necessary documents. In addition to information about the company, provide information confirming your business's financial stability.

- Wait for the results of the verification of your company. If everything is fine, the account will be opened.

What Documents Are Required for Opening an Account

When connecting high-risk acquiring, it is especially important to provide the provider with correct documents. The list of documents may vary, but the general list is as follows:

- application for opening an account;

- notarized copies of the ID of the owner and directors;

- utility receipts or other documents confirming where you actually live;

- incorporation documents for the business;

- proof that your company owns the domain;

- a description of the company's business;

- transaction history;

- copies of contracts with manufacturers and suppliers.

Crypto Processing for High-Risk Businesses

In some cases, getting a merchant account proves impossible for high-risk businesses. If financial organizations refuse to cooperate, the solution may be to connect crypto acquiring and accept payments in cryptocurrency.

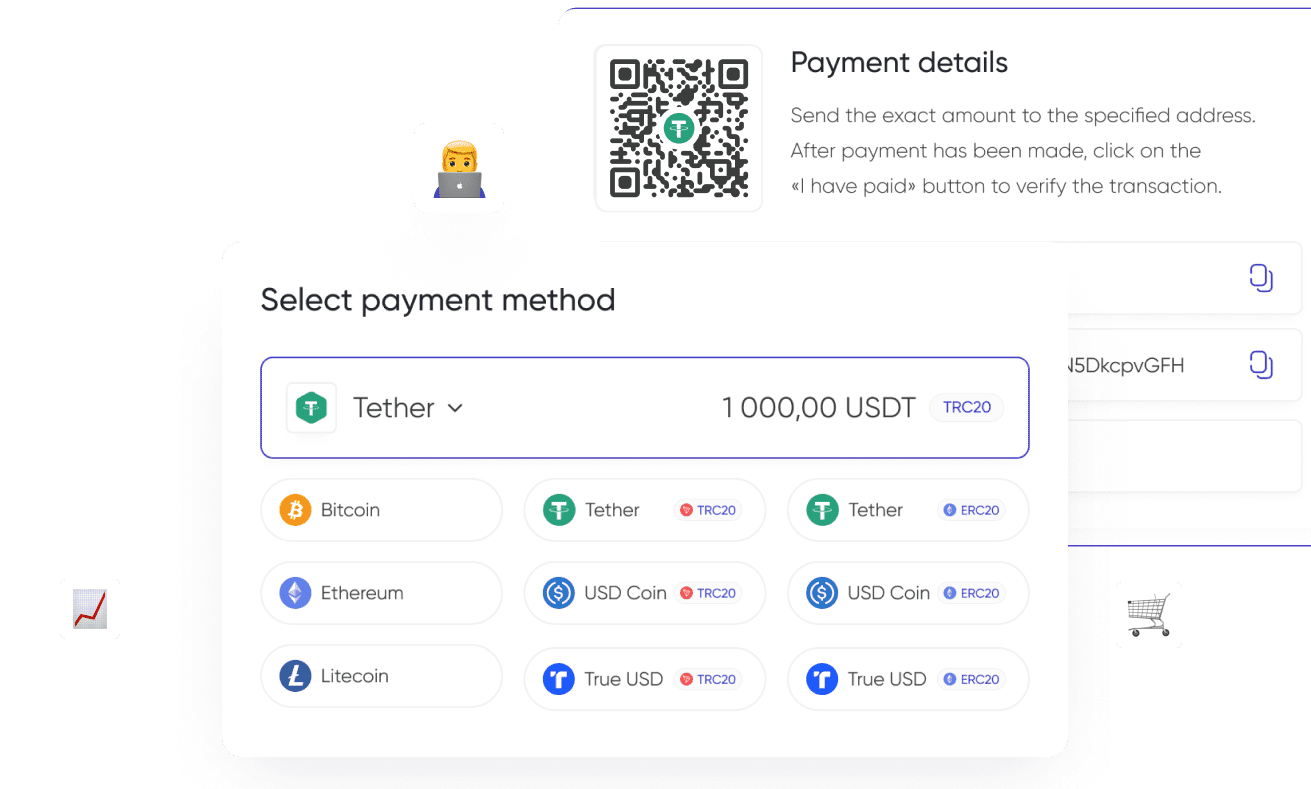

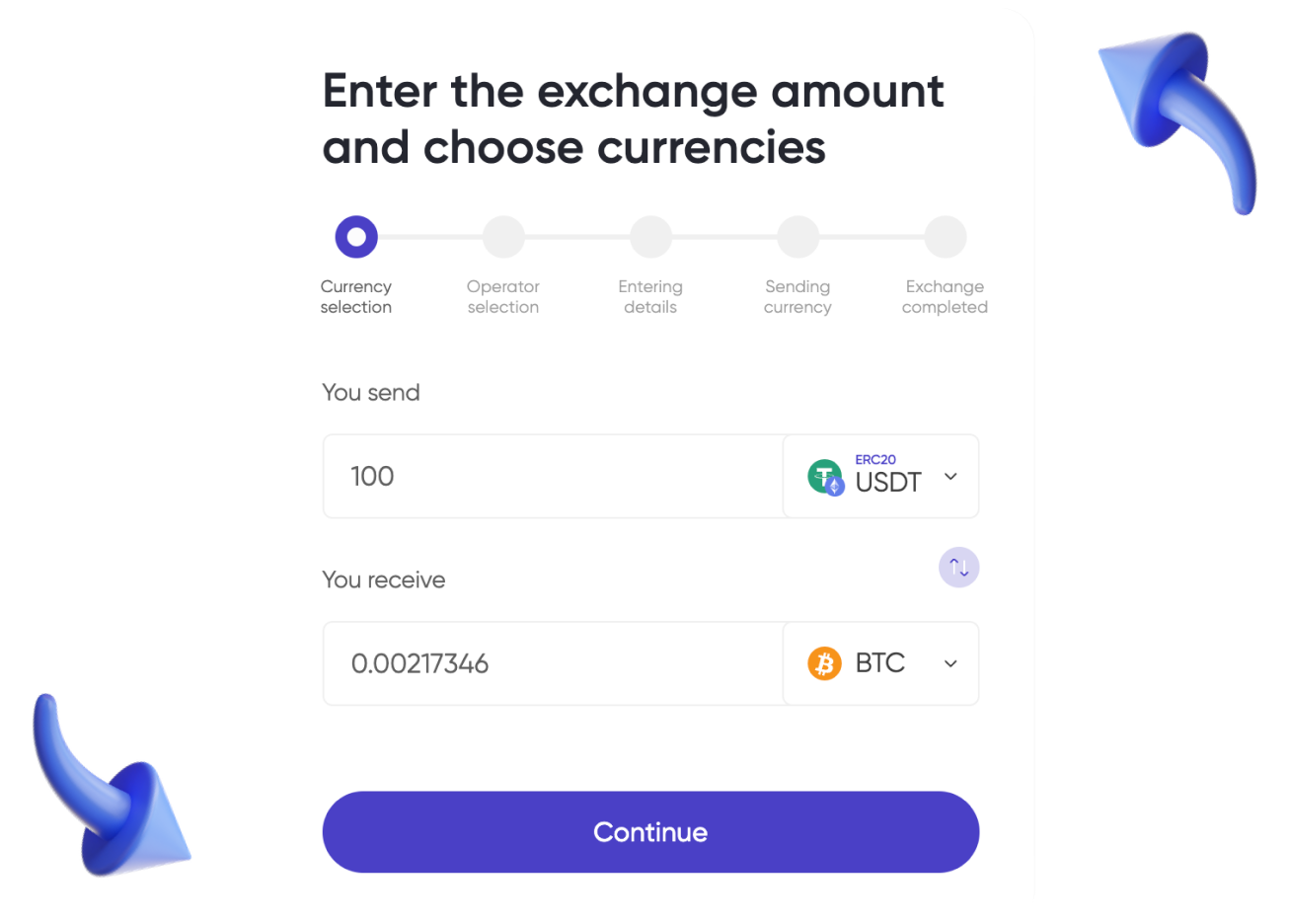

Cryptocurrency processing is a system that automatically processes crypto payments on your company's website. Connecting crypto acquiring has several advantages:

- increased payment page conversion;

- acceptance of international payments without restrictions;

- automating the issuance of data for payment, verification and acceptance of transactions.

Accepting blockchain payments is convenient for high-risk businesses in that the account cannot be blocked at the request of the bank or provider. Connecting crypto processing does not require registration of a legal entity - payment is received into the account of the company owner.

CryptoCloud Acquiring for High-Risk Businesses

A business can be considered high-risk for a number of reasons — from the location of the company to the specifics of its operations. In some cases, you will be able to open a merchant account by providing a number of documents, but sometimes this is not enough.

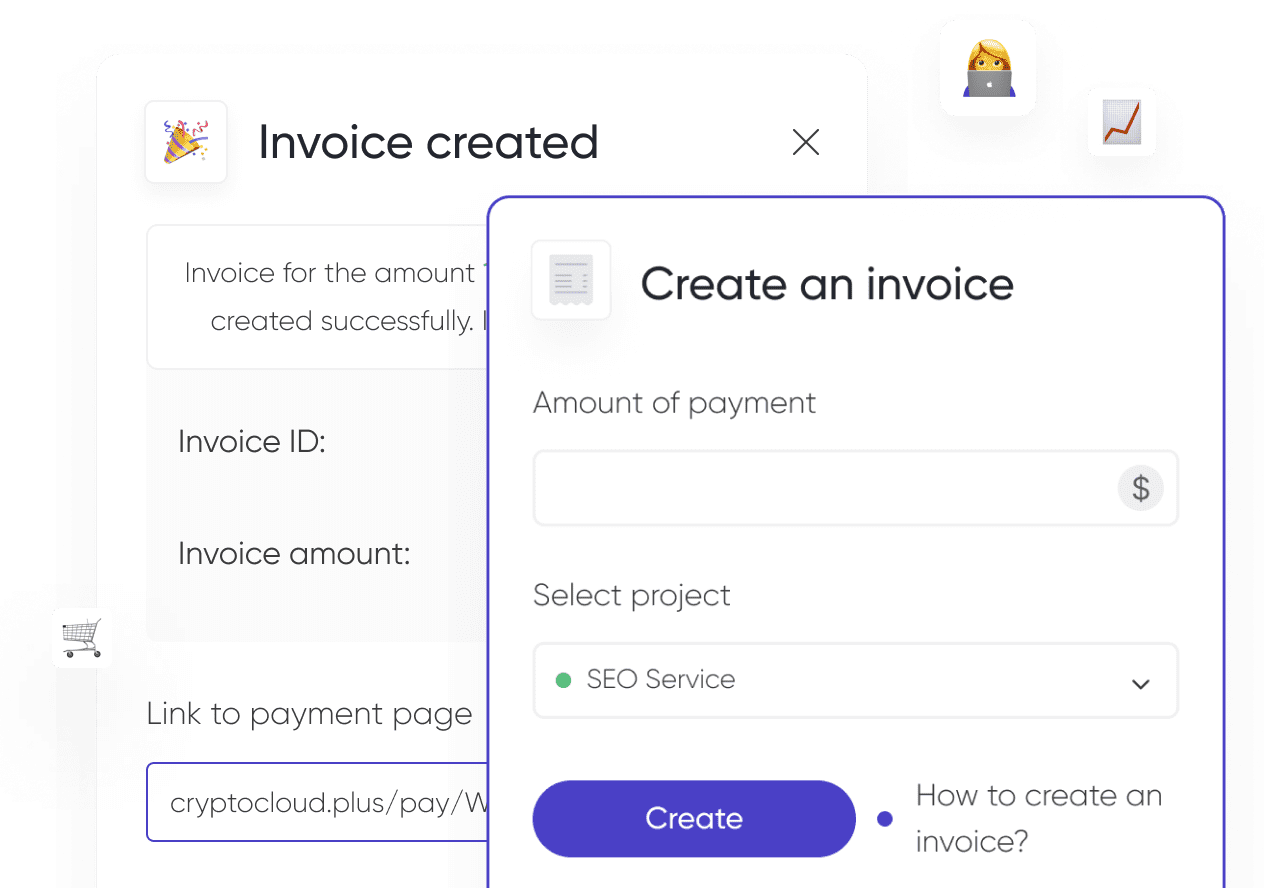

If standard payment systems refuse to cooperate, you can connect CryptoCloud crypto payment gateway. The service offers free personal account registration and integration with your website. CryptoCloud processes payments in the most popular cryptocurrencies and charges a commission for each transaction starting from 0.4%.

A full review of the CryptoCloud service you can find in the article. More information about connecting crypto processing can be found in our knowledge base.