According to a survey, more than 400 million people around the world own cryptocurrency.

Where to store cryptocurrency? What wallets exist and which one is better to give preference to? What does the choice in favor of one or another tool for storing cryptocurrency depend on? In this article, we will consider the main options, pros and cons of each of them.

The Main Ways to Store Cryptocurrency

Users today have several ways to store their assets.

Exchange account

To trade cryptocurrency, you need to fund an account, which is why exchanges are often used as a wallet. However, this is one of the most unsafe ways to store funds, as exchanges are very vulnerable to hackers.

The main risk is that exchange servers act as private key stores. Therefore, if an attacker gains access to them, he can easily get hold of the assets themselves. Some platforms create reserve funds for this purpose or transfer part of the funds to cold wallets. Therefore, before choosing an exchange, it is worth clarifying the proposed conditions for storing keys.

Staking

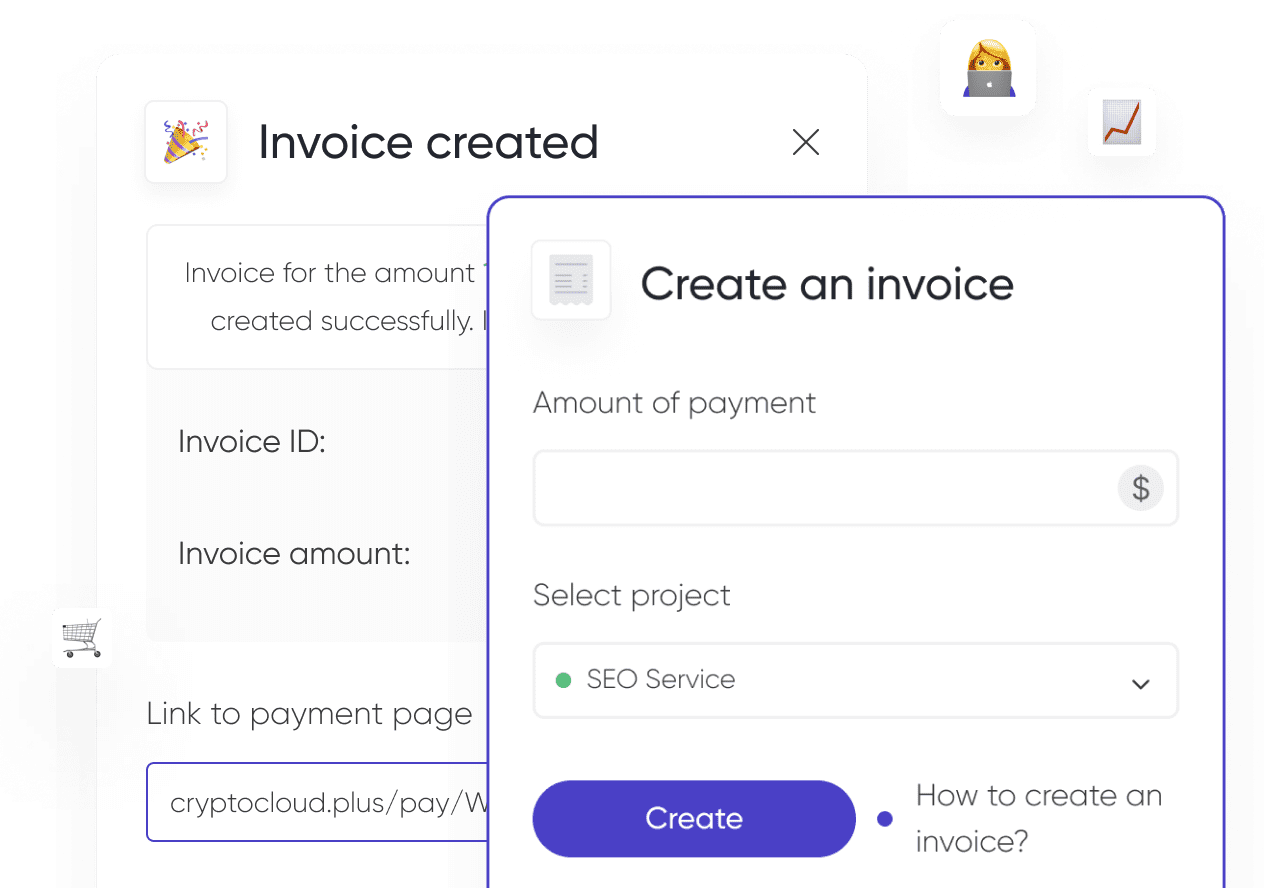

This instrument is similar to bank deposits. The owner transfers funds to the platform to confirm blockchain transactions or maintain the liquidity of other tokens.

Wallet

A cryptocurrency wallet is a tool that is specifically designed to store funds and, if selected correctly, provides the greatest security of cryptocurrency.

Wallets can be of two types:

- Custodial — provided and controlled by a third party. Usually, an exchange acts as the guarantor of the wallet (custodian). It is important to take into account that it has access to private keys and, therefore, to the funds themselves.

- Non-custodial — fully belong to the owner, who has access to the secret key or seed-phrase. Losing access to the funds in the wallet is entirely the responsibility of the owner.

Non-custodial wallets are also conditionally divided into two types:

- Hot or software wallets can be, for example, in the form of an application or browser extension.

- Cold or hardware ones look like an ordinary flash drive. Since they can be physically stored, they can provide complete autonomy and, as a result, almost 100 percent protection.

Cold and Hot Wallets

A wallet is the main tool for storing cryptocurrency assets. Let's take a closer look at cold and hot wallets types.

Cold wallets

They got their name due to the fact that they are able to be completely independent and autonomous, which means that they can provide the necessary level of security.

Cold wallets are divided into several types.

- Hardware. Externally, they look like a basic flash drive for storing data. As long as no one but the owner has access to the hardware medium, the savings are completely safe. It should be borne in mind that such devices themselves are rather expensive, so it makes sense to buy them in the first place to store large sums of money in cryptocurrency. Ledger and Trezor are examples of hardware wallets.

- Desktop. They combine the advantages of hardware wallets and applications that are used to store cryptocurrency. To fully protect your funds from fraudsters, you should, if possible, install a desktop wallet exclusively on standalone devices that not only cannot be connected to the Internet, but are not even used for operations within the local network. Only in this case will the desktop wallet be truly protected.

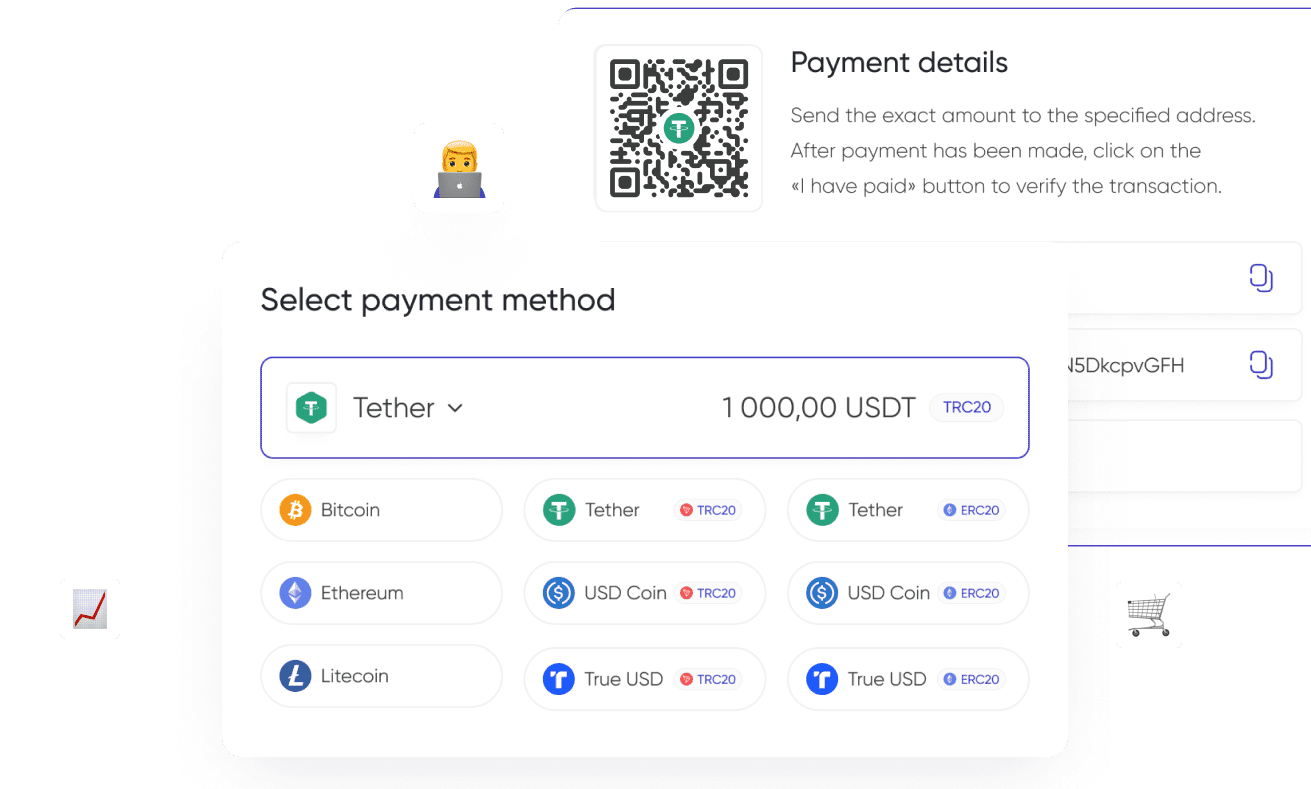

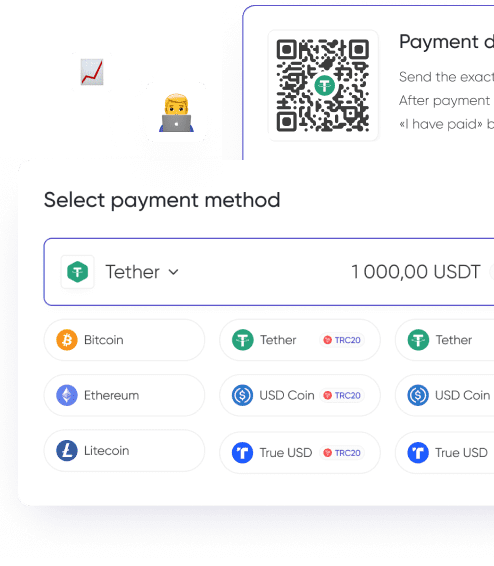

- Paper-based. Actually do not represent wallets, but only provide access to the assets that the holder has. As a rule, it is a piece of paper on which the access key in the form of a QR code or other encryption is printed.

Hot wallets

These are named in contrast to cold wallets, as they are connected to the Internet and blockchain and are intended for constant use. On the one hand, such wallets are convenient due to the fact that they are always available and it is difficult to lose them. On the other hand, they do not provide full autonomy and therefore do not offer full security guarantees.

The main types of hot wallets:

- Browser-based. They exist in the form of extensions or plug-ins for browsers. They can be released for various platforms, including both common Windows, MacOS, and other less popular operating systems. The features of the wallet directly depend on which browser is used for its use. The owner can access his assets at almost any moment when there is an Internet connection.

However, it should be taken into account that any unauthorized access to the browser will also give the attacker the opportunity to steal cryptocurrency assets as well. Therefore, such wallets are used primarily as buffer wallets or keep small amounts of money on them. An example of a browser wallet is MetaMask. - Mobile. These are used to store cryptocurrency on mobile devices in the form of an app. As in the case of a hot browser wallet, the disadvantages of this tool are pretty much the same. Because of this, they are also best used for relatively small amounts or for temporary storage of funds. We covered one of the most popular mobile cryptocurrency wallets TrustWallet in the article.

Safety Rules for Storing Cryptocurrency

It is important to remember that you will not be able to cancel a transaction, even if it was made by mistake, or it was carried out by an intruder.

The main rules to follow when storing cryptocurrency in a wallet:

- write down and store codes, through which a two-factor identification of the user is enabled;

- do not use easy passwords, as well as do not duplicate them, do not use the same words and phrases for access on different resources;

- use security protocols like WalletConnect:

- do not connect to the global network through unprotected channels;

- keep the seed-phrase on a physical medium (write it down); download software only from the official resource;

- do not store all assets in one place.

Sometimes users may lose access to their cryptocurrency wallet. In such cases, it can be restored using several methods, which we have described in the article.

Which Cryptocurrency Storage Option to Choose

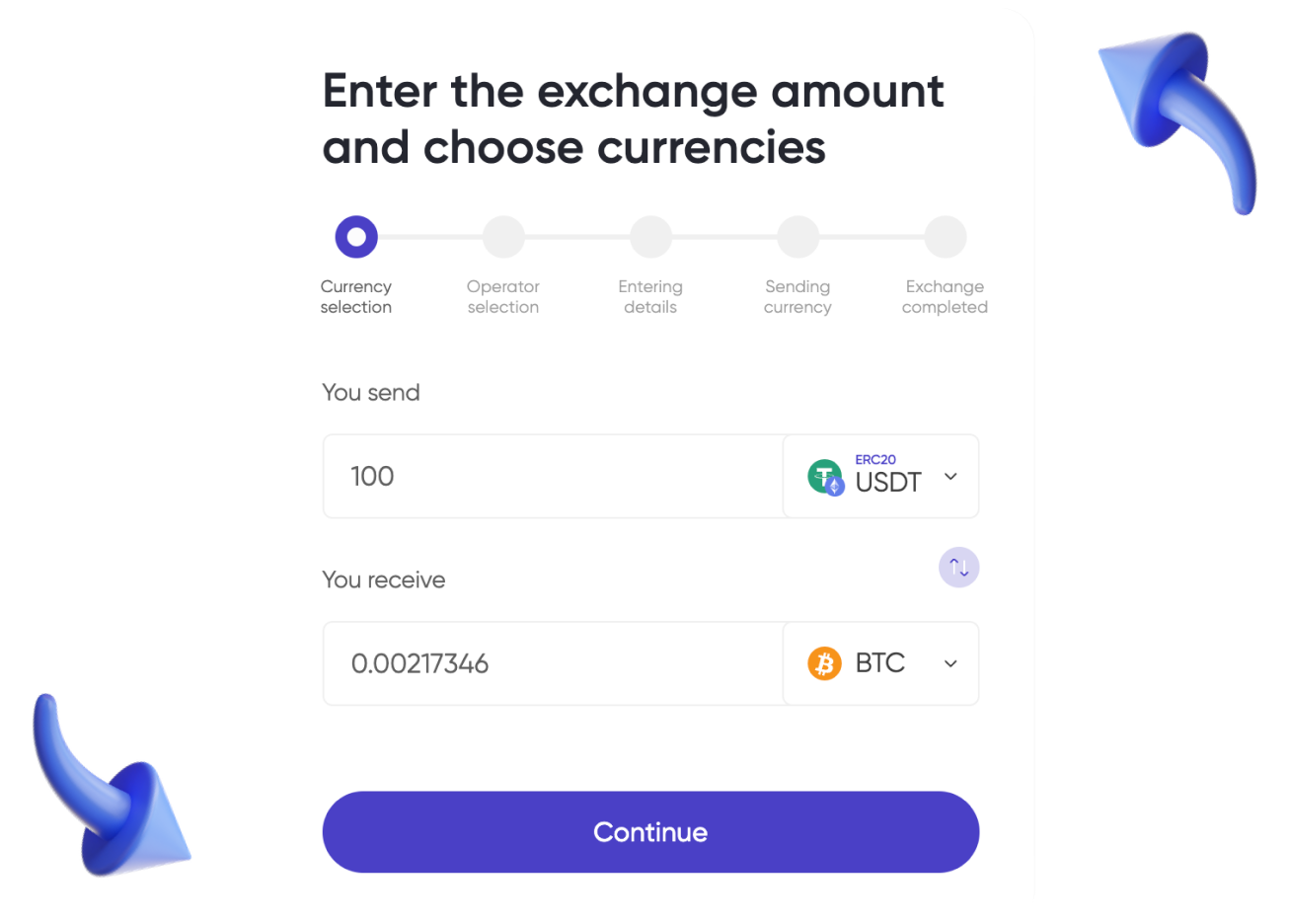

The storage solution for cryptocurrency savings depends on many factors: your knowledge and skills in handling cryptocurrency, how often you use it, the amount of savings and the desired speed of access to them.

Before choosing a way to store cryptocurrency, we recommend studying the offered terms of service and reading the user agreement. It is also important to keep in mind that the most reliable option for storing savings will be the one where only you have access to private keys and seed-phrase.