PayPal is one of the most popular payment systems in the world. The service has about 246 million active users worldwide.

In the article we will tell you about the features of the popular payment service with a turnover of over 200 billion dollars, how to register in PayPal and use it for business.

Brief Overview of PayPal

The service was launched in 1998, and since 2002 it has been part of eBay. Like other international payment systems, PayPal allows users to accept transfers when selling goods and supplying services in many countries of the world.

There are several reasons why there are so many people who want to register a PayPal account:

- payment and personal data are reliably protected from leakage and theft;

- the service is universal — both for transfer and withdrawal of funds is suitable for most international cards;

- the process of payment or transfer is carried out in a couple of clicks.

According to statistics, the service is used every day by more than 180 million people in more than two hundred countries. Two and a half dozen currencies of different countries are supported. The platform is positioned as a unified solution, capable of covering almost the entire world in the future, making it extremely easy to buy and sell goods, order and provide services.

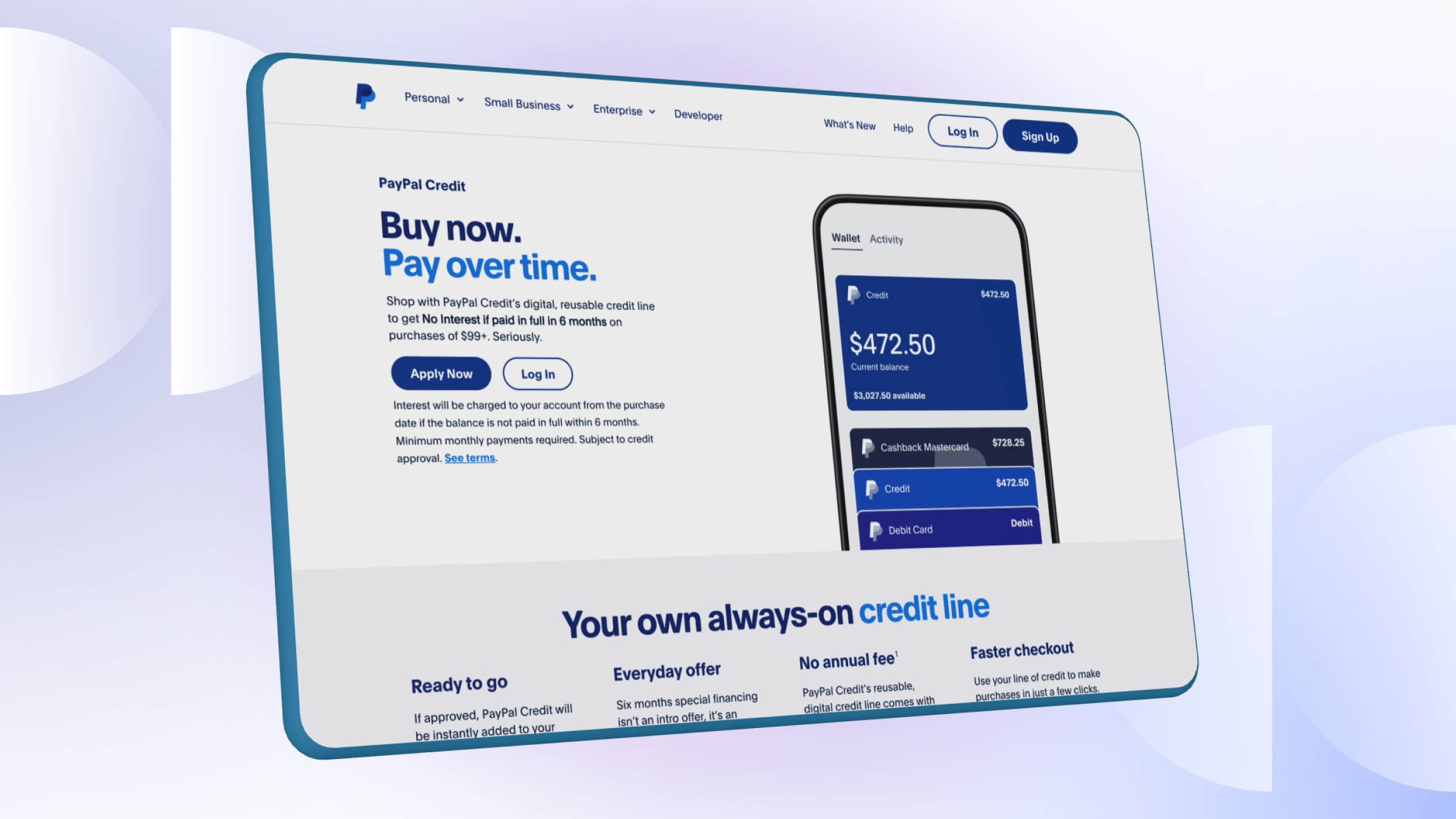

It is really convenient for merchants: you can avoid delays in payment, reduce risks, and increase audience loyalty. The service, like any similar service, charges commissions. If you use PayPal as an intermediary for accepting payments from clients, you will have to pay a fee.

The fee rate varies depending on the seller's jurisdiction, the currency used, and the withdrawal method. By default — from 2.9% of the transaction amount plus an additional fixed amount in the currency selected for the transfer.

Advantages and Disadvantages of PayPal

The PayPal system has a number of pluses, among them:

- Quick registration. You need only personal data, address and payment information;

- Reliability. The platform has been functioning for more than two decades and its services are used by hundreds of millions of people;

- Easy integration. You can connect cards of popular payment systems such as Visa, MasterCard, American Express;

- Choice of currencies. Dozens of popular currencies of different countries are available for transactions.

Nevertheless, the service has disadvantages:

- PayPal's commission is higher than that of many other payment processing companies;

- some options are available only when connecting paid services;

- at the first replenishment of the account the funds are frozen for three weeks;

- the quality of technical support is not always at a high level.

In case of violations of the rules and complaints from buyers, account can face restrictions. These include freezing the account for up to six months and complete blocking with no possibility of withdrawing funds.

For this reason, the wallet registered in PayPal should not be the only financial instrument. It is always necessary to have a backup in case there are any difficulties.

Connection Requirements

Like numerous analogues, the payment system PayPal provides certain terms for connection. To register, you need to:

- provide personal data, including passport, TIN, address and others;

- specify contact and payment information: phone number, details;

- pass verification.

At the same time, payment in PayPal is available to individuals, but the acceptance of payments must be made with the use of an online cash register. A personal account is not suitable for this — you will need a corporate account. When registering it, you should provide complete and accurate company data.

PayPal offers two main ways to organize the acceptance of payments. Among them:

- adding a ready-made payment button to the website;

- custom integration — this option requires programming skills.

Accepting International Payments with CryptoCloud

To accept international payments, you can use cryptocurrency payments through the CryptoCloud platform.The convenient online cryptocurrency payment system allows you to interact with customers around the world with no restrictions. Benefits of the service also include:

- free registration and integration;

- commission from 0.4%;

- support for popular cryptocurrencies (Bitcoin, Litecoin, Tether, Ethereum);

- ready modules for popular CMS (OpenCart, Drupal, WooCommerce, Shopify, Tilda, GetCourse);

- withdrawal of funds within a few minutes;

- intuitive interface;

- checkout with a high conversion rate.

The platform is constantly being improved and new features are being introduced. The service is also characterized by the ability to shift the payment of blockchain and system fees to buyers.

Convenient Digital Payments Around the World

It is possible to accept cross-border payments using various services, one of which is PayPal. It is characterized by a high level of security and works in a large number of states.

However, it is not the only way to accept payments from other countries. Entrepreneurs can accept cross-border payments by connecting CryptoCloud crypto processing. The platform has a wide range of features, and prompt support will help in solving any issues. Learn more about the service on our website.