International payment systems are one of the key tools in e-commerce to process transactions from cross-border customers. Most of these platforms operate in the B2B and B2C sectors — with 80% of the market in 2022.

At the moment, there are many systems in place to process international transactions — and this market continues to grow. We'll tell you how to accept payments from all over the world, which services you should pay attention to, and how to receive cross-border payments amid sanctions.

What Is an International Payment System

An international payment system is a service for processing money transfers from all around the world. Connecting such a system is a necessary step for business development in e-commerce: the platform allows you to accept payments from customers from other countries.

The main task of the system is to automate international payments and settlements. Integrating such a service into a website or mobile application is a way to make payment for orders convenient for customers, save time on transaction processing, organize tracking of payment status through a personal account and collection of statistics.

Many platforms allow you to accept payments not only from bank cards, but also via e-wallets and local payment methods, as well as to process different currencies.

Choosing a Payment System: What to Pay Attention to

There are several main criteria for choosing a cross-border payment system:

- Connection requirements. The service must be available in the country where the company is operating. Other nuances should also be taken into account: the required package of documents, the technical condition of the company's website, etc. Many platforms refuse to cooperate or set additional fees for high-risk businesses or companies operating in certain areas.

- Reputation. You can assess the reliability of the international bank payment system by reading reviews on third-party websites. Users note problems that are not obvious when reviewing the official website of the service — for example, slow technical support or unreasonable blocking. In addition, attention should be paid to the track record of the system: recently established companies may be unreliable.

- Convenience. The length and complexity of the connection, the user interface, the payment process for the client, data processing and withdrawals all affect the usability of the platform. In addition, it should be ensured that the chosen system is relevant to the market the company is working with.

- Fees and plans. This determines whether cooperation with the platform will be profitable for the business. It is necessary to evaluate not only the commission for processing transactions, but also the price of additional services, fees for resolving disputes between the business and the client, the cost of withdrawing funds to your wallet, and hidden fees. Usually, the systems offer several service plans, which allows you to choose a suitable option for cooperation.

- Timing of funds withdrawal. Services offer different time frames — from one to five working days. The possibility of instant or accelerated withdrawal of funds to the account is an advantage worth paying attention to. In addition to the official terms of the system, it is recommended to study reviews and make sure that withdrawal requests are really processed within the time specified by the company.

TOP-10 Popular Payment Systems

Stripe

Stripe is a widely recognized payment system focused on e-commerce businesses. One of the main advantages that users appreciate Stripe for is its extensive customization options and access to developer tools. Although programming skills are required for full use, the system can be customized to meet the needs of the business as closely as possible.

The platform includes a range of products, from checkout and invoicing to tax and anti-fraud. It's free to connect Stripe, and the fee is 2.9% + $0.30.

PayPal

PayPal is a platform that is used by businesses and everyday users alike. Despite fewer customization options than Stripe, the system offers a number of other benefits. These include a huge audience that trusts PayPal, integration of a button to make a payment in a few clicks, and the ability to connect PayPal Credit for installment payments.

The size of commissions depends on the currency and geographical location of the parties to the transaction.

You can learn more about the PayPal payment system in our article.

Braintree

Braintree is a subsidiary of PayPal. For users, this means a high level of security and compliance with international standards. Among the advantages are convenient tools for monitoring transactions and reporting, effective fraud protection, a number of integrations with business systems (shopping cart, accounting, etc.). Commission for bank cards and online wallets — 2.59% + $0.49.

Shopify Payments

Shopify Payments is a system for those who use the Shopify online store builder. The service integrates by default into every store created on this platform, making it as easy as possible to connect. The entrepreneur can track payments through the store control panel, and the customer can pay for orders without visiting third-party websites.

The service is developed on the basis of Stripe. The amount of commission is determined by the service's tariff plan.

Amazon Pay

Amazon Pay is a platform for making international payments through an Amazon account. This system is relevant for businesses focused on customers who actively use Amazon — in particular, the United States market.

Connecting the service allows entrepreneurs to simplify the payment process for customers. In addition to standard transactions, deferred payments and installment payments are available to users. The fee depends on the payment method, geographical location and other factors.

Authorize.net

Authorize.net is a system available for businesses registered in the USA, Canada, EU or Australia. The service supports both online and offline sales. Features include processing of regular and recurring payments, invoicing, and installment payments. For entrepreneurs who are just starting an e-commerce business, there is a feature to open a merchant account.

The cost of use is $25 per month. The commission depends on the chosen service plan.

Square

Square is a system with a wide functionality: payment processing, invoice generation, hosting, online shopping cart connection. There is an Afterpay option for paying for an order in installments. For businesses combining online and offline activities, the platform provides POS-terminals with software for payment processing at physical points of sale and the ability to track all transactions in a personal account.

The platform's commission is 2.6% + $0.1.

GoCardless

GoCardless is a platform for processing both single and recurring payments with the ability to connect automatic payment subscriptions. Customized billing is also available to users. In addition, customers can take advantage of deferred payment options through the loan checkout feature.

The system is available in 30+ countries and supports eight currencies. Fees vary depending on the service plan and are different for domestic and international payments.

Adyen

Adyen is another convenient platform for those who combine work through a website and traditional sales locations. The company provides a branded terminal for processing offline transactions, and the Unified Commerce system allows to control all payments made using the platform.

Users have access to 100+ payment methods, which allows them to work with clients all over the world. The amount of commission depends on the chosen payment method.

WePay

WePay is a system for processing payments on e-commerce websites, as well as collecting donations. It offers payment both by bank cards and via e-wallets and other systems. According to the company, 50% of US payments are processed through this service. The platform is also available in the UK and Canada.

In addition to standard solutions, WePay offers simplified payment acceptance for an instant start. The transaction fee is 2.9% + $0.25.

Connection Requirements

Payment systems impose a number of requirements for companies to connect their service. For example, a payment service may require multi-stage verification.

The company's website must meet security requirements and work consistently, and the necessary information (terms of cooperation, refund rules, etc.) must be made publicly available.

Many systems impose additional requirements related to the scope of the business. In addition to prohibiting the sale of illegal goods, the platform may refuse to work with a company that is recognized as high-risk according to internal evaluation criteria.

Crypto Processing — a Convenient Alternative

In the face of sanctions, more and more companies are turning to cryptocurrency as a means of payment. Crypto transactions are not subject to restrictions, provide a high level of security and anonymity for both parties, and do not depend on the work of financial organizations.

The speed of processing such a payment is not affected by the geographical location of the business and the customer, and the fees are usually lower than traditional payment methods.

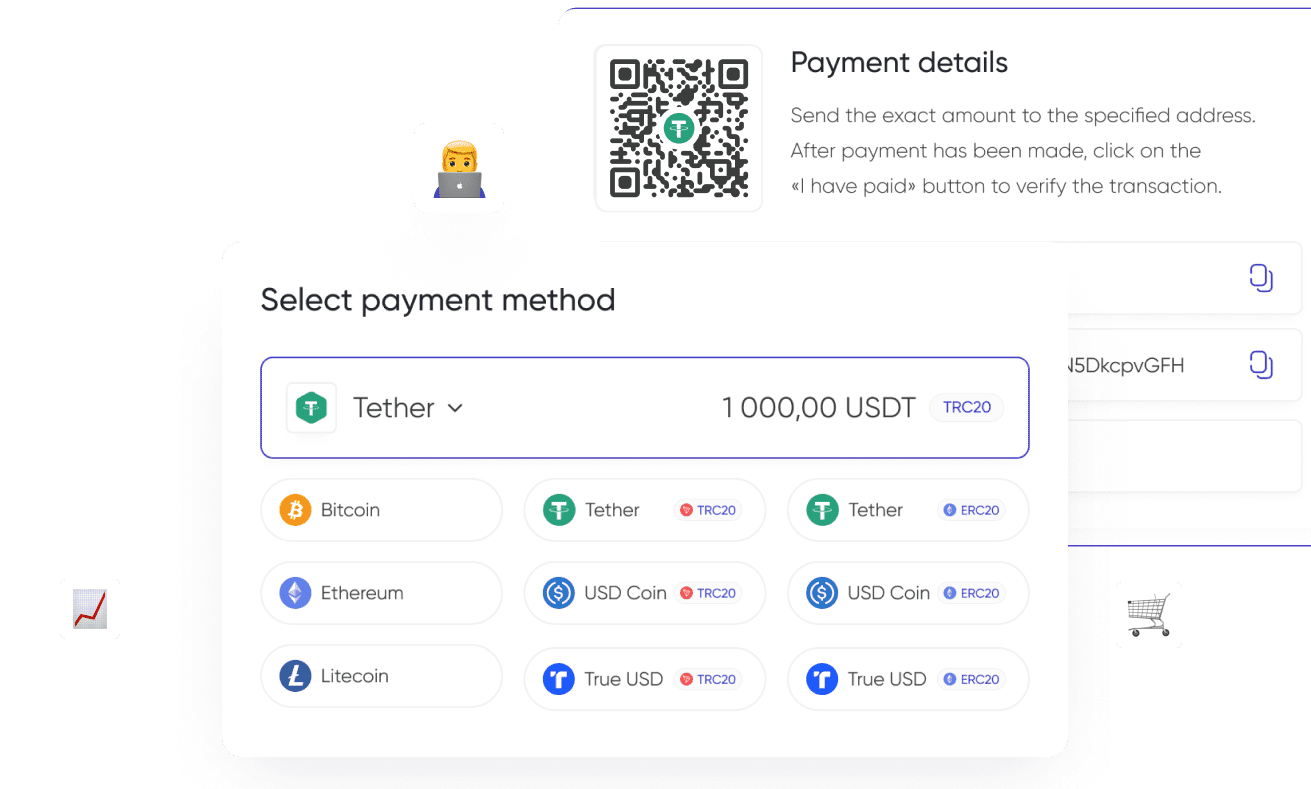

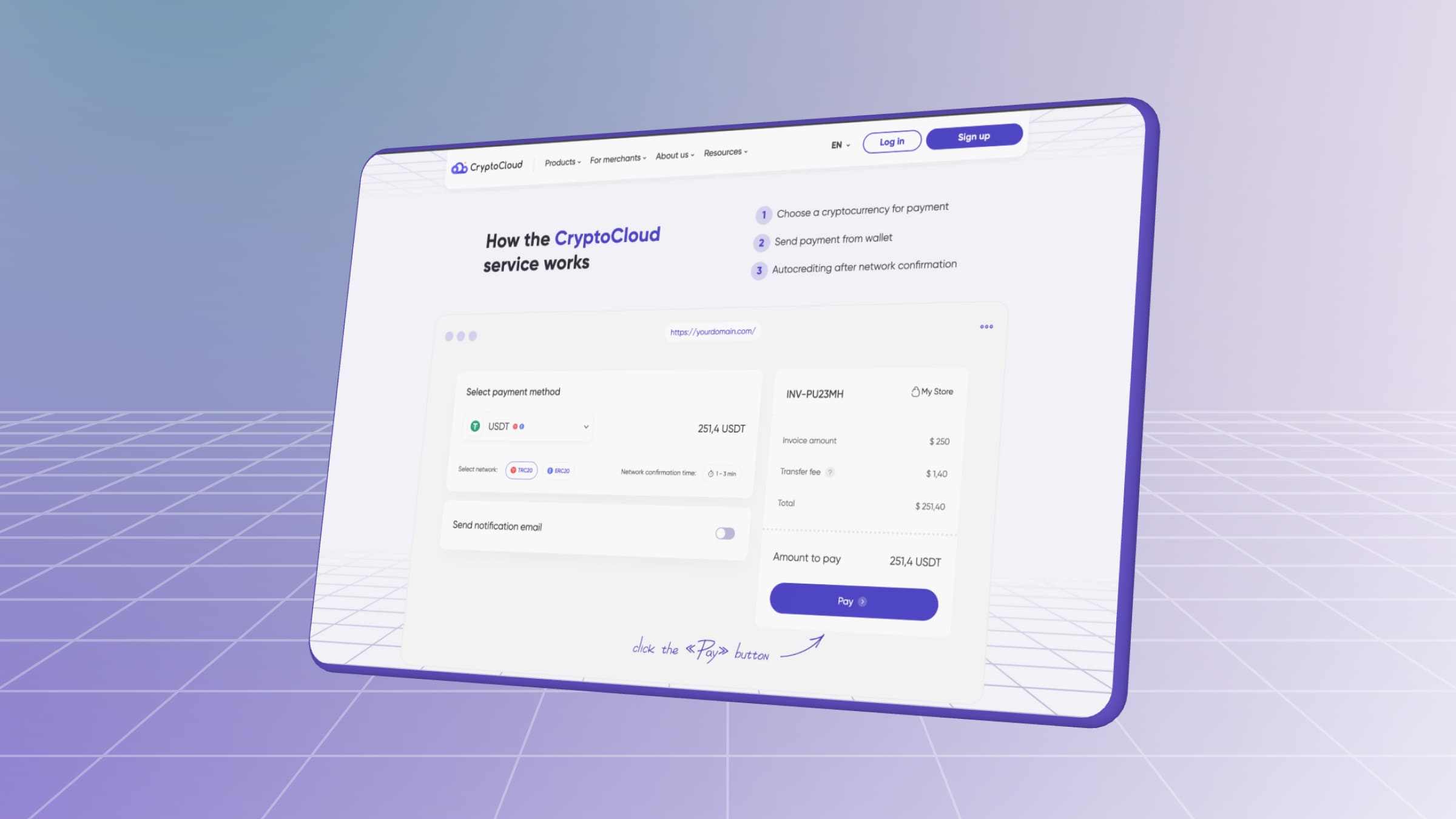

Crypto processing is a system that automates the acceptance of cryptocurrency payments. The customer selects a cryptocurrency payment on the checkout page and is then redirected to the checkout page.

Conversion to the selected currency, calculation of the network commission and payment confirmation happen automatically. Funds are deposited to an account in the personal account, from where they can be withdrawn to a cryptocurrency wallet or (in some systems) directly to a bank card.

CryptoCloud for International Payment Processing

CryptoCloud is a platform for accepting payments in cryptocurrency. Only an e-mail is required for registration. The checkout is available in several languages, which simplifies working with foreign clients, and the cryptocurrency exchange rate is fixed for the time of the transaction.

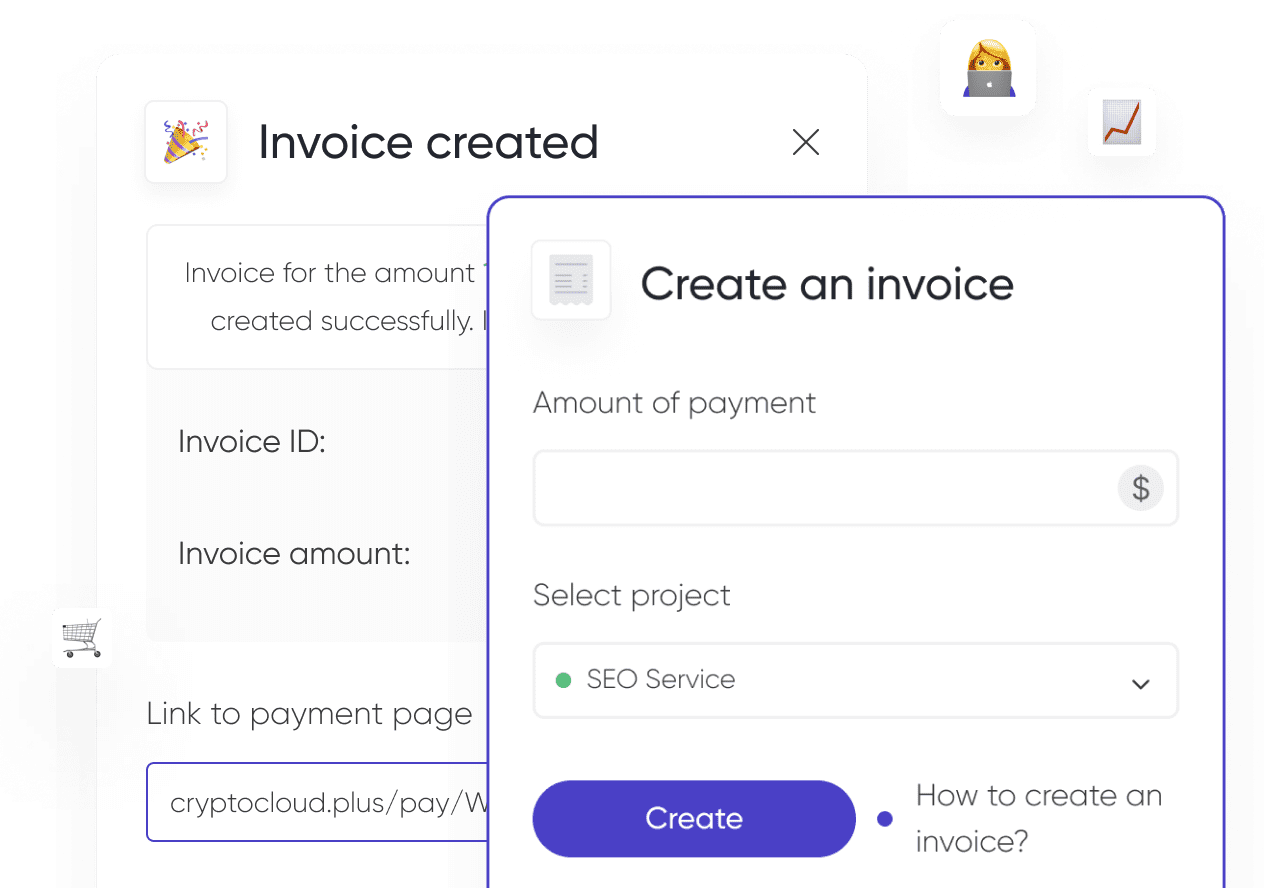

The system offers the following features:

- integration of cryptocurrency checkout to a website, mobile app or Telegram bot;

- payment links: both individual and permanent;

- customization of the payment page with the ability to add a company logo;

- working with several projects through one merchant account;

- selection of the party paying the commission of the service and the network;

- statistics and analytics with the function of uploading to Excel and the ability to provide access to other users;

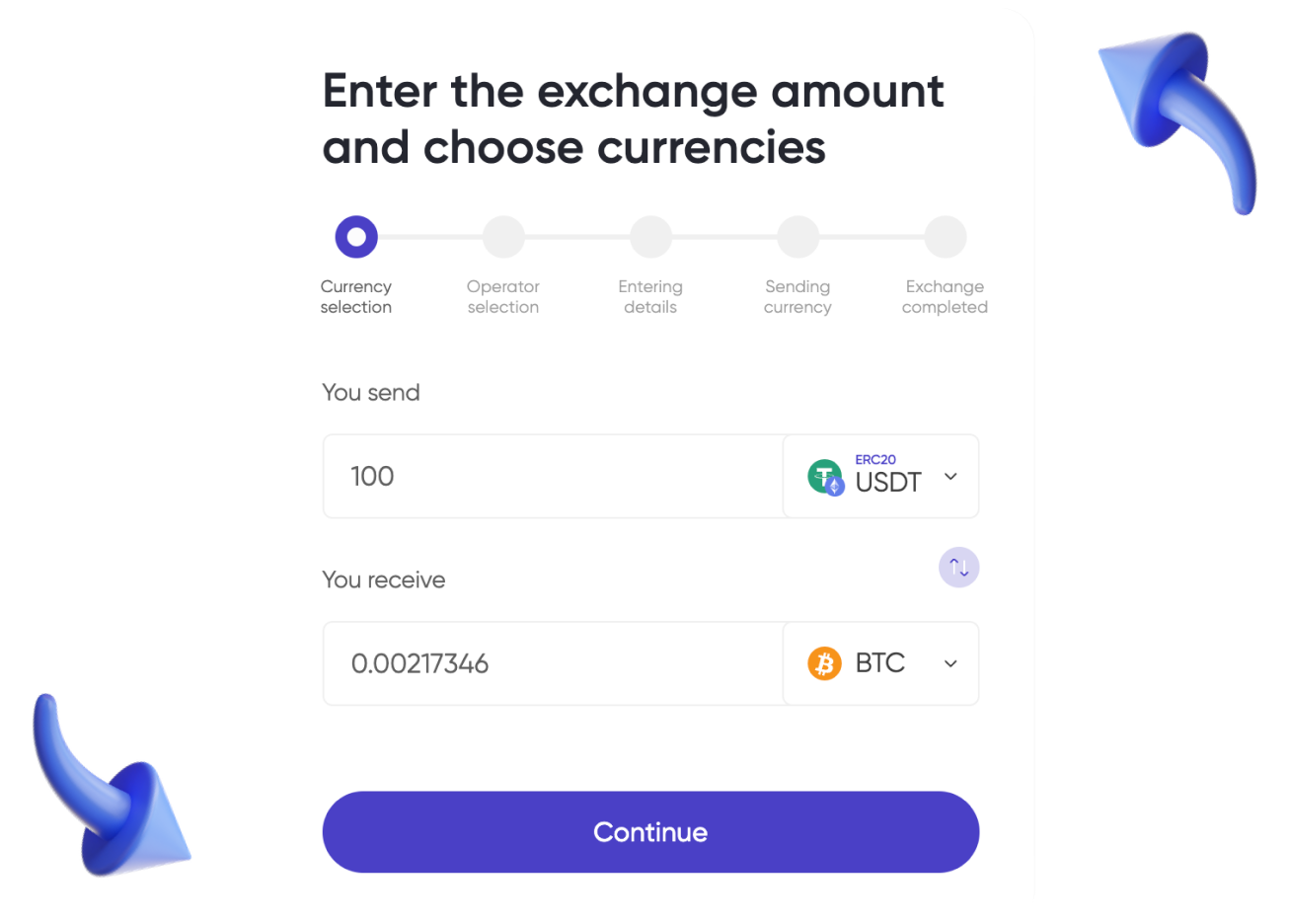

- exchange and purchase of cryptocurrency are available on the website.

CryptoCloud integration is performed via ready-made CMS modules, API or HTML widget. Connection is free of charge, and the commission for transaction processing is from 0.4%. Withdrawal of funds is performed within a few minutes.

Accepting International Payments

When entering the global market, it is necessary to organize the acceptance of cross-border payments. There are many systems that allow you to do this: Stripe, PayPal, Adyen, Square and a number of others.

Nevertheless, when connecting them, the user may face a number of restrictions. A convenient alternative is to accept payment with cryptocurrency. You can do this with CryptoCloud processing. More details about the features and peculiarities of connecting the system — on the official website.