In regulated markets, including financial and related sectors such as insurance, legal services or real estate, you are required to complete Know Your Customer (KYC) checks as part of anti-money laundering compliance.

However, the specifics of the procedure you undergo can vary depending on the nature of the business and its likely risks. For example, KYC is not necessary for certain cryptocurrency services such as CryptoCloud.

What is KYC?

KYC (Know Your Customer) is a process that involves a company verifying the identities of its customers. It is up to financial organizations to take care of who their customers are. The KYC process begins before any business relationship is established and continues throughout all subsequent transactions. Cryptocurrency payments can also undergo KYC.

With the growing risks of identity fraud in the online world, no business is completely safe from loss, but small or medium businesses are acutely aware of the impact of any verification procedures, as compliance can be quite costly for the company.

What Does a KYC Procedure Consist Of?

Generic KYC consists of four steps that are common to all types of businesses, including cryptocurrency transactions.

Customer Identification and Verification

The first step of KYC under the Customer Identification Program (CIP), a customer identification process, involves:

- collecting customer identity data;

- verifying against credible independent sources to ensure that they are not delinquent and are not on related lists;

- analyzing the image of required documents to ensure no potential identity theft.

Risk Assessment

The second step of KYC, based on the Customer Due Diligence (DD) risk assessment procedure, requires the entity to:

- evaluate the probability of the customer engaging in money laundering offenses;

- establish what risk a particular customer poses in terms of possible reputational or any other damage to the company;

- where appropriate, obtain information about the purpose and intended nature of the business relationship.

Identification of the Beneficial Owner

If necessary, reasonable steps may be taken to ensure the customer's ownership and control structure is clear.

Ongoing Monitoring and Record-Keeping

A company needs to investigate account activity and transactions made by its existing customers. The purpose of this monitoring is to ensure that no suspicious customer behavior remains undetected by the company. This procedure includes:

- assessing the customers' business and the risks associated with it;

- if necessary, identifying the source of funds;

- ensuring that available documents, data or information is up to date.

How are KYC and AML related?

AML (Anti-Money Laundering) is a broad term encompassing many different government and international organisations' regulations. These regulations require companies to prevent fraud, identify malicious parties and report organized crime, money laundering and terrorist financing offenses. KYC is just one method of implementing this process.

KYC subjects include:

- banks;

- credit unions;

- financial institutions;

- gaming sites and casinos;

- digital wallet providers and crypto exchanges.

Many small and medium businesses still rely on manual-based formats that can be time-consuming, inconsistent and even based on outdated information.

Well, the good news is that modern technology is no longer exclusive to large enterprises and can offer an easy and affordable way to conduct online KYC checks regardless of the size of your organization.

Implementing automated anti-money laundering services will ensure compliance with modern legislation, and help you perform stronger identity verification. It might even improve the registration process for your customers.

So Why is KYC Used in the Crypto Industry?

As mentioned above, some KYC measures include:

- establishing the identity of customers;

- predicting the types of transactions and activities that a customer is likely to engage in;

- tracking account activity.

Ongoing monitoring can detect activities that may not match what was predicted at the beginning of the business relationship. When some activity does not fit the "normal" pattern, the company should apply more rigorous monitoring and data validation of unusual transactions. Tracking existing customers ensures that no suspicious activity goes undetected.

The advantages of this approach for individuals and companies are that they become less vulnerable to fraudulent activity and gain the trust of customers, investors and traditional financial institutions.

A significant disadvantage may be the ban on anonymous accounts, which are an essential part of the cryptocurrency culture.

KYC's Impact on Anonymity

Decentralization has been and continues to be the core of all cryptocurrency transactions. Blockchain transaction histories are stored in numerous computing devices across the planet rather than in a single database. However, with the implementation of KYC requirements, control over such transactions must be transferred to a centralized authority. This has both positive and negative sides.

On the one hand, KYC procedure increases the level of trust in the participant of a financial transaction, makes him respectable in the eyes of partners, including traditional financial organizations. In addition, KYC seriously reduces the possibility of potential complications with the law.

On the other hand, the lack of anonymity increases the risks of personal data leakage. Moreover, no KYC system yet provides a hundred percent guarantee of its reliability. There have already been numerous cases where personal information obtained through the use of KYC procedures has been stolen by hackers and used for malicious purposes.

Pros and Cons of KYC

From the information above, KYC has significant advantages but can also result in severe inconvenience and even risk.

The positives of the procedure include:

- financial security enhancement;

- company's reputation growth;

- absence of serious problems with state regulatory authorities.

Challenges of KYC are:

- time and effort expenditure of the company's employees;

- additional financial expenses;

- risk of user data leakage.

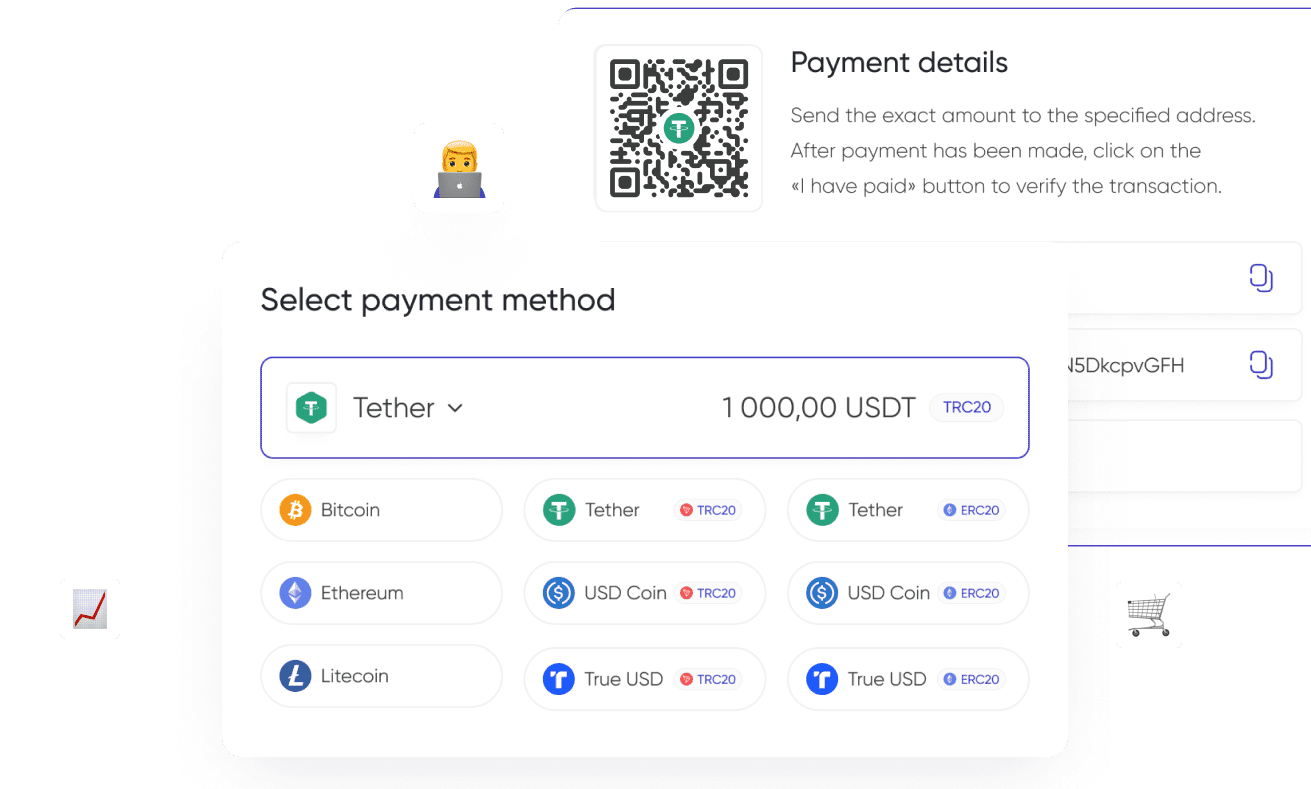

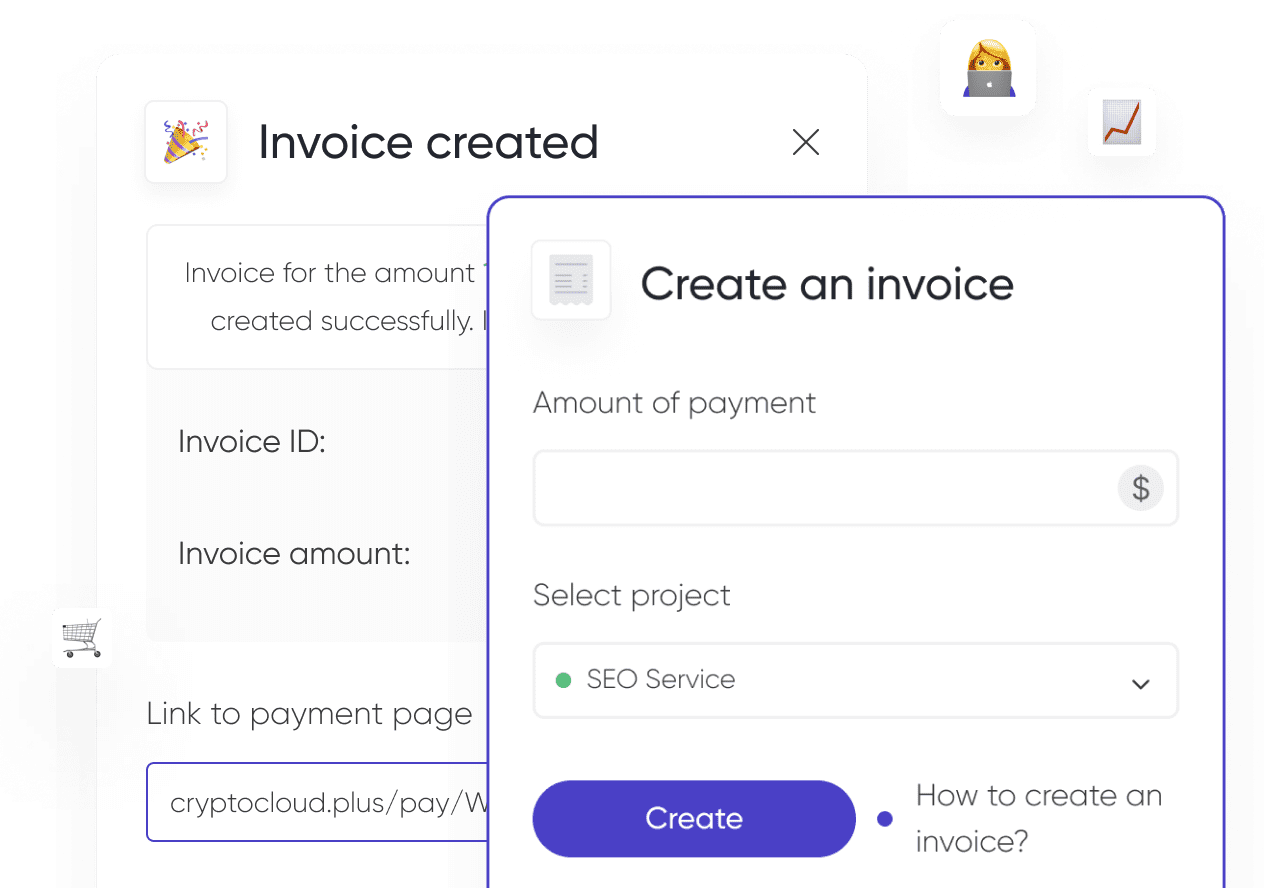

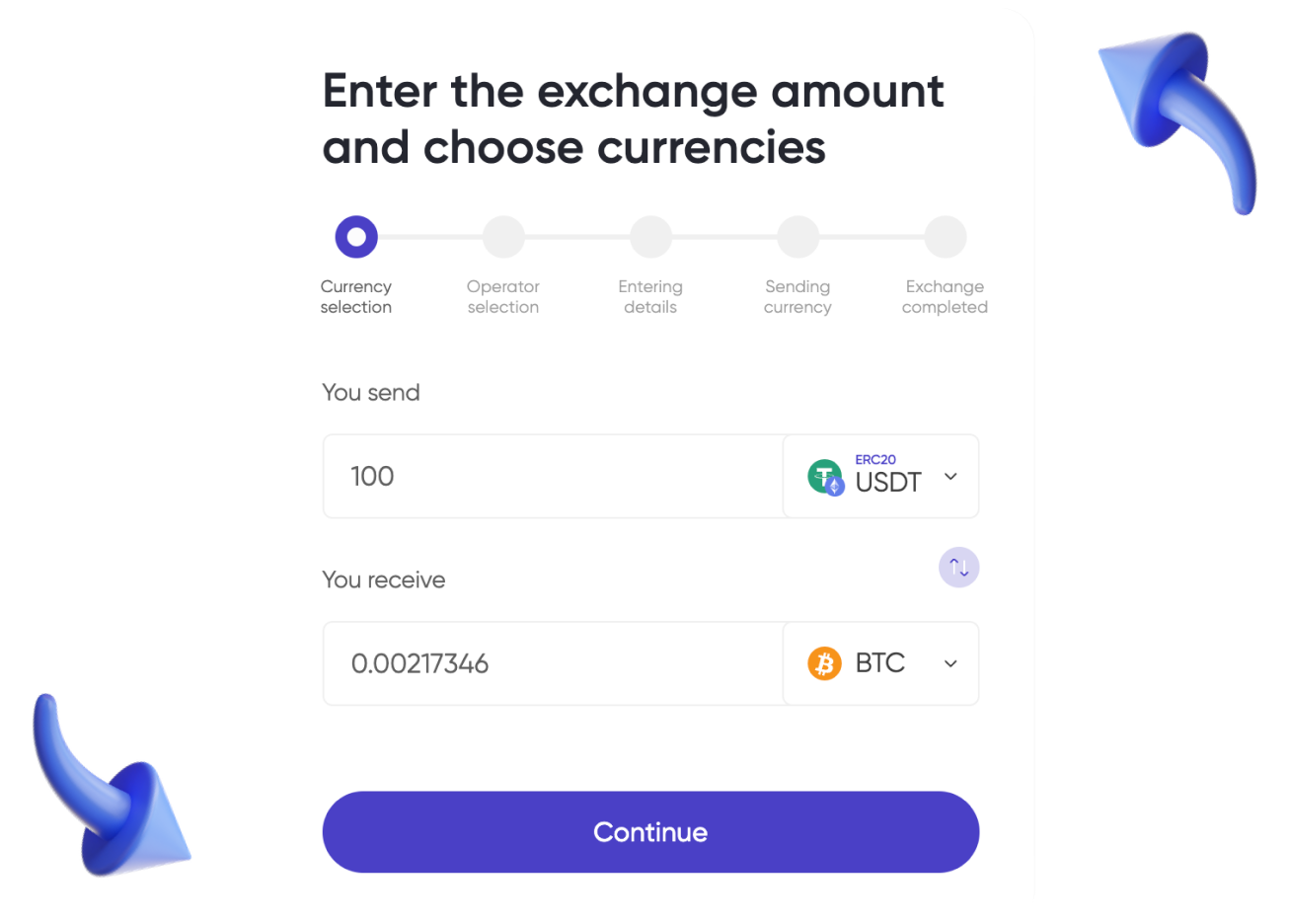

Crypto processing CryptoCloud provides its customers with the ability to accept payments in cryptocurrency. We do not require passing the KYC to connect crypto payment processing, as we are a technical platform for developers, providing a convenient interface to automate work with cryptocurrency. You can read more about the principle of crypto processing in the article «How to start accepting cryptocurrency payments on your website».