The cryptocurrency market has been developing rapidly in recent years, offering new opportunities for investment and financial transactions. At the same time, the dominance of altcoins over Bitcoin is becoming increasingly noticeable, as they represent an alternative way of using blockchain technology and expand the functionality of digital currencies.

In this article, we will take a closer look at what altcoins are, what types of altcoins exist, and their features and advantages. We will also present the top altcoins to help you navigate this dynamic sector.

What Is Altcoin

Altcoins is a term for all cryptocurrencies except Bitcoin (BTC). The name comes from alternative coins.

The first official altcoin is considered to be Namecoin (NMC), released in 2015, and the most popular is the project of the Canadian programmer Vitalik Buterin Ethereum (ETH).

The quantity of alternative digital coins is growing daily, thanks to the system of decentralization and virtually unlimited possibilities of the blockchain. Among the popular cryptocurrencies, Tether (USDT), BNB (BNB), Solana (SOL), XRP (XRP), Dogecoin (DOGE) stand out.

The main idea behind altcoins is to provide additional features and capabilities that Bitcoin lacks. These could include faster transaction speeds, improved security, new consensus mechanisms, or support for smart contracts and decentralized applications (dApps).

Types of Altcoins

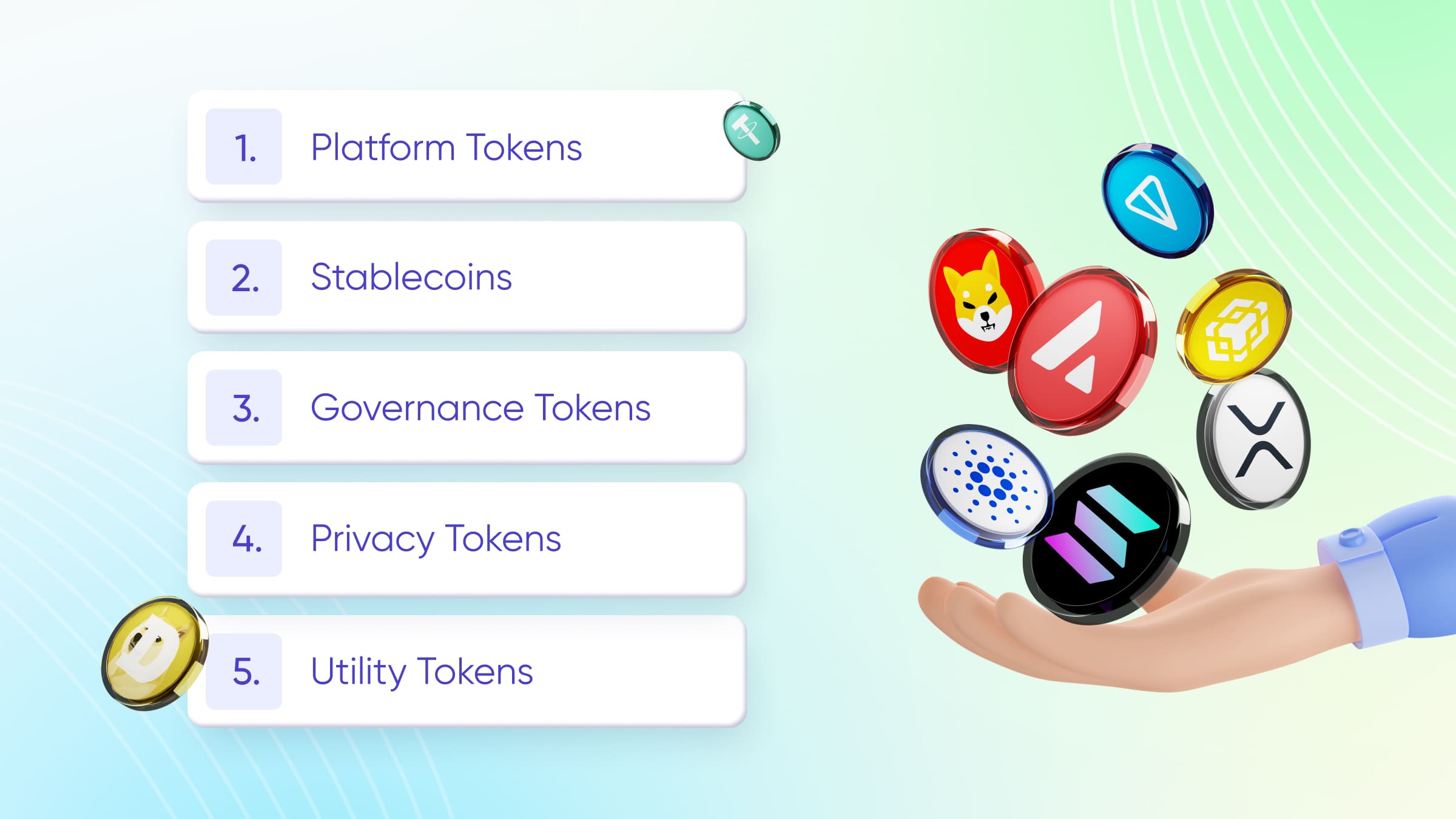

The emergence of new cryptocurrencies has pushed developers to create and implement unique blockchain platforms. As a consequence, several main groups of altcoins have been formed:

- Platform tokens. Assets issued on blockchains for use primarily as a means of payment. They give users access to goods and services and allow them to participate in the development and support of the application. In simple words, they are virtual monetary units with the function of the main driver of the network.

These include such altcoins as Ethereum, Cardano, and Polkadot. By the way, Binance Coin (BNB) was initially created on the Ethereum platform as a means of paying commissions. But after the launch of its own blockchain, it acquired a personalized status as a coin. - Stablecoins. These are cryptocurrencies tied to the value of fiat currencies or other assets, which allows you to minimize volatility. They are widely used to store value and conduct transactions without the risk of sharp price fluctuations.

Examples of stablecoins are Tether (USDT), which is one of the most popular and backed by the US dollar, and USD Coin (USDC), known for its transparency and regular audits. - Governance tokens. They give holders the authority to participate in the project’s governance. This means that everyone who has a governance token can influence the system’s development. The right to vote is proportional to the amount of tokens.

Most of the protocols work according to the standard submission scheme, when the application is sent for voting and token holders thus decide on changes in the project. The most famous management tokens are Uniswap and Compound.

- Privacy tokens. These are cryptocurrencies operating on the principles of anonymity and security. During transactions, the data of the sender, the recipient, and the amount of the transfer are not disclosed to third parties.

Anonymous altcoins (Monero, Zcash, etc.) are in great demand worldwide, but their prices are unstable, and to find the most profitable option, you need to constantly monitor statistical data. - Utility tokens. They provide access to the functions of specific blockchain platforms. Unlike conventional digital assets, which are only a means of exchange and storage, utility tokens (such as Chainlink, Basic Attention Token, Filecoin, Golem, Brickblock) can be used to pay commissions, receive discounts and bonuses, and make upgrades in the game.

Features and Advantages of Altcoins

There are thousands of types of alternative crypto coins. Each of them has a certain purpose, nuances of use and prospects. But all altcoins are characterized by similar advantages and disadvantages.

- Diversification. The variety of altcoins allows you to create a balanced crypto portfolio, with minimal risks and good returns.

- Innovativeness. The dominance of altcoins over Bitcoin lies in their technical superiority. They are less vulnerable to scalability issues or lack of transaction speed. They are often the flagships of new concepts, contributing to the development of the crypto industry as a whole. For example, Chainlink opens up new opportunities for blockchain schemes by enabling the synchronization of smart contracts and the real world.

- Diversity of functions. Altcoins can act as a means of exchange, settlement, storage, access to services and entertainment, energy efficiency of processes, credit.

- Potential. Some altcoins tend to grow rapidly, leading to solid profits. For example, Ethereum altcoin has grown by more than 40 thousand percent since its creation.

But do not forget about the obvious risks of investing in alternative cryptocurrencies:

- High volatility. Altcoins are subject to market fluctuations, which leads to significant losses in a short time. There are recorded cases when coins lost up to 90% of their value in just a few months.

- Regulatory risks. The introduction of restrictions on the use of digital currencies by governments of certain states negatively affects their liquidity. Everyone remembers how China's ban on cryptocurrency transactions in 2021 led to a massive market collapse.

- Technical risks. The codes of some coins are easily vulnerable and can be subject to hacker attacks. For example, the hack of the DAO project on the Ethereum platform in 2016 cost the company the loss of about 50 million US dollars.

TOP-10 Altcoins

Grayscale Investments, a leading US digital currency asset management company, has highlighted altcoins with the highest growth potential for 2025. When analyzing tokens, they took into account ecosystem activity, protocol updates, new product launches, market performance, macroeconomic and political risks.

The list of leading altcoins looks like this:

- Ethereum (ETH). Ethereum is the largest altcoin, a platform for decentralized applications (dApps) and smart contracts. Capitalization is $400 billion. It is not only a cryptocurrency, but also the basis for DeFi, NFT and a host of blockchain projects. In 2022, the network switched to Proof-of-Stake, making it more energy efficient. ETH is used to pay for transactions and run applications on the network.

- Tether (USDT). Tether is the most popular stablecoin backed by traditional currencies such as the US dollar. Capitalization of the coin is more than $138 billion. It is used to reduce volatility in transactions with cryptocurrencies and as a means of capital storage. Due to its peg to fiat currencies, the USDT exchange rate remains stable, which makes it in demand for trading and international transfers.

- Binance Coin (BNB). A traded asset of the Binance ecosystem with a capitalization of about $99 billion. It is used to pay commissions, conduct IEO, receive discounts for transactions. Today, its sphere of influence has extended far beyond the exchange. Can interact with decentralized applications, NFT, crypto derivatives.

- Solana (SOL). Solana is a high-performance blockchain platform capable of processing up to 65,000 transactions per second thanks to its unique Proof-of-History technology. It has a market capitalization of over $115 billion. It is suitable for creating scalable dApps and DeFi projects. SOL is used for fees and staking to secure the network.

- Ripple (XRP). XRP is a cryptocurrency created by Ripple for fast and cheap international funds transfer. The main focus is to replace traditional SWIFT banking systems. Transactions with XRP take only a few seconds and commissions are minimal, which makes it in demand among users. The coin has a capitalization of $179 billion.

- Dogecoin (DOGE). Dogecoin started out as a joke cryptocurrency but has become popular due to community and celebrity endorsements. It is used for micropayments, tips, and charity.

DOGE's meme status ensures its popularity among mass audiences. Despite the lack of extensive functionality has a fairly high market capitalization of $52 billion. - Toncoin (TON). Toncoin is a native token of The Open Network (TON) blockchain, originally developed by Telegram. The platform supports smart contracts, decentralized applications and payment systems.

Thanks to its high speed and integration with Telegram messenger, TON becomes a promising infrastructure for Web3. Capitalization — $12 billion.

- Cardano (ADA). Cardano is a blockchain with a scientific approach to development based on the Proof-of-Stake (Ouroboros) consensus mechanism. The cryptocurrency is capitalized at $34 billion and the network supports smart contracts and DeFi applications. ADA is used for steaking, project management, and transaction payment. Cardano emphasizes sustainability and security.

- Shiba Inu (SHIB). Shiba Inu is a meme token designed as a competitor to Dogecoin, but with a more developed ecosystem. It supports its own DeFi platforms and NFT projects. SHIB is popular due to its strong community and accessibility. The token runs on Ethereum, which gives it compatibility with other projects. Capitalization is $12 billion.

- Avalanche (AVAX). Avalanche is a blockchain for creating decentralized applications and custom blockchains. It is characterized by high transaction speed (less than 1 second) and low commissions. AVAX is used for transaction payment, staking and network management. The project stands out for its compatibility with Ethereum and wide opportunities for developers. The capitalization of AVAX altcoins has already exceeded $15 billion.

Altcoin Market

Altcoins are becoming an integral part of today's cryptocurrency market, offering new opportunities and solutions that push the boundaries of what blockchain technology can offer. From smart contract platforms to stablecoins and privacy tokens, altcoins allow users to participate in innovative projects and adapt to the rapidly changing financial landscape.