Cryptocurrency is increasingly being considered not only as an investment tool but also as a means of payment. Although crypto payments are not used as frequently as fiat currency transactions, digital money is gradually taking place in the market. Statista estimates that by 2030, the volume of such transactions will grow by 17% compared to 2023 figures.

In this article, we consider the advantages and disadvantages of cryptocurrency as a means of payment: reasons for its popularity, benefits for businesses, and ways to process such transactions.

Cryptocurrency Popularity Reasons

Cryptocurrency as a means of payment is used by 15,000+ companies around the world. There are several explanations for this:

- Decentralization. Crypto transactions are independent of banks. This makes it possible to make payments under sanctions, and protects users from having their accounts blocked or transactions frozen.

- Low commissions on cross-border cryptocurrency payments. The fee for processing crypto transfers does not depend on the countries where the parties are located, so the cost of international transactions is lower than that of bank transfers.

- Round-the-clock processing. Cryptocurrency transactions are processed 24/7 regardless of time zones and the bank or company's working hours. This simplifies working with clients from other countries.

- Privacy. Payments through cryptocurrency are anonymous. The parties do not disclose any data except the public key, which does not contain personal information.

- Security. One of the key features of the blockchain is the inability to change information about transactions. This eliminates chargebacks and reduces the risk of fraud.

Cryptocurrency Use Cases

Investments in cryptocurrencies and tokens

Digital coins, with the exception of stablecoins, are not backed by real assets and are therefore subject to high volatility. This is both a disadvantage and an advantage of cryptocurrency: rate fluctuations can both cause you to lose money and become a source of income. One of the most popular currencies for investment is Bitcoin.

Smart contracts

A smart contract is a decentralized algorithm that performs actions prescribed in the code in response to the fulfillment of specified conditions. Such algorithms are used to control compliance with contracts: the terms and obligations of the parties are entered into the code.

A smart contract can perform certain actions automatically (e.g., send a transfer on a specified date) or after confirmation from one of the parties.

Deposits/staking

Cryptocurrency deposits are similar in principle to bank deposits. The user «lends» funds for a predetermined or indefinite period of time and receives interest for it. Staking allows you to use cryptocurrency as a source of passive income. Nevertheless, it should be remembered that when placing a deposit for a predetermined period of time, there is a risk of losing money in case of a fall in the exchange rate.

Tokenization of assets

Tokenization is the conversion of an asset (or the right to own it) into a digital form. Almost any asset can be tokenized: from business shares and copyrights to artwork, real estate, collectibles and additional content for a video game. This simplifies transactions involving the transfer of property and increases the transparency of such transactions.

Transferring payments abroad

Payment via cryptocurrency allows you to send funds, pay specialists from abroad and perform other cross-border transactions.

Accepting payments from foreign countries

Cryptocurrency's capabilities include sending and receiving transfers from abroad. This is convenient for international businesses, particularly e-commerce companies and sellers of digital goods. Crypto payments are a reliable and safe way to get paid, even in the face of sanctions.

An additional advantage of accepting cryptocurrency payments is their accessibility for high-risk businesses. Many fiat payment systems, unlike crypto-processors, refuse to work with companies that are more likely to face fraud and/or reputational losses.

Safekeeping

Entrepreneurs and private users alike are turning to cryptocurrency to store funds. Hardware offline wallets that are disconnected from the network minimize the risk of hacking. Independence from banks eliminates the possibility of account freezing and fund loss.

Many users use stablecoins to avoid the volatility of cryptocurrencies. Their value is tied to real assets and less subject to fluctuations.

Purchase of goods and services

Cryptocurrency payments greatly simplify settlements with suppliers, especially for companies that work with foreign partners. Cryptocurrency payments avoid delays and additional costs associated with conversion and interbank transfers.

Digital currencies can be used to pay directly for purchases of raw materials, components and goods, which is especially important for businesses working in different countries with suppliers who have their own currency requirements. Fast transaction processing also simplifies accounting and streamlines the supply chain process.

In addition, cryptocurrency is suitable for settlements with equipment manufacturers, logistics and transportation companies, as well as international marketing agencies and IT specialists.

Wages payment

Some companies offer employees the opportunity to receive their salaries in cryptocurrency. Both manual transfers and automation via smart contracts can be used for payments. This method of settlement is especially convenient for businesses hiring foreign specialists: fiat transfers may be difficult in the context of sanctions.

Payment of bonuses and winnings

In most cases, cryptocurrency as a means of transferring bonuses is used by platforms focused on working with digital currencies (exchanges, wallets, etc.). However, some organizations may also offer cryptocurrency payments: for example, the UFC uses Bitcoins to pay contestants.

Why Should Businesses Consider Using Cryptocurrency

The benefits of cryptocurrencies for businesses are due to several reasons:

- Increased conversion rates. Crypto payments offer customers security, stability of transactions, and the ability to place orders around the clock. In addition, connecting crypto transactions expands the available payment methods. All of these factors contribute to higher conversion rates.

- Low commissions. Accepting payments in cryptocurrency costs less than processing international fiat transactions, where the commission can reach 10%. Cryptoprocessing fees, in turn, do not exceed 1–2%.

- Fast processing of international transactions. Sending or receiving cross-border payments in traditional currencies can take several days. At the same time, the bank may freeze the transaction. Crypto payments are processed quickly regardless of the parties' locations.

- No chargebacks. Transactions conducted via blockchain cannot be altered or reversed. This eliminates chargebacks, which can be a cost to the business, and protects the company from unscrupulous buyers.

- Additional payment method. Connecting crypto payments opens up an alternative payment option for customers. This increases conversion rates and attracts new customers who are comfortable with this payment method.

Accepting Cryptocurrency Payments

Wallet transfer

The easiest way to accept cryptocurrency payments is to create a cryptocurrency wallet and receive payment directly. To do this, the company will need to provide the customer with an address to send the transfer to, and once received, confirm the payment. This requires processing orders manually, but avoids connecting third-party services.

It should be taken into account that this option can be inconvenient for customers. It allows orders to be placed only during the company's business hours and requires waiting for a response from a store representative, which reduces conversion rates.

Crypto processor

Cryptocurrency payment gateway is a service for processing cryptocurrency payments. Its connection allows you to automate the payment of orders with cryptocurrency.

The system calculates the amount in the currency chosen by the client, provides the address and QR code for payment, tracks the payment and confirms the order after the funds are credited to the account. The client pays for the order via checkout at any convenient time and does not depend on the speed of manager's answers.

Processing charges a small additional commission (usually around 1–2%) and offers a range of convenient features. These may include statistics, automation of reporting, AML analysis of payments, currency conversion, etc. The set of features depends on the chosen service.

Connecting Crypto Processor

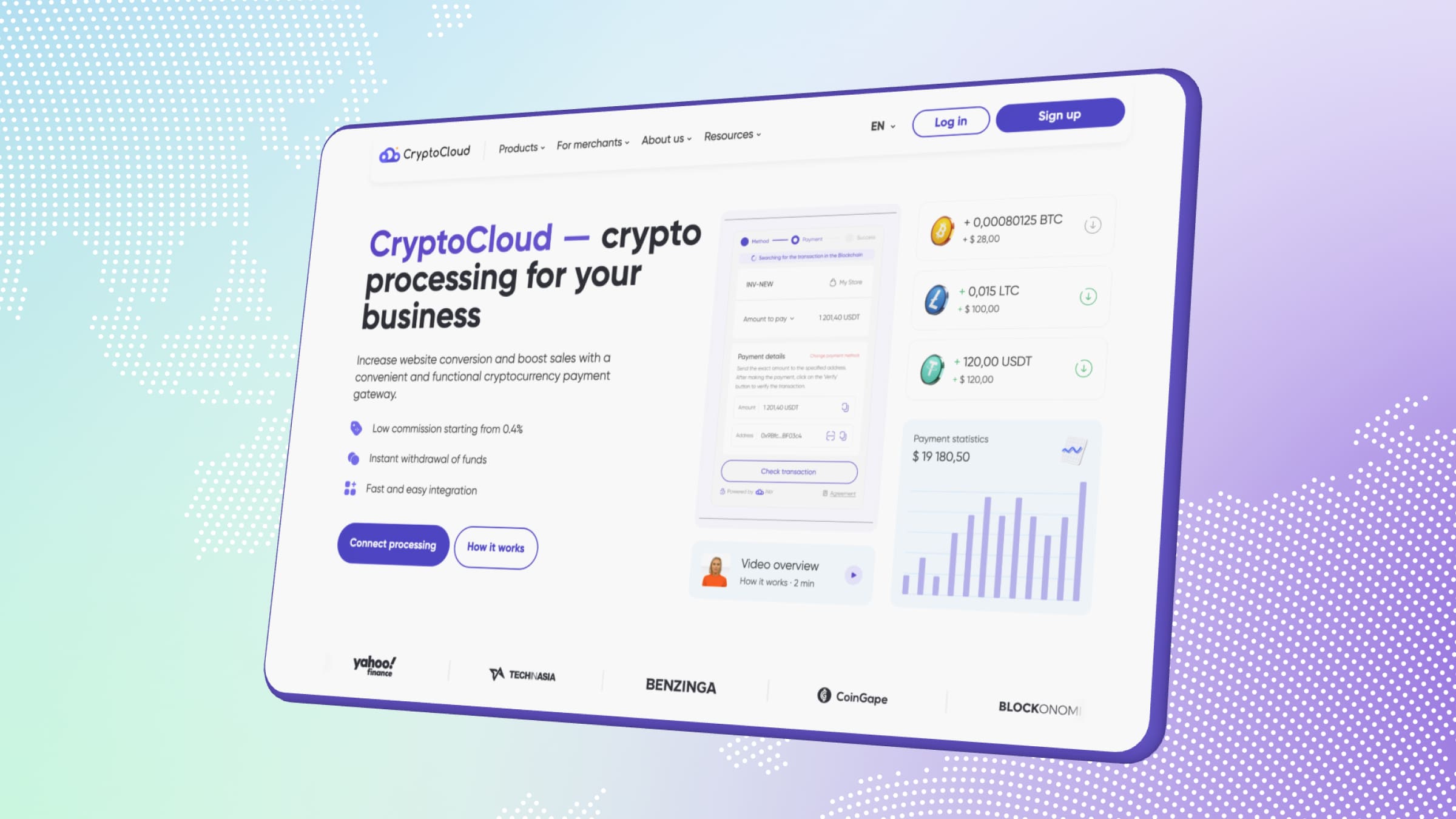

Various services are available in the market that allow you to automate the processing of crypto payments. One of them is CryptoCloud. This crypto processing service works with popular currencies and offers a convenient customizable checkout available in several languages.

Additional features include currency conversion via a personal account, automatic AML transaction checks, conversion of received funds to USDT, and analytics, with the ability to grant other users limited access to information.

It is quite easy to connect the service:

- Registration. You will need to enter your email and nickname in Telegram, set a password and confirm your email address.

- Creation of a project. You need to fill out a small form about the company in your personal account — name, type of activity, currencies of interest and payment methods (through the site or payment links for social networks and other platforms).

- Integration. You can use ready-made plugins, structured API or HTML-module. The service provides step-by-step text or video instructions for each option.

After that, you will only have to make a test payment, inform your clients about the new payment method and start accepting payments in cryptocurrency. The service's commission is from 0.4%.

Accepting Crypto Payments with CryptoCloud

Cryptocurrency is used in many different ways, from investments and staking to paychecks and online shopping. Businesses can use cryptocurrencies as a means of accepting payment from abroad. Such transactions are convenient, secure, and not subject to restrictions.

The most convenient way to handle crypto transactions is to connect a processing service. An example of such a service is CryptoCloud — a system with support for popular currencies. You can learn more about the system and connect processing via our website.