When searching for reliable means of payment, an increasing number of people pay attention to the coins that are less vulnerable to market fluctuations — stablecoins. The amount of transactions involving them grows steadily.

In 2022, the overall volume of transactions in stablecoins totaled $7.4 trillion. They surpassed Mastercard with $2.2 trillion, American Express with $1 trillion, and Discover with $200 billion. The number of transactions in stablecoins has grown by more than 600% over the past two years.

Why are transactions in stablecoins in such high demand, and which coins are the most popular? Let's find the answers to these and other questions in our article.

What is Stablecoin

Stablecoin is a cryptocurrency whose value is tied to an asset. Stablecoins were developed to reduce the volatility of cryptocurrency. Most often, secure stablecoins are used:

- for storing savings;

- as a means of payment when making and receiving payments from abroad;

- as an investment instrument.

Types of Stablecoins

All of the currently existing stablecoins can be divided into two groups.

Centralized

Centralized stablecoins are tied to an asset with the help of a collateral reserve. This means that the value of the coin depends on the availability of a reserve, the volume of which must be equal to the volume of the digital currency. Various tangible assets (precious metals, real money, etc.) stored in a bank's depository or accounts can be collateral.

Popular centralized stablecoins include Tether, USD Coin, and Binance USD.

Decentralized

This category includes Neutrino USD, USDD, Fei USD — digital assets controlled by algorithms. The value of decentralized stablecoins is confirmed by another cryptocurrency of the user, which is "frozen" in the blockchain through smart contracts.

They act as an algorithm that performs a peg to the dollar and stabilizes the price of coins using technical and market instruments. The minus of such stablecoins is higher volatility, and the plus is the impossibility of blocking by the issuer's decision.

Methods of Stablecoin Collateralization

Stablecoins can be:

- Secured by fiat. Linked to some real currency (euro, pounds sterling, American dollar, Swiss franc). The ratio of real currency to stablecoins is usually 1:1, but sometimes slight variations occur.

- Secured by precious metal. Secured by physical assets of precious metals, pegged to the exchange rate of gold, platinum, silver. These stablecoins are among the most reliable. For example, PAX Gold is backed by gold. In this case, one coin is equated to one troy ounce. Specialized companies or banks are responsible for storing real gold.

- Secured by cryptocurrency. Digital assets are used as collateral. To obtain stablecoins, the user's cryptocurrency is locked in a smart contract and becomes collateral.

- Uncollateralized.These are algorithm-based stablecoins whose value depends on the mechanisms that regulate the price: smart contracts, algorithms, and user decisions.

Popular Stablecoins

Below is a list of popular stablecoins. We will tell you about each one of them.

Tether (USDT)

Stablecoin USDT is one of the most popular, it ranks third in the overall ranking of cryptocurrencies in capitalization (first among stablecoins). As of January 2023, it stands at over $66 billion, with an exchange rate of $1.01. Tether USDT wallet is used to exchange stablecoin to fiat, make payments and withdraw USDT.

You can learn more about Tether from our article: «Tether (USDT) Backing: Is It as Reliable as Claimed?».

USD Coin (USDC)

USDC Stablecoin is the product of a collaboration between the Coinbase exchange and the company Circle, and is pegged to the US dollar. At the beginning of 2023, it was ranked fifth in capitalization among all cryptocurrencies, with a value of $43.5 billion. This token is highly liquid and multichained. The user can choose the optimal blockchain for him: USDC issues Ethereum, Stellar, Algorand, Tron, Solana.

Binance USD (BUSD)

BUSD is backed by fiat and approved by the New York State Department of Financial Services. Stablecoin is pegged to the U.S. dollar. The issuer is the Binance exchange partnered with Paxos. With over $15 billion capitalization, Binance USD (BUSD) ranks third among stablecoins.

Dai (DAI)

DAI belongs to the category of decentralized stablecoins. It was developed by Maker in 2017 and is backed by Ethereum coins. The DAI coin as an alternative to USDT is quite firmly established on the market — its capitalization as of the beginning of 2023 exceeds $5 billion.

The project has the following advantages:

- one DAI will always be worth $1;

- no government or other centralized authority can shut it down;

- no person can control it;

- it can be freely traded like any other ERC-20 token;

- anyone from anywhere in the world can receive and send DAIs simply by having an Ethereum wallet.

Pax Dollar (USDP)

USDP is a decentralized stablecoin developed by Paxos (the New York State Department of Financial Services regulates it). Released on the Ethereum blockchain in 2018, it is pegged to the U.S. dollar. Stablecoin is currently traded on various exchanges, including Bitrue, KuCoin, and Coinbase Exchange.

TrueUSD (TUSD)

TUSD, a stablecoin pegged to the American dollar, was created in 2018 primarily for e-commerce and is issued by the TrustToken platform. The developers guarantee that the assets are fully backed by fiat money and state that an appropriate amount of funds are held in trust company banks. It ranks fifth in capitalization among stablecoins at $940 million.

USDD (USDD)

USDD is an algorithm-based stablecoin released by the TRON platform in May 2022.

Gemini Dollar (GUSD)

Stablecoin from the Gemini exchange created in 2014, backed by the U.S. dollar.

Fei USD (FEI)

FEI belongs to the category of algorithm-based stablecoins, developed for DeFi. It appeared in December 2020 and immediately attracted the interest of the crypto community. In early March 2021, this led to it receiving $19 million in venture capital investment.

Neutrino USD (USDN)

USDN is an algorithm-based stablecoin. It is pegged to the US dollar and is backed by the WAVES token. All transactions with it are conducted using smart contracts.

Advantages and Disadvantages of Stablecoins

Stablecoins have both advantages and disadvantages. The undoubted advantages of stablecoins include:

- relative stability of the exchange rate due to pegging to other assets;

- efficiency of international transactions;

- the ability to quickly exchange for fiat.

As for the disadvantages, they include:

- complete dependence on the securing asset and, accordingly, the same risks as those of conventional currencies;

- opacity of information regarding the collateral (some issuers of stablecoins do not publish full reports);

- the risk of losing the tie to a tangible asset;

- complexity of use as an investment asset.

Stablecoins for International Payments

Stablecoins are subject to less volatility than regular cryptocurrencies due to their peg to another asset. However, they retain the advantages of cryptocurrency in that transactions in stablecoins are not subject to a single control.

This is why they are often used to make cross-border payments. Nevertheless, before buying and further using a particular stablecoin, we advise you to read the issuer's user agreement and study the audited statements to avoid losing money, which is what Terra (UST) stablecoin holders faced.

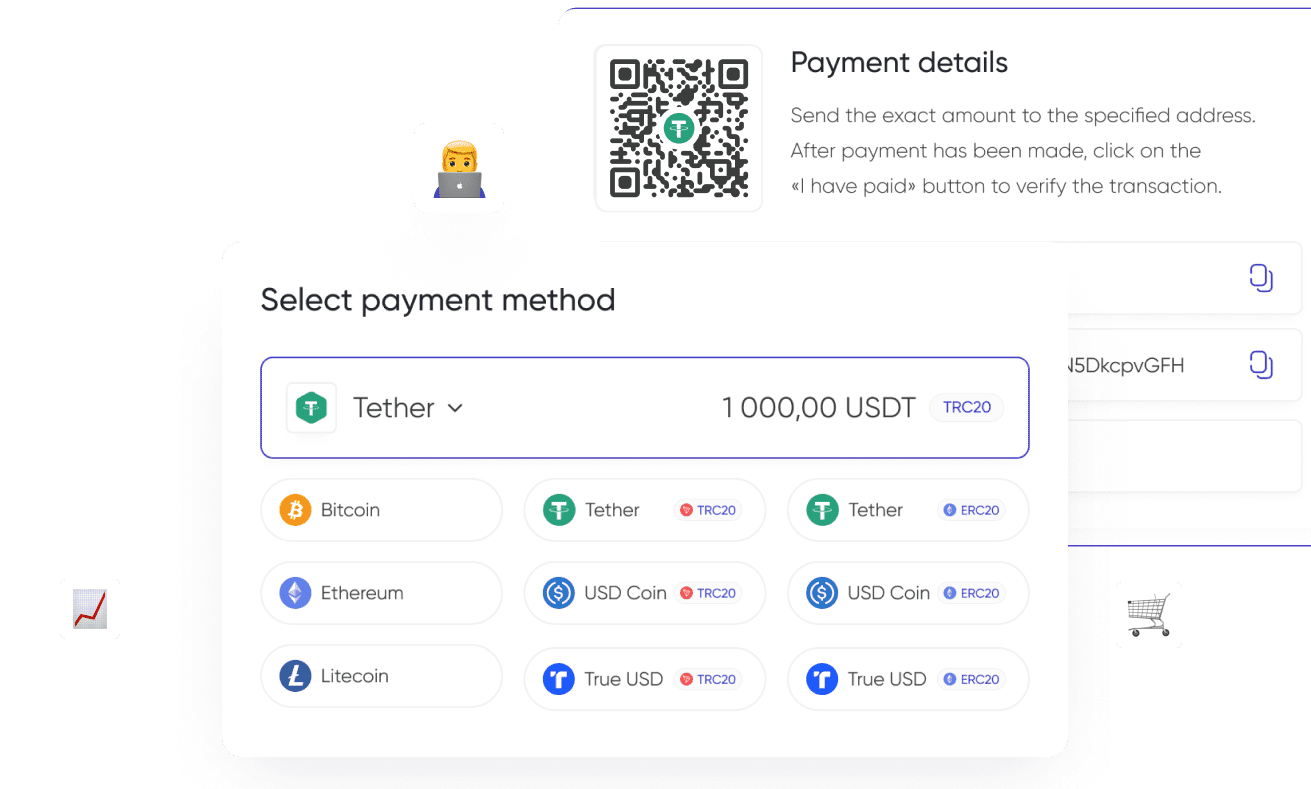

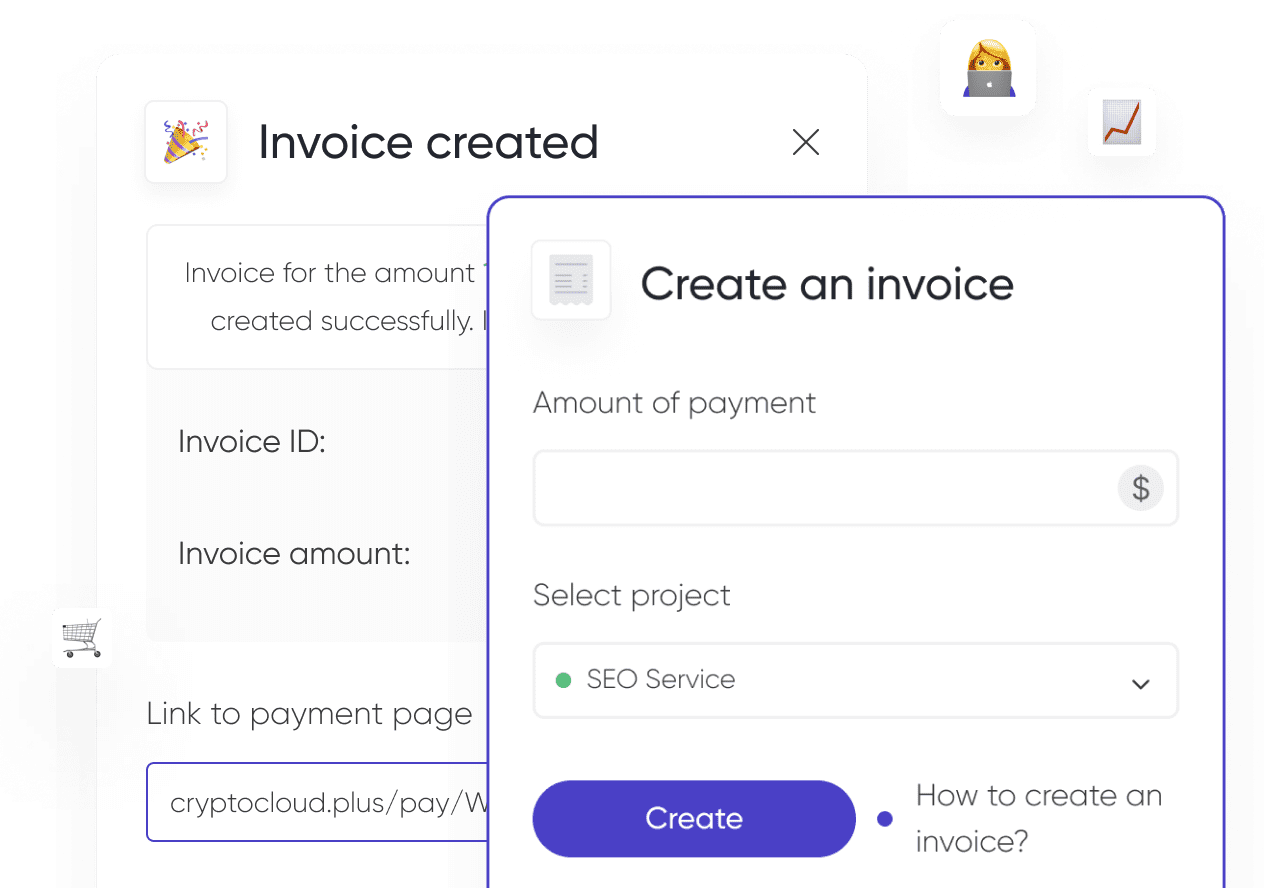

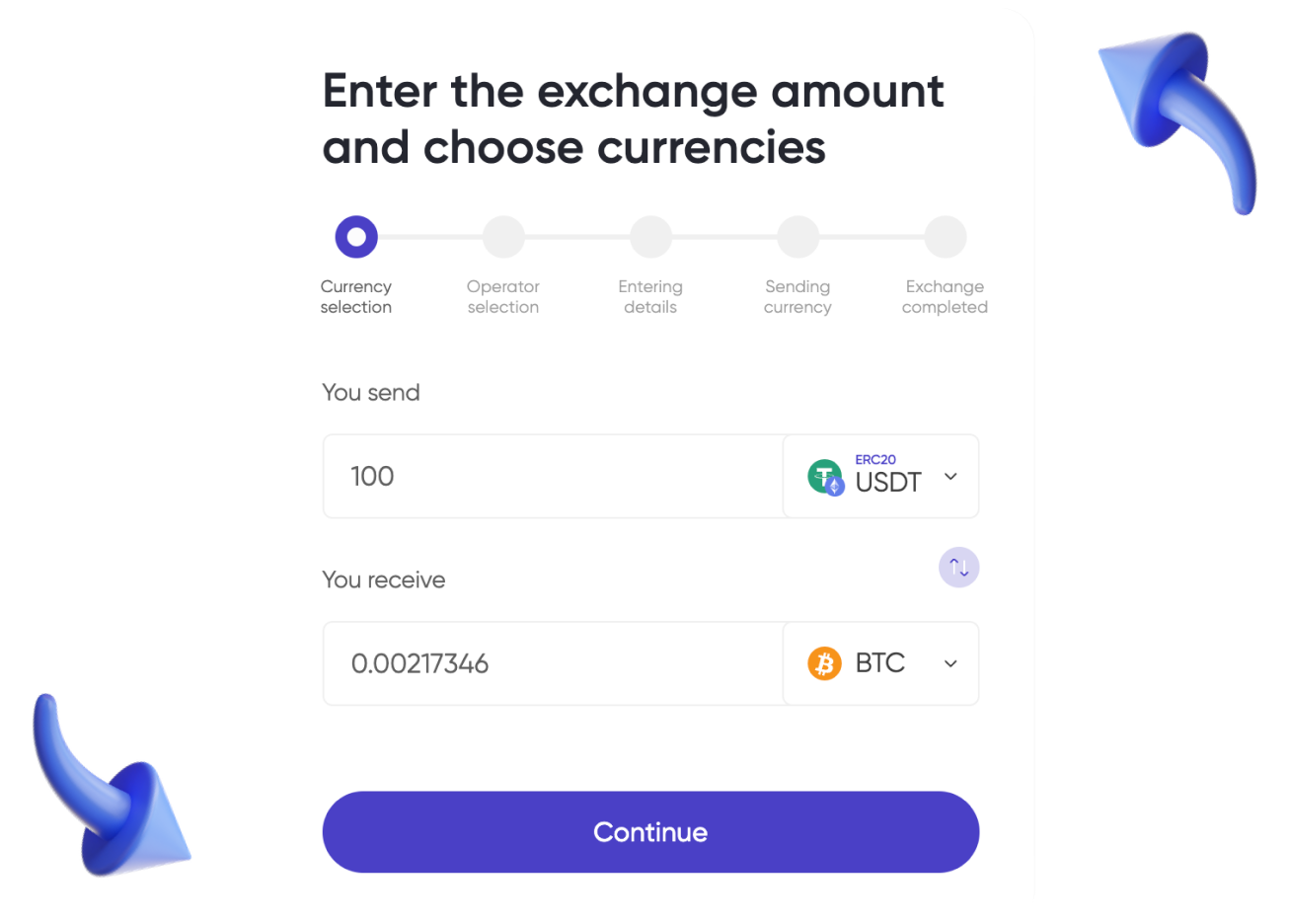

Our CryptoCloud service helps you accept cryptocurrency payments, including Tether (USDT), USDC and BUSD. If you have any questions about accepting payments in Stablecoin for your business, please go to our FAQ or sign up on the website.