There are many currencies on the crypto market that are convenient for paying for goods and services. Among them is USDD stablecoin, which is popular in the market and has several advantages for business owners and their clients. USDD's capitalization has reached $756 million.

In the article, we explain what this cryptocurrency can offer businesses as a means of payment, how USDD differs from other coins, and how to organize the acceptance of payment in this currency.

USDD: What You Need to Know

Decentralized USD, or USDD is a cryptocurrency from the decentralized organization TRON DAO. It is an algorithmic stablecoin that is pegged to the US dollar at a 1:1 ratio and operates on the TRON blockchain.

USDD has two key differences from secured stablecoins such as USDT and USDC, for example:

- Decentralization. Unlike steiblcoins issued by centralized companies (Tether, Circle), USDD tokens cannot be blocked or frozen by a third party.

- Redundant collateral. Being tied to other assets (e.g., USDD) is one of the key criteria that differentiates stablecoins from other cryptocurrencies. In the case of USDD, the developers' goal was to build reserves of at least 120% of the coins' aggregate value, and as of August 2024, the stablecoin was over 120% collateralized. The reserves include USDT and TRX.

A Mint-and-Burn mechanism is used to maintain price stability. Tokens are issued when USDD is purchased and burned when it is sold. In addition, the algorithm burns/releases tokens if the coin's value deviates from $1.

Decentralized USD: Brief History

Decentralized USD was launched on May 5, 2022 by the Tron DAO team led by its founder Justin San. The launch took place on three tier 1 blockchains which were TRON, Ethereum, and BNB Chain.

The main purpose of the stablecoin was to provide users with a convenient tool to pay with cryptocurrency, which would protect them from the volatility inherent in digital assets. To achieve this goal, the developers turned to a system of over-collateralization with reserves amounting to at least 120% of the coins in circulation.

Although the stablecoin has not achieved the same popularity as its larger competitors (USDT, USDC), it has not failed as well as, for example, the decentralized coin UST. USDD has successfully withstood the fluctuations of the exchange rate due to the collapse of FTX in November 2022, when the value of the coin dropped to $0.97, and is currently demonstrating the stability declared by the developers.

Current USDD issuance is more than 7 times higher than when it was launched.

USDD Advantages

Decentralized USD is actively used in making cryptocurrency payments for several reasons:

- Multichainability. At the time of launch, the coin worked on three blockchains: TRON, Ethereum, BNB Chain. However, this list has now expanded to 10 networks to also include Avalanche, Fantom, Polygon, Arbitrum, Aptos, Aurora, and Optimism.

- Over-collateralization. The coin is backed by more than 120% in assets. The reserves backing it are held in cryptocurrency - predominantly other stablecoins. Peg Stability Module (PSM), a swap tool that allows USDD to be exchanged for other stablecoins at a 1:1 rate, works for the convenience of users.

- Security. Highly liquid assets back cryptocurrency's value, and super-security protects the coin from market fluctuations. At the same time, USDD remains a decentralized asset, which prevents government blocks.

- Integration with TRON. Since USDD was developed based on the TRON DAO, it is deeply integrated into the TRON ecosystem, which includes various decentralized applications (dApps), exchanges, and cryptocurrency wallets. This makes USDD accessible to a wide audience and usable across a variety of services.

- Use of smart contracts for issuing/burning coins. This approach helps to ensure the stability of the coin's exchange rate. The algorithm tracks the value: in case of a decrease in the rate, some tokens are automatically burned to increase the price through a decrease in supply, and in case of an increase in the price, new tokens are issued to stabilize the rate.

How to Accept Payments in Decentralized USD?

There are two ways to organize the reception of payments in cryptocurrency: direct transfers and payment gateways. Let's consider the principles of operation of each.

Transfers to the wallet

Accepting crypto payments by wallet address is a payment option that does not require the use of additional services: it is enough to open a cryptocurrency account. The client contacts the company to place an order and receives the wallet address from the manager to which the payment needs to be transferred. After the transfer is received, the company confirms the order.

This payment processing option can make the cryptocurrency payment procedure quite long. Customers can make purchases only during the company's business hours, and the manager's response may take some time. As a result, the conversion rate decreases.

Crypto processing

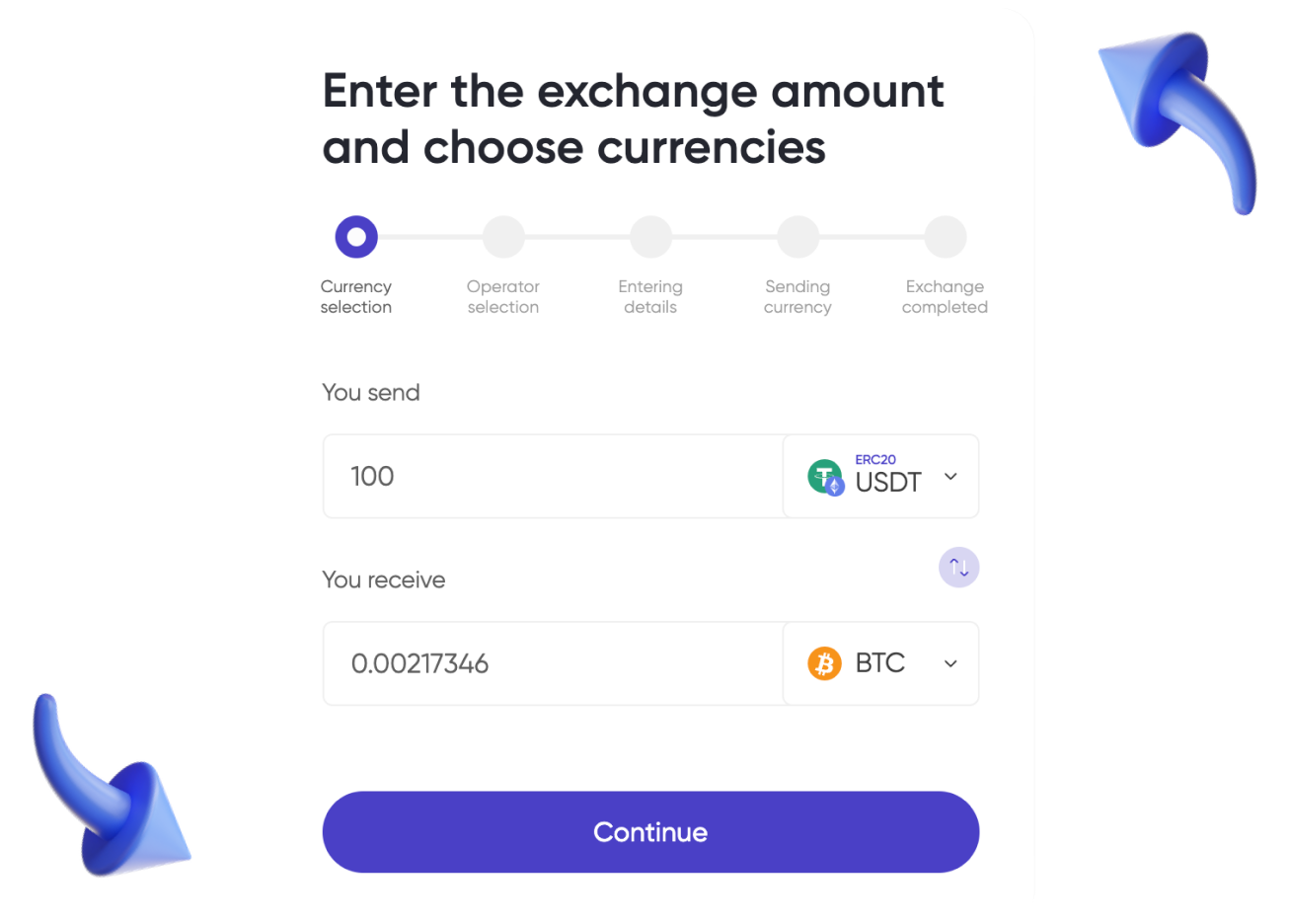

It is a cryptocurrency payment gateway similar to the checkout of traditional payment systems. The customer places an order as usual, but at the payment stage chooses to pay with cryptocurrency.

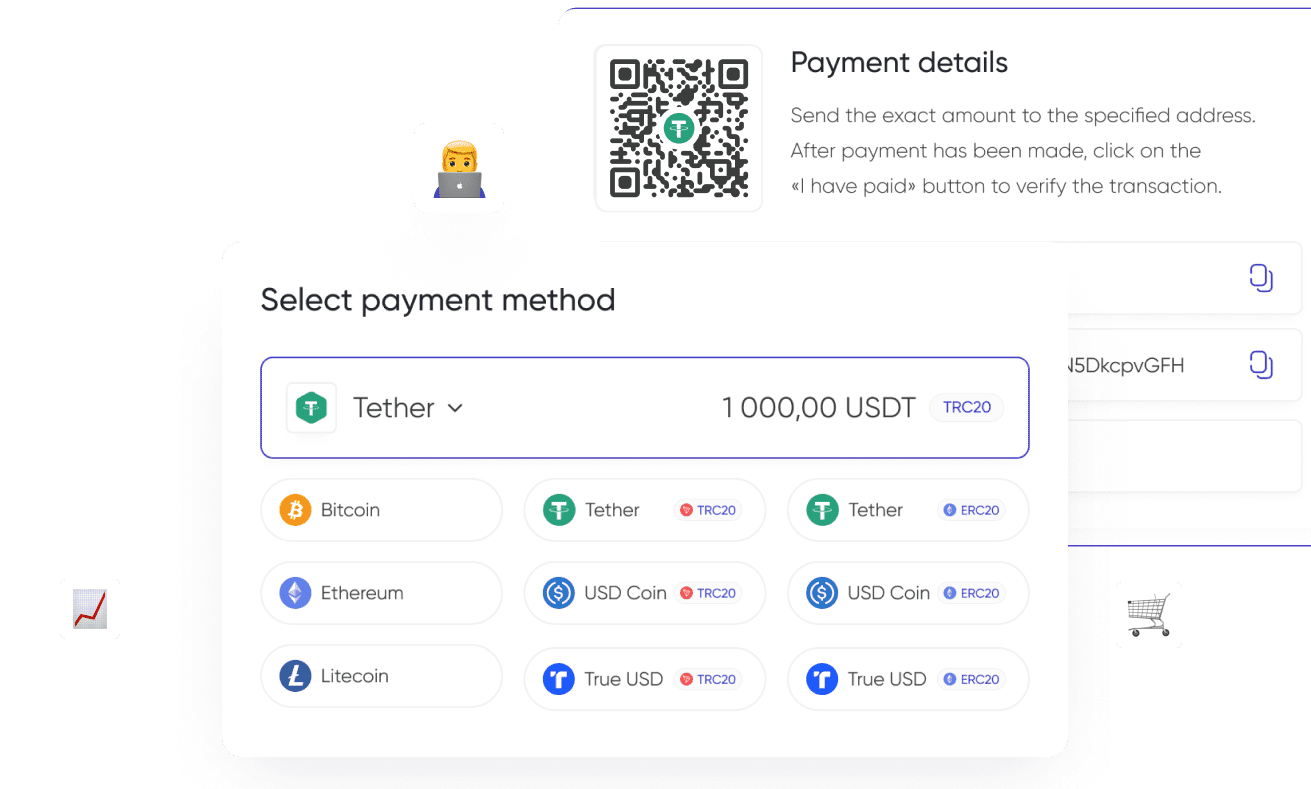

The system then offers to select the currency, converts the purchase amount, calculates the commission, and provides the customer with an address and/or QR code to make the transfer. After the customer sends the required amount, the processor automatically confirms the order.

Connecting a cryptocurrency payment system allows customers to pay anytime without waiting for a company representative to respond to their orders. The processing fee is usually 1–2%. In addition to processing transactions, the service can provide additional features: working with statistics, report generation, an anti-fraud system, and other tools.

Connecting Crypto Processing

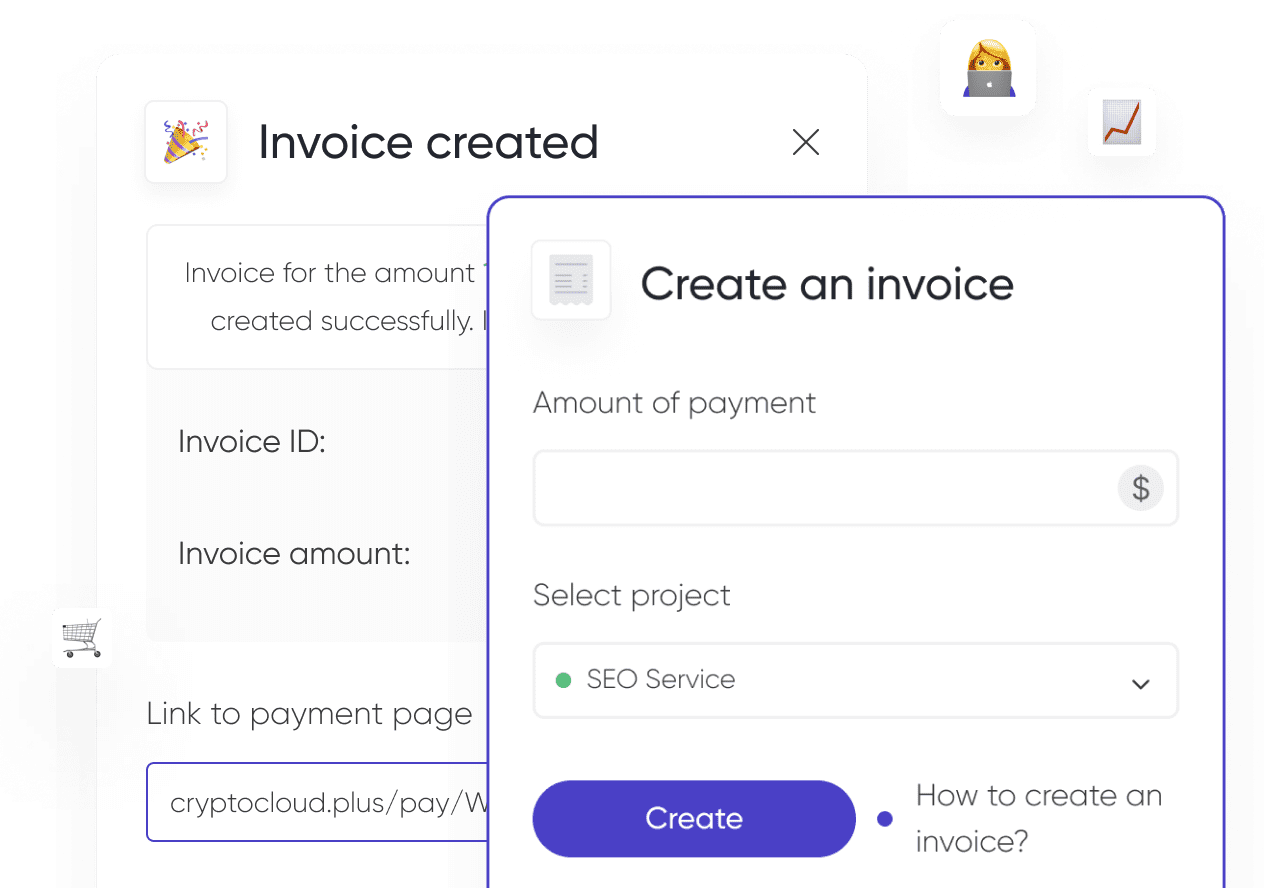

Below we describe how to connect cryptocurrency processing, using CryptoCloud as an example:

- Registration in the service and setting up an account. On CryptoCloud, to create a profile, you only need to specify your e-mail and Telegram. No verification is required.

- After that, the user gets access to the personal account, where they can work with statistics, withdraw funds and manage projects. To add a project, you need to fill out a questionnaire with basic information about the company or website.

- Connecting crypto payments. CryptoCloud offers a range of ready-made plugins for e-commerce platforms (Opencart, WooCommerce, GetCourse, Tilda, etc.). You can also use a structured API or HTML widget for integration.

- Testing the payment gateway. It is recommended to send a test payment to make sure that the integration works correctly.

In addition to USDD, CryptoCloud supports payments in other popular currencies such as Bitcoin, Ethereum, Tether and others. The system allows you to work both via checkout and payment links for social networks/messengers. AML checks and payment accuracy customization are available.

USDD: Payment for Purchases Without Limits

Crypto payments have several advantages for businesses: security, speed of transaction processing, independence from banks and sanctions restrictions. Connecting payment in USDD adds the possibility of using a currency with a stable exchange rate, which is almost immune to market volatility.

The most convenient way to accept payments in USDD is to use cryptoprocessing. CryptoCloud offers users support for popular currencies, fees from 0.4%, a convenient interface, and several additional features that are convenient for the business owner and the client.