Payment organization is one of the critical issues for businesses: customers should have access to convenient, reliable and diverse payment methods. According to PYMNTS, 18% of U.S. shoppers use seven different payment methods. This reflects how important it is to connect multiple payment methods to increase conversions.

We explain what online payment processing services are available for businesses, what payment methods customers use, and which payment options should be considered in addition to bank cards.

How to Accept Online Payments?

There are several ways to organize online payments:

- Bank acquiring. An official service from a bank that can be used on the website or through physical points of sale (PoS terminals). Allows customers to use bank cards for payment.

The customer enters the card details on the payment page, and the bank checks that the information is up to date and that funds are available on the account. Then, the bank confirms or rejects the payment. This method of accepting online payments on the website has the main advantages of relatively small commissions and high reliability. - Payment system. A third-party service that plays the role of an intermediary between banks and the parties to the transaction. Because of this, payment commissions may be slightly higher than those of acquiring.

Nevertheless, online payment systems offer a versatility that banks do not have: when installing such a service, the user gets access to a greater variety of currencies and payment methods. In addition, many systems have additional functionality — for example, tax calculation, financial and reporting management, working with clients, etc.

- Crypto processing. A system for receiving payment in cryptocurrency. The service converts the order amount, provides the client with an address and QR code to make the transfer, automatically tracks the transaction, and confirms the operation after the funds are credited to the account.

Some processors also allow clients to buy cryptocurrency on their website. Such services are a convenient way to receive international payments under sanctions. - Settlement account. The most technically simple way of accepting payments online without a website or on the company's website. The client manually transfers funds to the seller's details.

This method frees the business from the need to integrate a payment system and pay a commission to a third-party service. However, this payment option is not always convenient: it requires manual confirmation and wastes the client's time, which reduces conversion rates.

Main Online Payment Methods

There are several payment methods used by customers of online stores. To increase conversion rates, it is recommended to offer customers at least a few options from the list: this way any customer will be able to find a payment method that suits them.

Bank card

Credit and debit cards are still the most popular payment method. They are convenient for customers for multiple reasons: almost everyone has a bank card, there is no need to open accounts in third-party systems to use them, and the payment process is intuitive.

E-wallet

Another method of payment, the popularity of which is comparable to bank cards — e-wallets. There is a wide range of such services — for example, PayPal, which is used by millions of customers around the world.

Customers value wallets for their convenience and security. Many clients use such services to avoid handing over their bank card details. In addition, many wallets allow you to organize online payment acceptance for an online store through a quick payment button, which increases the convenience of use.

Cryptocurrency payment

Payment via cryptocurrency is a less popular payment method than using fiat («regular») money, but it has been gaining popularity recently. One reason is the imposition of sanctions restrictions that have made international payments more difficult.

Crypto transactions are not subject to these restrictions, which allow for free cross-border operations — with a guarantee of successful payment and low fees.

In addition, cryptocurrency is valued for its security and anonymity: parties do not disclose personal information when making a payment. From the point of view of businesses, crypto payments are also convenient because they cannot be canceled. This excludes chargebacks, which are one of the expenses of an online store.

We recommend reading our article «Best Cryptocurrencies for Accepting Payments».

Installment

Some services are available for quick execution of installments and loans at the moment of online payment. Many banks offer this service. In addition, you can make installments through some payment systems and e-wallets.

Installments are relevant, first of all, for stores that offer goods of high price category — for example, electronics, household appliances, etc. Connecting such a payment method allows you to increase conversion rate, attracting customers who cannot pay for the order at the time of purchase.

Payment by installments (BNPL)

«Buy Now, Pay Later» services allow you to divide the purchase amount into several payments — another useful option for high-priced online stores.

When using this payment method, the customer pays a part of the amount at the moment of order placement. The balance is divided into several payments, which are made within a certain period of time. Their number and terms depend on the service. The store receives the full value of the order at the time of purchase.

Bank transfer for legal entities

This method of payment is relevant for B2B settlements, i.e. when receiving payment from legal entities. The company-seller issues an invoice, which is paid by the company-buyer.

The funds are transferred to the legal entity's settlement account according to the details.After that, the representative of the legal entity-customer can receive the goods or services, providing a power of attorney or another document confirming the right to act on behalf of the company.

Payment link or QR code

Payment links and QR codes are a payment option that can be used to accept payments without the company's website. A link or a code can be placed in social networks, Telegram channels, messengers, e-mail, etc.

When clicking on the link, the customer gets to the payment page, where they enter payment information and confirm the transaction — similar to payment via an integrated checkout.

A link can be used for one-time invoicing and as a permanent payment method. For example, permanent links are convenient for collecting donations when the customer specifies the transaction amount themselves.

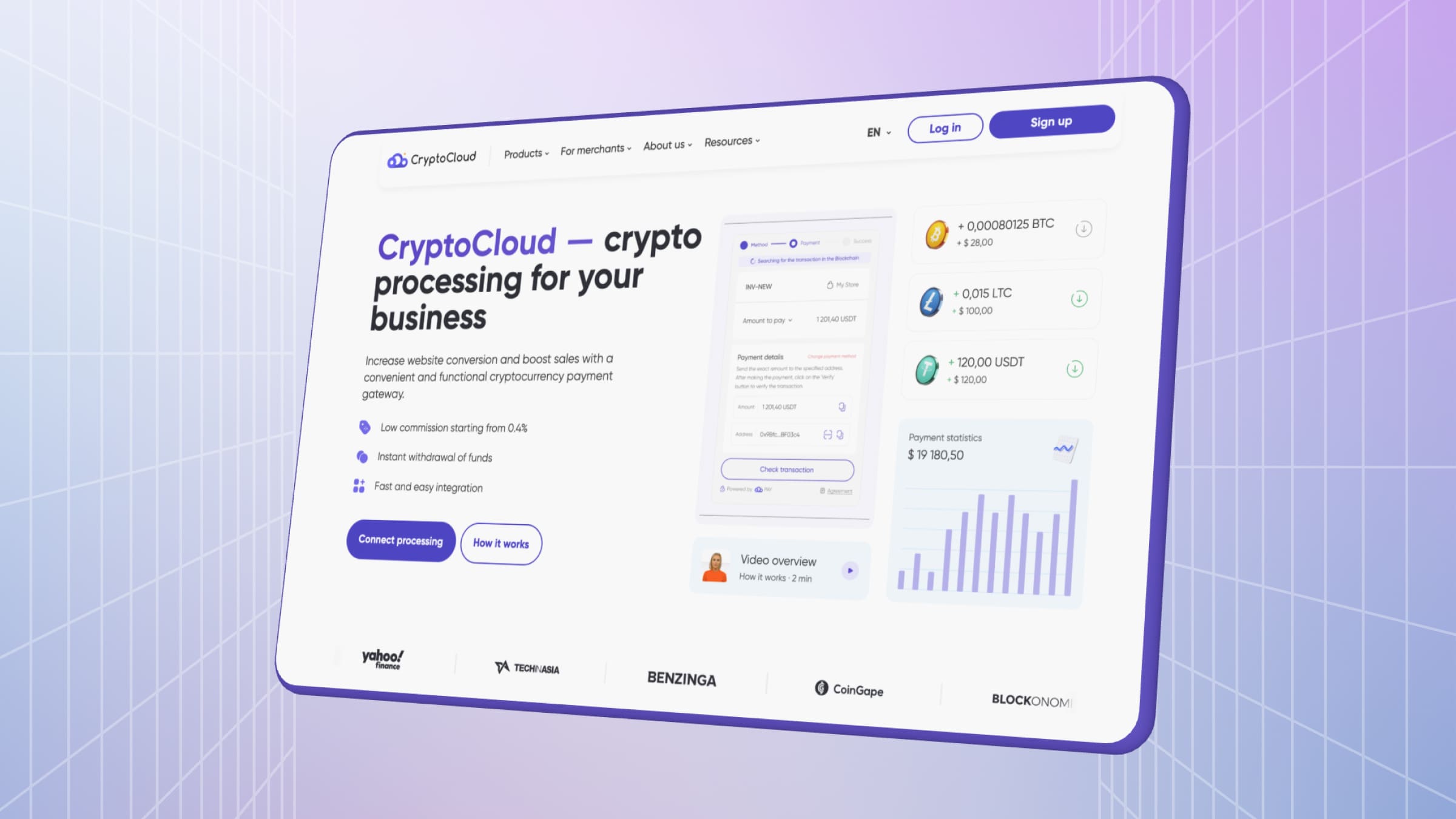

Accepting Crypto Payments With CryptoCloud

CryptoCloud is a cryptocurrency processor that allows you to automate crypto payments and accept them both through the website and off-site. It does not require verification when creating an account — you can register and start accepting payments within minutes.

It offers a wide range of integrations with popular e-commerce platforms, connections via API and HTML widget, and payment links that work without integration.

Users can activate AML checks to increase security, and automatic conversion to USDT to reduce losses due to cryptocurrency volatility. An entrepreneur can choose the payment side of the commission, adjust payment accuracy, and customize the checkout by adding a company logo.

Receiving Payment for Online Business

There are many ways to receive payments online: from official bank acquiring and payment systems to aggregators and crypto processing. To increase conversion rates, it is recommended to combine several options — for example, offering customers the ability to pay not only by bank card and e-wallet but also in cryptocurrency.

CryptoCloud will help to automate the reception of crypto payments. The system independently converts the order amount, tracks the transaction and confirms the payment after receiving the funds. Learn more about the system's features on our website.