Tether is the world's first stablecoin, that is, a cryptocurrency pegged to fiat. In the case of Tether, it is pegged to the U.S. dollar. However, we can't say that a stablecoin is the same as the U.S. dollar since it was created to facilitate cryptocurrency exchange rather than to replace fiat money.

There are also rumors that despite the issuing company's strong assurances about the dollar's backing, the stablecoin cannot be considered fully equivalent to it. Is it true? Let's find it out.

What Is Tether (USDT) And Where Does It Come From?

Tether (USDT) takes its name from Tether Limited, which brought this project to life in 2014. Initially, it was based on Bitcoin and differed from other cryptocurrencies by the following characteristics: exchange rate stability, high reliability and insurability.

In 2015, the token entered exchanges and began to be traded in pairs with other currencies. The first exchange on which it appeared was the famous Bitfinex.

As the cryptocurrency began to gain popularity, Tether was launched on other blockchains:

- OMNI - Tether protocol in Bitcoin blockchain.

- ERC20 - Tether protocol in the Ethereum blockchain.

- TRC20 - Tether protocol in the Tron blockchain.

- BEP2 - Tether protocol in the Binance blockchain.

- BEP20 - Binance smart chain.

You can learn more about the Tether protocols in our article «Tether (USDT) types: differences between ERC20, TRC20, BEP2».

Tether is not considered as attractive an investment as Bitcoin or Ether because of its fixed value. Yet it remains a popular means of payment, a way to pay for goods and services used by sellers and buyers worldwide.

You can learn more about stablecoins in our article: «Ranking the Best Stablecoins of 2023: TOP-10 Revealed».

Tether Features

What distinguishes this cryptocurrency is that it has neither its blockchain nor transaction blocks. Realization of tokens occurs with the help of third-party systems, and the purchase — through fund transfers to the company's accounts.

The Tether algorithm is called Proof-of-Reserves. The amount of available tokens is verified on the Bitcoin blockchain, while their value is confirmed by the dollar reserves in the accounts. Stablecoin's financial situation is monitored with the help of independent auditing companies.

Available for purchase funds are published on the Tether website. You do not need a bank account to buy the required amount of stablecoins. You can make a purchase for another cryptocurrency directly on the exchange.

The disadvantages of stablecoin come from its very nature. Although it is believed that the value of the coin is at 1:1 to the U.S. dollar, there are jumps and strong fluctuations in the price due to changes in the dollar's value. Also, the company's documents state that it is not obligated to exchange its token for the dollar and is not responsible for exchanging Tether on other platforms.

Since only one company issues stablecoin, it is hard to say that its system is decentralized because addresses and transactions can be blocked.

You can find rumors on the internet that only 70% of USDT tokens are actually secured, but there are also refutations of these bruits.

Is Tether Fully Backed?

A major audit firm BDO quarterly analyzes Tether Holding's assets. The results of the last published audit showed that as of the 30th of June, the Group’s consolidated assets exceed its consolidated liabilities.

The company's assets totalled about $86.5 billion, which consisted of:

- $55.8 billion accounted for by the U.S. Treasury bills;

- $8.5 billion held in overnight reverse repurchase agreements;

- $8.1 billion held in money market funds;

- $90.8 million is in cash.

Tether for Accepting Payments and Storing Funds

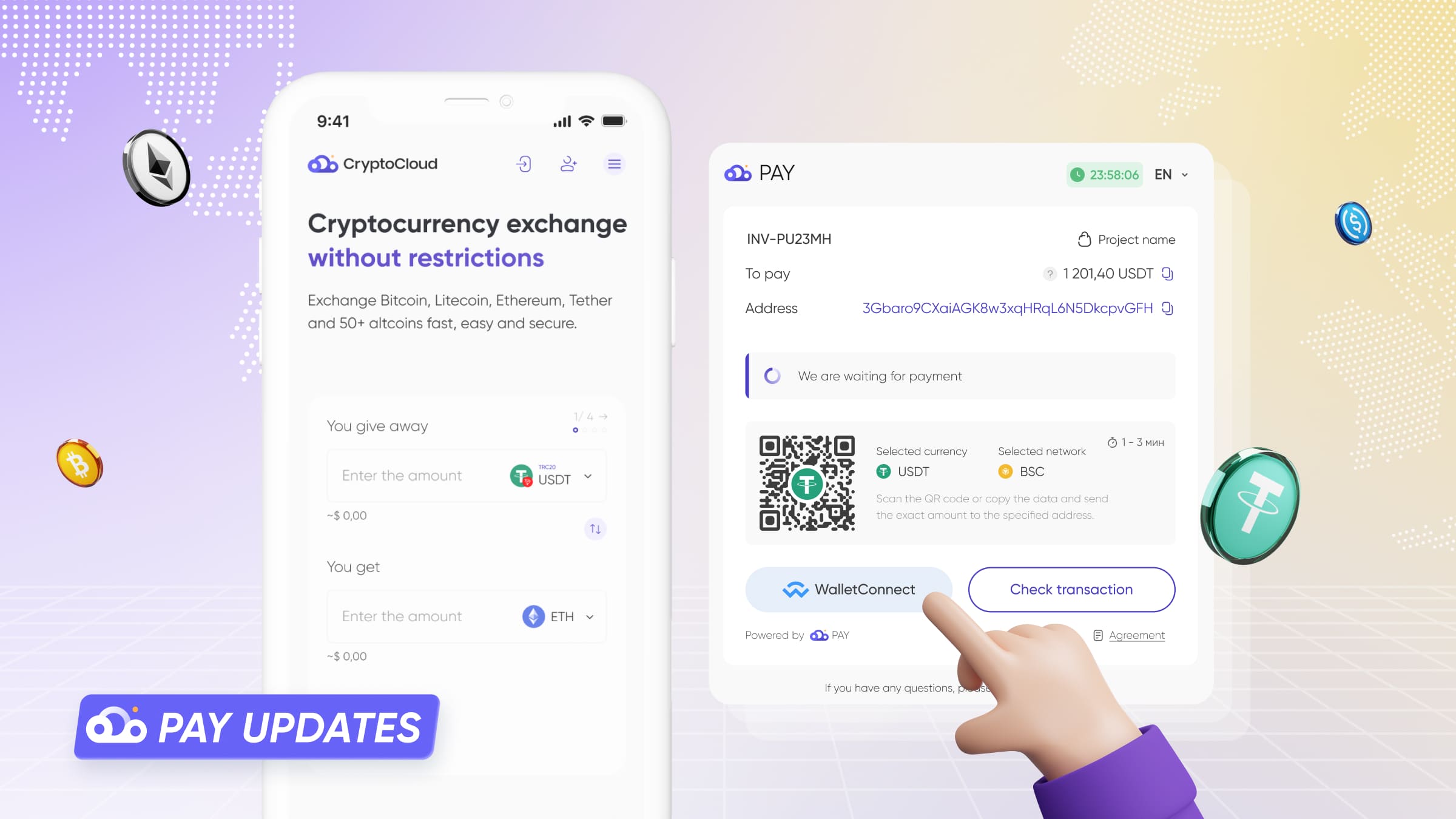

There are no doubts in the security of this asset. It is considered to be relatively safe for storing funds, which is why many entrepreneurs do take advantage of it. In the article, we've menthioned what payment systems can be used to accept payments in Tether.

The use of stablecoin to pay for goods and services is also gaining popularity, so business owners are choosing to connect the ability to accept cryptocurrency payments on their website to please potential and standing customers. If you have questions on how to connect USDT crypto processing to your website, we recommend reading our article «Getting Paid in Tether (USDT): A Complete Overview».