Stripe is one of the most popular international payment systems. It is used in 50+ countries on more than a million websites, making it the second most popular service for accepting payments worldwide.

Despite its convenience and comprehensive functionality, some business owners are looking for alternative systems to process payments. They may be shifting away from Stripe due to its complexity of integration, high cost, and inaccessibility in certain regions.

In the article, we consider how to find a payment service, what popular options are worth considering and how to accept payments from abroad.

Stripe: Features and Functionality

Stripe is a service that allows you to process transactions, manage company finances, collect statistics, ensure security and perform many other actions related to payment for goods and services.

Stripe operates in 195+ countries and supports various currencies and payment methods — from online wallets with an audience of millions to local payment methods designed for users from specific regions.

Features include accepting international payments via integrated checkout and payment links, recurring payments, and invoicing. Security is ensured through an internationally compliant checkout page and Stripe Radar, which analyzes transactions for suspicious activity.

Users have access to 450+ developer tools that allow them to customize the system according to their business needs. The system also offers many integrations with e-commerce services and ready-made templates for accelerated customization.

In Stripe, payments reception is paid for in the form of commissions from processed transactions. The cost depends on the payment method: when making payments from cards and online wallets — 2.9% + 30¢. The system may also charge additional fees — for example, for the use of certain services or currency conversion.

Learn more about the platform in our article «Stripe: Features and Advantages of the International Payment System».

Why Are Businesses Looking for an Alternative?

Although accepting payments through Stripe has a range of benefits, many entrepreneurs seek alternatives. There are several reasons for this, including:

- Quality of technical support. While Stripe offers support options, the responsiveness to resolve issues is not always high.

- Cost. Accepting payments from abroad through Stripe can be quite expensive: for example, 1.5% is added to the standard fee when using international cards and 1% for currency conversion.

- Complex customization. Templates and ready-made integrations are available for Stripe users to connect, but full-fledged use of the system requires programming skills.

- Lack of support for high-risk industries and countries. To connect Stripe, a company must meet certain requirements — including country of incorporation and area of operation.

- Expensive chargebacks. Every dispute and refund request opened by a customer costs the company $15. This amount is not refunded even if the resolution favors the entrepreneur.

Key Factors in Choosing a Payment Service

Selecting an analog of the Stripe payment system is a choice from a variety of options. To find a suitable platform, it is recommended to consider several criteria:

- Requirements. One of the main ones is geography: services work with a limited number of countries. In addition, the system may refuse to cooperate with certain niches and spheres of activity.

- Reputation. It is recommended to analyze reviews. This is necessary to avoid fraud and assess the quality of service, including the level of security and customer support.

- Convenience. Both the comfort of customers and the peculiarities of work from the entrepreneur's point of view should be taken into account: ease of connection, intuitiveness of the interface, etc.

- Commission. Many services offer several plans with different limits and a set of functions. In addition, the price often depends on the payment method. The cost of popular options of payment — cards, e-wallets — should be taken into account.

- Withdrawal speed. Most services offer withdrawal within two to three business days. A fast withdrawal option may also be available — within a day or a few hours.

- Tech support. The quality of support is an important factor. Quick answers from a specialist will help solve the problem if it occurs.

- Security. The system should protect buyers' payment data and the entrepreneur's money. An anti-fraud system and protection against chargebacks will be advantageous.

International Payment Systems

PayPal

PayPal is an e-wallet that offers transaction processing for business accounts. The service supports receiving one-time and recurring payments, delayed payments, and various currencies. Settlements can be accepted via an integrated gateway or invoice links. A button for quick payment via PayPal is available.

The wallet is highly popular and is easy to connect without requiring complicated setup. However, its functionality is limited compared to Stripe, and connection requires multiple verifications.

Our article «PayPal: International Payment System Features Reviewed» provides a detailed review of the service.

Braintree

Braintree is a subsidiary of PayPal. The system offers security at the level of the parent service, as well as a wider functionality designed for e-commerce businesses, support for 130+ currencies, and can be connected in 45+ countries.

Features include business process management, analytics and reporting. There is a system to track and block suspicious transactions and functionality to scale your business.

Authorize.Net

Authorize.Net is a cross-border payment system for companies from the US, Canada, Australia and the EU. Features include one-time/recurring settlements, checkout, e-checks and payment links, installment processing.

There is a feature to save the payment information of regular customers and a system to analyze transactions for suspicious activity. In addition to connecting a payment gateway, a merchant account is available for start-ups.

Square

Square is a tool for multiplatform stores that make sales through both online venues and offline terminals. It offers checkout, invoices, and Afterpay installments to online stores.

Companies that have yet to launch their online store can use Square's hosting and shopping cart customization service. For offline stores, Square provides POS terminals.

Verifone

Verifone (former 2Checkout ) is a payment system operating in 180+ countries. Its features include online shopping cart integration, one-time and recurring payments, reporting, risk management, dispute and return management.

In addition, users have access to a range of extra services, such as 2Partner for affiliate promotion and 2Bill for subscription management.

Adyen

Adyen is a multiplatform business service that uses Unified Commerce to collect transaction information from online store to offline POS. The service handles 100+ payment methods and provides a terminal for offline stores.

In addition to tools for receiving payments, the system offers statistics collection, risk management, intelligent authentication, and analysis of customer actions to improve marketing strategies.

Integration Requirements

While Stripe is a versatile and widely used payment system, the platform and many alternative services have specific connection requirements and works only with certain types of businesses.

For example, payment systems work exclusively with companies operating in low-risk sectors or require a formal incorporation in specific regions. Additionally, many alternatives charge higher fees for processing cross-border payments, which can be a significant factor for businesses operating internationally.

These fees often include higher transaction percentages, currency conversion charges, and additional costs for managing chargebacks or disputes, making it crucial for businesses to carefully evaluate the cost structures before switching providers.

Alternative: Crypto Acquiring

One of the alternative ways to process payments from international customers is to accept cryptocurrency payments. While not as popular as fiat transactions, this payment option is becoming increasingly common — especially among e-commerce companies.

Crypto transactions have several advantages: they are processed quickly, do not require the involvement of intermediaries, and provide anonymity.

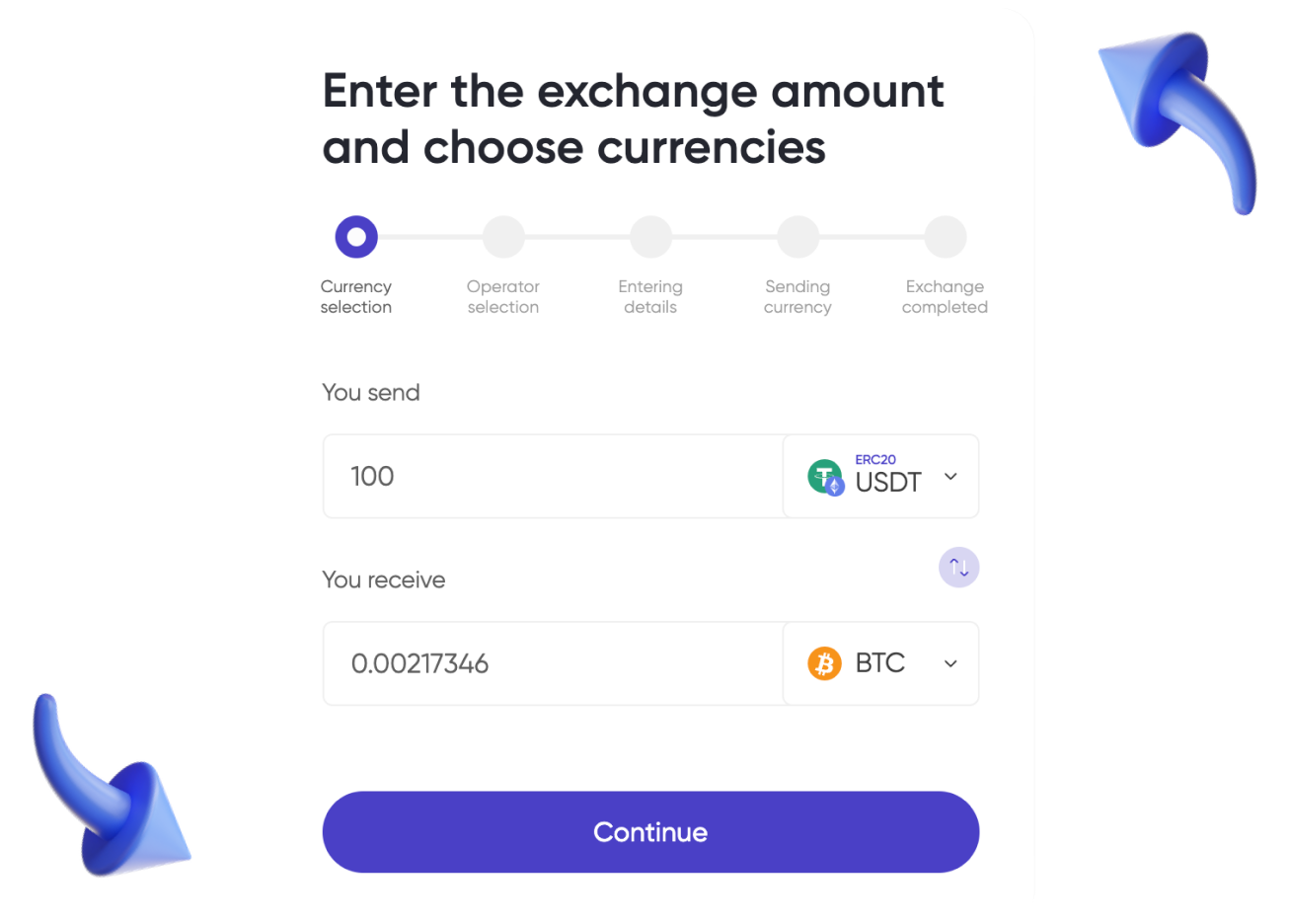

A cryptocurrency payment gateway can automate the receipt of crypto operations. Such services provide automatic conversion and transaction confirmation and offer a user-friendly interface to the client and business owner.

CryptoCloud Processing

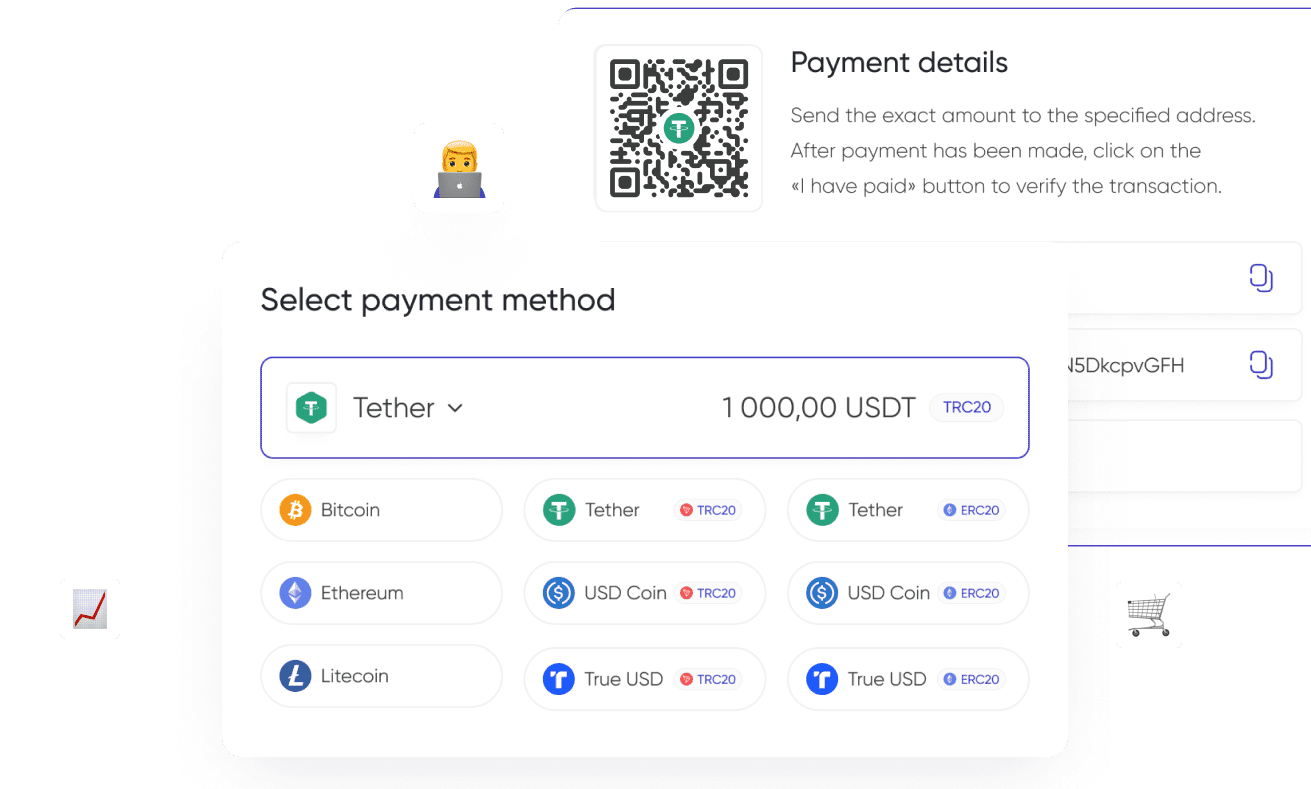

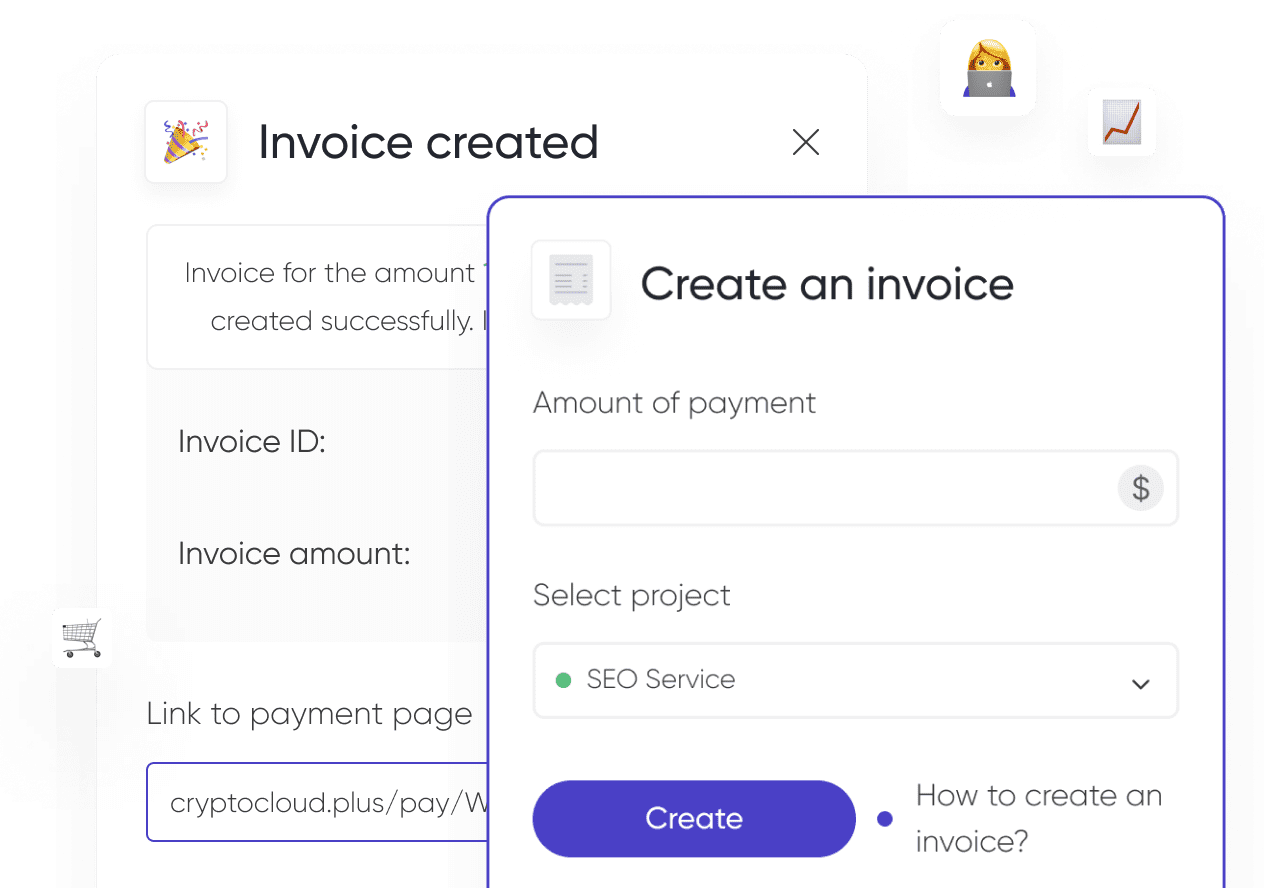

CryptoCloud is a cryptocurrency processing service that supports the receipt of popular coins. Features include payment processing through a convenient multilingual checkout, as well as payment links that enable operation without integrating the service into a website.

Crypto processing ensures the safety of working with finances thanks to encryption, protection from DDoS attacks, cold wallet storage, and AML transaction checks.

Users can customize the payment page, configure the payment's accuracy, and specify the side of the commission charge. An automatic conversion function to USDT prevents funds from being lost due to volatility.

The commission for receiving cross-border payments in cryptocurrency is from 0.4%. Connection is free of charge and is performed via API, HTML widget or CMS plugins.

Payment Services for International Companies

Stripe is a payment system with a wide range of functionality, high-quality data protection and support for a variety of payment methods. Despite its advantages, some entrepreneurs are looking for alternatives to Stripe — because of its high cost, difficulty of integration or inaccessibility in a certain country.

Entrepreneurs often face strict connection requirements when looking for a payment system, making it hard to accept cross-border settlements. This problem can be avoided by connecting CryptoCloud crypto processing, a multilingual payment gateway for processing cryptocurrency transactions that allows you to work with clients all over the world.