Tether is one of the most popular cryptocurrencies, which is used not only for investments, but also for everyday transactions. In 2022, the volume of daily transactions in Tether was estimated at $45 million — this is higher than the figures of Bitcoin and Ethereum.

In this article, we will talk about the benefits of accepting payments in Tether, as well as how to integrate such payments into your company's website, withdraw USDT to your card, and maximize efficiency when paying with stablecoins.

Tether: What It Is

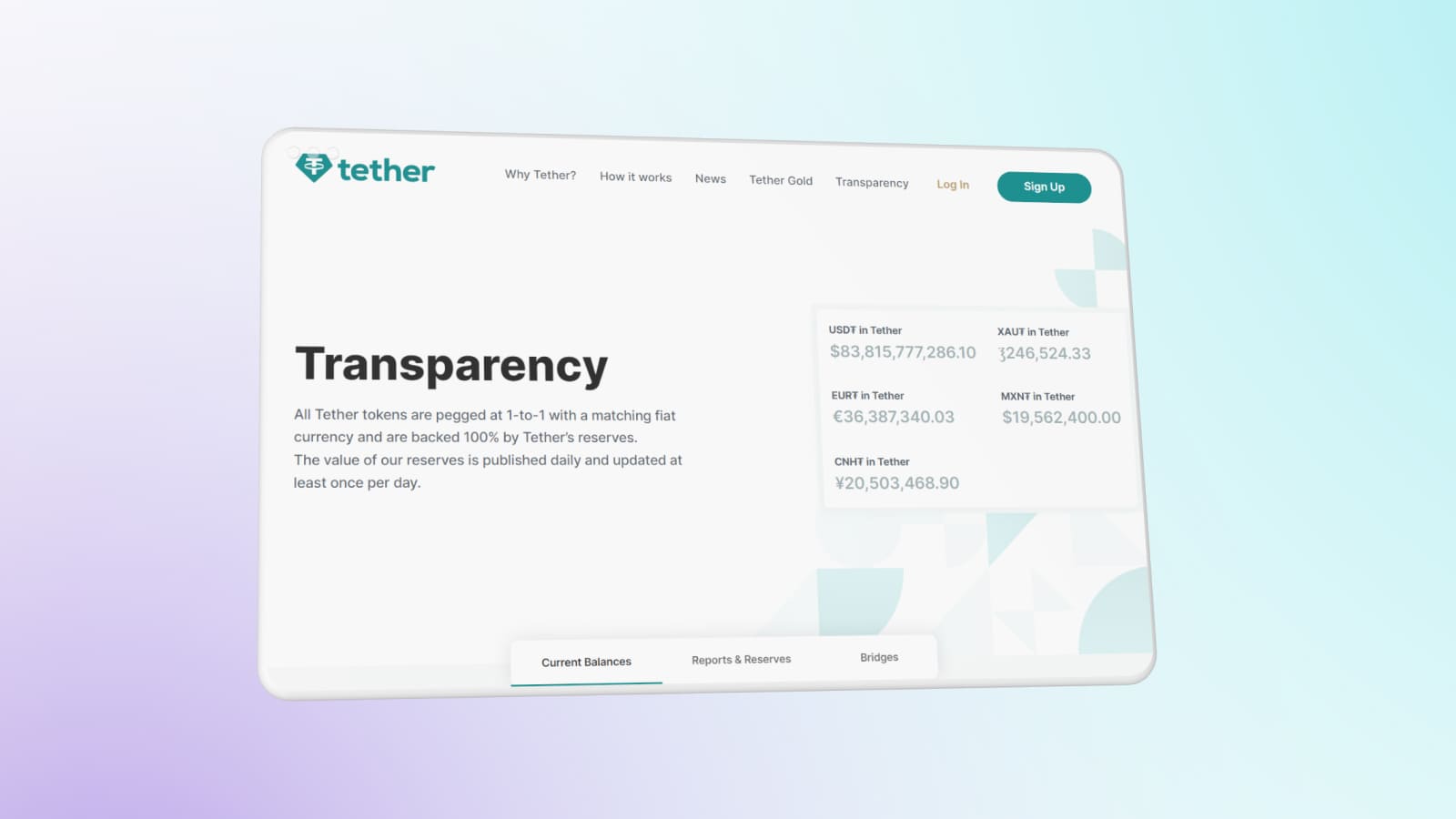

Tether (USDT) is one of the world's first steblecoins. Its exchange rate is pegged to the US dollar at a 1:1 ratio. The price of the koin can deviate from the dollar, but only slightly, which makes it the digital equivalent of this fiat currency. The market capitalization as of July 2023 is over $83.7 billion.

The difference between stablecoins and other cryptocurrencies is the linkage of their value to the underlying asset, which can be another currency, commodities, stocks, etc. The value of Tether is provided by the reserves of Tether Limited. More than 84% of these reserves are cash, 6.54% are secured loans, and 4.14% are precious metals. The company undergoes quarterly audits, the last one was conducted on September 30, 2023.

Read our article: «Tether (USDT) Backing: Is It as Reliable as Claimed?»

A wide range of large and small companies accepts payment in USDT. Among them are marketplaces (Paxful), travel and tourism services (Travala, Alternative Airlines, Arburton), software developers (Rock'n'Block) and many other brands.

Accepting Payments in Tether: Advantages and Disadvantages

Using USDT to accept payments on the website has a number of advantages:

- Speed. Due to the absence of intermediary banks, transactions, including cross-border ones, are processed in a few minutes.

- Commission. Its size depends on the chosen standard. Nevertheless, the fee for a stablecoin transaction is much lower than the fee for a bank transfer.

- Volatility. The rate is pegged to the US dollar and almost does not fluctuate unlike other cryptocurrencies, including Bitcoin. This makes USDT one of the most reliable stablecoins on the market.

- Transparency. The audit results of Tether Limited are in the public domain.

- Popularity. In 2022, Tether was owned by 32% of crypto users willing to pay with a stablecoin during online shopping. This figure puts USDT in third place after Bitcoin and Ethereum. Moreover, with crypto payments, merchants can attract more customers.

- Security. The use of blockchain technology provides a high level of protection against fraudsters.

The disadvantages of this stablecoin are incomplete anonymity (unlike, for example, bitcoin) and occasional rate fluctuations. Nevertheless, deviations from the dollar exchange rate are rare and, as a rule, do not exceed 1%.

Some crypto owners regard Tether with concern due to rumors that Tether Limited reserves are not able to provide 100% of the currently available stablecoins. In addition, the reason for apprehension is the company's official documentation, which does not guarantee the exchange of digital currency into dollars. Nevertheless, this risk is only theoretical at the moment. In fact, Tether remains the most popular stablecoin for both investors and other users.

How Businesses Can Receive Payments in Tether

You can accept crypto payments on a website or online store through direct transfers to a crypto wallet, by developing your own module or connecting cryptocurrency acquiring. Let's analyze in detail the advantages and disadvantages of each method.

Transfers to a cryptocurrency wallet

The easiest to implement method, which does not involve the use of additional services — transfer of USTD to a cryptocurrency wallet.

The entrepreneur needs to manually convert the amount of goods or services into cryptocurrency, determine the appropriate network, send the client the address of their wallet or QR code, track the payment, confirm the order. For each transaction, it will be necessary to sort out from whom and for what the transfer was received.

We have listed wallets that support Tether in the article.

Payment module development

Accepting cryptocurrency on the website can be done through your own payment module. This will simplify the process for both parties and automate the order placement by the buyer. Nevertheless, creating a module requires investment of both time and financial resources, and in case of a development error, the company may suffer serious losses.

Connecting crypto processing

Using a cryptocurrency payment system provides checkout automatization without the need for the entrepreneur to invest money in the development of his own module.

The buyer selects the appropriate cryptocurrency, and then the order amount is automatically converted and displayed on the screen along with the commission rate and the address to which the payment should be sent. The payment is tracked by the system and confirmed automatically. The entrepreneur, on the other hand, gets access to statistics, order tracking and other features depending on the system chosen.

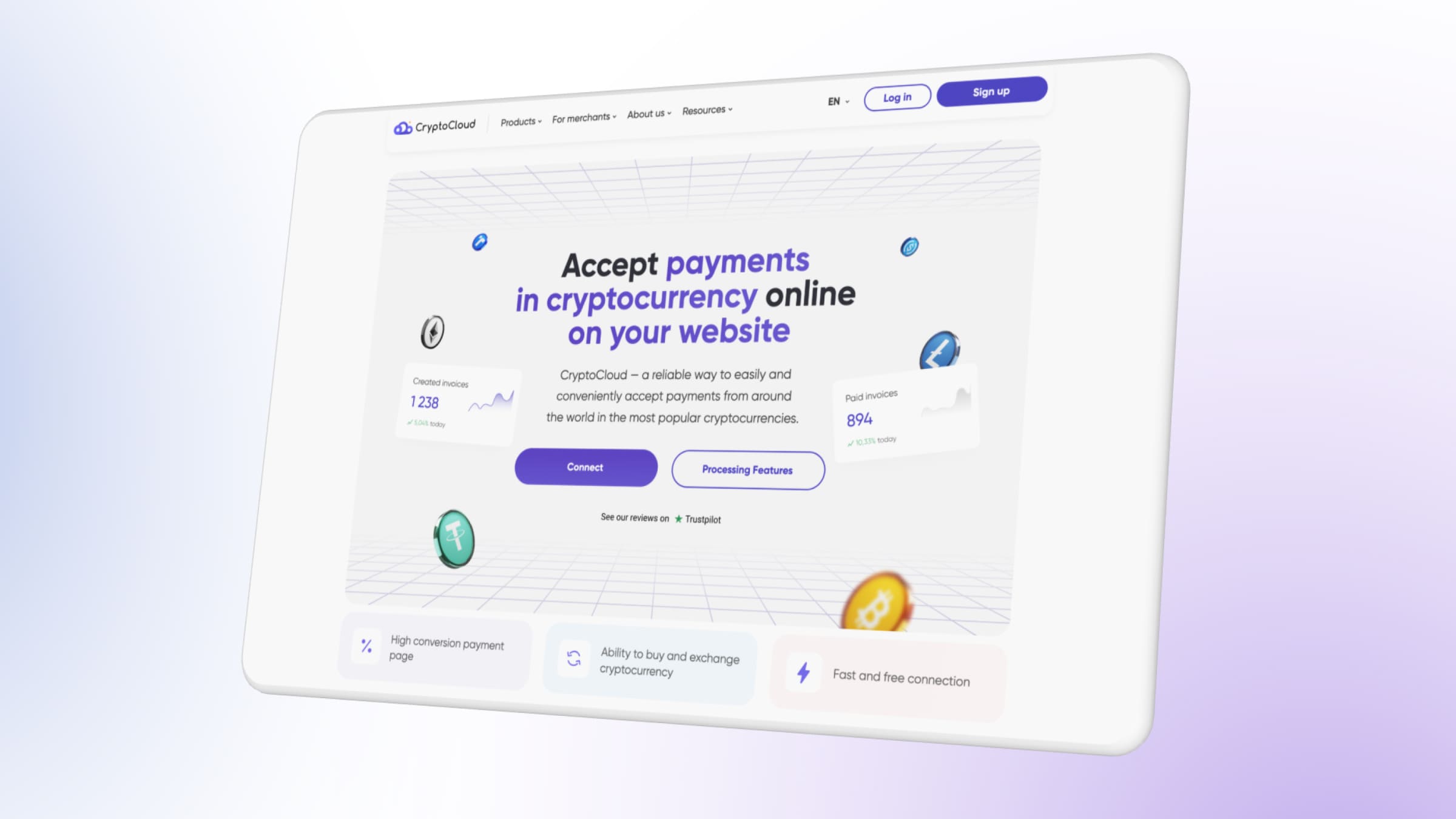

CryptoCloud for USDT Payment Acceptance

CryptoCloud is a platform for accepting payments in cryptocurrency, which supports transactions in Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Tether (USDT), True USD (TUSD) and others. Its connection is accomplished in a few steps:

- Registration. A valid e-mail is required.

- Adding a project. To do this, you need to fill out a short questionnaire with information about the company. You can link several projects to one account.

- Integration. There are three available methods: API, module for CMS, HTML widget.

- Test the integration.

- Now you can accept payments in USDT and other cryptocurrencies.

In the personal account, the merchant can track transactions in real time, analyze statistics for a selected period, and upload information about orders to Excel. Notifications on all your transactions are also available: they will come to your e-mail or Telegram.

Read more about the cryptocurrency gateway in the article: «CryptoCloud crypto payment gateway: a full review».

7 Ways to Withdraw Tether

Withdrawing USDT to a card or e-wallet is possible in several ways:

- Crypto exchanges. It is possible to withdraw both to a bank card and to an online wallet or account in a payment system. This is one of the safest ways.

- Payment systems. If the service supports cryptocurrencies, the user can exchange it in the personal account at the current rate. Examples of such systems: Payeer, Advcash, Capitalist.

- Exchangers. Give the opportunity to quickly sell cryptocurrency and withdraw fiat to your account or wallet.

- P2P-platforms. Such services allow users to directly make transactions to buy and sell USDT Stablecoin or other cryptocurrency and protect both parties from fraud.

- Telegram bots. Both standalone bots and those that duplicate exchangers or p2p platforms are available. To sell stablecoins, you need to follow the bot's instructions and then make a payment to the specified wallet address.

- Cryptomats. They provide an exchange of USDT for cash.

When working with the CryptoCloud service, the merchant can withdraw funds to their cryptocurrency wallet or exchanger. Minimum limits are different for each coin and range from 1.7 to 20 dollars. There is no maximum exchange amount.

To withdraw, you need to click on the «Withdrawal» button in the «Balance» section and fill out an application, which specifies the currency and wallet address. Application processing takes no more than a couple of minutes.

Tether — Stablecoin for Your Business

Paying via USDT is convenient and beneficial for both business and customer. Tether is one of the most widely used digital currencies and more and more businesses are using it as a means of payment.

There are several ways to accept cryptocurrency payments. If you receive more than 10 transfers daily, the best option is to connect crypto processing. It automates payment acceptance and provides statistics on all payments.

CryptoCloud is one of the popular processing services. It provides cryptocurrency acquiring for online stores and online schools, as well as payment links, for example, for Telegram bots. Video instructions will help you understand the connection procedure. More information about the service — on our website and in the FAQ.