Payment methods are evolving along with online technology — more and more shoppers abandon cash, even for offline payments. In 2022, only 14% of Americans used banknotes to pay for their purchases — and that percentage continues to decline.

Store customers prefer bank cards, online wallets and other payment options, with more young shoppers turning to «Buy Now, Pay Later» (BNPL) services.

It is important for e-commerce businesses to keep an eye on the current market and offer customers a variety of online payment methods on their store's website. We have prepared a brief overview of the main methods, from the popular to the less obvious ones.

Main Payment Methods

Bank card

Payment by card on the website is one of the most popular payment methods: it is familiar, reliable and easy. According to experts, credit and debit cards are used by more than 55% of customers.

This payment option is convenient, first of all, because of the simplicity of order placement. Customers do not need to create an account in an online wallet or authorize on third-party services: they just enter the card details. It should be taken into account that in order to make such a transaction, a business needs to ensure data protection: the payment system used on the website must meet security standards.

E-wallet

Online wallets are another website payment method that many customers use. The market for such wallets is huge, from popular ones like PayPal or Google Pay to lesser known options.

Most of them offer businesses the option of integrating their own online payment service into the website. In addition to the usual checkout, the store can place a payment button that redirects the buyer to the website of the e-wallet. This guarantees data protection: all transactions are made on the website of a verified system, which increases the client's trust in the company.

Cryptocurrency

Crypto transactions are a method of online payments that started gaining popularity relatively recently. While earlier users considered cryptocurrency more as a tool for earning and investment, now more and more companies and their customers recognize digital currency as a means of payment. Such transactions are convenient, secure and anonymous.

There are several ways to connect crypto payments to your website — integrate a payment system, place a link or QR code, organize direct transfers from wallet to wallet. We recommend considering the available options and connecting cryptocurrency as an additional payment method in your store — this will help increase conversion rates and attract new audiences, including those from abroad.

Buy Now, Pay Later

This option has surged in popularity as a flexible payment method that allows customers to purchase items immediately and pay for them over time. Typically, BNPL services divide the total purchase amount into a series of equal, interest-free payments, often spread over a few weeks or months.

This option is particularly appealing to younger consumers who may lack credit history or prefer not to use credit cards. The benefits for businesses include increased conversion rates and higher average order values, as customers are more likely to complete their purchases when offered the option to pay later.

Installment loans

Installment loans provide another viable method for consumers to finance their online purchases. Unlike the interest-free model of BNPL, installment loans often come with interest rates and are repaid over a longer period, ranging from several months to a few years.

This option is suitable for larger purchases where spreading the cost over time can make high-ticket items more affordable for consumers. Financial institutions or specialized fintech companies usually offer installment loans directly at the point of sale on e-commerce platforms.

Services like PayPal Credit are prominent examples that facilitate these loans, offering flexible repayment terms tailored to the consumer’s financial situation. For businesses, offering installment loans can help attract customers who may be hesitant to make significant upfront payments, thereby enhancing customer satisfaction and loyalty.

Cashless payment for legal entities

To accept payments on the website, it is not always necessary to connect third-party services — in some cases, direct bank transfers using the company's details may be relevant for businesses. This method will eliminate the commission for online payment, reducing costs.

For customers who are afraid to enter their payment details on the website, this method may also be preferable. However, it should be remembered that for most customers, direct transfers are likely to be inconvenient — this method is recommended to be used in combination with others, not instead of them.

Payment link or QR code

Another option for organizing payment acceptance for an online store without additional integrations is the use of payment links. The entrepreneur will still need to create an account in the payment system, but instead of connecting a checkout, the service generates a link or QR code, which can be placed both on the website and in social networks or an email.

A customer when clicking on such a link will be redirected to a familiar payment page where they can enter their payment details.

To increase conversion, it is recommended to use several payment methods simultaneously. Having different options also reduces cart abandonment — according to Stripe, 86% of shoppers are ready to abandon an order if their preferred payment method is not presented on the website.

How to Organize Online Payments

There are three main ways to connect online payment processing for an online store and automate the processing of transactions:

- Bank acquiring. Allows you to accept payments from bank cards. Normally, such systems provide a high level of data protection and are trusted by customers.

Nevertheless, when connecting such a service, an entrepreneur may encounter both high commissions and multi-stage security checks — this should be taken into account when planning integration. It's better to familiarize yourself with the terms and conditions in advance. - Payment aggregator. Aggregators are services that allow you to accept payment in several ways at once: bank cards, e-wallets, payment services, etc.

An entrepreneur enters into an agreement only with an aggregator — there is no need to register separately in each payment system involved. This makes it possible to connect a variety of payment methods in a minimum period of time. The disadvantage of such services is high commissions compared to other options.

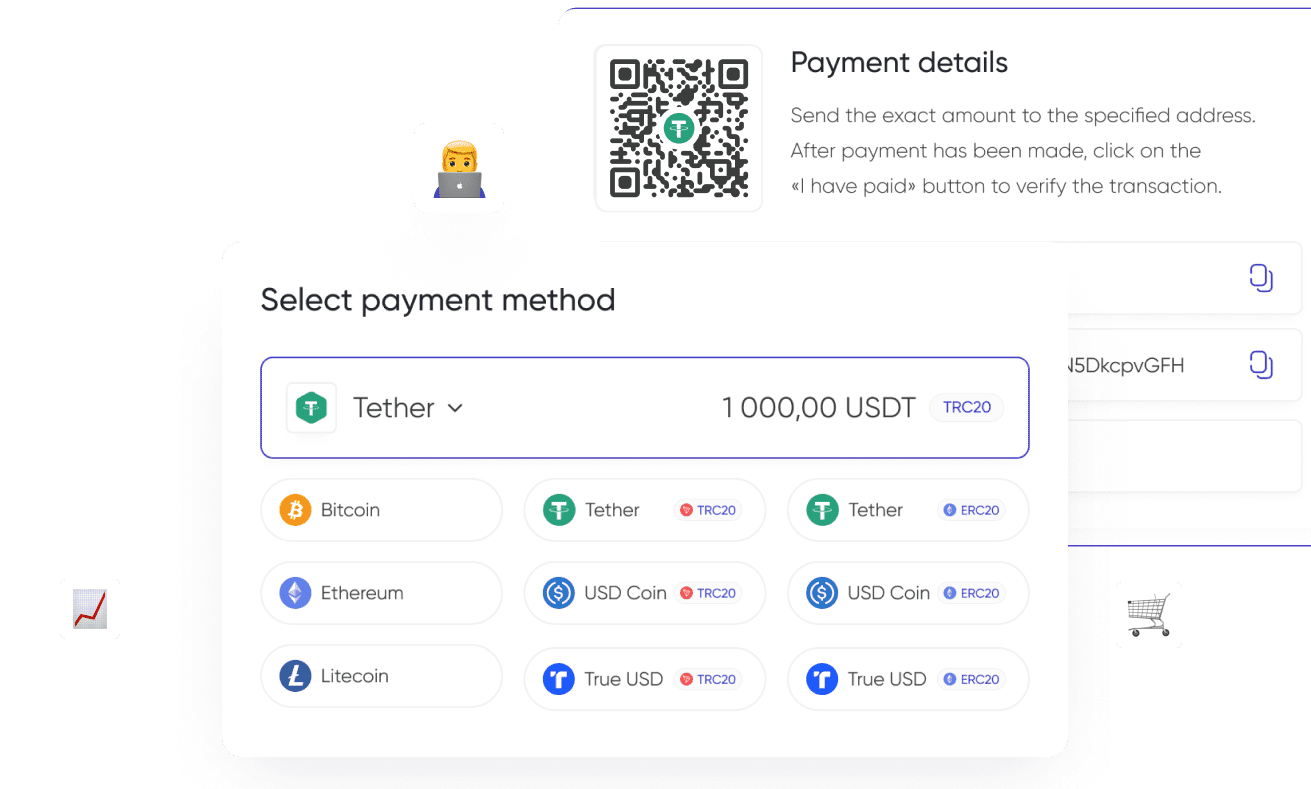

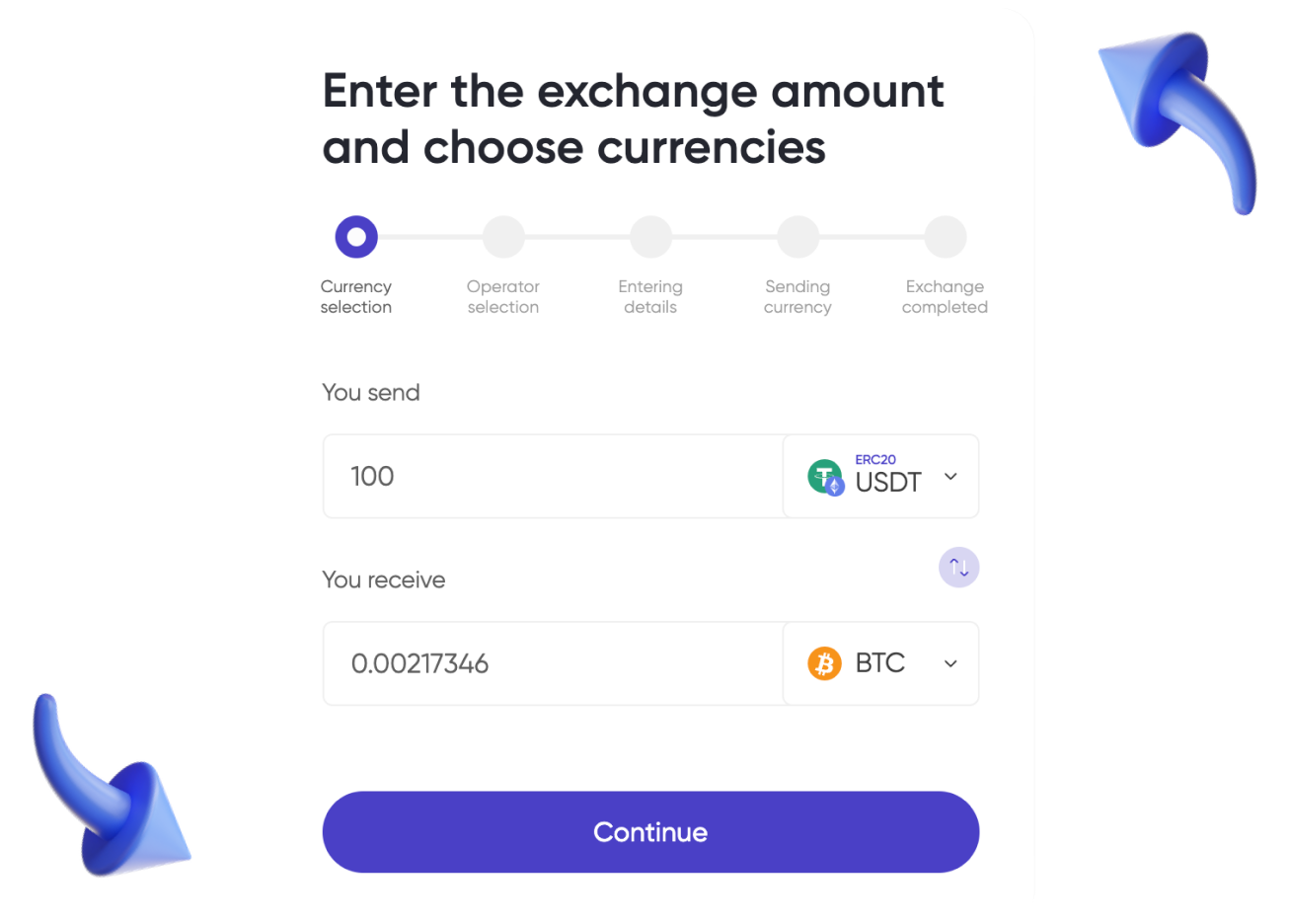

- Crypto processing. Such services allow you to use cryptocurrency as a means of payment. When paying, the system converts the amount of the order into the currency chosen by the client, calculates the commission, displays the address and QR code for payment.

Transactions are automatically tracked, confirmed and displayed in the merchant's personal account for further withdrawal of funds to a cryptocurrency wallet or (in some services) directly to a bank account in fiat currency.

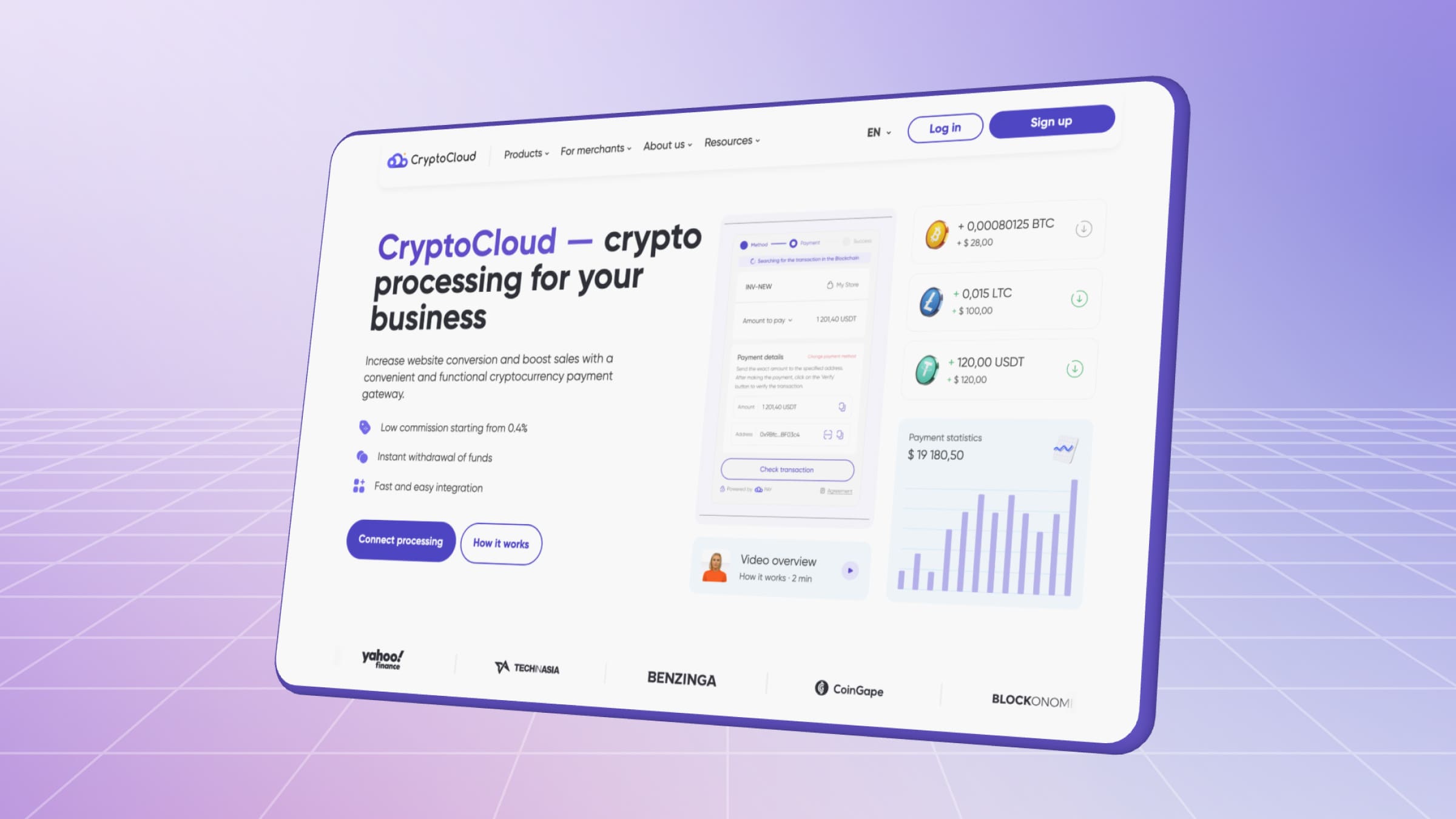

Accepting Payments with CryptoCloud

One of the services that allow you to accept cryptocurrency payments on the website is CryptoCloud. It is a system with multi-lingual checkout and support for major cryptocurrencies — BTC, ETH, LTC, USDT, TUSD and others.

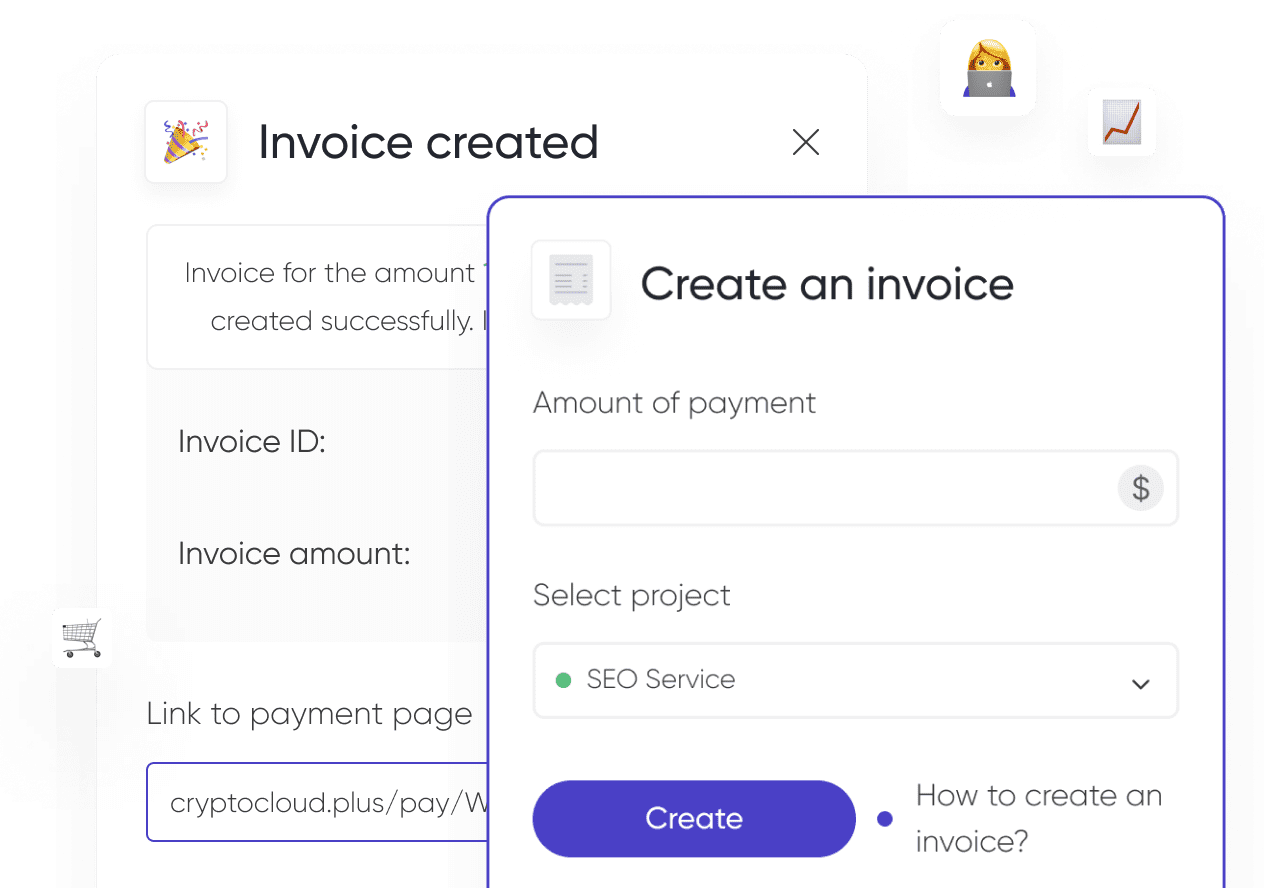

Cryptocurrency processing functions include payment on the website through the checkout page, use of permanent and one-time payment links, invoicing. In the personal account, the merchant can view the history of transactions, work with statistics. The number of projects that can be connected to one account is not limited.

Cryptocurrency acquiring for an online store can be connected free of charge. Integration is performed via API, HTML or ready-made modules for CMS. The commission starts from 0.4%. Withdrawal of funds is within a few minutes.

Processing Payments in an Online Store

Modern e-commerce business has access to a wide range of services and systems that allow you to accept online payments. Their competent use helps to improve the shopping experience and increase conversions.

We recommend not to focus on the usual payment methods and connect additional opportunities for customers to the website — for example, crypto processing. CryptoCloud service will help to organize the acceptance of payments in cryptocurrency and provide customers with convenient, fast and secure payment of orders.