Stripe is a payment system used by companies in 46 countries. Nearly 1.2 million websites accept payments through Stripe. In 2022, the system processed over $817 billion worth of transactions, including for 100+ leading companies with annual transaction volume exceeding $1 billion.

In the article we will tell you why this system has earned its popularity, what functionality users can count on and how to connect the system to your website.

Stripe: Quick Overview

Stripe is an international payment system, with functionality designed primarily for e-commerce businesses. This service is a tool that can be customized for the needs of a particular company.

In addition to a convenient payment gateway, Stripe offers instruments for reporting, tax management, dispute resolution, and recurring payment processing. The electronic payment system supports more than 100 payment methods and over 135 currencies, and allows working with customers in 195+ countries.

The service also offers a high level of security. Since Stripe is designed for business, the payment gateway complies with all the necessary standards required for e-commerce. In addition, the system includes a number of tools to protect businesses from fraud, such as Stripe Radar, which tracks suspicious transactions, and chargeback protection.

Using Stripe does not require a monthly subscription payment. The system works in a commission format. The standard rate when paying with a bank card is 2.9% + 30¢ per transaction. The cost may differ when using other payment methods, as well as when additional services are connected.

The current charges you can find on the official website. Large companies have the option of an individual rate, the terms of which are discussed with a representative of the platform.

System Functionality

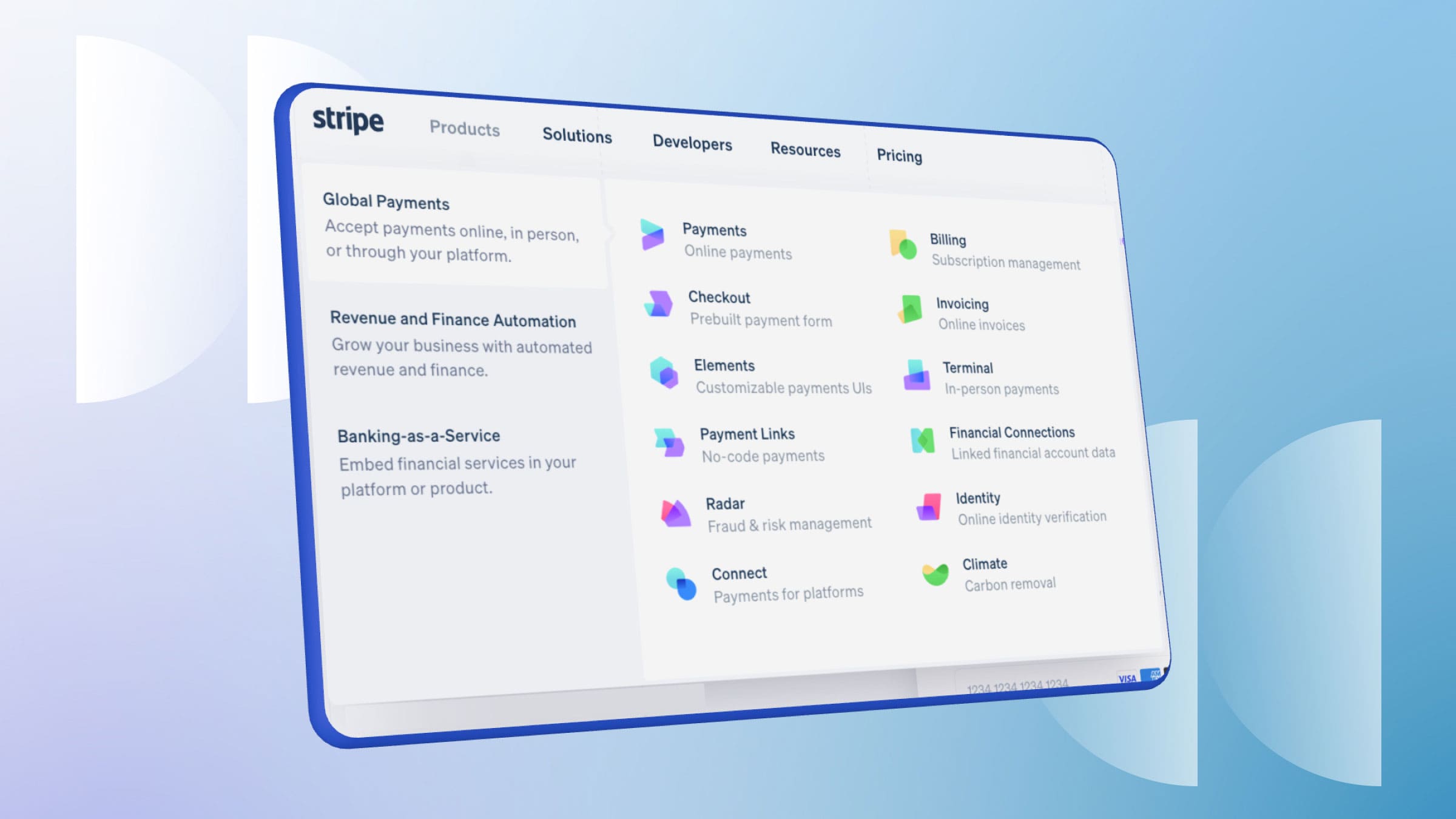

The service offers a number of useful business instruments, up to paying taxes and controlling a company's carbon footprint, but Stripe's main functionality is accepting international payments. There are several main products available to users:

- Checkout is a built-in payment gateway that integrates into the website. Entrepreneurs can use a ready-made checkout or customize it to fit the company's needs. The payment gateway is optimized for all devices, is available in 30+ languages, loads quickly, offers the customer maximum convenience and speed of payment, and meets security requirements.

- Payment links — accept payments from abroad and within the country through payment links. An option for companies that operate via social networks, messengers and other platforms where checkout integration is impossible or inconvenient. The status of invoices can be tracked in the personal account.

- Invoicing — one-time or recurring billing. Like checkout, Stripe invoices are customizable — in addition to design, you can add discounts, promotions, the ability to use a promo code, specify the tax rate, etc. The functionality also includes sending reminders to the buyer's e-mail.

- Billing — acceptance of recurring payments. A tool for companies working in the subscription format. Besides regular recurring payments, more advanced options are available: for example, with payments for additional services/content, with a free trial period, with partial payment (e.g., in case of premature subscription cancellation), etc. There are two plans available: Starter and Advanced.

- Radar is a tool to protect against fraudulent transactions. Radar is built into the system by default: no additional connection actions are required. The system is powered by machine learning and utilizes Dynamic 3D Secure when processing high-risk transactions. The cost is 5¢ per transaction (no commission is charged to users who have activated the standard plan).

Platform Advantages

Stripe's online payment acceptance service is popular for a number of reasons:

- International payment processing. The system is available in almost 200 countries and supports 135+ currencies, as well as allows you to work with local payment methods (100+ available methods). This provides the ability to accept payments from buyers from all over the world.

- User-friendly functionality. In addition to checkout integration, users can work with payment links, making Stripe a convenient option for those who don't have their own website and use social media or messengers for promotion.

- Centralized control panel. All necessary tools are available in the personal account. You can work with the system not only in the browser version, but also via a smartphone app.

- Developer tools. Stripe is the most customizable online payment system with a special developer panel (450+ tools).

- Templates for fast work. Users can use ready-made solutions or create custom ones.

- Dispute management tools. Dispute handling is automated and completed in minimum time. The status can be tracked in the personal account.

- Fast withdrawals. Instant Payouts allows you to instantly withdraw money to your bank account.

- High level of security. According to the requirements for transactions performed online, the payment system for the website has a PCI Service Provider Level 1 certificate. Payment and personal data are protected by encryption.

- High-quality tech support. You can contact tech support representatives via phone, online chat or e-mail. Users also have access to a range of informational materials and guides on how to use the system.

Connection Requirements

To connect an international payment system, you will need to pass a range of anti-fraud checks.

First of all, it is necessary to make sure that the company's sphere of activity is allowed for connection of the payment system. Stripe cannot be used to sell illegal goods, distribute 18+ content and services, sell products that violate intellectual property or mislead users.

Some industries are in the «gray zone» and must be approved by the company — for example, financial and insurance services, crowdfunding, and medical products. An up-to-date list of prohibited and regulated areas can be found on the official website.

If a business operates in an area permitted by the rules of the service, it requires an identification procedure to connect. The business owner must confirm their identity and bank account ownership, as well as provide the company information requested by the service (physical address, website and other data).

Finally, the final step to connect Stripe is to check the risk level. The website's compliance with security requirements, availability of necessary pages (terms of cooperation and return, privacy policy, etc.), accuracy of descriptions, and contact information are assessed.

Stripe Integration

Stripe supports a number of out-of-the-box integrations with popular e-commerce platforms. One of the integration options is Stripe Connect: a tool that allows you to quickly link Stripe Checkout to the system you need. The list of integrations includes Shopify, WordPress, WooCommerce, Telegram, Getcourse, Tilda, Wix, Etsy, Payoneer, 3dCart, etc.

Users also have access to applications that allow them to manage the company more efficiently: to manage reporting, logistics, calculate taxes, work with analytics, etc. An up-to-date list of partners is available on the official website — and systems that are not included in it can be connected via API.

Accepting Payments with CryptoCloud

In cases when a company cannot connect an international payment system, accepting payments in cryptocurrency will help to continue cooperation with foreign clients. CryptoCloud crypto processing is a solution for processing crypto transactions, the functionality of which includes:

- automatic processing of payments through an integrated checkout: from value conversion to payment confirmation;

- generation of payment links for work via social networks, messengers or e-mail;

- placement of a permanent payment link to the project, when working with which the client himself enters the required amount — convenient for accepting donations;

- management of several projects through one personal account;

- the ability to choose the party that pays the network and platform commission;

- checkout customization with the addition of the company logo;

- statistics and analytics.

You can connect the service and start accepting payment via cryptocurrency for free and in a minimum period of time — you only need an e-mail address. The commission is from 0.4% per transaction. Ready-made modules for popular CMS-platforms are available for integration, as well as a structured API.

Withdrawal of funds is carried out within a couple of minutes. The system offers a high level of security, stable operation and convenient design, as well as high-quality technical support and extensive knowledge base.

Payment System for International Transactions

There are many services that provide international payment processing. One of the popular options is Stripe. The platform offers a number of tools for business, the possibility of deep customization, a user-friendly interface, and integration with popular platforms.

If it is impossible to create a Stripe account, an alternative is CryptoCloud — a convenient crypto payment processor.