Connecting payment processing is an important stage of launching any business, from education to an online store. A payment processing method must be convenient for customers, offer all the functions necessary for the seller and work at favorable rates.

We explain Internet acquiring, which international systems are worth considering, and what factors should be taken into account when choosing an online payment system.

What Is the Internet Acquiring

Internet acquiring for an online store or other online business is a service that involves processing cashless transactions on the company's own website or on another platform through which the entrepreneur operates (e.g. an e-commerce website or social media). There are several basic types of acquiring for online businesses.

- Bank acquiring. The advantages include a high level of security. In addition, fewer intermediaries are involved in the transaction than when working through third-party systems, thanks to which commissions can be relatively low. The number of payment methods is limited: as a rule, only cards.

- Payment system. A third-party online payment service is used. Such Internet-acquiring services usually have higher commissions than banks, but the set of functions is larger, from in-depth statistics to tax calculation. The list of available payment options is wider than that of bank acquiring.

- Crypto acquiring. A system for accepting payments in cryptocurrency. Many users connect it as an additional service. It allows you to work with clients from abroad and offers high security and low commissions.

Internet Acquiring Platforms

Stripe

Stripe is an international system that accepts online payments. It is designed for businesses and offers several opportunities, from accepting payments on various sites to maintaining reports and organizing business processes.

The advantages include various developer tools for customizing the payment page and anti-fraud protection. The system supports several international and local payment methods, which simplifies working with clients from different countries.

We also recommend you reading our article: «Stripe: Features and Advantages of International Payment System».

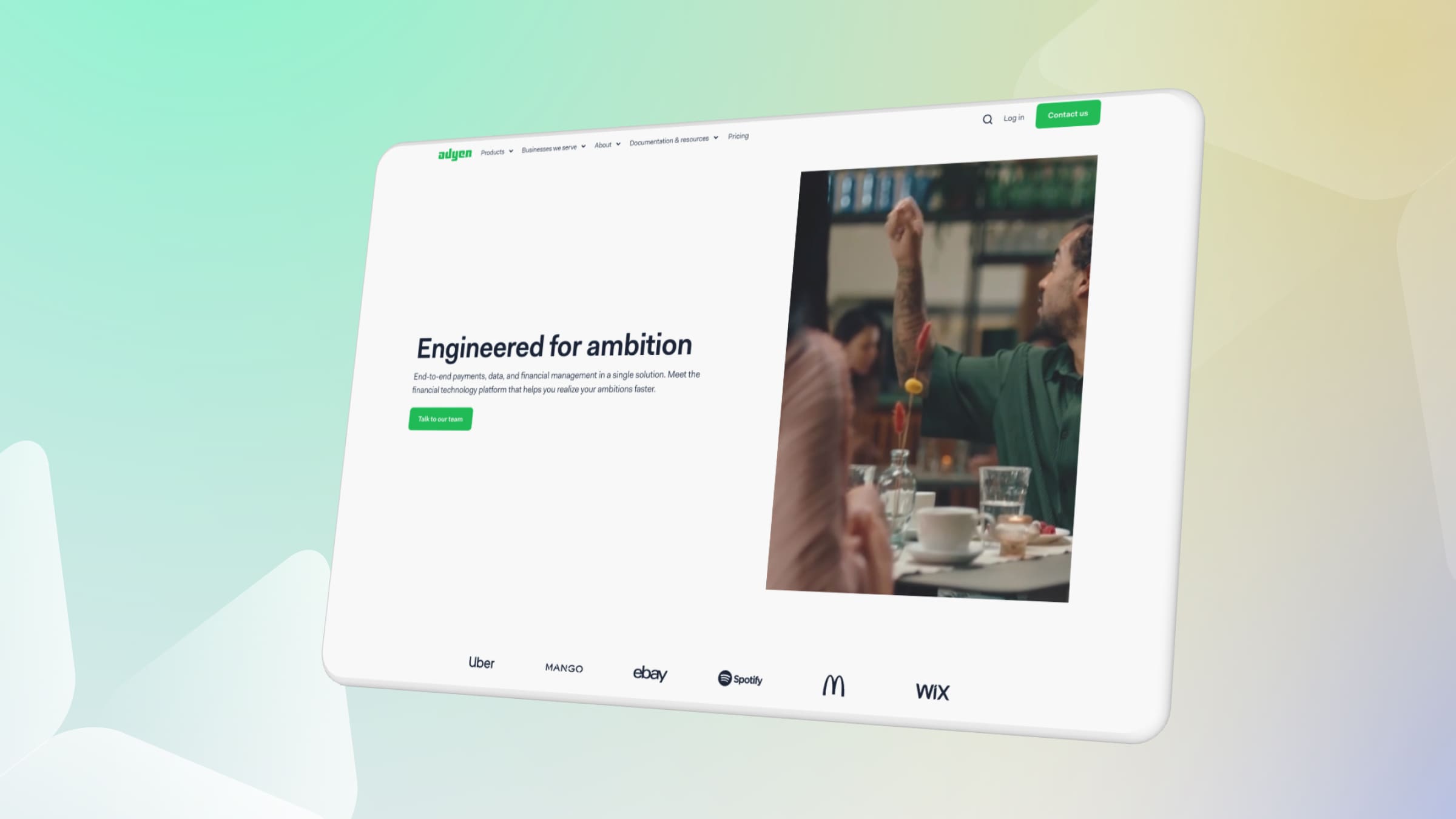

Adyen

Adyen is a cross-border payment system that includes tools for processing payments through online acquiring and for receiving funds at physical points of sale. Unified Commerce processes data from all of the company's involved websites, allowing revenue to be tracked through a single interface.

The system offers flexible options for working abroad, from support for local payment methods to automatic transactions in local currency.

PayPal

PayPal is a popular e-wallet that also offers an Internet acquiring option. The system includes a standard checkout, where a customer can pay for an order with a bank card or other method, and a payment button from a PayPal account.

A user-friendly interface, easy integration and a wide range of ready-made modules for various platforms and online stores characterize the service.

Read more about the platform in the article: «PayPal: International Payment System Features Reviewed».

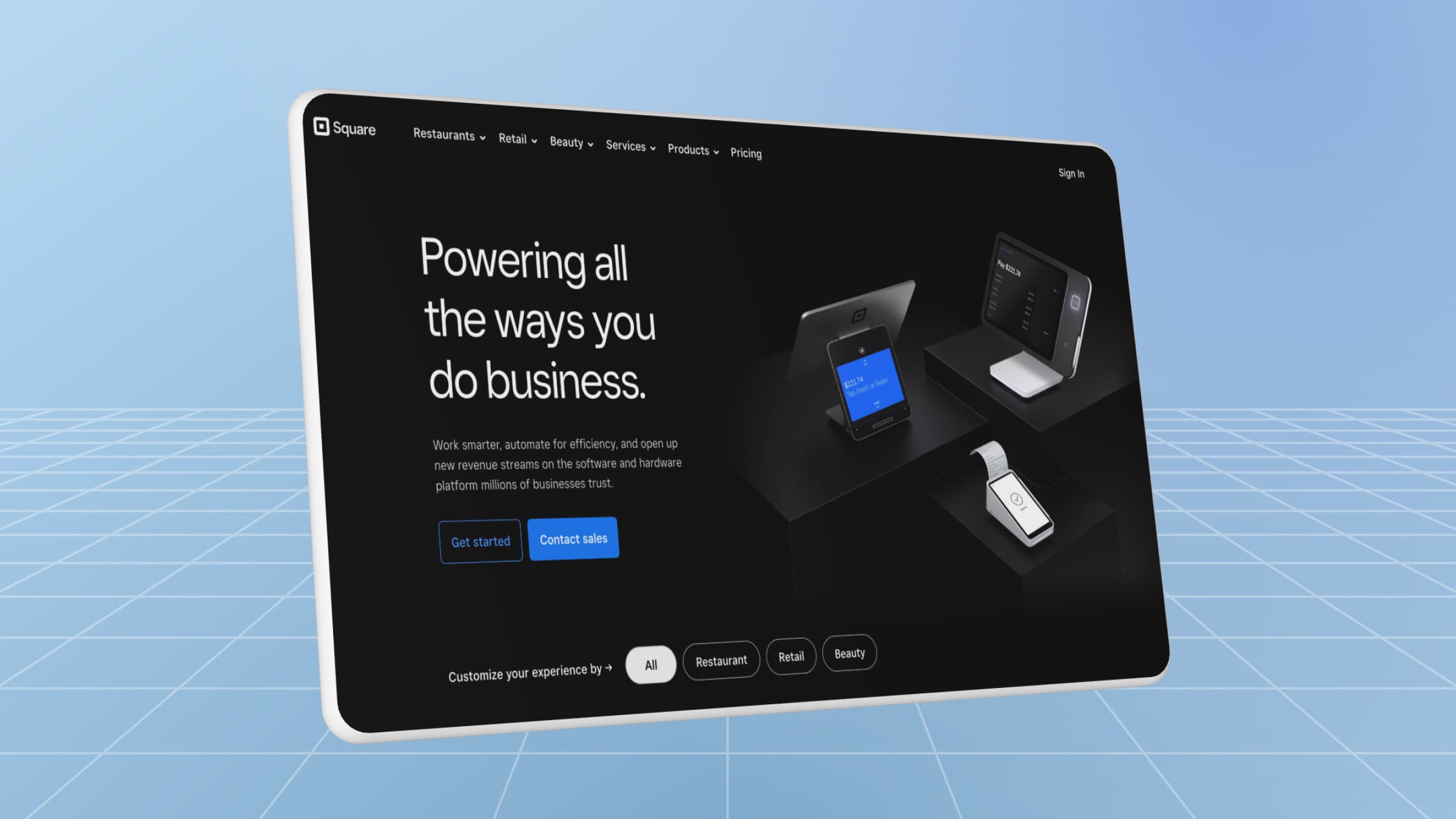

Square

Square is an international aggregator focused on online stores. In addition to accepting payments on the website, the functionality includes hosting a store, connecting a shopping cart, and using other tools to start a business. It is possible to connect to checkout and work through links and terminals.

Another payment method is the Afterpay installment service, which customers can use at checkout.

Authorize.Net

Authorize.Net is a payment system available to entrepreneurs in the USA, Canada, Australia, and the EU. Its functionality allows you to connect online payments, work in a subscription format with monthly/annual payments, allow users to make installments, and offer bonuses for loyal customers.

To work with the system, an entrepreneur can use a ready-made trading account or choose a tariff that includes trading account opening.

Crypto processing CryptoCloud

One of the disadvantages of international acquiring for online payment is that most services are subject to sanctions restrictions.

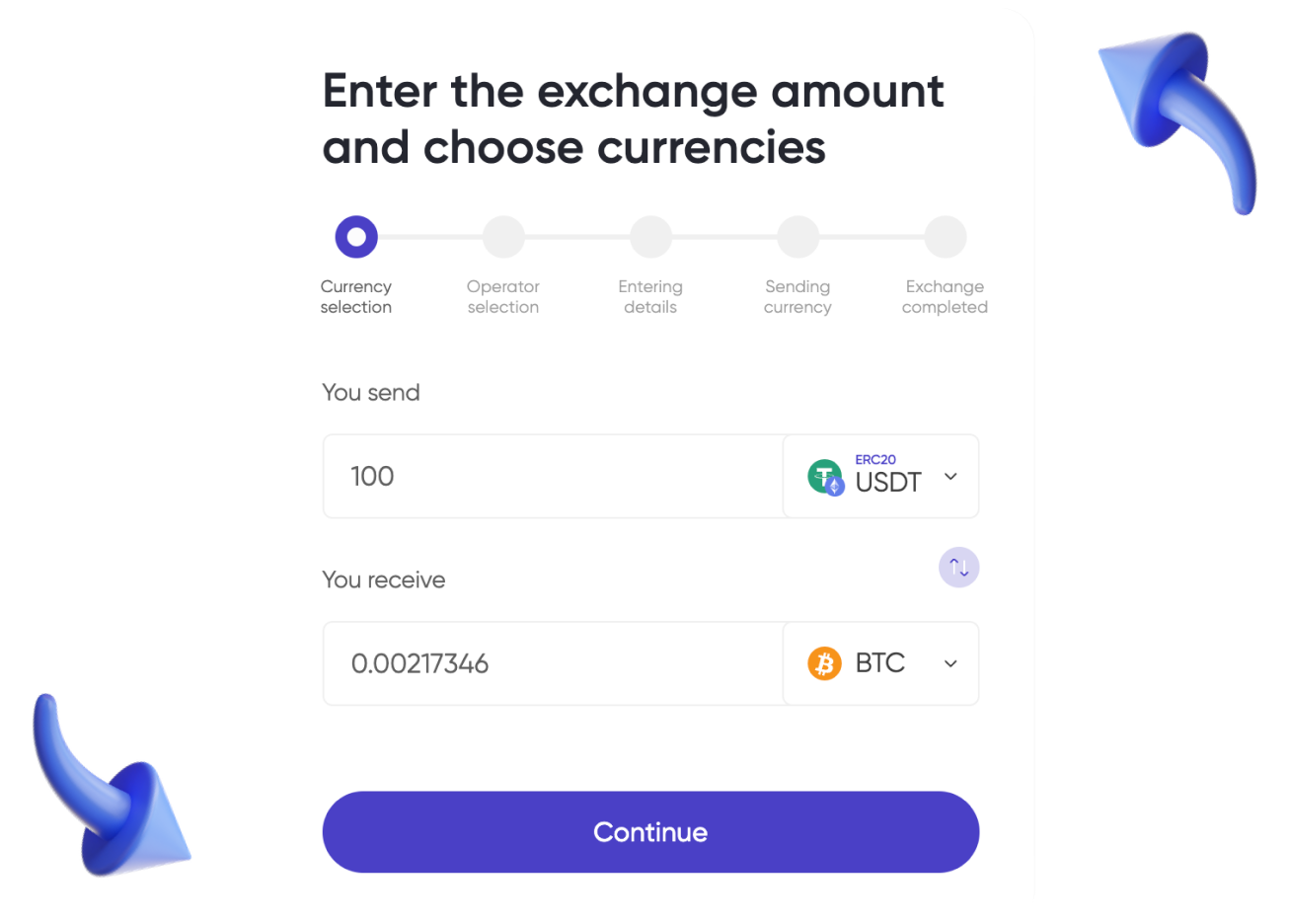

An alternative way of working with foreign clients is to accept payment in cryptocurrency. Crypto transactions do not depend on sanctions and allow payments to be received normally.

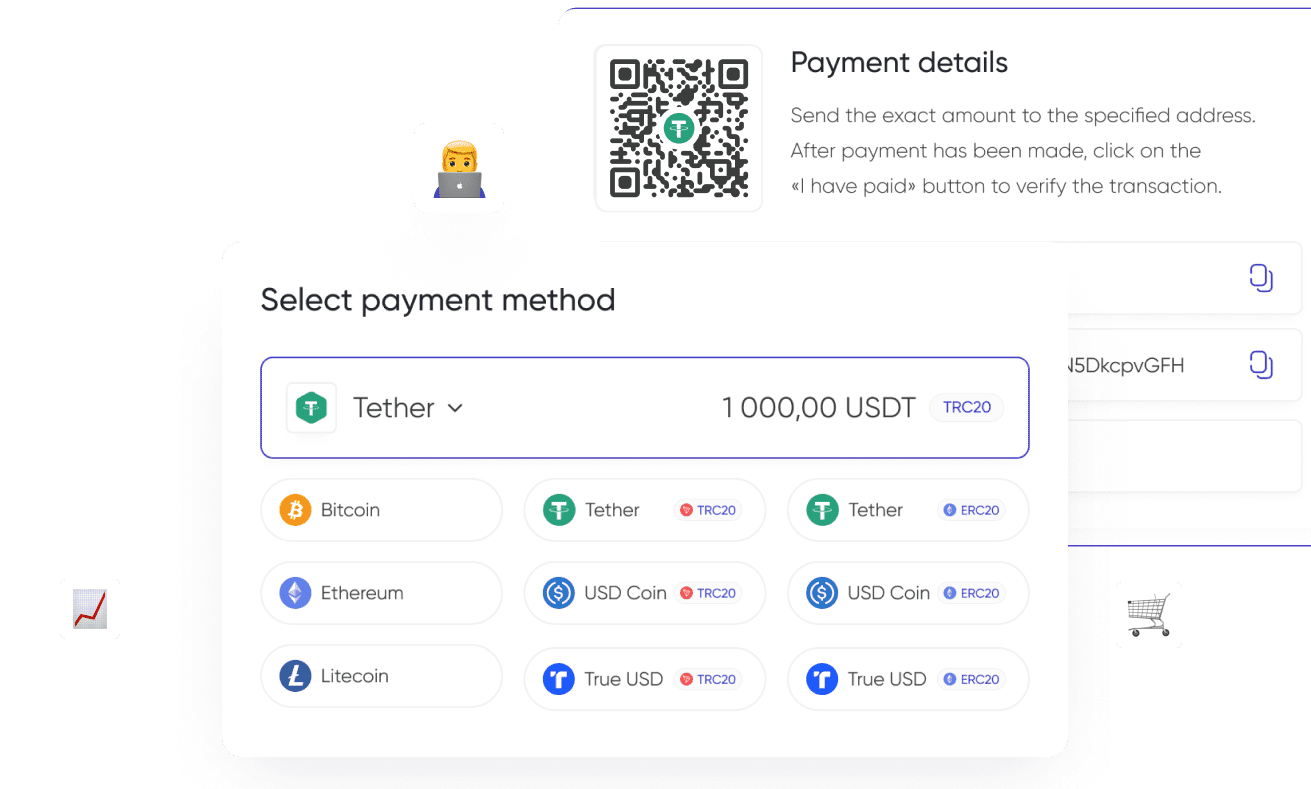

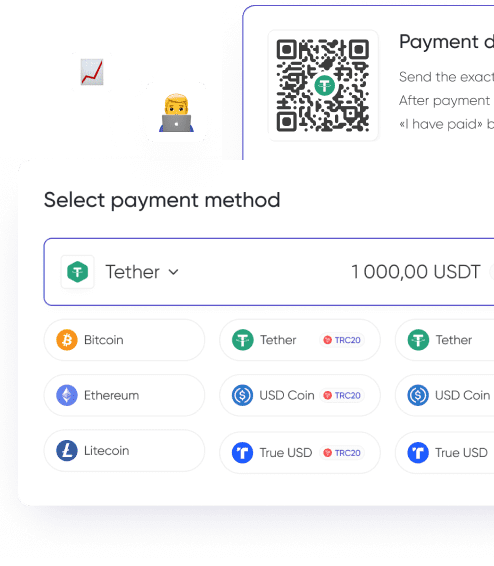

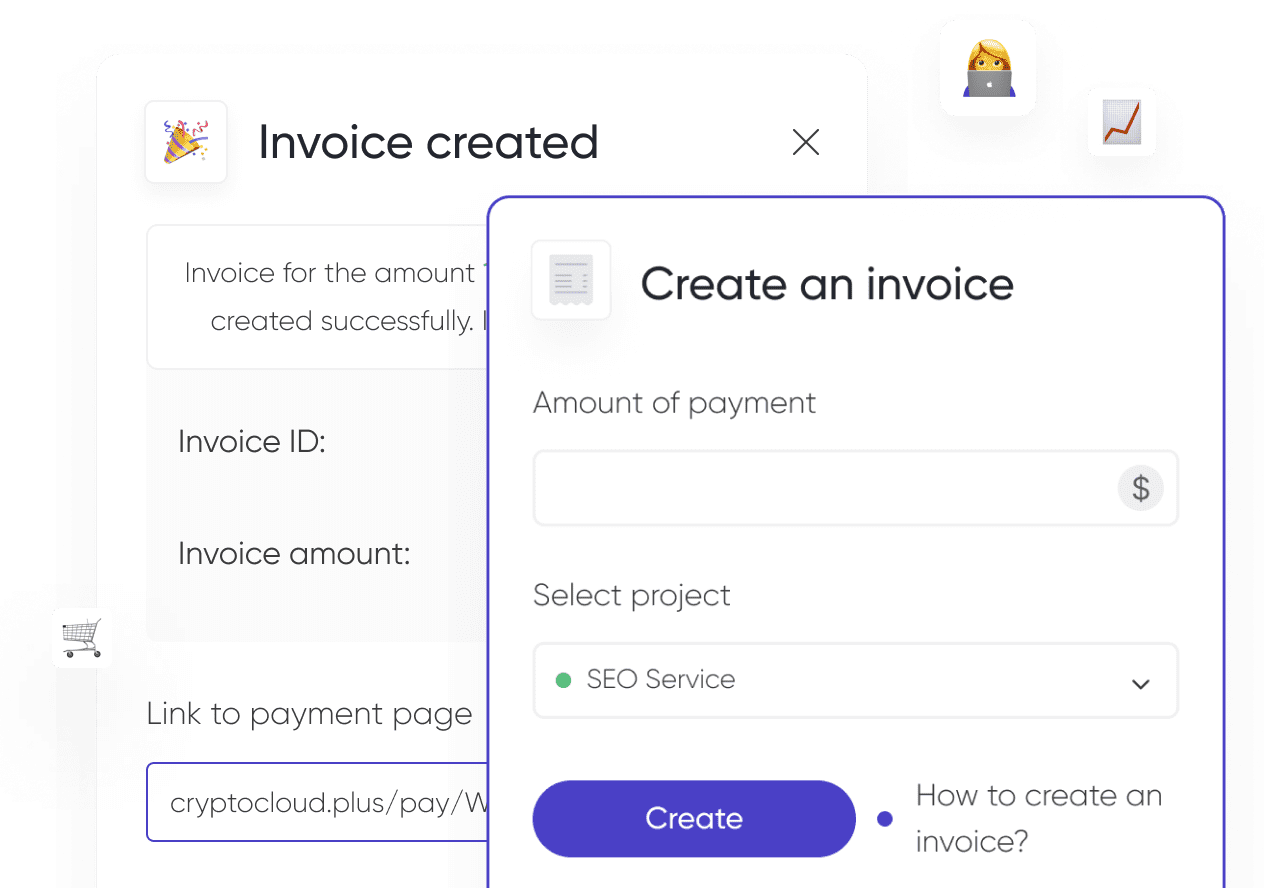

Crypto acquiring CryptoCloud will help organize the receipt of payment in cryptocurrency. The system works with major currencies, offers multilingual checkout for cooperation with clients around the world, and guarantees the security of operations: protection from DDoS attacks, encryption, storage of user data on cold wallets, and AML checks of operations.

Customization is possible: adding the company logo to the payment page, selecting the payment side of the commission, and setting the accuracy of transactions. Entrepreneurs can quickly withdraw funds in supported currencies, work with analytics, and provide access to the personal account to other company employees.

How to Choose a Payment System

The e-commerce market offers a wide range of services. You can choose the right one according to several criteria:

- The size of commissions. It is necessary to focus not on the minimum fees but on the rates for payment methods that are in demand among the target audience — for example, bank cards or e-wallets.

- Hidden payments. Additional fees may be charged for various reasons, such as using optional functionality, exceeding the established transaction limit, or a large percentage of returns. It is important to familiarize yourself with the terms and conditions in advance.

- Requirements for connection. A number of systems work only with legal entities and do not cooperate with the self-employed. The service may impose requirements to the website or request verification.

- Security. Both measures to protect customer data (encryption, compliance with security standards for the checkout page) and tools to prevent fraud or hacking of the company's account should be evaluated.

- Tech Support. Promptness of technical support increases the chances that the problem will be solved in a minimum period of time and the company will not suffer losses due to failure or user error.

Accepting Online Payments: Which Service to Choose

The convenience of the payment process is an essential factor in increasing conversion. The interface should be clear, and the transaction should be processed quickly. In addition, it is important to provide the user with a preferred payment method.

For this purpose, many companies use several acquiring services simultaneously: for example, a traditional payment system with support for local payment options can be combined with cryptocurrency processing. Entrepreneurs also turn to CryptoCloud, a system with checkout in several languages, high-quality tech support, fast connection and a user-friendly interface.