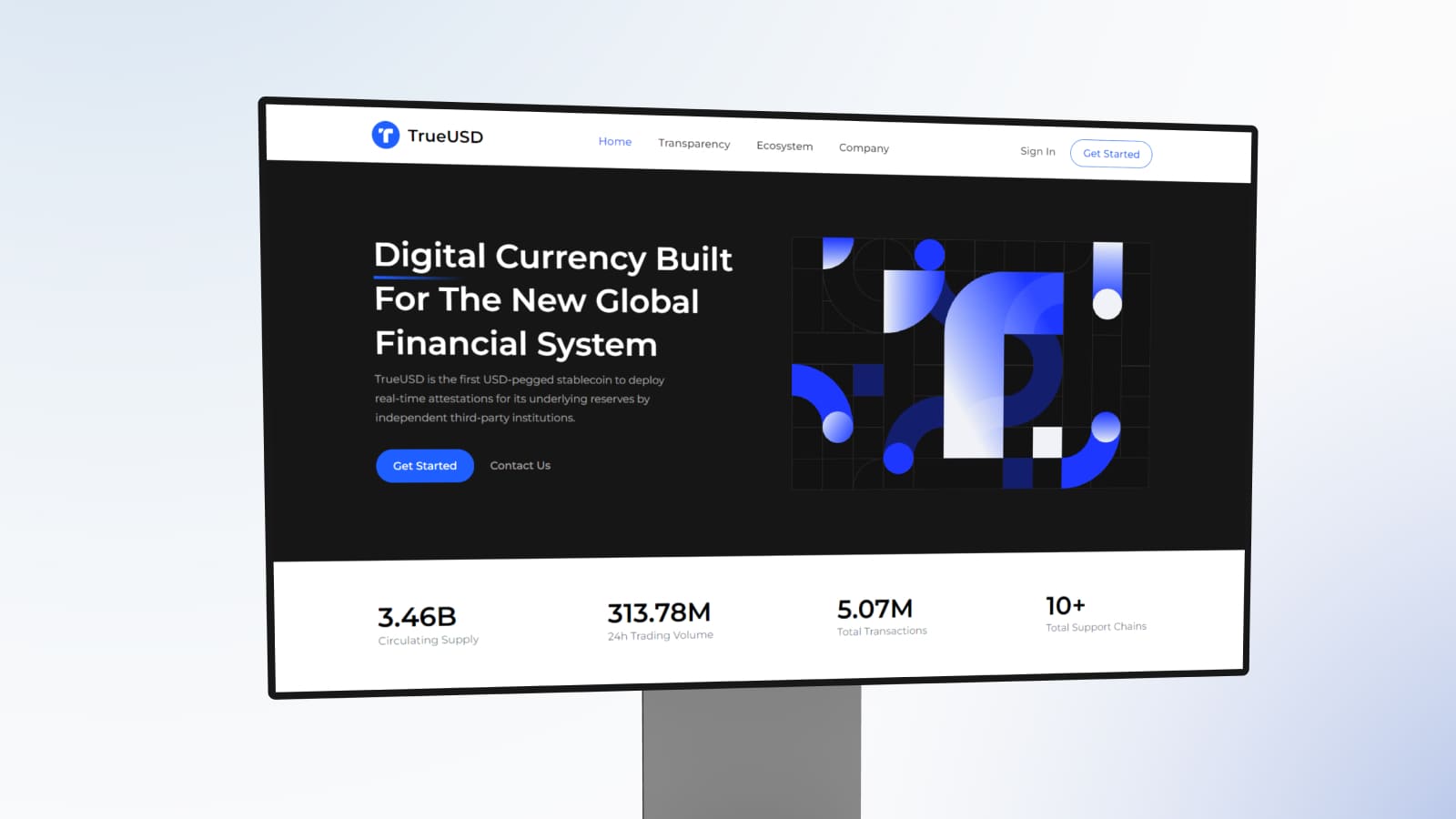

True USD (TUSD) is a stablecoin that is pegged to the U.S. dollar. It ranks 23rd among all cryptocurrencies — the current market capitalization of TUSD is $3.1 billion. By the volume of currency sold in 24 hours, True USD is in 11th place in the CoinMarketCap ranking. This is a reliable and affordable coin, with which most major crypto exchanges work.

In the article we will tell you what are the features of this stablecoin, when TUSD was officially launched, how it differs from USDT and how to accept payments in this currency.

TUSD: What Is It

TUSD is a cryptocurrency (stablecoin) pegged to USD at a 1:1 ratio. It was launched by the company TrustToken. Each token in circulation is backed by a USD in reserve. The reserves are spread across several banks and owned by multiple trust funds.

The goal of True USD was to develop a reliable, simple and «transparent» stablecoin. Therefore, the token does not use hidden bank accounts or special operating algorithms. TUSD is based on the ERC-20 standard, which ensures its compatibility with most blockchain networks. It operates on the basis of a smart contract:

- when buying TUSD tokens, the user's money is sent to the account of one of the TrustToken trust funds, and the smart contract automatically generates the necessary number of stablecoins, adding them to the existing circulation;

- when sold, the tokens are «burned», permanently leaving the circulation, and the user's account receives the required number of US dollars.

The tokens can be purchased by any user who has undergone the KYC procedure.

Brief History of True USD

TUSD is a stablecoin that was launched in March 2018. It was developed by TrustToken in cooperation with PrimeTrust. Half a year after the launch, the token's turnover reached $100 million.

The goal of the creators of the token was to maximize the stability of the TUSD exchange rate, as well as the transparency of its work. Therefore, the turnover of the stablecoin is regulated by an open smart contract, and the reserves are stored in the accounts of independent trusts registered in the United States and regulated by the laws of the United States. This ensures that funds held in trust accounts are not accessible to the founders or individual TrustToken entities.

TrustToken has always highlighted the importance of the regulability of stablecoins. Systematic audits of TUSD are conducted by Network Firm LLP. In February 2023, True USD became the first dollar-linked stablecoin to begin using Chainlink's Proof of Reserves technology. This technology automatically validates dollar reserves when tokens are issued, giving TUSD additional transparency, safety, and security.

True USD: Main Features

The features of True USD include:

- Full securing of USD, which is held in the accounts of independent trusts. High stability and transparency through use of a smart contract for issuing new tokens.

- Fast approval of transactions for verified customers (KYC/AML). The platform approves the requested exchange of stablecoins to US dollars without delays (minimum — $1000).

- Regulability. The trust funds in whose accounts TrustToken reserves are held are subject to U.S. law and undergo regular independent audits. The company's founders do not have access to the reserves.

- Direct currency exchange. Exchanges are made directly with trust accounts instead of TUSD's own network.

- The need to undergo verification and anti-money laundering compliance. This can be seen as an advantage or disadvantage depending on the purpose of using the tokens. Nevertheless, in general, it increases the reliability of coins as it ensures compliance with legal requirements.

- Support for various networks. The token is supported by the following networks: Ethereum, BNB Chain, Avalanche, Arbitrum, Optimism, TRON.

- Full centralization. This means that TrustToken can block a user's account if the security system detects irregularities or suspicious activity. This feature is the main disadvantage of the token compared to decentralized cryptocurrencies.

You can also read our article «CBDC: Is It Cryptocurrency or Fiat? Unveiling Differences».

TUSD & USDT: Differences

Tether (USDT) is the world's first and most popular stablecoin, which, like TUSD, is pegged to the US dollar. With a market capitalization of over $83 billion, it ranks third after Bitcoin and Ethereum. Most Tether tokens run on the Omni network, while TUSD is based on Ethereum.

Apart from their different levels of popularity, an important difference between TUSD and USDT is their level of regulation. Tether Limited is registered in Hong Kong and is not subject to US laws. Although the creators claim that Tether's reserves are also subject to regular independent audits, there are doubts that all USDT tokens are backed by US dollars.

In 2021, for example, the company was fined for providing false information about its reserves. In 2022, it became the subject of an investigation on suspicion of fraud. Because of this, many experts consider Tether a less safe currency for investing and storing funds.

You can learn more in our article «Tether (USDT) Backing: Is It as Reliable as Claimed».

Accepting Payments in True USD

There are three main ways to accept crypto payments: direct transfer, developing a payment module, and connecting crypto acquiring. Below let's take a closer look at how to accept cryptocurrency payments using each of them.

Direct transfer to wallet

This is technically the simplest method, but the least convenient for the merchant and the client. To make a payment, the customer needs to contact the merchant to manually convert the order amount into cryptocurrency, calculate the commission, send the address or QR code for payment, and then confirm the payment and complete the order. This is time-consuming, reduces conversion rates and is only suitable for entrepreneurs with a small customer flow.

Payment module development

Accepting cryptocurrency payments on the website is done through a payment module developed for the website. The entrepreneur does not need to manually perform the necessary operations or pay a commission to an intermediary. Nevertheless, it should be taken into account that the development itself requires the expenditure of time and money. In addition, the merchant is fully responsible for the operation of the module — failures and errors can lead to reputational and financial losses.

Crypto processing

Cryptocurrency processing is the automation of accepting cryptocurrency payments without the expense of developing your own payment module. There are many services that provide this service.

The entrepreneur integrates crypto acquiring on their website, and then the buyer gets the opportunity to choose the desired payment method and the suitable currency. The service automatically calculates the amount to be paid, displays the necessary data on the screen, tracks the payment and confirms the order. The business owner can track information about transactions in the personal account. A commission is charged for processing — usually no more than 1-2%.

The specific list of functions depends on the chosen system. Services offer the option of cryptocurrency exchange, withdrawal of funds in cryptocurrency and fiat, etc. We have given a selection of crypto processing in the article.

Connecting Crypto Processing

The process of integrating processing into a website depends on the specifics of the chosen cryptocurrency acceptance service. Let's explore the connection on the example of the CryptoCloud platform:

- Merchant account registration. When working with CryptoCloud, you will only need an e-mail to which you will receive a confirmation — there is no need to go through the verification procedure.

- Adding a project. You can do this through your personal account. The system will offer to fill in a small questionnaire with information (company name, type of activity, brief description), and choose one of the options: accepting payment on the website or via invoicing (payment links). Merchants can add several projects — no new account will need to be registered.

- Integration. Several options are available: API, plugins for CMS, universal HTML widget. For the main e-commerce platforms (WooCommerce, OpenCart, Shopify, Tilda, etc.) you can use ready-made modules. The service provides step-by-step instructions that will allow you to perform integration even without programming experience.

After completing these steps, the entrepreneur only needs to test the integration. The connection process takes a couple of minutes.

TUSD: Reliable Stablecoin for Your Company

True USD is a token backed by US dollars at a 1:1 ratio. The company issuing this stablecoin aims to maximize transparency and regulation, making TUSD one of the safest currencies for investment and payment transactions.

It is possible to accept payment in TUSD using crypto processing such as CrytoCloud. The system offers an intuitive checkout and personal account interface, commissions from 0.4%, fast withdrawal, easy connection and high level of security. You can learn more on our website.