Business owners who use acquiring to accept non-cash payments are looking for ways to painlessly reduce the costs of using payment technologies. There are a variety of ways to lower expenses.

Some methods are related to the terms and conditions under which banks provide services. It is important to find a balance between minimizing bank fees, convenience and security. Another option is to pay with cryptocurrency on a website, in social networks or messengers. This method is becoming more and more demanded.

Internet Acquiring: Working Principle

Acquiring is the acceptance of non-cash payments for goods and services. It simplifies the settlement between the merchant and the customer; it also minimizes the risk of errors that can occur when entering details manually.

Properly set up acquiring works without failures and delays, provides security of financial resources and personal information.

A business owner can choose one of two options:

- apply directly to the bank to connect acquiring;

- use the services of a provider company.

The processing center receives payment data and then processes the transaction itself. Usually acquiring means that the buyer enters the details into the payment form and then confirms the payment: for example, by means of a code in an SMS.

How to Reduce Acquiring Costs

There are several ways to reduce expences.

- Discuss the terms and conditions in detail with the bank representative. It is important to make sure that the bank works with the particular business sphere.

- Cancel unnecessary options and functions. They can be provided by default.

- Determine hidden acquiring fees by carefully reading the contract. A low commission may mean, for example, that the bank may oblige the client to open an account with paid service. Or will charge an additional fee for payments over a certain limit.

- Participate in the bank's loyalty program. In some cases, the commission can be reduced to 1.5% or less.

- Increase the transaction processing time. The money will be credited to the account not instantly, but within a certain period of time after the payment, for example, three days. The bank will reduce the commission for this.

It is also possible to work with customers who have local cards. Processing payments from foreign cards is more expensive for the bank, but if it is not required, the commission will be lower. But this is often disadvantageous for the merchant. They can lose part of their audience which consists of citizens of other countries and locals with cards of foreign banks.

Crypto Acquiring: How Does It Work

This is another way to reduce the cost of payments. Cryptocurrency payment processing is a system that also conducts payments. The main difference is that it uses cryptocurrency instead of fiat for it.

The first crypto processing from BitPay appeared in 2011. Today, there are many more such systems.

The principles on which cryptocurrency payments are based:

- payments are not dependent on the location of participants and political factors;

- the system is decentralized, not subject to external pressure from organizations and individuals;

- anonymity of participants is guaranteed, there is no possibility of personal data disclosure.

Competent use of crypto processing allows both parties not to worry about financial and information security. Additional costs are minimized. To conduct transactions, it is enough to have a cryptocurrency wallet. Technically, all operations on depositing, sending funds and withdrawing them are much simpler than when working with fiat money.

Crypto Acquiring for Business: Pros and Features

For merchants — sellers of goods and service providers — payment through cryptocurrency has several advantages:

- Commissions are reduced. Bank transfers can be very expensive, especially international transfers (commissions are up to 4-5%). Blockchain fees on cryptocurrency transfers are usually around 1%, and they do not depend on the location of the buyer and seller.

- Accepting payments from abroad is seamless. Neither technical nor political factors get in the way. It is especially relevant for those who sell digital products or for other reasons often work with foreign customers.

- No chargebacks. There are no difficulties associated with disputing transactions and no risks to suffer from fraudsters.

- Simple verification procedure.

A significant plus is the ability to transfer the payment of the commission to the buyer, we told you more about it in the article. This is another answer to the question of how to reduce acquiring costs and increase the profitability of business, regardless of the sphere of business activity.

You can learn more about the advantages of crypto processing in the article: «Bank and Crypto Acquiring: What Online Payment Option to Choose».

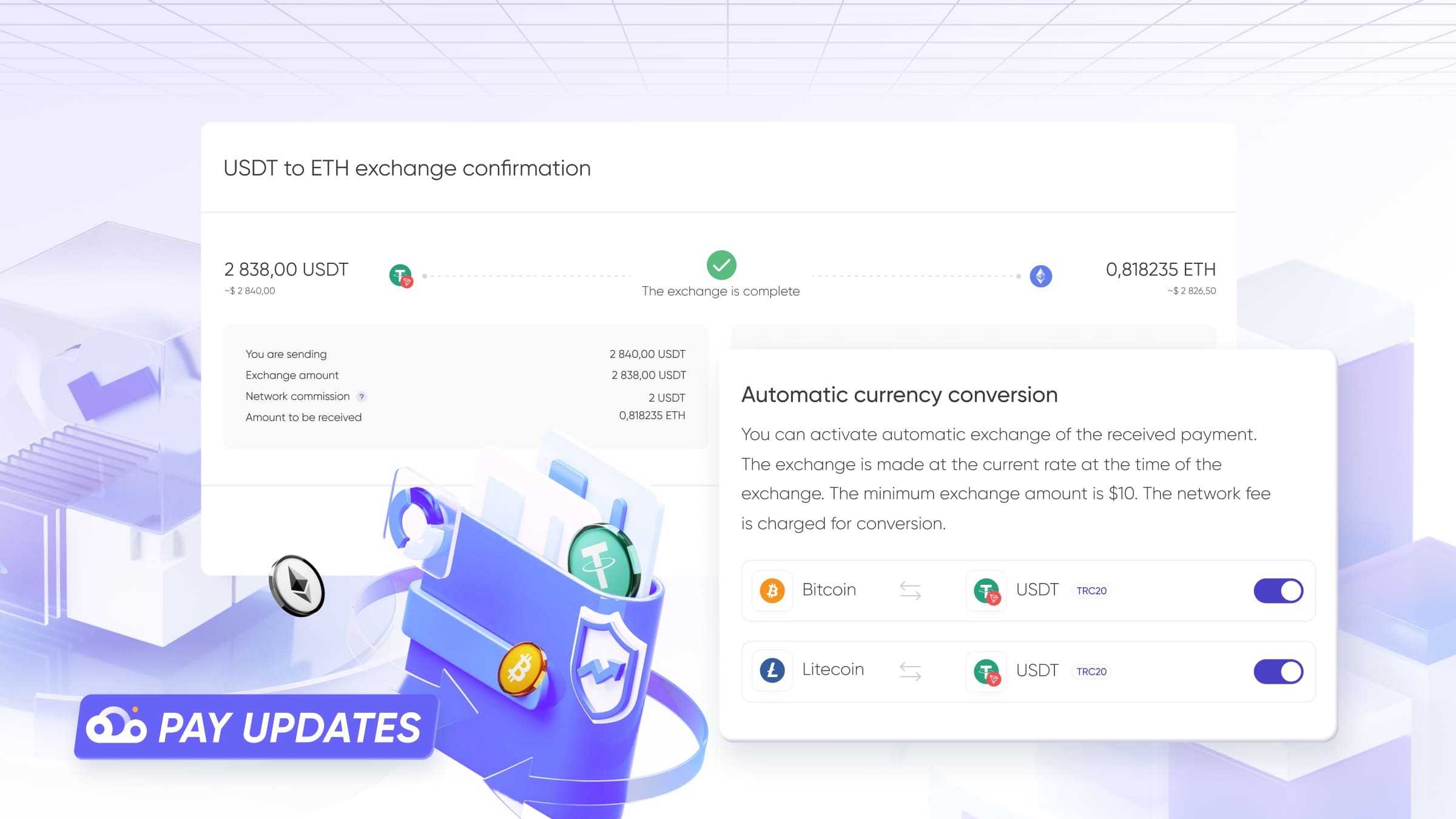

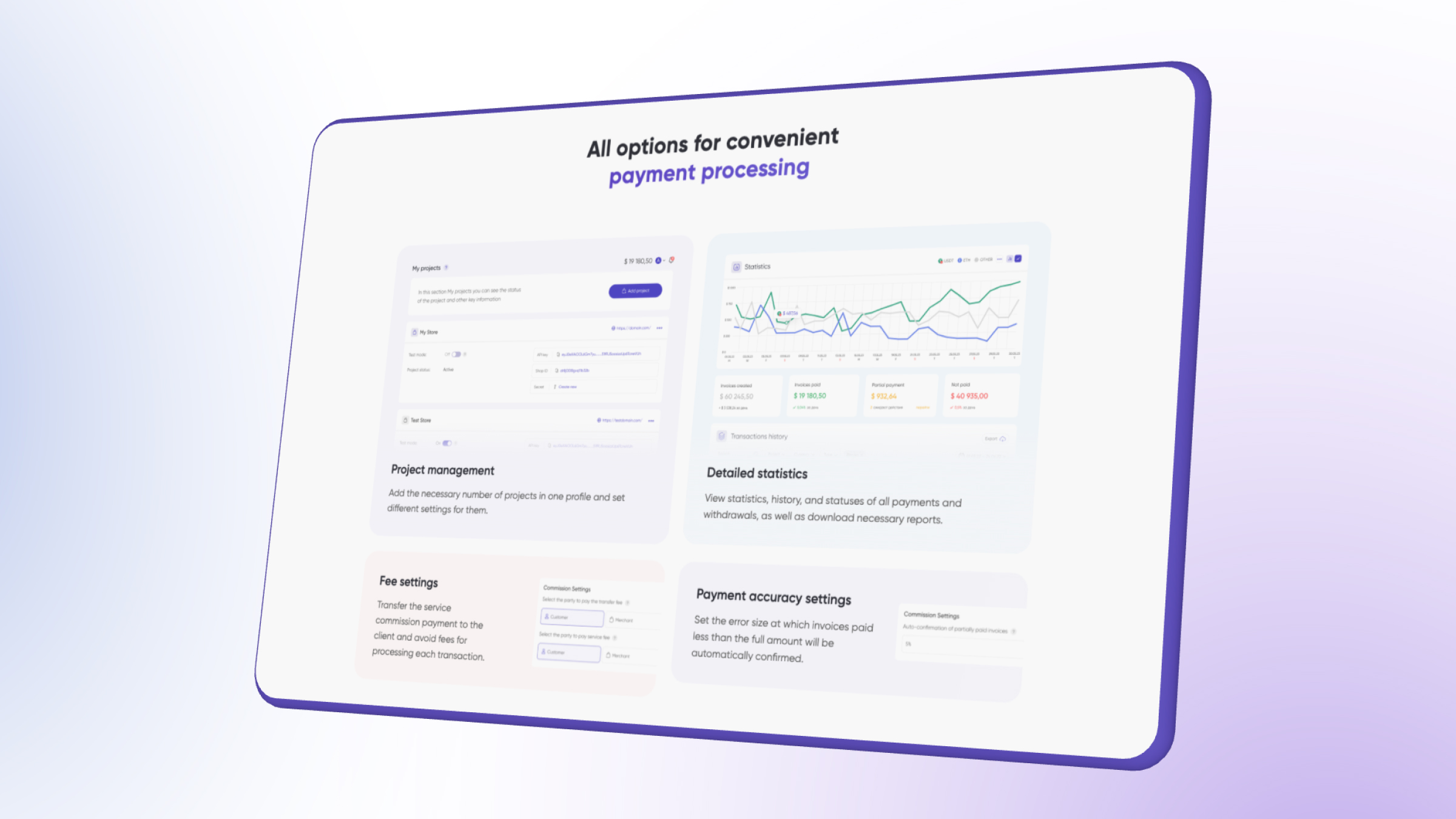

Save Funds on Acquiring with CryptoCloud

CryptoCloud is a cryptocurrency payment gateway. You can accept payments in Bitcoin, Tether, Ethereum, Litecoin and other currencies, the list of which continues to grow. The service allows you to conduct transactions via a website module, an online store form, and payment links.

CryptoCloud advantages for merchants:

- commission starts from 0.4%;

- the possibility to transfer the commission payment to the buyer in order to use the service practically free of charge;

- the payment module is compatible with various devices and is available in several languages;

- invoices are issued instantly;

- the system is easily integrated with popular CMS (Woocommerce, Shopify, PrestaShop, OpenCart, WHMCS, etc.).

- detailed statistics, including transaction history and reports on them;

- notifications about completed operations are sent immediately.

You can connect the service in a few minutes. Different payment methods for cryptocurrency are available: API, ready-made CMS module, HTML widget.

How to Efficiently Save Money on Acquiring Services

You can reduce the cost of online banking acquiring by paying attention to details, carefully reading the contract and carefully selecting the terms and conditions. You can also become a member of the bank's loyalty program, increase the transaction processing time, and work only with customers who have local cards.

Crypto acquiring is a more modern payment processing tool. CryptoCloud provides safe and fast acceptance of payments in cryptocurrency.