PayPal is one of the world's most popular online wallets and international payment services. It has over 425 million active users and is used by 35+ million companies worldwide.

Despite its popularity, this service has drawbacks: high commissions and user blocking. As a result, many entrepreneurs are looking for alternative payment systems. In this article, we will review the main analogs of PayPal available to entrepreneurs.

Overview of PayPal

PayPal's major purpose is as an online wallet that allows users to receive and send international transfers. The service offers legal entities the opportunity to create a corporate PayPal account. This allows you to accept payments through the site, issue invoices, and manage finances.

Corporate PayPal wallet gives entrepreneurs access to one-time and recurring payments, invoicing, analytics, and mass payments. The system supports 100+ currencies. Available payment methods include installment payments (for US buyers only).

When paying with PayPal, the customer is transferred to the wallet site, where they can log into their account and complete the transaction. This method of payment is convenient for businesses whose audience actively uses this wallet (for example, the USA).

The client gets an opportunity to pay through a service they trust, increasing the conversion rate. The wallet has hundreds of millions of active customers, so having this payment feature on a company's website will increase trust in the business.

Other advantages of PayPal for business include a high level of security thanks to encryption and monitoring of transactions for fraud. In addition, due to the popularity of this wallet, entrepreneurs have access to several ready-made integrations with e-commerce platforms and services, simplifying the connection to the site.

Our article «PayPal: International Payment System Features Reviewed» provides a detailed review of the service.

Why Are Businesses Looking for an Alternative

The service has many advantages. Nevertheless, many companies are looking for alternatives to PayPal. There are several reasons for this:

- Quality of support. The service is available in many countries but does not offer the same high quality of service everywhere.

- High fees compared to other services. Some services are only available for a fee, and PayPal's currency conversion fee is quite high (4.5%). In addition, although individuals can transfer funds to Paypal for free, business rates range from 3–4% and higher.

- Strict control of merchants. When working with the service, company is required to pass verification repeatedly. Even if all the system's requirements are met, there is a high risk of blocking/freezing funds, to the point that a class action lawsuit was filed against the service in 2022.

- Limited customization options. PayPal is primarily a wallet, and its functionality for business is limited compared to specialized services.

How to Choose a Payment System?

When selecting an international payment system that will replace PayPal, it is recommended to focus on several criteria:

- Commission. The fees of the service are an important factor. You should take into account the charges for processing payments made by methods popular with the audience (for example, bank card), and additional commissions for conversion, cross-border payments, etc.

- Security. Make sure that the service's payment gateway complies with international standards and ensures data protection. In addition, it is important that the system protects the merchant for instance through an anti-fraud system.

- Requirements for connection. The systems expose restrictions both on the sphere of activity and on the geographical location of the company.

- Timing of withdrawal of funds. On average, withdrawal takes 1-2 days. Some services offer the option of fast/instant withdrawal (in some cases - for an additional commission).

- Reputation. Before using a service, it is recommended that you read reviews and feedback on it to ensure that there are no hidden problems or shortcomings. In addition, you should check the company's history — major hacks, lawsuits, etc.

- Convenience. The connection process should be intuitive and fast (ready-made integration modules will help). In addition, the system should be suitable for the audience: offer convenient payment methods, intuitive interface, etc.

- Quality of technical support. It is important to make sure that the system offers good support: several communication channels, quick contact with a live specialist, problem solving in a short period of time.

International Payment Systems Similar to PayPal

Stripe

Stripe is an e-commerce system for businesses, available in multiple countries and supporting a variety of payment methods. The service allows you to work through checkout and invoicing, accept recurring payments, and automatically check transactions for fraud.

One of Stripe's key advantages over PayPal is the customization possibilities and a number of additional functions for managing company finances. This is also a disadvantage of the service: programming skills will be required to fully utilize all the features.

You can learn more about the service's features in our article.

GoCardless

GoCardless works with direct bank payments and allows you to accept both one-time and automated recurring payments for goods and services. The service partners with 2,500+ banks in Europe and the UK to enable secure transfers.

GoCardless is available in 30+ countries and offers low fees (1% + €0.20 for the standard rate). However, it should be taken into account that not all customers are ready to use this method instead of the more usual card payment.

Shopify Payments

Shopify Payments is a service that is automatically embedded in all stores created on the Shopify platform. One of its main advantages is its ease of use: the owner of a Shopify store only needs to activate the acceptance of payments through the control panel.

In addition, it is a favorable option for those who work through this website builder, as Shopify charges an additional commission when using other systems.

Amazon Pay

Amazon Pay is a system from Amazon that allows you to use your account on the platform to make a payment. Users have access to both regular payment and deferred or installment payment.

The principle of operation is similar to PayPal: the customer is redirected to the Amazon website, logs into the account and makes a payment. This increases trust in the business and is convenient for the audience that frequently uses Amazon, for example, for customers from the United States. However, for countries where this platform is rarely used, this method of payment will be irrelevant.

Worldpay

Worldpay is a system for businesses that allows them to accept payments, make single and bulk payments, and manage finances. Features include accepting payments online on a company's website, through marketplaces, through invoicing, and at physical points of sale.

In addition, the service offers tools to optimize the payment process, protect against fraud, generate intelligent reports and launch loyalty programs. The co

Square

Square is a payment aggregator for online stores. Available features include generating and sending invoices, accepting payments via checkout (including installments via Afterpay), as well as hosting and cart integration for online start-up stores.

In addition, users have access to terminals and software to sell goods offline and track all payments through a single personal account. The commission for online payments is from 2.9% + 30 cents.

Requirements and Connection

In addition to the requirements for geographical location, most systems set requirements for the company itself. Thus, many services do not work with high-risk business, and the criteria for the concept of high-risk are determined by the system itself.

Besides, the payment system may require multi-step verification, compliance of the site with certain criteria and fulfillment of other conditions that complicate the connection of payments.

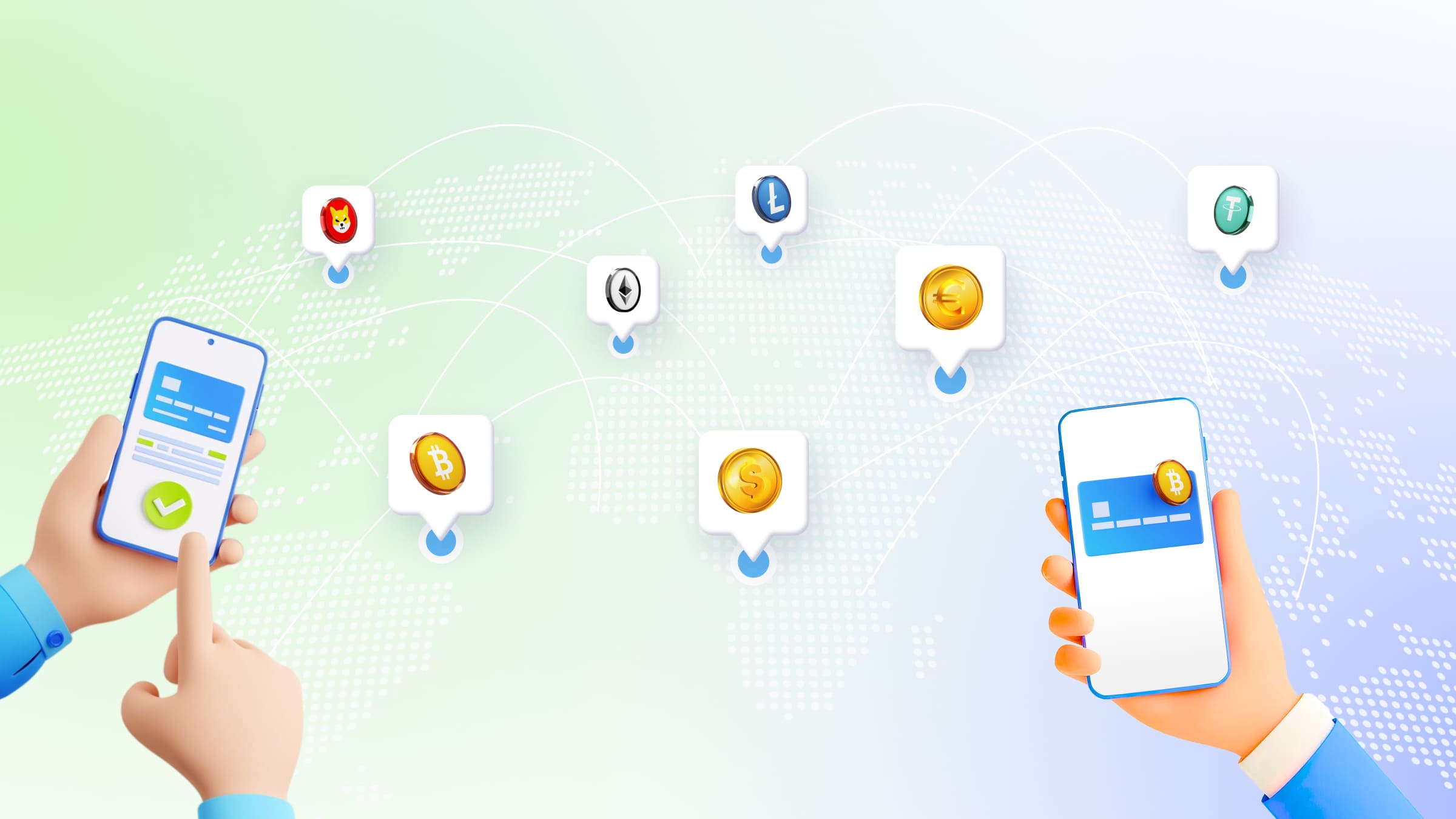

Alternative: Crypto Acquiring

In the face of sanctions, more entrepreneurs are considering crypto transactions as an alternative to fiat systems for accepting payments. Cryptocurrency as a means of payment has several advantages: flexibility, security, availability of international payments, and low fees (up to 1–2%).

Blockchain is a decentralized network that excludes both blocking as a result of sanctions and freezing individual accounts at the system's initiative. Companies use crypto acquiring to automate the acceptance of payments in cryptocurrency.

Connecting such a service allows a payment gateway similar to a fiat system checkout to be integrated into the site. The service automatically converts currency, confirms payments, tracks transactions and performs other functions. The set of available tools depends on the specific system.

CryptoCloud for International Payments

CryptoCloud is a cryptocurrency payment gateway that allows you to accept payments in Bitcoin, Ethereum, Litecoin, Tether, True USD, and other popular currencies. It offers a multilanguage checkout that automatically adjusts to the language of the client's system.

The service processes cross-border cryptocurrency payments through the company's website and through one-time/permanent payment links. Merchants can activate AML transaction checks and automatic conversion to USDT to protect assets from volatility.

The entrepreneur's personal account includes features such as managing several projects simultaneously, working with analytics and reporting, and currency conversion. Funds are withdrawn within a few minutes, and the commission is 0.4%.

Cryptocurrency and Fiat Payments: What to Choose?

The e-commerce market offers several services for processing international payments: PayPal, Stripe, GoCardless, Square, and many others.

Many entrepreneurs consider cryptocurrency processing as an alternative or additional way of accepting cross-border payments. A service like CryptoCloud allows you to accept payments in popular cryptocurrencies from anywhere in the world, charges a low commission (from 0.4%), and offers a variety of additional opportunities for financial management.